Last updated in 2025 to reflect recent gold price dynamics and long-term forecasts.

Since ancient times, gold has remained a crucial element of global economies. Its unique properties have made it not only valuable as jewellery but also a reliable means of preserving wealth. Today, this metal constitutes a significant part of both investor portfolios and central bank reserves. This review analyses the dynamics and reasons for changes in the price of gold and presents forecasts from leading banks and experts regarding the XAU/USD pair in the medium- and long-term perspectives.

Gold remains one of the most popular long-term investments, and experts’ forecasts for 2025–2050 range from moderate growth to scenarios where XAU/USD reaches several thousand dollars per ounce.

Gold Price: From Ancient Times to the 20th Century

● Ancient Times. Gold mining and usage began in the 4th millennium BC. One of the first civilizations to actively use this metal was ancient Egypt, where it was mined from around 2000 BC. The importance of gold in ancient Egypt is hard to overestimate – it was considered "the flesh of the gods" and used in all aspects of life, from religious ceremonies to burial rites, in making vessels and statuettes, jewellery, and home decor, as well as a means of payment. Gold’s resistance to corrosion made it a symbol of immortality and strength.

Exact data on the value of gold in ancient civilizations is hard to find, but it is known to have been one of the most valuable commodities, used not only for trade but also for wealth storage. For example, in Babylon in 1600 BC, one talent of gold (about 30.3 kg) was worth approximately 10 talents of silver (about 303 kg).

In the late 8th century BC, in Asia Minor, gold was first used as coinage. The first pure gold coins with stamped images are attributed to the Lydian King Croesus. They were of irregular shape and often minted only on one side.

● Antiquity. In antiquity, gold continued to play a key role in the economy and culture. The Greeks mined gold in various places, including the region of Troy, where, according to myth, the deposit was a gift from the god Zeus. For the ancient Greeks, gold symbolized purity and nobility and was used to create unique artworks and jewellery.

In classical Athens (5th century BC), one gold drachma was worth about 12 silver drachmas. During the time of Alexander the Great (4th century BC) and the subsequent Hellenistic kingdoms, the gold-to-silver ratio varied but generally stayed within the range of 1:10 to 1:12. (Interestingly, this ratio has now grown to about 1:80). Alexander the Great issued gold staters weighing about 8.6 grams, highly valued coins often used for large international transactions.

● Middle Ages. In the Middle Ages, gold remained a vital element of the economy. In the Byzantine Empire, the solidus gold coin, weighing 4.5 grams, was used for international trade. In medieval Europe, gold also played a significant role, especially after the discovery of large gold deposits in Africa. In 1252, the gold florin was introduced in Florence and used throughout Europe. In England, the gold sovereign appeared in 1489.

What could one buy with such a coin? In England in the 11th-12th centuries, a sovereign could purchase a small piece of land about one acre or a part of a farm. In the 13th century, a gold coin could buy several heads of cattle, such as two cows or several sheep.

Gold was also used to acquire weapons or armour. For example, a good quality sword might cost about one coin. One gold coin could also pay for a skilled craftsman’s work for several months. For instance, such money could order the construction or repair of a house. Additionally, it could buy a large amount of food, such as a year's supply of bread for a family.

● Modern Times. During the Age of Exploration, gold came to the forefront again. After the discovery of America, Spanish conquistadors brought vast quantities of gold to Europe. In the 17th-18th centuries, gold became the basis for the formation of monetary systems in Europe. By 1800, the price of one troy ounce of gold (31.1 grams) in Britain was about £4.25. Therefore, one troy ounce of this metal could buy a small plot of land in some rural areas or pay rent for housing for 8 months. It could also order the tailoring of four men's suits or pay for elementary school education for several years.

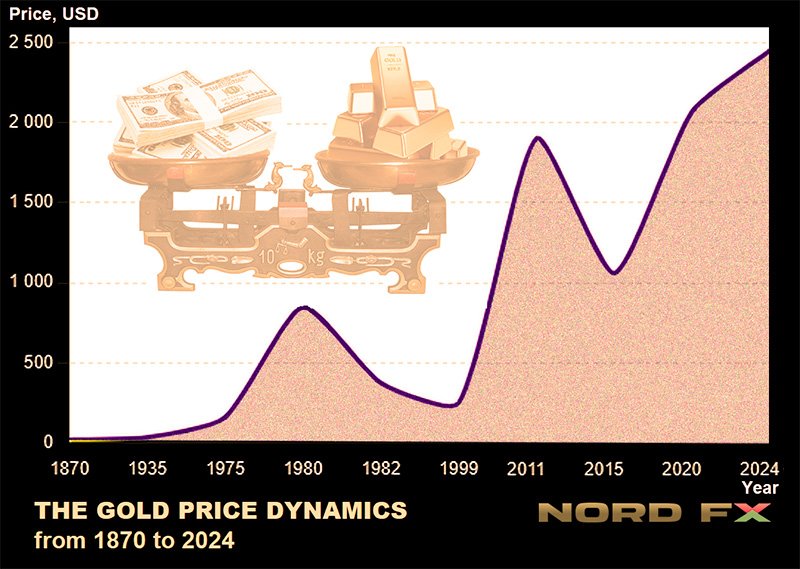

● 19th Century. The 19th century was marked by the Gold Rush, especially in California and Australia. This led to a significant increase in gold production and, consequently, a relative decrease in its price. In 1870, the price of one troy ounce of gold was about $20. Starting in 1879, the US monetary system was based on the so-called "gold standard," which tied the amount of paper money to the country’s gold reserves, and $20 could always be exchanged for a troy ounce of this precious metal. This price level remained until the early 20th century.

20th Century: $20 – $850 – $250

● 1934. It had been 55 years since the adoption of the "gold standard" when, during the Great Depression, US President Franklin D. Roosevelt enacted the "Gold Reserve Act." According to this document, private ownership of gold was declared illegal, and all precious metals had to be sold to the US Treasury. A year later, after all the gold had been transferred from private ownership to the state, Roosevelt raised its price by 70% to $35 per troy ounce, allowing him to print the corresponding amount of paper money.

For the next four decades, gold prices remained stable at around $35 until 1971, when another US President, Richard Nixon, decided to abandon the "gold standard" altogether, delinking the dollar from gold. This decision can be considered a turning point in the history of the modern world economy. Gold ceased to be money and began to be traded on the open market at a floating exchange rate. This completely freed the US government’s hands, allowing it to print infinite amounts of fiat currency, and the price of precious metals to grow exponentially.

By the end of 1973, the price of precious metals had already reached $97 per ounce and continued to rise amid economic instability and inflation, reaching $161 in 1975 and $307 in 1979. Just a year later, amid high inflation and political instability (including the Soviet invasion of Afghanistan and the Iranian revolution), XAU/USD reached a record level of $850 .

● 1982. After reaching this peak, there was a rollback to $376 in 1982, linked to rising interest rates in the US and stabilizing economic conditions. Political and economic changes in the world, such as the end of the Cold War and the development of global financial markets, stabilized the gold market, and until the mid-1990s, XAU/USD traded in the range of $350-$400. By 1999, the price had fallen to $252 per ounce, due to rising stock markets, low inflation, and decreased demand for gold as a safe-haven asset.

First Quarter of the 21st Century: From $280 to $2450

● 2000s. At the beginning of the 2000s, the price of gold was about $280 per troy ounce. However, it began to rise following the dot-com bubble burst and sharply increased during the global financial crisis, reaching $869 in 2008. This growth was driven by economic instability, falling stock markets, declining confidence in the dollar, and increased demand for gold from investors seeking safe-haven assets. By the end of 2010, the gold price continued to rise, reaching $1421. In September 2011, it reached a record level of $1900 per ounce. This rise was due to the European debt crisis and concerns about global economic instability. However, the dollar began to strengthen, inflation expectations fell, and stock markets rose, leading XAU/USD to turn south, falling to $1060 by the end of 2015.

After this, another reversal occurred, and the pair headed north again. In 2020, the price reached a new record level of $2067. The primary driver here was the COVID-19 pandemic, which prompted massive monetary stimulus measures (QE) by governments and central banks, primarily the US Federal Reserve. The historical maximum to date was reached in May 2024 at $2450, aided by geopolitical instability in the Middle East, Russia’s military invasion of Ukraine, and expectations of interest rate cuts by the Federal Reserve, ECB, and other leading central banks. All current price levels in this review are given as of mid-2024 and may differ from live XAU/USD quotes in your trading platform.

For traders, this history shows that gold can stay flat for years and then move sharply when monetary policy or geopolitics change, creating both risks and opportunities for XAU/USD trading.

Why Gold?

● Mid-2024. Before moving on to gold price forecasts, let's answer the question: what exactly makes this yellow metal valuable?

Firstly, note its physical and chemical properties. Gold is chemically inert, resistant to corrosion, and does not rust or tarnish over time, making it an ideal asset for value storage. It has an attractive appearance and lustre that does not fade over time, making it popular for making jewellery and luxury items. It is also relatively rare in the Earth’s crust. Limited availability makes it valuable since demand always exceeds supply.

● Next, follow the economic factors, which are perhaps more important in the modern world. Gold is traditionally used as a means of preserving capital. We have already mentioned that in times of economic instability and geopolitical tension, investors often turn to gold to protect their savings from depreciation. Naturally, in such a situation, its price is influenced by the level of inflation and related monetary policies of central banks, including interest rate changes and quantitative easing (QE) or tightening (QT) programmes.

Investors use gold to diversify their portfolios and reduce risks. Gold has high liquidity, allowing it to be quickly and easily converted into cash or goods and services worldwide. This makes it attractive not only for investors but also for central banks, which hold significant gold reserves as part of their international reserves. This helps them maintain national currency stability and serves as a guarantee in case of financial crises. For example, the Federal Reserve holds nearly 70% of its foreign reserves in gold. More information about gold can be found in this guide.

For example, an investor with a 10,000 USD portfolio might allocate 5–10% (500–1,000 USD) to gold. Even a relatively small share can help smooth portfolio drawdowns during periods of high inflation or financial stress

Forecasts for the Second Half of 2024 and 2025

● Gold price forecasts for the end of 2024 and 2025 vary, but most analysts from leading global banks and agencies agree that its price will rise. UBS strategists predict an increase to $2500 per ounce. J.P. Morgan also targets $2500 in the medium term, provided the Federal Reserve cuts rates and economic instability persists.

Goldman Sachs has revised its forecasts and expects the price to reach $2700 per ounce in 2025. Bank of America economists initially forecasted $2400 for 2024 but also revised their forecast upwards to $3000 by 2025. The primary condition for growth, according to the bank, is the start of active rate cuts by the US Federal Reserve, which will attract investors to gold as a safe-haven asset.

Citi specialists agree with this figure. "The most likely scenario in which an ounce of gold rises to $3000," they write in an analytical note, "besides the Federal Reserve rate cut, is the rapid acceleration of the current but slow trend – the de-dollarization of central banks in developing economies, which will undermine confidence in the US dollar."

Rosenberg Research analysts also mention a figure of $3000. The consulting agency Yardeni Research does not rule out that due to a possible new wave of inflation, XAU/USD could rise to $3500 by the end of next year. The super-bullish forecast was given by TheDailyGold Premium magazine editor Jordan Roy-Byrne. Based on the "Cup and Handle" model, he stated that a breakout is coming, and with it a new cyclical bull market. "The current measured target for gold," writes Roy-Byrne, "is $3000, and its logarithmic target is somewhere between $3745 and $4080."

Forecasts to 2050

● Most major banks and financial data providers typically offer only short- and medium-term forecasts. The main reason is that markets can be very volatile, and small changes in supply or demand factors and external events can lead to unexpected price fluctuations, casting doubt on prediction accuracy.

Despite this, there are different scenarios and long-term price forecasts for gold for 2030-50. Economist Charlie Morris, in his work "Rational Case for Gold by 2030," forecasts a price of $7000 per ounce. Another specialist, David Harper, predicted that the price of gold could reach $6800 by 2040. This scenario, according to Harper, describes reasonable growth with a return rate of about 7.2% per year.

Regarding a 25-year horizon, Josep Peñuelas, a research professor at the Centre for Ecological Research in Barcelona, warned that by 2050, the world might run out of key metals, including gold. However, other futurist theories are more optimistic. According to renowned investor and writer Robert Kiyosaki, gold has existed since time immemorial and, being "God’s money," is likely to become the primary form of currency in the future. In his book "Fake," Kiyosaki argues that ultimately, gold, along with bitcoins, could destroy paper currencies and become the foundation of the global financial system.

These forecasts are scenarios, not guarantees. Traders should combine analyst opinions with their own risk management rules and avoid over-leveraging XAU/USD positions.

Why now Is the perfect time to trade gold you can find in this article. Here is a Gold Trading Guide: How to Trade XAUUSD Step by Step.

Q: Is gold a safe investment for beginners?

A: Gold is often viewed as a safe-haven asset, but its price can still fluctuate significantly. Beginners should start with small positions, use low leverage, and always set stop-loss levels when trading XAU/USD.

Q: How much of my portfolio should be in gold?

A: There is no universal rule, but many investors consider a 5–10% allocation to gold as a way to diversify and hedge risks. The exact share depends on your risk tolerance, investment horizon, and whether you hold other defensive assets.

Q: What affects gold prices the most?

A: The key factors include interest rates, inflation expectations, the strength of the US dollar, central bank policies, and geopolitical risks. When uncertainty rises or real interest rates fall, demand for gold as a safe-haven asset usually increases.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back