First, a review of last week’s forecast:

- EUR/USD. The upward trend of the pair, which began on New Year's Eve 2017 and which marks a steady fall in the US dollar, was continued last week. Thanks to growing GDP, the US currency had a chance, at least temporarily, to change the situation. However, the growth of the German consumer market turned out to be more impressive, and the pair went up by 100 points, ending the five-day period at 1.1750. Thus, our basic forecast, supported by 55% of experts, graphical analysis and 100% of trend indicators, was justified;

- The US dollar was also falling against the British currency. Our forecast for the GBP/USD spoke of the predominance of bullish sentiment and the desire of the pair to gain a foothold above the level of 1.3100. 1.3120 was identified as a local target and the pair completed the weekly session just above it;

- USD/JPY. Most analysts (65%) and about 80% of the indicators said that the pair would continue to move down. However, what happened, can hardly be called a proper fall: it fell by only 40 points as the result of the week. And, before that, in the first half of the week the pair managed to rise by 120 points, due to which the question of overselling, which was signaled by the oscillators, was closed;

- Practice shows that the USD/CHF rate very often mirrors the movement of the EUR/USD. Last week, though, the opposite happened. At a time when the dollar was falling against other major currencies, it rose sharply (by more than 250 points) against the Swiss franc. The reason was the stop orders issued by major Japanese traders and investment banks, which made the pair return to a strong medium-term support/resistance level in the 0.9700 area;

As for the forecast for the coming week, summarizing the opinions of analysts from a number of banks and brokerages, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

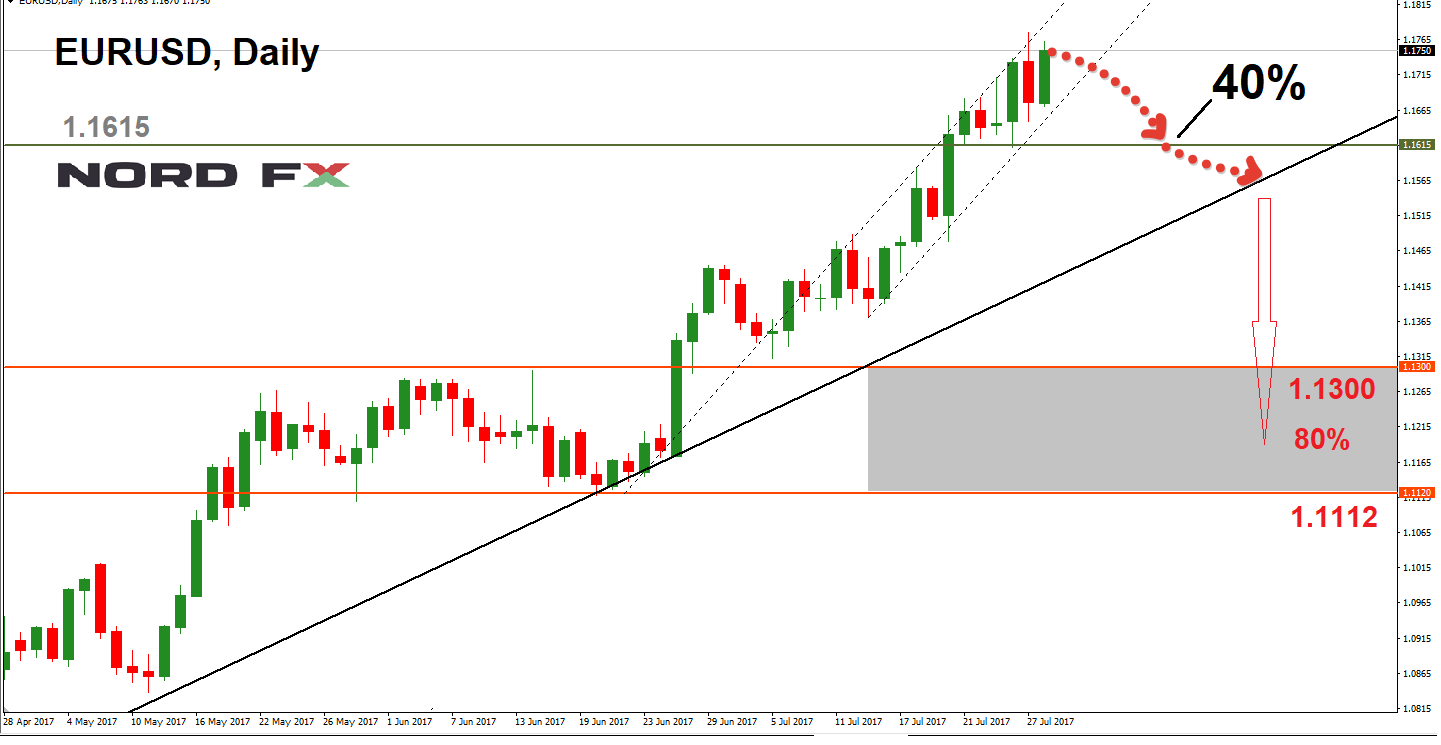

- EUR/USD. Last week, the pair exceeded the August 2015 maximum,1.1715, and rushed to the next target: the highest point of all 2015,1.1870. 60% of experts agree that it will be able to reach it in the near future. The rest believe that the pair is facing a downwards correction: first to 1.1615, and then to the support line of the upward four-month channel near 1.1570. Apart from the experts, graphical analysis on H4 and D1 and a quarter of oscillators agree with such a development of events, with the latter signaling that the pair is overbought.

It should be noted that 80% of experts believe the pair will fall to 1.1112-1.1300 in the medium term;

- GBP/USD. About 70% of analysts, supported by 100% of trend indicators and the vast majority of oscillators, believe that the upward momentum for this pair has not yet dried up, and it will strive to reach the upper limit of last year's summer corridor at 1.3370. The nearest resistance in the zone is 1.3200-1.3225. Support is at the level of 1.3050.

The remaining 30% of experts, supported by graphical analysis on H4 and D1 and just one oscillator, believe that the pair will not be able to rise above the 1.3160 horizon, and will return first to support 1.3050, and then, possibly, drop another 50 points.

The medium-term forecast for the pair remains the same – southwards movement to 1.2700-1.2800. 75% of analysts agree with this development of events; - 65% of experts expect that USD/JPY should still break through the support of 110.60 and fall into the 109.00-110.60 range. However, 20% of the oscillators once again signal that the pair is oversold, and, together with 35% of analysts, talk about a possible return to 112.20. The next resistance is 112.85, then 113.55;

- USD/CHF. After an impressive upwards spurt last week, the opinions of experts are divided almost evenly: 5% side with bears, 45% are on the side of bulls. As for indicators, naturally, the vast majority of them are colored green. However, even here 20% of the oscillators are in the oversold zone. Graphical analysis offers a compromise option at D1: first a decline to the zone of 0.9550, and then growth to 0.9700, and finally 0.9770.

Summarizing the weekly review, it is worth recalling that the upcoming week will be filled with many events that traditionally attract the attention of currency traders. The beginning of the week from Monday to Wednesday will be devoted, mainly, to the data from the Eurozone. Thursday, 3rd August will be marked by a meeting of the Bank of England, and here the distribution of votes regarding interest rate changes will be of great interest. Recall that the number of supporters of rate increases is growing, and therefore certain surprises cannot be ruled out. And finally, at the very end of the week - on Friday, 4 August - US employment data (NFP) will be published, and judging by the forecasts (187K compared to 222K in June), they could apply negative pressure to the dollar.

Roman Butko, NordFX

Go Back Go Back