A market economy is an economic system where supply and demand determine prices, production, and distribution of goods and services. Businesses and individuals make economic decisions independently, and most resources are privately owned. Prices act as signals that coordinate activity between consumers and producers.

Market economies explain how many modern economies allocate resources without central planning. When demand increases, prices rise and encourage higher production. When demand falls, prices decline and reduce output. Most real-world economies are mixed systems that rely on market mechanisms alongside government regulation.

Key takeaways:

- Definition: A market economy is driven by supply, demand, and price signals.

- Ownership: Resources are mainly privately owned.

- Decision-making: Economic choices are decentralized, not centrally planned.

- Pricing role: Prices balance supply and demand.

- Real-world use: Most economies operate as regulated market economies.

How Market Economies Work

Market economies work through decentralized decision-making. Individuals and firms make decisions independently based on their objectives. Consumers seek to maximize their satisfaction, while producers aim to maximize profits. Prices emerge from the interaction of supply and demand and provide feedback to economic agents.

Supply and Demand

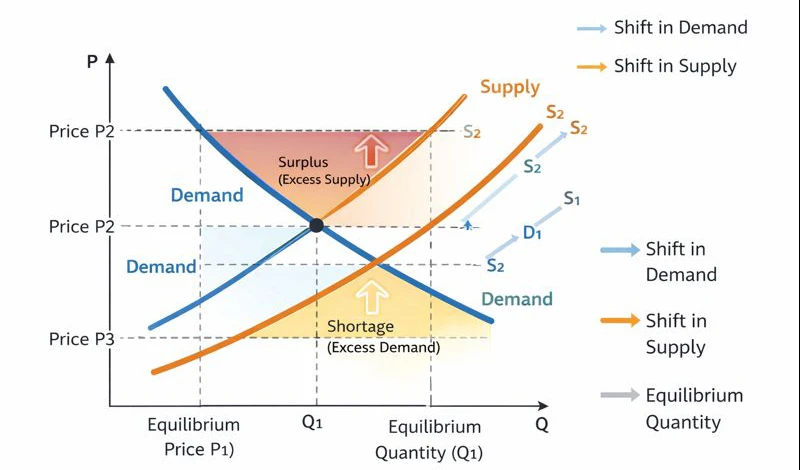

Supply and demand are the fundamental forces in a market economy. Demand represents how much of a product consumers want at various price levels. Supply reflects how much producers are willing to produce at different prices. When demand increases, prices tend to rise, prompting producers to supply more. Conversely, if supply increases and demand remains unchanged, prices tend to fall.

The point where supply equals demand is known as the equilibrium price. At this price, the quantity supplied equals the quantity demanded. Market economies continually adjust toward equilibrium as conditions change.

Price Signals

Price signals are crucial in guiding decisions. When prices rise for a particular good, consumers may buy less of it and substitute other goods. Higher prices signal producers to allocate more resources toward producing that good. For example, if the price of oil rises, oil companies may invest more in exploration and production.

Competition

Competition is a key mechanism in market economies. Firms compete with each other to attract customers by offering better products or lower prices. Competition can drive efficiency, as firms seek to reduce costs and innovate to stay ahead of rivals.

Competition also affects wages and input prices. Workers with scarce skills may command higher wages, while abundant skills may lead to lower wages. Input prices reflect the relative scarcity of resources used in production.

Role of Private Property

Private property rights are essential in a market economy. Individuals and firms must have secure rights to own and use resources. Property rights provide incentives for investment and innovation. When people can benefit from their efforts, they are more likely to take risks and create value.

Limited Government Role

In a pure market economy, the government’s role is limited to enforcing contracts, protecting property rights, and maintaining the rule of law. Governments may also provide public goods that markets find difficult to supply, such as national defense, infrastructure, and basic education. However, the degree of government involvement varies across different countries.

Feedback Mechanisms

Markets provide continuous feedback. If a product becomes unpopular, its price falls, leading firms to produce less of it. If a new technology becomes desirable, demand increases, prices rise, and more resources flow into that industry. This feedback loop promotes dynamic allocation of resources.

Market Adjustments

Market economies adjust to shocks through price and quantity changes. If a natural disaster disrupts supply, prices may rise, signaling consumers to reduce consumption and producers to find alternatives. Over time, markets can adapt to new conditions, though adjustment periods may involve economic pain for some groups.

Market Theory

Market theory refers to the set of ideas that explain how markets operate and how prices are determined. It encompasses several key concepts, including supply and demand, equilibrium, elasticity, and market efficiency.

Classical Economics

Classical economics laid the foundation for modern market theory. Economists like Adam Smith, David Ricardo, and John Stuart Mill emphasized the role of markets in allocating resources. They believed that individuals acting in their own interest could lead to outcomes beneficial for society as a whole.

Adam Smith’s concept of the “invisible hand” suggests that self-interested actions can unintentionally contribute to the public good. Smith argued that when producers compete for consumers, they innovate and improve efficiency, which can raise overall economic welfare.

Neoclassical Economics

Neoclassical economics builds on classical ideas and introduces formal models of supply, demand, and utility. It assumes that individuals make rational choices to maximize their utility and firms aim to maximize profits. Neoclassical theory introduces the concept of marginal analysis, which examines how small changes in price or quantity affect decisions.

Supply and Demand Curves

In market theory, supply and demand curves represent the relationship between price and quantity. The demand curve typically slopes downward, indicating that consumers buy more at lower prices. The supply curve slopes upward, reflecting that producers supply more at higher prices.

The intersection of these curves determines the market equilibrium. Changes in factors like consumer preferences or production costs shift the curves and lead to new equilibrium prices.

Elasticity

Elasticity measures the responsiveness of quantity demanded or supplied to changes in price. If a small change in price leads to a large change in quantity, the good is considered elastic. If quantity changes little when price changes, it is inelastic. Understanding elasticity helps firms and policymakers predict how markets respond to changes.

Market Efficiency

Market efficiency refers to how well market prices reflect available information. In efficient markets, prices incorporate all relevant information, and assets are fairly valued. While this concept is often used in financial markets, it also applies to product markets. When markets are efficient, resources are allocated effectively, and opportunities for arbitrage diminish.

Limitations of Market Theory

While market theory provides valuable insights, it relies on simplifying assumptions. For instance, it assumes perfect competition, complete information, and rational behavior. Real-world markets often deviate from these conditions. Factors like monopolies, externalities, and information asymmetry can lead to market failures.

Modern Market Economy

A modern market economy blends traditional market mechanisms with varying degrees of government regulation. Pure market economies are rare; most countries operate mixed economies that incorporate both market forces and government interventions to address social goals and market failures.

Characteristics of Modern Market Economies

Modern market economies share several characteristics. They rely on private property, competitive markets, and price signals to allocate resources. At the same time, governments regulate markets to prevent abuse, protect consumers, and provide essential public services.

Market economies also depend on financial systems that facilitate the movement of capital. Banks, stock markets, and other financial institutions help channel savings into productive investment. These systems support economic growth and innovation.

Role of Technology

Technology plays a vital role in modern market economies. Advances in information technology, automation, and communication have transformed how markets function. Technology increases efficiency, expands market reach, and creates new products and services.

E-commerce platforms allow buyers and sellers to connect globally. Digital payment systems streamline transactions. Data analytics helps firms understand consumer behavior and make informed decisions.

Globalization

Globalization has integrated market economies around the world. Countries trade goods and services, invest in each other’s markets, and share technology. Global supply chains link producers and consumers across continents. While globalization has expanded opportunities, it also introduces challenges, such as competitive pressures on domestic industries.

Government Regulation

Governments in modern market economies regulate activities to protect public interests. Regulations may target financial stability, environmental protection, consumer safety, and labor standards. For example, antitrust laws prevent monopolies, while environmental regulations limit harmful emissions.

Governments also provide social safety nets such as unemployment benefits and public healthcare. These measures aim to reduce economic inequality and cushion citizens from adverse economic shocks.

Fiscal and Monetary Policy

Fiscal policy involves government spending and taxation decisions that influence economic activity. During recessions, governments may increase spending or cut taxes to stimulate demand. During inflationary periods, they may reduce spending or raise taxes.

Monetary policy refers to central banks’ actions to influence money supply and interest rates. Lower interest rates can encourage borrowing and investment, while higher rates may curb inflation.

Mixed Economic Models

Most modern market economies are mixed. For example, some countries emphasize free markets with limited regulation, while others maintain more extensive welfare systems and regulatory frameworks. The balance between market freedom and government intervention varies across cultures and political systems.

Advantages of a Market Economy

Market economies offer several advantages that contribute to economic growth and individual freedom. These benefits stem from the decentralized nature of decision-making and the incentive structures created by competition and private ownership.

Efficient Resource Allocation

Market economies allocate resources where they are most valued. Prices reflect scarcity and demand, guiding producers to supply goods that consumers want. When prices change, economic agents adjust their behavior, helping ensure resources are not wasted.

Innovation and Entrepreneurship

Competition creates incentives for innovation. Firms that develop better products or improve processes can gain market share. Entrepreneurs are encouraged to take risks because they can benefit directly from successful ventures. Innovation drives productivity and economic growth.

Consumer Choice

In market economies, consumers enjoy a wide range of choices. Firms compete to attract customers by offering diverse products, features, and prices. This variety allows consumers to select goods and services that best suit their needs and preferences.

Flexibility and Adaptability

Market economies can adapt to changing conditions. Prices adjust to shifts in supply and demand, and firms respond accordingly. This flexibility helps economies recover from shocks and evolve with technological advancements.

Incentives for Efficiency

Profit motives encourage firms to minimize costs and improve efficiency. Inefficient firms that cannot compete may exit the market, while efficient ones thrive. This competitive pressure promotes overall economic efficiency.

Decentralized Decision-Making

Decentralized decision-making allows individuals to make choices based on their own information and preferences. Rather than central planners determining production, numerous market participants interact to shape economic outcomes.

Disadvantages of a Market Economy

Despite its strengths, a market economy has limitations and potential drawbacks. These disadvantages can lead to social and economic challenges if not addressed through policy measures.

Income Inequality

Market economies can produce significant income inequality. Individuals with scarce skills or capital may earn much more than others. While inequality can motivate people to improve their skills, excessive disparities may lead to social tension and reduced social mobility.

Market Failures

Markets do not always allocate resources efficiently. Market failures occur when conditions like externalities, public goods, or information asymmetry prevent optimal outcomes. For example, pollution is a negative externality that markets may not address without regulation.

Short-Term Focus

Firms in market economies may prioritize short-term profits over long-term sustainability. This focus can lead to underinvestment in areas like environmental protection, infrastructure, and employee development.

Public Goods and Externalities

Public goods like national defense and street lighting are difficult for markets to provide because individuals cannot be excluded from benefiting. Market economies may underproduce these goods without government intervention. Likewise, positive externalities like education can be undervalued by markets.

Economic Cycles

Market economies are subject to business cycles. Periods of expansion can be followed by recessions, leading to unemployment and reduced income. While markets adjust over time, these cycles can cause hardship for many people.

Monopoly Power

When competition diminishes, firms may gain monopoly power and exploit consumers through higher prices or reduced quality. Governments often regulate monopolies to prevent such outcomes, but enforcement can be challenging.

Unequal Access to Opportunities

Not everyone has equal access to opportunities in a market economy. Barriers such as education costs, discrimination, and unequal starting conditions can limit individuals’ ability to participate fully in the economy. Targeted policies can help reduce these barriers, but differences often persist.

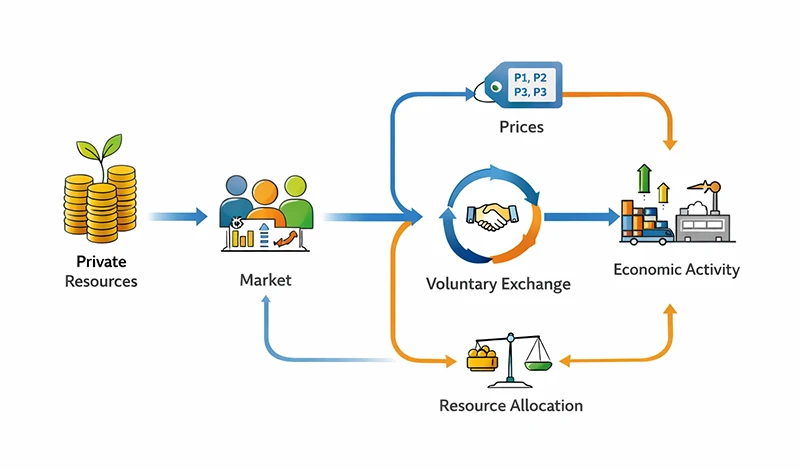

Role of a Market Economy in Trading

A market economy plays a foundational role in trading at both domestic and international levels. Trading activity relies on core market economy principles such as supply and demand, price signals, competition, and voluntary exchange. These mechanisms determine how assets are priced, how quickly markets respond to new information, and how efficiently capital moves between participants.

In a market economy, financial markets enable the trading of assets including stocks, bonds, currencies, and commodities. Prices in these markets are formed through interactions between buyers and sellers who act based on expectations, risk assessments, and available information. For example, currency traders buy and sell currencies in response to interest rate decisions, economic data, and geopolitical developments, while equity traders react to corporate earnings and growth prospects. Understanding how a market economy functions helps traders interpret these price movements and assess market sentiment.

Price discovery is a central function of trading in a market economy. It refers to the process through which markets determine the fair value of an asset based on current supply and demand. Traders contribute to price discovery by placing buy and sell orders at different price levels, allowing markets to reflect new information in real time. Efficient price discovery ensures that asset prices remain aligned with economic conditions and expectations.

Liquidity is another key feature supported by market economies. Liquidity describes how easily assets can be bought or sold without causing significant price changes. Highly liquid markets allow traders to enter and exit positions quickly and at predictable prices, which is essential for effective trading and risk management. Liquid markets also reduce transaction costs and improve overall market efficiency.

Trading within a market economy also requires active risk management. Because prices fluctuate based on changing information and sentiment, traders use tools such as stop-loss orders, diversification, and hedging strategies to manage potential losses. A solid understanding of market dynamics helps traders identify risks and respond appropriately to volatility.

Market economies also facilitate global trade by enabling the cross-border exchange of goods, services, and financial assets. Exchange rates, trade policies, and economic indicators influence trading decisions in international markets. Traders who monitor global economic developments can anticipate shifts in supply and demand and adjust their strategies accordingly.

Finally, trading in a market economy reflects human behavior as well as economic logic. Markets do not always operate in a perfectly rational way, as emotions such as fear and greed can influence decision-making and increase volatility. Recognizing these behavioral patterns allows traders to better understand market movements. At the same time, regulations in market economies aim to promote transparency, fairness, and stability. Trading venues operate under established rules, and regulatory bodies oversee market activity to reduce fraud and protect participants, helping maintain confidence in the trading system.

Market Economy Principle | Role in Trading | Practical Impact for Traders |

Supply and demand | Determines asset prices based on buyer and seller interest | Helps traders identify potential price increases or declines |

Price signals | Reflect new information such as economic data or earnings | Guides entry and exit decisions |

Financial markets | Enable trading of stocks, bonds, currencies, and commodities | Provide access to different asset classes |

Price discovery | Establishes fair market value through active trading | Ensures prices reflect current expectations |

Liquidity | Allows assets to be bought or sold easily | Enables faster execution and lower transaction costs |

Risk management | Helps control losses during market volatility | Protects trading capital over time |

Global trade | Connects international markets and economies | Creates opportunities in forex and global assets |

Market behavior | Reflects emotions like fear and greed | Helps traders anticipate volatility |

Market regulation | Promotes fairness and transparency | Increases confidence in trading systems |

Understanding Market Structures

Market structures describe the competitive environment in which firms operate and directly influence pricing, output levels, and overall efficiency. The level of competition within a market affects how much control firms have over prices and how resources are allocated.

One form of market structure is perfect competition, which represents an idealized scenario with many buyers and sellers, identical products, and free entry and exit. Firms in perfectly competitive markets are price takers, meaning they must accept the market price rather than influence it. Although rare in practice, some agricultural markets come close to this structure due to standardized products and high competition.

Another common structure is monopolistic competition, where many firms sell similar but differentiated products. Each firm has limited pricing power because its products are not identical to those of competitors. Businesses compete through quality, branding, service, or location, as seen in industries such as retail, restaurants, and consumer goods.

An oligopoly occurs when a small number of large firms dominate a market. These firms may compete aggressively or implicitly coordinate pricing and output decisions. High barriers to entry make it difficult for new firms to enter the market. Industries such as airlines, telecommunications, and automobile manufacturing often operate under oligopolistic conditions.

A monopoly exists when a single firm controls the entire market for a product or service. Without competition, a monopolist can set prices above competitive levels and restrict output. Because monopolies can disadvantage consumers, governments often regulate or oversee these markets to limit pricing power and ensure fair access.

A monopsony is a market structure in which there is a single dominant buyer rather than a single seller. This structure can influence wages and input prices, particularly in labor markets. For example, a large employer in a small geographic area may have significant control over wage levels.

FAQs:

What is a market economy in simple terms?

A market economy is an economic system where prices and production are determined by supply and demand. Businesses decide what to produce, and consumers decide what to buy. Most decisions are made through voluntary exchange rather than government planning.

How is a market economy different from a command economy?

In a market economy, individuals and private businesses make economic decisions. In a command economy, the government controls production, pricing, and distribution. Most real-world economies fall somewhere between these two models.

Is a market economy the same as capitalism?

The two concepts are closely related but not identical. A market economy focuses on how prices and resources are allocated, while capitalism emphasizes private ownership of capital. Many capitalist systems operate through market economies.

Why are prices important in a market economy?

Prices act as signals that guide decisions. Rising prices encourage producers to increase supply and signal consumers to reduce demand. Falling prices do the opposite, helping balance markets over time.

How does a market economy affect financial trading?

Financial trading relies on market economy principles such as price discovery, competition, and supply and demand. Traders analyze economic data and market behavior to make decisions within this system.