EUR/USD: Two Events of the Week

- The past week was marked by two significant events. First, the EUR/USD pair updated its 20-year low on Tuesday, September 06 once again, falling to 0.9863. And then the European Central Bank raised its key interest rate for the first time in its history by 75 basis points (bp) to 1.25% on Thursday, September 08, accompanying this act with very hawkish comments.

We must say that both events did not come as a surprise to the market and, on the whole, were in line with the forecasts that we voiced in the previous review. The pair's rebound to the upside following the ECB's decision was not surprising either. Having risen by about 250 points, it peaked at 1.0113 on September 9. This was followed by a correction to the north, and the pair finished at 1.0045

Despite such a hawkish move, the ECB is still far from the US Fed: the current rate on the dollar is 2.50%, which is exactly twice as high as on the euro. But this is not all. If the September meeting of the European regulator has already passed, its American counterpart still has it ahead. And if the Fed's FOMC (Federal Open Market Committee) raises the rate on September 21 once again, the dollar will go even further into the lead. And the probability of such a step is close to 100%.

It is still difficult to predict what both Central Banks will do next month, October. But there is a feeling that the ECB may, at least for a while, lower its hawkish attitude to understand how the rate hike has affected inflation and the state of the economy. The factor of the energy crisis in Europe, caused by anti-Russian sanctions, is still playing against the euro. However, the leadership of the European Union is taking active steps to reduce energy dependence on Russia on the eve of winter. And judging by the fact that the Eurozone GDP growth published on September 7 turned out to be higher than both the previous value and the forecast (4.1% versus 3.9%), stagflation may be avoided.

At the time of writing this review, on the evening of Friday, September 09, the votes of the experts are distributed as follows. 55% of analysts stand for the fact that EUR/USD will continue to move south in the near future, 30% vote for its growth and the strengthening of the euro, the remaining 15% predict a side trend along Pivot Point 1.0000. The readings of indicators on D1 do not give any certainty. Among trend indicators, the ratio of forces is 50% to 50%. Among the oscillators, there is a slight advantage on the green side, 50%, 35% are on the red side, and 15% are colored in neutral gray.

The main trading range of the last three weeks was within 0.9900-1.0050. Taking into account breakdowns in both directions, it is somewhat wider, 0.9863-1.0113. The next strong support after the 0.9860 zone is located around 0.9685. The resistance levels and targets of the bulls look like this: 1.0130, then 1.0254, the next target area is 1.0370-1.0470.

There will be quite a lot of important events in the coming week. Consumer Price Indices (CPI) in Germany and the US will be published on Tuesday, September 13. CPI is an indicator of consumer inflation and reflects changes in the level of prices for groups of goods and services in August. The September ZEW Economic Sentiment Index in Germany will be released the same day. Another batch of economic statistics will arrive on Wednesday, September 14 and Thursday, September 15 in the form of the Producer Price Index (PPI) and data on retail sales and unemployment in the US. We are waiting for the publication of the Eurozone CPI, as well as the US University of Michigan Consumer Confidence Index, at the end of the working week, on Friday, September 16.

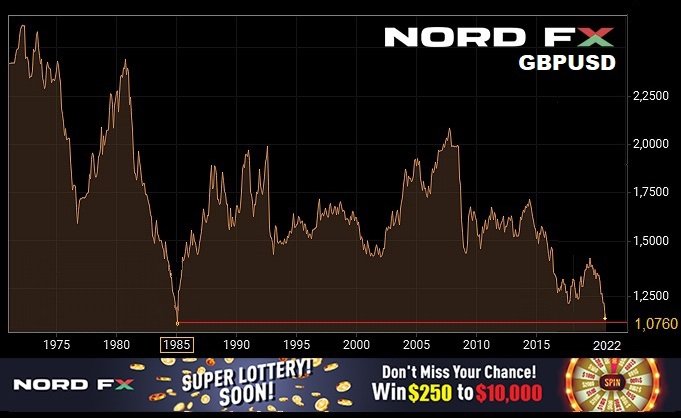

GBP/USD: British Pound's Anti Record

- We titled our previous review of GBP/USD "On the Way to a 37-Year Low". Recall that the lows of March 2020 (1.1409-1.1415) were at the same time the lows for the last 37 years. And now, this offensive forecast for the British currency came true: the pair reached a local bottom at around 1.1404 on September 07, breaking the 2020 anti-record. Then the euro, strengthening against the dollar, pulled up other currencies, including the pound. As a result, GBP/USD rose to 1.1647, and the five-day period closed at 1.1585.

An important event on August 7 was the hearing of the UK Inflation Report and the speeches by members of the Monetary Policy Committee, headed by the head of the Bank of England, Andrew Bailey. As predicted, officials reaffirmed their commitment to tightening monetary policy (QT). Their statements strengthened the market's expectations that the regulator could raise the rate from 1.75% to 2.50% at its September meeting. This meeting was originally scheduled for next Thursday. However, due to mourning for Queen Elizabeth II, it was postponed for a week and will take place on September 22, after the US Federal Reserve makes its decision on the rate.

If the forecast for a growth in the interest rate on the pound comes true, this will create an even greater burden on the UK economy, which already causes serious concerns. The UK is already amid a recession and inflation will hit 14% this year, according to the British Chamber of Commerce (BCC). And according to Goldman Sachs, it could reach 22% by the end of 2023, which will provoke a protracted economic downturn and a contraction of the economy by more than 3.5%. British energy regulator Ofgem has already announced that average annual electricity bills for UK households will rise by 80% from October. And according to the Financial Times, the number of fuel-poor households will more than double in January to 12 million.

Of course, investors are very worried about whether the new prime minister, Liz Truss, will be able to cope with the deplorable situation in which the country's economy has found itself. Having failed to fully recover from Brexit and the COVID-19 pandemic, the United Kingdom has faced unprecedented inflation, a decline in the population's ability to pay and a catastrophic collapse of the national currency.

The median forecast for the coming week looks fairly neutral. A third of analysts side with the bulls, another third side with the bears, and another third have taken a neutral position. The indicator readings on D1 are mostly colored red. Among the trend indicators, the ratio is 70% to 30% in favor of the red ones. For oscillators, 65% point south and 35% point east. No oscillators are pointing north.

As for the bulls, they will meet resistance in the zones and at the levels of 1.1600, 1.1650, 1.1720, 1.1800, 1.1865-1.1900, 1.2000, 1.2050-1.2075, 1.2160-1.2200. The nearest support, apart from the 1.1475-1.1510 zone, is the September 07 low 1.1404. One can only guess to what levels the pair can fall further. Given the increased volatility, it is probably not worth focusing on either round values, or Fibonacci levels, or any figures of graphical analysis.

With regard to the economic statistics of the United Kingdom, data on GDP and output should arrive on Monday, September 12, that on the level of wages and unemployment in the country will be published on Tuesday, September 13. The Consumer Price Index (CPI) will be published on Wednesday, September 14, and retail sales in the UK will be known on Friday, September 16. The source of all this data is the Office for National Statistics, so the schedule for their publication is subject to change due to mourning for Elizabeth II.

USD/JPY: Astronaut Pair

- USD/JPY rose to a high of 140.79 on September 2, thus reaching a 24-year high. Most analysts were waiting for another rise and taking new heights from the past week. This is exactly what happened: the pair soared to the level of 144.985 on Wednesday, September 07. The last chord of the week sounded a bit lower, at 142.65.

Describing the cause of what happened is quite simple using Copy Paste on the keyboard, it is enough to take any of our reviews over the past couple of years. That's what we're doing right now. So, the reason is the same: the divergence between the monetary policies of the Bank of Japan (BOJ) and other major Central Banks, primarily the US Federal Reserve. Unlike the American hawks, the Japanese regulator still intends to pursue an ultra-soft policy, which is aimed at stimulating the national economy through quantitative easing (QE) and a negative interest rate (-0.1%). This divergence is a key factor for the further weakening of the yen and the growth of USD/JPY. And the situation will not change until BOJ raises the rate.

And why should the Japanese Central Bank raise it? The published data on the country's GDP (Q2) look quite good: the indicator rose from 0.5% to 0.9%, while the forecast was 0.7%. Of course, inflation in Japan has exceeded the 2% target, which is bad. But this is almost nothing compared to inflation in the US, the Eurozone or the UK. So there is no need to worry too much here. So Japanese Finance Minister Shunichi Suzuki said that price increases will be extinguished not by tightening monetary policy, but, on the contrary, by injecting 5.5 billion yen from the budget reserve. In addition, the minister said that he is "closely monitoring the movement of the exchange rate", that "it is important that it moves steadily" and that "abrupt movements of the currency are undesirable."

Haruhiko Kuroda, Governor of the Bank of Japan, said almost the same thing, word for word, on Friday, September 09, after his meeting with Prime Minister Fumio Kishida. His main theses are as follows: "I discussed the foreign exchange market with Kishida", "Fast movements in the exchange rate are undesirable", "We will closely monitor the movement of exchange rates."

We do not know what is so positive in the words of these high officials, but, as the media write, thanks to them the yen received support, and now 45% of experts vote for its further strengthening. Another 45% remain neutral, and only 10% are waiting for further growth of USD/JPY. The indicators on D1 have an absolute advantage on the side of the greens. Among oscillators there are 100% of them, among trend indicators - 90%, and only 10% on the side of the reds.

The nearest resistance is 143.75. The bulls' task No.1 is to renew the high of September 07 and gain a foothold above 145.00. Back in the spring, when analyzing the rate of the pair's rise, we made a forecast according to which it could reach a peak of 150.00 in September. And it looks like it's starting to come true. Supports for the pair are located at the levels and in the zones 142.00, 140.60, 140.00, 138.35-139.05, 137.50, 135.60-136.00, 134.40, 132.80, 131.70.

No important events in the economic life of Japan are expected this week.

CRYPTOCURRENCIES: Main Week of the Calendar

- Last week was marked by another wave of sales. The bitcoin rate approached the June 19 low ($17,600), falling to $18,543 on September 7. At the same time, Ethereum fell below $1,500, an important support/resistance level, and recorded a local bottom at $1,488. This dynamic is primarily due to the hawkish rhetoric of the Fed and, as a result, the strengthening of the US currency. However, later, against the background of the ECB meeting, both coins won back their losses in full, and even seriously increased in quotes. At the time of writing this review, on Friday evening, September 9, they are trading as follows: BTC/USD at $21.275, ETH/USD at $1,715. The total capitalization of the crypto market has risen slightly above the psychologically important level of $1 trillion and is $1.042 trillion ($0.976 trillion a week ago). The Crypto Fear & Greed Index has fallen by another 3 points in seven days from 25 to 22 and is in the Extreme Fear zone.

According to the TradingView service, the ratio of ethereum to bitcoin has grown to its highest values for 2022. It was fixed at 0.0843 in the afternoon of September 06. The last time such a level was noted was in December 2021. 1 BTC is worth about 12.4 ETH at current values.

The ETH community has linked the growth of this indicator to the upcoming network merger. Many users have been talking for almost a year now that a revolution will happen in this tandem sooner or later. Then ethereum will overtake bitcoin in terms of capitalization and value. Recall that the update of the ethereum network is scheduled for the period from September 13 to 20. This merge is likely to be the most important event of 2022 in the cryptocurrency industry. This is because it will bring several key changes to how the network works. The main ones are a 99.99% reduction in energy consumption and a decrease in the emission of the ETH coin.

According to a number of experts, if the transition to the Ethereum 2.0 network and the implementation of the Proof-of-Stake mechanism go as planned, this altcoin can rise sharply in price and pull the entire market up with it, primarily its main competitor, bitcoin. But that's if everything goes smoothly and according to plan. Or maybe not. So, it became known on Wednesday, September 07 that the ethereum network encountered a problem after the Bellatrix update. The blockchain is seeing a noticeable spike in “number of missed blocks,” the frequency with which the network fails to process blocks of transactions scheduled for validation. This figure has increased by about 1700%. Before the update, it was about 0.5%, and after the Bellatrix it rose to 9%.

CoinShares Chief Strategy Officer Meltem Demirors believes that investors are ignoring the general situation in the market, amid the hype around the transition of ETH to the PoS mechanism. And that, despite the benefits of the merger for the ethereum network itself, it is not certain that this event will attract significant investment capital: “While there is significant enthusiasm in the crypto community for a merger that can rapidly reduce supply and increase demand, the reality is more prosaic: investors are concerned about rates and macro indicators. I believe that significant amounts of new capital are unlikely to enter ETH. There are certain risks that need to be played out in the market because the merger has been used as an excuse to buy on the rumor and sell on the news. How will these risks be played out? Most likely on the institutional side or through trading, but through options rather than outright purchases of the asset.”

Experts of u.today portal also remind about macro statistics. They note that September 13 could be an important date, not only because of the merger of the ethereum networks. There is one more factor. As we wrote above, fresh data from the US Consumer Price Index (CPI) will be published on the same day. According to analysts, this information will help investors understand what is happening with the inflation rate in the country and will directly affect the financial markets, including cryptocurrency. If the network update does not cause problems with volatility, liquidity and security, and the CPI shows a decrease in inflation, then a bullish momentum can be predicted, otherwise the crypto market will continue to fall.

Glassnode allowed BTC to fall further to support around $17,000. The specialists do not rule out such a wave of capitulation due to an increase in the proportion of "unprofitable" coins at the disposal of speculators (who traded in the previous 155 days). It rose to 96% (3.11 million BTC out of 3.24 million BTC). The situation was aggravated by the suspension of the bearish rally from June 19 to August 15. The rise in the price to $25,000 and its subsequent fall in just a few days transferred half of the speculators' coin reserves to the category of “unprofitable”.

In the short term, it is the stress testing of speculators that will determine the disposition in the market, since most of the on-chain activity was carried out by them. Three such episodes in the current downtrend had led earlier to sales with a short planning horizon and the subsequent formation of a local bottom.

Analyst Kevin Swenson agrees with Glassnode's alarming outlook. He issued a warning about a possible downward movement of bitcoin as well. The US dollar soared to its highest level in 20 years, while bitcoin fell below the diagonal support that kept the asset afloat from its June lows of $17,600, Swanson said. Swanson admits further bearish scenario for bitcoin as the DXY dollar index is still in a strong uptrend.

Another expert, Naeem Aslam, believes that the fall will not be to the level of $18,000 or $15,000, but much lower, to about $12,000.

Cryptoanalyst Nicholas Merten does not rule out either that bitcoin will soon collapse to a strong support level in the range of $12,000-14,000. He made this forecast based on the net unrealized profit and loss (NUPL), which shows the state of the positions of BTC holders. (When NUPL is above 0, most investors are in the black. If below 0, then more investors suffer losses).

At the same time, Merten believes that the BTC movement can be unpredictable since the asset has never been traded during a period of tightening monetary policy and raising interest rates. He also doubts the imminent return to quantitative easing (QE) by the US Federal Reserve, as it was in the past. “I would like to note,” the expert writes, “that there has never been a 50% recession, almost depressive correction or a bearish stock market in all 10 years during which BTC has been liquidly traded on exchanges, . There were typical bear markets around 20%, and then the Fed came to the rescue and saved the day. But the Fed cannot do the same now. If you print money and try to save the day, you can seriously exacerbate the problem of inflation.”

And some positive at the end of the review. Despite the fall in the capitalization of the crypto market and the bankruptcy of a number of large projects, the bitcoin hash rate is close to its historical maximum. The situation seems inconsistent with the fall of the main cryptocurrency by more than 70% from the maximum, and the collapse of the shares of public mining companies. However, miners continue to introduce new capacities. Analysts attribute this to the optimism of some companies and the readiness for market turbulence of others. If we add to this the Glassnode data, which observes an increase in the number of coins at the disposal of hodlers, then we can hope that the crypto winter will still be followed by spring.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back