First, a review of last week’s events:

- EUR/USD. Making a forecast for the past week, the majority of experts (60%) were in favor of reducing the pair first to support 1.2100, and then, possibly, another 50 points lower. Almost everything happened as forecasted: the EUR/USD pair was at the level of 1.2075 at the end of the trading week.

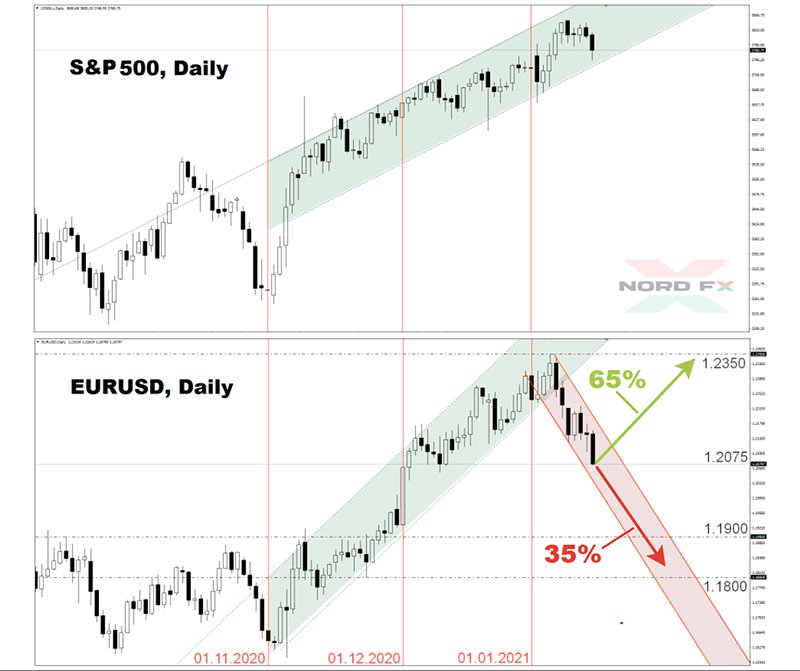

It should be noted that a somewhat atypical situation has developed on the market since the start of 2021. Usually, the rise in the stock market puts downward pressure on the dollar. This is exactly what happened in the previous month: fueled by risk appetites, the S&P500 grew steadily, while the dollar index, which plays the role of a defensive asset, was steadily falling. According to Bank of America Merrill Lynch, in December, large investors hoped for a quick victory over COVID-19, a surge in GDP, they were actively buyingt shares of technology companies and were also actively getting rid of the dollar. And now the situation has changed dramatically: the USD DXY index began to grow in parallel with the S&P500.

What is the reason for this? First, US stocks look overvalued at the moment. At least from the point of view of American investors. In addition, we wrote in the previous review that after the certification of the US President-elect Biden and the majority of Democrats in the Senate, the yield of 10-year American Treasuries went up sharply, pulling the dollar with it. The leaders of the Federal Reserve Banks (FRB) of Richmond and Philadelphia added fuel to the fire, hinting at a possible curtailment of the QE program and an increase in interest rates on the dollar; bulls began to close long positions in EUR/USD; - GBP/USD. Over the past five days, this pair has drawn a clear sinusoid, moving in the 1.3450-1.3700 channel along the 1.3575 Pivot Point. At the beginning, it dropped to the lower border of this trading range, and then turned around and sharply went up, reaching the values of 2.5 years ago on Wednesday.

The pound was supported last week by the head of the Bank of England, Andrew Bailey, who not only rejected the possibility of introducing a negative interest rate, but also expressed the opinion that the coronavirus pandemic is not capable of causing any structural changes in the UK economy. As a result, the pound showed the biggest gains in the past two months. However, then, following the general trend of strengthening dollar, the pair returned to the Pivot Point and finished the week at 1.3580; - USD/JPY. The forecast, which was voted for by the majority of analysts (55%), turned out to be absolutely correct: the pair kept within the descending medium-term channel and, having bounced off its upper border, moved to its center.

Recall that another 10% of analysts assumed that the pair would move sideways, making fluctuations around Pivot Point 104.00. And they also turned out to be right: having started the five-day week at 103.95, it completed it also within this zone, at 103.85; - cryptocurrencies. By the evening of Friday January 15, the bitcoin chart can equally likely speak of both a return to an uptrend or a continuation of a downward correction. Reaching a historic high of $41.435 on January 08, the BTC/USD pair turned south and dropped to $30.600 by January 11. All major indicators have long been giving signals of bitcoin being overbought, and only an excuse was needed for such a deep correction. And it was found in the form of an increase in the yield on US government bonds, which caused the dollar to strengthen. As a result, the main cryptocurrency lost more than 25% in price in just three days.

Then, to the delight of investors, the pair again approached the $40,000 mark, and the USA again became the formal reason for this. More precisely, President-elect Joe Biden, who announced a new $1.9 trillion economic aid package that includes $2,000 in direct payments to Americans. Such massive fiscal and monetary stimulus is likely to drive inflation and, as a result, increase demand for risky assets, including cryptocurrencies.

All good things are known to end someday. So bitcoin stopped its growth on January 14, and failed to set a new height record. And then the head of the ECB Christine Lagarde called for global regulation of the digital currency market. Referring to the speculative nature of bitcoin, she stated that such regulation could be initiated within the G7 countries, then carried over to the G20, and eventually expanded to a global level.

Taking advantage of the situation, the bears regained control of the situation and the BTC/USD pair dropped below the $ 35,000 level again in the second half of Friday, January 15.

It should be noted that the activity of investors has significantly decreased at the start of 2021. According to CoinShares, only $29 million was invested in crypto funds in the first week of January. This is despite the fact that similar investments amounted to more than $ 1 billion the week before Christmas. Of course, such a lull can be explained by a respite for the holidays. Moreover, crypto whales also reacted sluggishly to the correction on January 8-11: withdrawal operations were recorded only on a very small number of their BTC wallets.

PayPal data show that at least the retail market is gradually waking up after the Christmas and New Year hibernation, the volume of bitcoin trading on this platform has increased by 950% since the beginning of January, that is, almost 10 times. If, according to the analytical service Nomics, platform users made transactions with BTC for only $22.8 million on January 01, 2021, their volume amounted to $242 million ten days later.

The total cryptocurrency market capitalization was $1 trillion by January 15 (it was $1.13 trillion at the high of January 10). The BTC dominance index is in the region of 68%, and the Crypto Fear & Greed Index fell from 95 to 88 points over the week.

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. Federal Reserve Chairman Jerome Powell denied the statements of his colleagues from the regional Federal Reserve Banks, saying that one should not count on raising interest rates and curtailing soft monetary policy in the near future. These words, coupled with Joe Biden's new $1.9 trillion fiscal stimulus package, are likely to halt the rise in US Treasury yields and support the bulls on S&P500. Moreover, the hopes for vaccination, which will lead to a rapid growth in GDP, have not disappeared. Thus, Wall Street Journal experts predict an increase in American GDP by 4.3% in 2021.

But will this break the current correlation between the dollar and the stock market? Will the dollar stop rising? It is not excluded that the growth of the S&P500 will be supported not only by American, but also by major investors from other countries. And such an infusion of foreign capital into the US economy will lead to the strengthening of the US currency.

Now, specifically about the EUR/USD pair. It is clear that at the time of writing the forecast (January 15), most indicators are painted red. 100% of trend indicators on H4, 75% on D1, as well as 75% of oscillators on both timeframes look to the south. The remaining oscillators signal that the pair is oversold.

As for the experts, their opinions are divided equally at the moment. But when moving from a weekly to a mid-term forecast, the scales are tilted towards the bulls. 65% of analysts, supported by graphical analysis on D1, expect the dollar to weaken and the pair to rise to at least 1.2500-1.2550 over the next one and a half to two months. The nearest resistances are 1.2175, 1.2275, 1.2300 and 1.2350. The main support area is 1.1800-1.1900.

As for the important events of the coming week, attention should be paid to the ECB's interest rate decision and the subsequent press conference of the management of this regulator on Thursday 21 January. And data on business activity of Germany and the Eurozone as a whole will be published the next day, on January 22;

- GBP/USD. Not only Germany and the EU, but also the UK will release statistics on business activity (Markit in the services sector) on Friday 22 January. This data could send a signal to investors about how the attack of a new coronavirus strain has affected the country's economy. Recall that earlier Britain reported record levels of deaths and new cases over the past few weeks in London and the south-east of England.

However, problems associated with COVID-19 are intensifying in other countries as well, including the United States. Therefore, 60% of analysts, supported by graphical analysis on H4 and D1, believe that the pair will be able to return to the level of 1.3700, and perhaps rise another 100 points higher. An additional argument for its growth is the new fiscal stimulus in the US, which has been discussed above.

Support levels 1.3540 and 1.3450; - USD/JPY. The rise of the pair from the lower to the upper border of the descending medium-term channel, which took place in the first two weeks of January, is associated by a number of experts with an increase in risk sentiment and a decrease in interest in the yen as a safe-haven currency. Based on this, they believe that the pair will still be able to break through the upper border of the designated channel and rise to the 105.00 zone. 35% of analysts and graphical analysis on D1 vote for this scenario. The next target of the bulls is 105.70, the nearest resistance is the zone 104.00-104.35.

The majority of experts (65%) are confident that the pair will stay within the designated channel. The nearest support is 103.60, the next one is 103.00. The target is located in the 102.50 area. - cryptocurrencies. So, the total cryptocurrency market capitalization is now at the level of $1 trillion. This is an important psychological level, especially for retail investors. Further growth of this indicator will be a clear confirmation of forecasts about the rise of the BTC/USD pair at least to a height of $50.000. If the capitalization goes down, then this can cause a landslide sale of coins: the example of the 2018 crypto winter is alive in the market memory.

In the meantime, the market is still dominated by an optimistic mood. So, for example, Bloomberg crypto analyst Mike McGlone believes that $50.000 is a real target for bitcoin. He gave a forecast a few months ago, according to which BTC was supposed to grow to a new historical high in December 2020, which eventually did happen. “I think that the asset will take the barrier of 50 thousand in the near future,” said this expert and added that the chances of BTC growth are much greater than its further weakening, and a pullback to $20,000 is now practically excluded.

Dan Morehead, CEO of investment company Pantera Capital, predicts that bitcoin's price will hit $115,000 by August 2021 and events such as the launch of the digital yuan will help further the penetration of cryptocurrencies into the global economy.

If this happens, there will be even more crypto millionaires and billionaires in the world. For now, according to Forbes, the list of the richest of them looks like this:

In first place are the founders of the bitcoin exchange Gemini, the Winklevoss brothers. The estimated value of their cryptocurrency assets, according to Forbes, is about $1.4 billion each. Bloq co-founder Matthew Roszak with $1.2 billion in digital assets ranks second, followed by venture capitalist Tim Draper. According to Forbes, the value of his assets is estimated at $1.1 billion.

In fourth place is the head of MicroStrategy, Michael Sailor, with assets worth $600 million, in fifthis the founder of the crypto bank Galaxy Digital Mike Novogratz. Forbes valued his cryptocurrency assets at $478 million. The last on the list is the co-founder of ethereum Vitalik Buterin with assets worth $360 million.

Speaking of ethereum. According to the founder of the investment fund DTAP Capital Dan Tapiero, this coin is ready for further growth. This is evidenced by the interest on the part of institutional clients of the American financial holding Northern Trust. The holding company launches a service for storing cryptocurrencies, in partnership with Standard Chartered bank. And "if Northern Trust stores bitcoin and ethereum, then they have buyers for both assets," Tapiero substantiated his point of view.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back