First, a review of last week’s events:

- EUR/USD. The Jackson Hole Annual Economic Symposium has traditionally served to give investors an understanding of where US monetary policy will move. That is why the markets were looking forward to Fed Chairman Jerome Powell speaking at this event.

On the other hand, back in the days when Alan Greenspan was Head of the Federal Reserve, another tradition appeared: let in as much fog as possible when answering questions, so as not to bind oneself with any specific promises.

This was what Powell did in Jackson Hole on Friday August 23. He did not give a clear signal for the Fed rate in the future, explaining that there were no precedents that could serve as the basis for a specific answer. But he said that the Fed was ready to provide more incentives in the event of a slowdown in economic growth.

Powell could not do without a hint that the trade wars waged by the US president are causing a lot of headache to the American Central Bank either.

Speaking of wars. Inside the EU, a counterattack plan for trade tariffs introduced by Trump has matured. A retaliatory strike scheme is described in detail in 173 pages, as the main goals for which the American hi-tech giants Apple, Amazon, Facebook, Google are chosen. A counterattack may also include the unilateral imposition of duties on goods from the United States. In parallel, it is proposed to invest about €100 billion into shares of European companies in order to increase their competitiveness compared to enterprises in the USA and China.

Returning to Powell, despite the vagueness of his wording, as well as the discord among other members of the Fed, many market participants still expect one or two (or even three) base rate cuts before the end of 2019. Moreover, the next cut may be announced on September 18.

Naturally, this market sentiment could not but affect the quotes, and on Friday evening the pair came close to the height of 1.1150; - GBP/USD. In addition to the head of the Fed, the head of the Bank of England Mark Carney also spoke on Friday, August 23. However, an incomparably greater impression on the market was made by the words of German Chancellor Angela Merkel that were said the day before that the EU and Great Britain could reach an agreement on Brexit by October 31. Of course, this is just an intention, but it helped the pound a lot: thanks to these words, the British currency reached a three-week high, rising on Thursday August 22 to 1.2272. Then a pullback followed, but after the speech of the Fed head, the bulls prevailed once again, raising quotes to the level of 1.2285 by the end of the week;

- USD/JPY. There is no doubt that investors continue to be very worried about developments in the markets. It is quite natural against such a background, that the Japanese Yen turned out to be the best currency of the G10, not only in August, but throughout the last months of 2019, playing the role of a quiet haven among the trade and financial wars thundering around. At the same time, experts supported by graphical analysis on H4 had suggested that last week the pair would take a break and move in the side channel 105.00–107.00. That was it until Friday night. Moreover, the corridor was even narrower than expected: only 50 points bounded by horizons 106.20 and 106.70.

Powell’s performance on the evening of Friday, August 23, pushed the pair sharply down, however, it did not manage to reach the level of 105.00, completing the five-day period at 105.40; - Cryptocurrencies. We wrote in our previous forecast that the Bitcoin Fear and Greed Index is at the “Fear” mark. And it is this fear that leads to a continuous decrease in volatility (remember, again, the triangular pennant on the chart of the previous week, whose edges converge in the $10,400-10,500 zone).

This forecast turned out to be absolutely correct, and during the whole seven-day period the BTC/USD pair did not go beyond the borders of $9,785-10,980, which indicates consolidation at the level of $10,385. TOP altcoins also fluctuated in the range of 11-13%: Litecoin (LTC/USD), Ripple (XRP/USD) and Ethereum (ETH/USD).

There is only one conclusion: the market is in a state of uncertainty, and players, both the bulls and the bears, fearing to take risks, froze in anticipation of any distinct signal.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. The meeting of G7 leaders on August 24-26 is among the events of the end of summer. It cannot be ignored. However, it is unlikely that the results of these negotiations of the heads of the G7 countries will set any definite trends in the foreign exchange market. Most likely, the leaders will simply urge the heads of their central banks to respond more actively to external and internal economic threats. Investors are much more worried about the euro interest rate cut announced for September and the European Central Bank’s reanimation of the QE program, as well as when and in what amount the Fed will lower the interest rate.

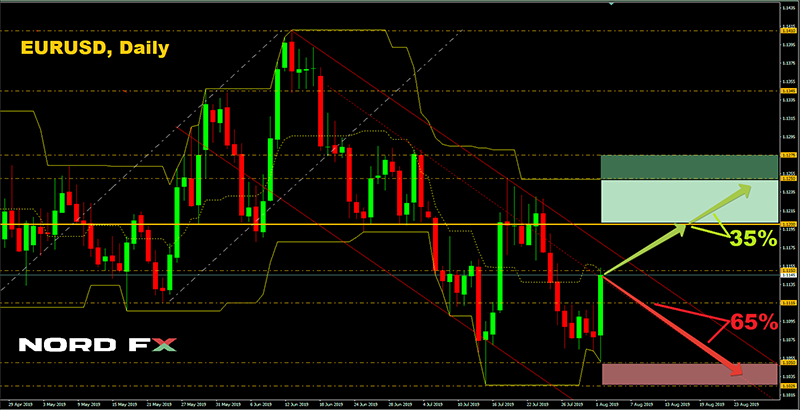

After Jerome Powell's performance on the evening of August 23 and the sharp rise of the pair, it is natural that both the graphical analysis and most of the indicators on H4 look up. However, the picture is completely different on D1: 70% of the trend indicators turned red, and among the oscillators, either red or neutral gray prevail. At the same time, 10% of them are already signaling the pair is overbought.

Strengthening of the dollar and the pair's return to the August lows of 1.1025-1.1050 are also expected by 65% of analysts. An alternative point of view is represented by the remaining 35% of experts, according to whom the pair may well reach zone 1.1200-1.1250. The next goal is 100 points higher;

- GBP/USD. No less active than Brexit, the world discusses the fact that during the meeting with French President Emmanuel Macron, the new British Prime Minister Boris Johnson put his feet on the coffee table. Macron has been and remains one of the most consistent supporters of the EU’s tough stance on relations with Britain. And maybe his British colleague wanted to show in this way that France’s position, to put it mildly, doesn’t really bother him?

Of course, Merkel, Macron, and Johnson continue contacts during the G7 meeting, but even after them the probability of Britain leaving the EU without an agreement remains as high as before. That is why 70% of experts, in full agreement with graphical analysis on H4 and D1, expect a continuation of the downtrend and a decrease of the pair to the August 12 low - 1.2015. The closest resistance zone is 1.2280-1.2320, support is in the areas of 1.2180-1.2200 and 1.2075-1.2100.

30% of analysts continue to remain on the side of the bulls, believing that the good news regarding the Brexit agreement has not yet ended, and the pair will still be able to rise to the zone 1.2415-1.2520. More than 70% of indicators support this scenario. However, 15% of the oscillators on D1 are already signalizing the pair is overbought; - USD/JPY. Experts (70%) expect the strengthening of the dollar against the yen as well. Despite the fact that the Japanese currency remains, along with the Swiss franc, the most popular safe haven currency, many major investors begin to fix short positions, converting their capitals to the gold.

The words of Bank of Japan representative Sayuri Shirai who said on Thursday August 22 that in order to counter the impending recession, the Bank allows a further reduction in the interest rate, which is already negative and amounts to minus 0.1%, played against the yen as well.

The immediate goal of the bulls is to return to the zone 106.20-106.70, then breakdown and consolidation above the level of 107.00. As for the bears (30%), they, with the support of 90% of the indicators on D1, will try to break the bottom in the zone of 105.00 and move the pair to the March 2018 low 104.60; - Cryptocurrencies. In general, the news background is quite favorable: Bank of America plans to patent a system for the safe storage of digital assets. Another US bank, Silvergate, has announced plans to launch a new product - loans issued against cryptocurrencies. - A study by Nobl Insurance showed that the cryptocurrency market has grown by 48% from 2018 to 2019 and will continue to expand over the next 12 months.

There is one more interesting piece of news. According to a statement from US economist Jim Rickards, Russia and China are working together to create their own cryptocurrency, which will be tied to gold. And that is precisely why, in his opinion, they have been so actively buying up this precious metal in recent years.

One can argue with Rickards. First, why should Russia and China issue a joint cryptocurrency? Each of these countries may well release their own cryptocurrency. And secondly, they replenish their gold reserves, most likely, not for the sake of issuing any digital coins, but in order to reduce their dependence on the US dollar.

As for the forecast, crypto enthusiasts, as usual, make every effort to push bitcoin up. This time, famous trader Alex Kruger made a prophetic prediction. According to him, the cost of bitcoin will soon begin to increase and reach 50 thousand dollars by the end of 2021. But at the same time, Kruger added that this will happen ... only if the coin now holds the positions above 10 thousand dollars. Well, what can one say to this?

The Bitcoin Fear & Greed Index has recently dropped to the Extreme Fear mark. 70% of analysts are looking south, but nevertheless they accurately mark the threshold of the fall with a zone of $9,000-9,500. It is possible that, pushing off from this support, Bitcoin will begin a new take-off to the $12,000 and $20,000 marks. But now it’s too early to talk about it and we need to wait for clear signals.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

Go Back Go Back