First, a review of last week’s events:

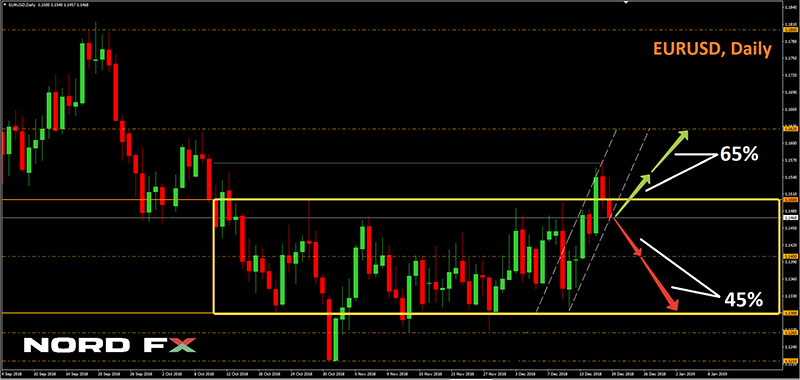

- EUR/USD. On Wednesday, January 9, after repeated attempts, the pair managed to break through the upper limit of the mid-term side channel in which it was located, starting from November 2018. Having overcome the resistance in the area of 1.1500, it reached the height of 1.1570, after which the followed by a trend reversal, and the pair once again found itself within the above channel, ending the week at 1.1470.

The weakening of the dollar was influenced by a number of factors: the unplanned “holidays” of the US Government, a very cautious, “pigeon”, speech of Fed Chairman Jerome Powell at the Economic Club meeting in Washington, where he pronounced the word “patience” five times. But the main factor, according to many experts, was the active strengthening of the Chinese yuan before the expected signing of a trade agreement with the United States; - GBP/USD . Recall that only 15% of analysts sided with the bulls last week. But they were right. Unclear prospects for the dollar outweighed the concerns associated with Brexit. The pound was supported by positive UK GDP data released on Friday, January 11th. As a result, the pair rose by almost 150 points, reaching the height of 1.2865, after which a slight rebound followed, and the quotes dropped to the zone of 1.2840;

- USD/JPY. After the “New Year storm,” caused by the lack of liquidity, the Japanese currency is complete calm, moving in a fairly narrow side corridor within 107.75-109.10. The pair met the end of the week in the same place where it started , near the Pivot Point 108.50. The reason for this is the emerging balance between the attractiveness of the yen as a safe-haven currency and the growing interest in other currencies that can bring grat profits if a trade deal is concluded between the US and China;

- Cryptocurrencies. Our review is fundamentally different from other reviews in that it is not an opinion of one particular analyst. In our analysis, we strive to collect as many opinions of various experts as possible so that, getting rid of harmful “noises”, we can identify the main trend that determines the movement of the pairs in one direction or another. However, it can be very difficult, as, for example, now, for cryptocurrencies.

Some experts consider the decline of the main crypto pairs last week as the end of the positive correction that started in mid-December 2018, and a return to the negative dynamics of the market. And someone, on the contrary, see it as a post-holiday syndrome, at the end of which the quotes will again rush up.

Whatever it may be, the crypto market's capitalization fell from $138 billion on January 6 to $123 billion on Friday January 11, having lost almost 11%. The quotes of major cryptocurrencies, Bitcoin, Litecoin, Ethereum, Ripple, and many other, also fell. Thus, the pair BTC/USD is traded near the three-week low in the $3,700 zone.

The reasons for the fall are the fact that investors, hoping for a festive gap, disappointed, are now closing their positions, and the fact that about 40,000 Ethereum coins have been stolen from Gate.io exchange. The news about the failure of the Japanese regulator FSA to launch ETF based on cryptocurrency might also add to the negative reasons. In general, there are many reasons, but the fact remains that all the main altcoins have moved to the red zone and are traded down, from 5% to 23%, as, say, ETH.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. As you know, the European currency has a strong correlation with oil and metals. And on the commodity market, we are now witnessing a positive trend, especially with regard to energy. The intentions of OPEC to completely remove the excess oil from the market should lead to a further increase in prices, which plays into the hands of the euro. The pause, taken by the Fed regarding the increase in lending rates for the US dollar, is worrying investors.

As a result, at the moment, 65% of analysts, supported by 90% of oscillators and 70% of trend indicators on D1, have voted for the rise the pair above the 1.1500 zone up and its growth, first to the height of 1.1550 and then to the level of 1.1625.

The experts, who still remain loyal to the US currency, believe that, returning to the medium-term channel 1.1300-1.1500, it will not break out of it for a long time. And this is why the pair is expected to decline, first to its central line 1.1400, and then 100 points lower;

- GBP/USD. It is clear that the absolute majority of indicators are currently colored green. However, already 10% of oscillators on D1 signal that this pair is overbought. The possibility of its falling to the horizon 1.2600 is indicated by graphical analysis on the daily time frame as well. As for experts, there is no clear advantage here either for bulls or bears. 55% of them have voted for the growth of the pair, and 45% are for its fall.

On Tuesday, January 15, the British Parliament will vote on Brexit. It is likely that the version of the agreement with the EU proposed by Prime Minister Teresa May will be rejected, and another delay is coming. At the same time, it is becoming more and more obvious that a tough divorce with the European Union is not included in the government’s plans, which positively affects the quotes of the British currency. The additional support for the pound is rendered by the rise in oil prices.

Until the results of the voting become known, there is no sense to make any predictions. One can only specify the key levels: support - 1.2780, 1.2720, 1.2660 and 1.2600, resistance - 1.2925 and 1.3050; - USD/JPY. Indicators and graphical analysis on D1 predict a strengthening of the Japanese currency, with which 65% of experts agree, they expect the pair to decline to 107.50-107.80, and then even lower, to support 106.70.

On the other hand, due to low interest rates in Japan, the pair is quite strongly correlated with the major global stock indices. And the upward trend in this market implies a possible growth of the pair to the levels of 109.10 and 109.45, and in case of the breakdown of the latter, its transition to the zone of 110.25-110.80; - Cryptocurrencies. Despite the fall in the crypto market capitalization, the average daily number of transactions with Bitcoin approached 280,000 over the last week, which is comparable to the peaks of 2018. Therefore, it is is hardly worth it to predict the end of the benchmark cryptocurrency, and indeed the entire market. But the probability of the BTC/USD breakout of support $3,700 and its return to the mid-December lows in the $3,250 zone remains quite high. This scenario is supported by 45% of experts.

Most analysts believe that next week the pair will be able to stay in the three-week “speculative” zone of $3.685-4.385. However, they speak very cautiously about the rise to the level of $5,000 and only in the longer term.

The expectations for Ethereum are somewhat better. Experts expect that after the hard fork called Constantinople, the ETH/USD pair will go up.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

Go Back Go Back