First, a review of last week’s events:

- EUR/USD. it looks like the thanksgiving celebration in the US started not in Thursday 28 November, but as early as on Monday 25. The last week of autumn was unusually calm, and the volatility did not exceed 40 points until Friday, driving traders into hibernation. Positive data on GDP and production in the US were balanced by the growth of the consumer price index (CPI) in the Eurozone. And even the controversial law on support for democracy and human rights in Hong Kong, signed by President Trump on Thursday, coupled with a sharp reaction to it from Beijing, made little impression on the markets.

Recall that our previous forecast said that in the current situation, the pair will not be able to break through the support of 1.1000 and after one or two unsuccessful attempts, it will turn around and go up. That's exactly what happened. Even the breakthrough at the end of the week to the level of 1.0980 was unsuccessful, and the pair soon returned to where it started the five-day period, to the zone of 1.1015-1.1020; - GBP/USD. In anticipation of the parliamentary elections in the UK, since the last decade of October, the pair is moving in the side channel 1.2780-1.2980. Thanksgiving in the United States only narrowed this channel to the interval 1.2825-1.2950, and the final chord of the week sounded at 1.2935;

- USD/JPY. The majority of experts (65%) expect that the pair will reach the height of 109.50 within the week. This forecast was justified by 100%. And even China's threats against the United States because of support for protesters in Hong Kong did not prevent the growth of the dollar. Threats remain threats, but the trade agreement must be signed. As a result, the pair rose to the level of 109.66 by Friday evening, and ended the trading session at the level of 109.44;

- cryptocurrencies. This is the market that, unlike Forex, never sleeps. And first a few words about the news background, statements and actions of financial mega-regulators. So representatives of the European Central Bank did not rule out the release of their own tokens. Even ECB Board Member Benoit Coeuré, who previously called bitcoin "an evil creation of the financial crisis of 2008", supported the idea of "crypto-Euro" . South Korea went as far as to recognize cryptocurrencies, adopting a bill to regulate virtual assets. But the Central Bank of Russia has once again shown its negative attitude to alternative financial products, agreeing with the proposal to ban all payments with bitcoin and other coins.

But, of course, the strongest impact on the market this fall was the news from China. Recall that the regulator of Shanghai has recently decided to liquidate companies engaged in cryptocurrency trading, and the regulator of Beijing declared the illegality of exchange operations with cryptocurrencies. The mega-regulator, the people's Bank of China, announced its position on Friday, November 22, ordering all companies to eliminate any improper practices of working with crypto assets. Representatives of such an influential force as the Communist Party of China also support a complete ban on digital currencies. As a result, investments in bitcoin in China decreased by more than 15% at the end of November.

In general the cryptocurrency market has "shrunk" by more than $20 billion over the past week, which is almost 10% of its volume. But, despite this, the week, in general, can be called successful for bitcoin. Having found a six-month bottom at $6,585 on Monday, November 25, the benchmark cryptocurrency bounced back up, resting on a strong level of $7,800. In the period from September 26 to October 22, it made a strong support for the BTC/USD pair. And now there are a lot of chances to turn into an equally strong resistance.

Quotes of top altcoins, such as Ripple (XRP/USD), Ethereum (ETH/USD) and Litecoin (LTC/USD), generally repeated the movements of the "big brother". However, if compared to Friday, November 22, Bitcoin grew by about 5%, altcoins were only able to win back losses, returning to their original positions.

As for the forecast for the coming week, summarizing the opinions of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. We would like to hope that with the onset of winter, both bears and bulls will not finally go into hibernation. Moreover, these days we are waiting for a number of quite important events. This is the speech of the new head of the ECB Christine Lagarde and the publication of the US business activity data (ISM) in the first half of the week, Eurozone GDP data on Thursday, and the US labor market (including NFP) on Friday.

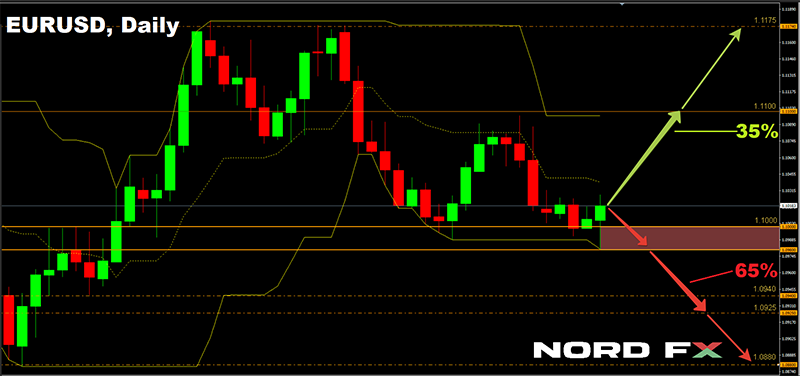

According to forecasts, such an important indicator as the number of new jobs created outside agriculture (Non-Farm Payrolls, NFP), can grow in the US by more than 40% (from 128K to 183K). Which may still lead to a breakdown of support 1.1000. At the moment, 65% of experts agree that the pair will be able to fall to the 1.0880-1.0925 zone, supported by 95% of oscillators and trend indicators on D1. There is another support on the way of the pair to the south: 1.0940.

The opposite view is shared by only 35% of analysts and graphical analysis on H4 and D1. In their opinion, the pair will go north starting from the support of 1.0980-1.1000. The targets are 1.1100 and 1.1175;

- GBP/USD. The results of the parliamentary elections, and, accordingly, the future of Brexit, will be known only in a week and a half, after December 12. For now, investors are focused on the statements of politicians and, for a small part, on the macroeconomic indicators of the UK, the EU and the US. From above, the pound is pressured by the decline in the yield of 10-year UK government bonds in relation to similar securities of its "competitors". From below, due to the correlation of the British currency with "black gold", it is pushed up by an upward trend in the oil market. And here it should be borne in mind that the OPEC+ summit next week may well extend the limit on carbon production, which will lead to a shortage of oil and an increase in its cost, especially in the III and IV quarters of 2020. In general, in everything that concerns the pound, there is a complete uncertainty so far.

Experts' forecasts look similar: 40% are for the growth of this currency, 40% are for its fall, and 20% just shrug. So, we can assume that the GBP/USD pair will continue to move in a sideways channel until the parliamentary elections, consolidating in the Pivot Point zone of 1.2900; - USD/JPY. Most investors considered the differences between the US and China concerning human rights in Hong Kong unimportant. In their opinion, a trade deal will sooner or later be concluded, which will lead to a rise in the dollar, including the rise against the yen. The growth of the US stock market and the SP500 index, according to 85% of experts, will push the USD/JPY pair up to the landmark level of 110.00 already now (taking into account the slippage-110.25). However, the pair can then turn to the south and return first to the intersection of the horizontal support and the lower border of the ascending channel around 109.00. And then go down and even lower: the next support levels are 108.50 and 107.80. This scenario is fully supported by graphical analysis on H4 and 15% of oscillators on D1, according to which the pair is already in the overbought zone;

- cryptocurrencies. Bitcoin is still within the downward channel, which began on June 26. Some experts call the rebound that occurred last week a "dead cat jump", believing that we will soon see another collapse of the BTC/USD pair, now to the level of $5,000. However, according to most analysts, the pair will stay within the side corridor of $7,000-8,000 for some time.

About 40% of experts remain optimistic and hopeful that the upper limit of this corridor will be broken. At the same time, for example, the famous financial analyst Joseph Young, although confident in the long-term growth of the cryptocurrency market, does not exclude the fall of Bitcoin to $3000-4000. Martin McDonagh, co-founder of investment firm KR1, has expressed a similar opinion. "Now, swinging like a pendulum, the market tries to know where the bottom is once again", he says. "I think we are in the early stages of a bull market and we will soon see rising highs on the way to new heights," he predicts.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back