Short answer

Gold trading is the process of speculating on changes in the price of gold rather than buying or storing physical metal. Traders open buy or sell positions based on gold price movements driven by macroeconomic factors such as interest rates, inflation, currency strength, and global uncertainty.

Gold has been a store of value for centuries, and today you can trade it from a simple trading platform as XAUUSD. This guide is designed for beginner and intermediate traders who want a clear, practical framework for trading gold CFDs, especially the XAUUSD pair, in a disciplined way.

A gold trading guide is a structured framework that explains how to trade XAUUSD step by step: what the instrument is, what moves its price, when to trade it, which strategies to consider, and how to manage risk and emotions. It helps you move from random trades to a repeatable, rules-based approach to gold trading.

Table of Content

What Is XAUUSD and How Gold Trading Works

Step-by-Step Guide: Your First XAUUSD Trade

When Is the Best Time to Trade Gold?

What Moves Gold Prices: Fundamentals and News

Reading Gold Charts and Indicators

Managing Risk and Emotions on XAUUSD

Gold in a Diversified Trading and Investment Plan

Advanced Ways to Trade Gold with NordFX

Key takeaways

- Gold trading focuses on price movement, not physical ownership

- Gold is globally priced in US dollars under the symbol XAU

- Traders can profit from both rising and falling gold prices

- Gold behaves differently from stocks, currencies, and industrial commodities

- Volatility and leverage make gold attractive but require strict risk control

🔗 what

What Is XAUUSD and How Gold Trading Works

XAUUSD is the symbol for gold quoted in US dollars. XAU represents one troy ounce of gold; USD is the US dollar. When you see XAUUSD at 2300.00, it means one ounce of gold is valued at 2,300 US dollars in the spot market or via a CFD.

In most forex/CFD accounts, gold is traded as contracts with a fixed size. A common contract size is:

- 1.00 lot of XAUUSD = 100 troy ounces of gold

- This means if the price of gold moves by 1 USD per ounce, a 1-lot position will gain or lose 100 USD. A minimum tick size could be 0.01, so a move from 2300.00 to 2300.01 would be a 0.01 change, often worth 1 USD per lot (depending on the broker’s contract specifications). You can usually trade much smaller sizes, for example 0.10 lot (10 ounces) or 0.01 lot (1 ounce).

There are three main ways people interact with gold:

1. Physical gold

This includes coins, bars and jewelry. You pay the full value, plus spreads and storage costs, and you own the metal. It is more suitable for long-term saving and wealth preservation than for active short-term trading.

2. Financial gold (ETFs, futures)

Gold exchange-traded funds (ETFs) and futures are traded on exchanges. They can be efficient but may require larger capital, margin requirements, and sometimes access to specific exchanges. Futures also have expiry dates and may involve rollovers.

3. XAUUSD CFDs / forex-style pair

This is where most online traders operate. You do not own physical gold; instead, you trade a contract based on the price of spot gold. You can trade long (buy) if you expect gold to rise, or short (sell) if you expect it to fall. Margin and leverage allow you to control a larger position with less capital.

Key characteristics of XAUUSD as a forex-style pair:

- Quoted similar to major currency pairs, with bid/ask prices.

- Traded on the same platforms as EURUSD or GBPUSD, such as MT4 and MT5.

- Supports both buy and sell positions, making it suitable for trend following in either direction.

- Often has tighter spreads and lower trading costs at specialized brokers than physical or futures markets.

Understanding these basics is the foundation of any structured approach to gold trading.

🔗 why

Why Trade Gold with NordFX

Gold is known as a safe-haven asset and a potential inflation hedge. When uncertainty rises, investors often move capital into gold, viewing it as a store of value that is not tied to the credit risk of a government or company. When inflation expectations rise and real interest rates fall, gold tends to become more attractive.

In 2025, global markets still fluctuate around central bank policies, inflation cycles and geopolitical risks. This environment frequently pushes gold into strong trends or sharp swings as traders constantly re-price the metal based on new data. For active traders, such movement can create both opportunities and risk. Understanding this backdrop helps you appreciate why XAUUSD remains one of the most popular instruments on many trading platforms.

Trading gold via a broker such as NordFX offers several practical advantages over physical gold:

- No need for storage, insurance or logistics.

- Ability to trade both rising and falling markets.

- Access to leverage, allowing smaller capital to control larger positions (while also magnifying risk).

- Fast execution on MT4/MT5, with charting and indicators integrated in the same platform.

With NordFX-style conditions, XAUUSD trading can be especially attractive for active strategies. Key points typically include:

- Platforms: MT4 and MT5 for desktop, web and mobile, suitable for discretionary trading and automated Expert Advisors.

- Leverage: Flexible leverage on gold CFDs, which can be useful for both small and larger accounts when used carefully.

- Spreads and commissions: 0 spread on XAUUSD and 50% reduced commission on Zero accounts means your total round-trip cost can be significantly lower, especially for short-term trades.

Low spreads and reduced commissions are most visible for scalpers and day traders who open many trades per day. Every pip (or cent) saved in costs directly improves your net outcome over a large sample of trades.

For a broader overview of why current market conditions and fee reduction can be attractive to gold traders, see this article.

🔗 Step

Step-by-Step Guide: Your First XAUUSD Trade

Let’s walk through the process of placing your first XAUUSD trade from start to finish. The steps are similar whether you use MT4 or MT5.

1. Open and fund your trading account

- Register for a trading account with your chosen broker.

- Complete identity verification as required by the broker.

- Choose the account type that includes XAUUSD and the trading conditions you prefer (for example, a Zero account with reduced commissions).

- Deposit funds using one of the available payment methods. Start with an amount you are comfortable risking.

If you are completely new, you can first practice on a demo account where trades are simulated with virtual funds.

2. Choose your platform: MT4 or MT5

Both MT4 and MT5 support XAUUSD trading:

- MT4 is widely used, simple, and has many existing indicators and Expert Advisors.

- MT5 is the newer platform with more built-in timeframes and some additional features.

Download the platform, log in with the account credentials provided by your broker, and ensure your connection status shows as “connected”.

3. Find XAUUSD and open an order ticket

In MT4/MT5:

- Open the “Market Watch” window.

- Right-click inside the window and choose “Symbols” or “Instruments”.

- Look for XAUUSD (sometimes named “Gold”, “GOLD”, or a similar symbol) and double-click to show it in Market Watch.

- Drag XAUUSD onto a chart to open the price chart.

- Right-click the chart or Market Watch symbol and choose “New Order” (MT4) or “New Order/Order” (MT5).

This opens the order ticket where you choose your volume (lot size), order type, and protective orders.

4. Worked example: placing a trade

Assume:

- Account balance: 1,000 USD

- Risk per trade: 1% (10 USD)

- XAUUSD price: 2300.00

- You want to buy XAUUSD because your strategy signals an uptrend.

- You plan to place your stop-loss 5 USD below entry (at 2295.00).

First, estimate the value per lot. Suppose 1 lot = 100 oz and price changes of 1.00 USD correspond to 100 USD per lot. Then a 5 USD move against you is 500 USD per 1 lot.

You want your maximum loss to be about 10 USD, so:

- Risk per trade (10 USD) / risk per 1 lot (500 USD) = 0.02 lot

So you would enter 0.02 as the volume.

On the order ticket:

- Symbol: XAUUSD

- Volume: 0.02

- Order type: Market Execution (for an immediate entry)

- Stop-loss: 2295.00

- Take-profit: you might set it 10 USD above entry at 2310.00 (risk: 5 USD, potential reward: 10 USD, so a 1:2 risk–reward ratio).

Click “Buy by Market” to enter the trade. The platform will show your position, including floating profit/loss.

5. Monitoring and closing the trade

You can manage your trade by:

- Moving stop-loss to break-even when price moves in your favor.

- Adjusting take-profit if your analysis changes (always stay consistent with your plan).

- Closing part or all of the position manually if you reach your target or your conditions change.

To close the trade, right-click the open position in the “Terminal” (MT4) or “Toolbox” (MT5) and choose “Close Order” or click the “x” button. The result will be added to your account balance.

For a platform-specific walkthrough with screenshots and more examples, see Gold Trading Basics: How to Trade XAUUSD Step by Step on MT4/MT5.

🔗 When

When Is the Best Time to Trade Gold?

The best time to trade gold is when liquidity and volatility are both healthy but not chaotic. For XAUUSD, that is usually during the London and New York trading sessions, especially when they overlap. During this period, spreads tend to be tighter and price movements clearer.

Trading sessions and XAUUSD

Global Forex/CFD markets follow three major sessions:

- Asia (Tokyo, roughly 00:00–09:00 platform time, varying by broker)

- London (roughly 08:00–17:00)

- New York (roughly 13:00–22:00)

Gold trades almost 24 hours on weekdays, but activity is uneven. A simplified comparison:

Session | Liquidity for XAUUSD | Typical volatility | Comments |

Asia | Lower | Often calmer, rangey | Good for range trading, scalping small moves |

London | High | Strong directional moves | Often sets the tone for the day |

New York | High | Spikes around news | Key US data releases move gold sharply |

London–New York overlap | Very high | Frequently strongest | Many traders’ preferred window |

Most intraday gold traders focus on the London session and the London–New York overlap. Here, spreads are usually tight, liquidity is deep, and technical patterns are more reliable because many large participants are active.

Spreads, liquidity and slippage

- During liquid hours, the bid–ask spread on XAUUSD can be very low, especially with 0 spread pricing on specific account types. Slippage is usually minimal in normal conditions.

- During illiquid periods (late New York, early Asia), spreads may widen, and order execution may slip, especially around price gaps or thin order books.

- During major news, spreads can widen and slippage can increase dramatically for a few seconds or minutes.

When to be careful or flat

It is often wise to be extra careful or flat during:

- Major US macro releases: Non-Farm Payrolls (NFP), CPI, PPI, GDP, ISM, unemployment data.

- Central bank meetings and press conferences (especially the Federal Reserve).

- Unexpected geopolitical events or surprise headlines.

- Holiday periods and half-days (for example, around Christmas, New Year, major US holidays) when liquidity can be very thin.

- The final hour before the weekly market close and the first hour after the weekly open (to avoid weekend gaps).

Some traders specialize in trading the news, but this requires specific experience and risk management rules. For most beginners, focusing on liquid, “normal” conditions is a safer way to build skills. For a dedicated deep dive, see Best Time to Trade Gold (XAUUSD): Sessions, Volatility and News.

🔗 Moves

What Moves Gold Prices: Fundamentals and News

Gold prices are driven by a mix of macroeconomic, financial and geopolitical factors. Understanding these drivers helps you interpret why XAUUSD moves and avoid being surprised by seemingly random spikes.

Main fundamental drivers

1. Real interest rates

Real interest rates are nominal interest rates minus inflation. When real rates fall or are expected to stay low, holding cash or bonds becomes less attractive, and gold (which has no yield) often becomes more appealing. Falling real rates can support gold; rising real rates may pressure it.

2. Inflation expectations

Gold is viewed as an inflation hedge. Rising inflation or expectations of future inflation often trigger demand for gold as investors look for assets that can preserve purchasing power. However, the relationship is not always linear, because central banks can offset inflation with aggressive rate hikes.

3. US dollar strength

XAUUSD is quoted in US dollars, so USD strength and weakness have a strong influence. A stronger USD tends to push gold prices lower (it takes fewer dollars to buy the same ounce), while a weaker USD often supports higher gold prices. This is why many traders watch the US Dollar Index (DXY) alongside XAUUSD.

4. Risk sentiment

In risk-off environments (market fear, stock market drops, geopolitical tensions), gold often benefits from safe-haven flows. In risk-on environments (optimism, rising equities), capital may flow out of gold into higher-yielding or more speculative assets.

Key economic events and their impact

Some of the most important news events for gold include:

- Non-Farm Payrolls (NFP): Strong job data may support expectations of higher interest rates, which can be negative for gold; weak data can have the opposite effect.

- CPI and other inflation data: High inflation may initially lift gold, but if it leads to expectations of aggressive rate hikes, the reaction can be mixed.

- FOMC meetings and Fed speeches: Changes in interest rates, forward guidance, and tone regarding inflation and growth can strongly move both the USD and gold.

- GDP, PMI, ISM surveys: These shape expectations about economic growth and monetary policy.

- Geopolitical events: Conflicts, sanctions, or political crises can drive safe-haven buying in gold.

Example reactions:

- Strong NFP: Suppose NFP comes in much stronger than expected and the unemployment rate falls. Traders may anticipate tighter monetary policy, strengthening the USD and pushing gold lower. XAUUSD might drop sharply in the minutes after the release.

- Weak CPI: If inflation data is weaker than expected, markets may expect a more dovish central bank stance. The USD can weaken, and gold may jump higher as traders reprice future interest rates.

Integrating fundamental data with your technical analysis helps you avoid trading blindly into major events. For a more detailed overview of fundamentals, see Fundamental Drivers and Economic News that Move Gold (XAUUSD) and Risk Management for Trading Gold: Position Sizing and Volatility Control.

🔗 Core

Core Gold Trading Strategies

There is no single “best” strategy for XAUUSD. Instead, traders choose approaches that fit their time, risk tolerance and personality. Gold is suitable for several main trading styles.

Trading styles on XAUUSD

1. Scalping and day trading

Scalpers and day traders hold positions for minutes to a few hours, targeting small moves (for example, 1–10 USD swings). They rely on tight spreads, low commissions and fast execution. Gold’s volatility can provide multiple intraday opportunities.

Swing traders hold positions for several days to weeks, seeking larger moves (50–200 USD per ounce or more). They base decisions on higher timeframes (H4, daily) and combine technical and fundamental analysis.

3. Position trading

Position traders hold gold for weeks to months, often based on macro views such as central bank policy, inflation trends or long-term risk sentiment. They may use smaller leverage and wider stops, focusing less on intraday noise.

Example strategy 1: Breakout from consolidation

Setup:

- Timeframe: M15 or H1

- Market condition: Gold has been moving sideways in a tight range (e.g., 2285–2300) for several hours.

- Entry: Place pending orders slightly above resistance and below support. For example, buy stop at 2301, sell stop at 2284.

- Stop-loss: On the long breakout, stop below the middle of the range; on the short breakout, stop above the middle.

- Take-profit: Aim for at least 1.5–2 times your stop size.

This strategy seeks to catch strong moves when gold breaks out of a congestion area, often triggered by news or the start of a liquid session. Low spreads and commissions improve your net outcome, especially if you use multiple small breakout attempts.

Example strategy 2: Pullback in a trend

Setup:

- Timeframe: H1 or H4

- Trend: Use a moving average (for example, 50-period) to identify direction. If price is consistently above the MA, the trend is up.

- Entry: Wait for a pullback towards the moving average or a previous support level, then look for bullish price action (for example, a rejection candle) to enter long.

- Stop-loss: Below the recent swing low.

- Take-profit: At recent highs or a measured move equal to your risk.

This approach tries to enter at better prices within an existing trend rather than chasing spikes.

Example strategy 3: Range trading near support and resistance

Setup:

- Timeframe: M30 or H1

- Market condition: Gold oscillates between a clear support and resistance zone (for example, 2250 and 2300) without strong news.

- Entry: Buy near support with tight stops just below it; sell near resistance with tight stops just above.

- Take-profit: At the opposite side of the range or a reasonable partial target within the range.

Range trading works best in calm periods and can be combined with oscillators like RSI or Stochastic to time entries.

Whichever strategy you use, consistency and risk management matter more than any single “magic” setup. For a deeper exploration of specific gold methods, see Gold Trading Strategies: Day Trading, Swing and Trend Following on XAUUSD.

🔗 Reading

Reading Gold Charts and Indicators

Gold charts behave like other liquid markets but have their own rhythm and volatility profile. Learning to read them properly is a key skill for any XAUUSD trader.

Marking key levels and trends on gold charts

Start with higher timeframes (daily and H4):

- Draw horizontal support and resistance at major highs and lows where price reacted strongly.

- Mark trendlines by connecting higher lows in an uptrend or lower highs in a downtrend.

- Note consolidation zones where price traded in a range for an extended period.

Then drop to lower timeframes (H1, M15) to refine entry and exit points. Gold often respects psychological levels (e.g., round numbers like 2200, 2250, 2300), so include them in your analysis.

Common indicators for XAUUSD

Some frequently used tools on gold charts include:

- Moving Averages (MA): 20, 50, 100 and 200-period MAs help identify trend direction and dynamic support/resistance.

- RSI (Relative Strength Index): Measures momentum and helps spot overbought/oversold conditions or divergences.

- Stochastic Oscillator: Another momentum tool, often used in ranges or pullback setups.

- ATR (Average True Range): Measures volatility and is very useful for setting dynamic stop-loss distances on gold, which can move quickly.

- MACD: Helps identify trend strength and momentum shifts via its histogram and signal line crossovers.

- Fair Value Gaps (FVG): Zones where price moved quickly, leaving imbalances between buyers and sellers. Traders sometimes use these gaps as potential areas where price might return.

Example: combining price action with an indicator

Imagine XAUUSD has been in a clear uptrend on H4, with price above the 50-period MA. On H1:

- Price pulls back from 2320 to 2300, near the rising 50-MA and a previous swing high (now support).

- RSI on H1 dips from 70 towards 40, relieving overbought conditions without breaking below 30.

- A bullish rejection candle forms at 2300, closing near its high.

This combination of support level + MA + mild RSI pullback + bullish candle can form a higher-probability long setup within a larger uptrend. You could then use ATR on H1 to size your stop (for example, 1–1.5 times the ATR value) to respect gold’s volatility.

For more indicator-based techniques, see Using Technical Indicators on Gold Charts: Stochastic, ATR, FVG and More.

🔗 Risk

Managing Risk and Emotions on XAUUSD

Gold is more volatile than many major FX pairs. Intraday moves of 20–30 USD per ounce are common, and sharp spikes can occur around news. This volatility can be attractive but also dangerous if you use excessive leverage or trade emotionally.

Volatility, stops and leverage

Because of gold’s volatility:

- Stop-losses typically need to be wider (in USD terms) than on EURUSD.

- Using the same lot size as you would on a currency pair can lead to much larger swings in your account.

- Leverage must be used carefully; a small move against you can create a large percentage drawdown.

A practical approach is to set stop-loss distances based on ATR or recent swing levels, then adjust lot size so that your monetary risk remains constant.

Simple risk rules for trading XAUUSD

Many disciplined gold traders follow guidelines like:

- Risk per trade: 0.5–2% of account equity (1% is a common benchmark).

- Maximum daily loss: 3–5% of equity; if reached, stop trading for the day.

- Maximum open risk: The total risk of all open trades should stay within a predefined limit (for example, no more than 3% at once).

- Use of leverage: Choose a leverage level that allows you to comfortably place trades with your desired stop distance without risking too large a fraction of your capital.

A small example:

- Account equity: 2,000 USD

- Risk per trade: 1% = 20 USD

- Stop-loss distance: 7 USD on XAUUSD

- Value per 1 lot per 1 USD: 100 USD

- Risk per lot: 7 USD × 100 = 700 USD

- Lot size: 20 / 700 ≈ 0.03 lot

This way, your stop-loss is based on the market’s volatility, while your risk per trade remains controlled.

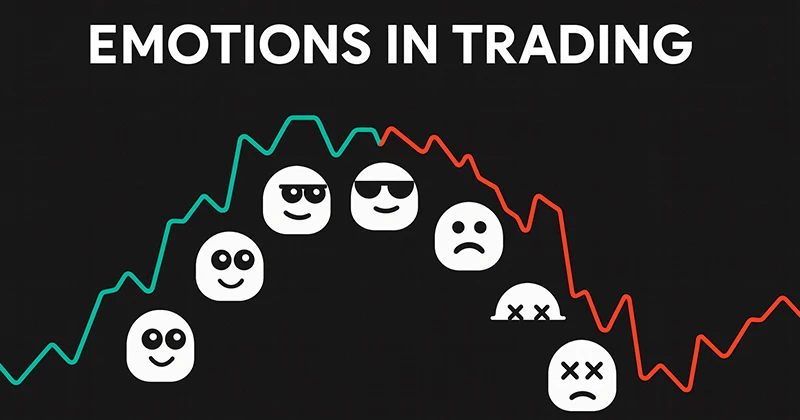

Emotional traps in gold trading

Common psychological pitfalls include:

- Chasing spikes: Jumping in after a large candle because you “don’t want to miss the move”, often right before a reversal.

- Widening stops: Moving your stop-loss further away when price approaches it, turning a manageable loss into a large one.

- Revenge trading: After a loss on gold, immediately opening a new, larger position to “win it back”.

- Overtrading: Taking multiple impulsive trades in a row when you see sharp moves.

To reduce emotional trading:

- Define your strategy and risk rules in writing before the session.

- Use alerts or pending orders instead of staring at every tick.

- Review your trades in a journal to spot patterns in your behavior.

- Take regular breaks, especially after big wins or losses.

For more structured frameworks, see Risk Management for Trading Gold: Position Sizing and Volatility Control and Psychology and Common Mistakes in Gold Trading.

🔗 Plan

Gold in a Diversified Trading and Investment Plan

Gold should not exist in a vacuum within your portfolio. It can play multiple roles alongside FX majors, stock indices and cryptocurrencies.

Gold as part of a broader portfolio

In a diversified trading or investment plan, gold can be:

- A hedge: When stocks or risk assets fall, gold often (though not always) rises or falls less, helping smooth portfolio swings.

- A core asset: Some traders always keep a portion of their capital engaged in gold, either via long-term holdings or recurring trading strategies.

- A diversifier: Gold’s drivers differ from those of individual stocks or single currencies, so its correlation to them can change over time.

Alongside XAUUSD, traders might follow major FX pairs (EURUSD, GBPUSD), stock indices (e.g., S&P 500, DAX), and cryptocurrencies like Bitcoin or Ethereum. Each instrument has its own risk profile; gold tends to sit closer to safe-haven assets, though it can still be very volatile.

Comparing gold with other safe havens and Bitcoin

You can roughly compare:

Asset | Type | Typical role | Key risks |

Gold | Physical/CFD | Safe-haven, inflation hedge | Volatility, no yield |

USD | Fiat currency | Reserve currency, safe-haven | Policy risk, inflation |

JPY | Fiat currency | Funding/defensive currency | Policy changes, yield differentials |

Bonds | Fixed income | Income + safety | Interest rate risk, default risk |

Bitcoin | Cryptocurrency | Speculative, “digital gold” | Extreme volatility, regulatory risk |

Gold is often compared with Bitcoin as “digital gold”. Both can act as alternatives to fiat currencies, but Bitcoin tends to be much more volatile and sensitive to sentiment in the crypto market. Some traders hold both, using gold as a more traditional hedge and Bitcoin as a higher-risk, higher-volatility asset.

Using gold as hedge or core trading instrument

Practical ways to integrate gold include:

- Hedging: If you hold long positions in indices or risk currencies, you might partially hedge with long XAUUSD positions when risk sentiment worsens.

- Correlation plays: Monitoring the relationship between XAUUSD and USD, JPY, or yields to identify when gold is under- or over-reacting.

- Core strategy: Building a primary strategy focused on gold (for example, daily trend trading) and supplementing it with secondary trades in other markets.

The key is to ensure that your total portfolio risk is coherent and that you are not unintentionally overexposed to a single theme. For a deeper comparison of safe-haven assets, see Gold vs Other Safe-Haven Assets (USD, JPY, Bitcoin): When Does XAUUSD Outperform?.

🔗 Ways

Advanced Ways to Trade Gold with NordFX

Once you understand the basics of gold trading and have some experience, you may explore more advanced methods to participate in XAUUSD trends without constantly watching the charts.

Using Social Trading for gold-focused strategies

Social Trading allows you to automatically replicate the trades of experienced gold traders on your own account. You choose which strategy providers to follow, how much capital to allocate, and you can usually start or stop copying at any time.

Integrating long-term gold forecasts into your plan

Long-term gold forecasts are based on analysis of:

- Central bank policies and interest rate cycles.

- Inflation and growth projections.

- Currency trends and global risk sentiment.

- Structural factors such as central bank gold purchases.

Swing and position traders can:

- Form a macro bias (for example, mildly bullish gold over the next 6–12 months).

- Trade in the direction of that bias when technical signals align.

- Use higher timeframes (daily, weekly) for key support/resistance and trend structure.

For example, if your long-term outlook is bullish due to expected lower real rates, you might focus more on buying pullbacks rather than shorting rallies, while still respecting strict risk rules.

Checklist: from demo to live trading

Before committing serious capital, it is useful to run through a simple checklist:

- Have you read a complete gold trading guide and understand how XAUUSD contracts work?

- Do you have at least one clear strategy (entry, stop, take-profit, position sizing)?

- Have you tested your strategy on a demo account and in different market conditions (trend, range, news)?

- Do you have written risk rules (max risk per trade, daily loss limit, maximum open risk)?

- Are you prepared psychologically to accept losing trades as part of the process?

If you can answer “yes” to these questions, you can gradually transition from demo to live trading, starting with smaller position sizes. Over time, you can adjust and refine your plan based on real-world experience. For a longer-term perspective on gold, see Gold as an Investment: Long-Term Forecasts and What They Mean for XAUUSD Traders.

🔗 FAQs

FAQs

What is the minimum capital needed to trade XAUUSD?

There is no universal minimum, because it depends on your broker’s margin requirements and the lot sizes you choose. However, you need enough capital to risk only a small percentage per trade while using reasonably sized stops. Even a few hundred dollars can be used to start with micro-lots, but larger capital gives more flexibility and stability.

Is gold more risky than trading major currency pairs?

Gold is often more volatile than pairs like EURUSD or USDJPY, especially around news and during active sessions. This volatility can lead to larger profits or losses in a short time. With proper position sizing and conservative leverage, you can manage this risk, but trading gold casually with oversized positions is generally more dangerous than trading major FX pairs.

Can I hold gold trades overnight or over the weekend?

Yes, you can hold XAUUSD positions overnight and across multiple days. However, you will typically pay or receive swap/financing charges depending on your position and the broker’s rates. There is also gap risk if you hold positions over weekends or major events, meaning price might open far from your stop-loss. Swing and position traders account for this by using wider stops and smaller lot sizes.

How many gold trades should I place per day?

There is no fixed number. Scalpers might place many small trades in a single session, while swing traders may only enter a few trades per week. A useful guideline is quality over quantity: only trade when your setup is present, your risk rules are met, and you are mentally fresh. If you notice yourself trading just to “do something”, it may be time to step away.

Which timeframe is best for trading XAUUSD?

The best timeframe depends on your strategy and schedule. If you can only check markets a few times a day, H1, H4 or daily charts may be better. If you enjoy active intraday trading and can focus for several hours, M5–M30 may work. Many traders use a multi-timeframe approach, analyzing trend on higher timeframes (H4, daily) and entering on lower ones (M15, M30).

Do I always need to check the news before trading gold?

It is wise to know the economic calendar, especially for major US data releases and central bank events. You do not have to avoid trading on every news day, but you should be aware of when volatility might spike. Some traders simply avoid entering new trades right before key announcements, while others adjust position size or temporarily widen stops.

Can technical analysis alone work on gold?

Many traders successfully use primarily technical analysis on gold, focusing on support/resistance, trendlines, and indicators. However, ignoring fundamentals completely can be risky, because major news can invalidate technical setups very quickly. A balanced approach is to use technicals for entries and exits while being aware of the fundamental context.

What should I learn after mastering the basics of this gold trading guide?

After you understand XAUUSD mechanics, timing, core strategies and risk management, you can deepen your skills in several areas: advanced technical patterns specific to gold, automated and algorithmic strategies on MT4/MT5, multi-asset hedging ideas, and long-term macro analysis. Good next steps include Gold Trading Strategies: Day Trading, Swing and Trend Following on XAUUSD and Risk management in forex.

This is not trading advice and is provided for educational purposes only.