EUR/USD: Falling Inflation Has Crushed the Dollar

- So, we can either congratulate (or, conversely, upset) everyone with the onset of a global process of dedollarization. As Bloomberg reports, after the inflation rate in the US approached 3.0%, which is not far off the Federal Reserve's target of 2.0%, it seems like a turning point is approaching for the US economy.

Last week, the dollar faced the most significant pressure from national macroeconomic statistics in over a year. The Consumer Price Index (CPI) published on Wednesday, July 12, showed a 0.2% increase in June, falling short of the forecasted 0.3%. The annual indicator dropped from 4.0% to 3.0%, reaching the lowest level since March 2021. Core inflation also fell from 5.3% in May to 4.8% in June, against a forecast of 5.0%.

Against the backdrop of such steady deceleration in inflation, market participants began to factor into the quotations both a refusal of the second Federal Reserve rate hike, as well as an imminent turnaround in monetary policy. According to CME Group FedWatch data, the likelihood that the regulator will raise the rate again after a 25-basis point hike in July has fallen from 33% to 20%. As a result, most financial instruments have made a successful onslaught on the dollar. Meanwhile, the market completely ignored statements by Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, his Federal Reserve Bank of Richmond colleague Thomas Barkin, and Federal Reserve Board member Christopher Waller that inflation is still above the target level and hence the Federal Reserve is ready to continue tightening its policy (QT).

The story of the dollar's decline did not end there. EUR/USD continued its rally after the US Bureau of Labor Statistics reported on Thursday, July 13, that the Producer Price Index (PPI) had grown by just 0.1% in annual terms in June (forecast was 0.4%, May value was 0.9%). As a result, the DXY Dollar Index broke the 100.00 support level and fell to the values of April 2022, and EUR/USD reached its highest level since February 2022, marking a high at 1.1244.

Many market participants decided that the best times for the US currency are over. The US economy will slow down, inflation will reach target values, and the Federal Reserve will begin a campaign to soften its monetary policy. As a result, the second half of 2023 and 2024 will become a period of strengthening for other currencies against the dollar. The result of such expectations was the fall of the Spot USD Index to a 15-month low, and hedge funds exclusively engaged in selling the US currency for the first time since March.

After a crushing week for the dollar, EUR/USD finished at 1.1228. As for near-term prospects, at the time of writing this overview, on the evening of July 14, 30% of analysts voted for the pair's further growth, 55% for its decline, and the remaining 15% took a neutral stance. Among trend indicators and oscillators on D1, 100% are on the side of the greens, although a third of oscillators signal the pair is overbought.

The nearest support for the pair is located around 1.1200, then at 1.1170, 1.1090-1.1110, 1.1045, 1.0995-1.1010, and 1.0895-1.0925. Bulls will meet resistance around 1.1245, 1.1290-1.1310, 1.1355, 1.1475, and 1.1715.

The blackout period leading up to the next Federal Open Market Committee (FOMC) meeting, which is set for July 26, will begin on July 15. Therefore, it's not worth expecting any statements from Federal Reserve officials in the coming week. The quotations will only be influenced by the macroeconomic data hitting the market. On Tuesday, July 18, data on US retail sales will be released. On Wednesday, July 19, we will find out what is happening with inflation (CPI) in the Eurozone. Then on Thursday, July 20, data on unemployment, manufacturing activity, and the housing market in the United States will come in.

GBP/USD: The Potential for Growth Remains

- Back at the end of June, we speculated that GBP/USD might cover the remaining distance to 1.3000 in just a few weeks or even days. And we were right. In the current situation, the British pound did not miss an opportunity for growth: the peak of the week was recorded at the height of 1.3141, which corresponds to the levels of the end of March - beginning of April 2022. The final note of the five-day period sounded at the mark of 1.3092.

In addition to a weakening dollar, another driver of the pound's growth was the semi-annual report on the assessment of the UK's financial system. It demonstrated the resilience of the national economy against the backdrop of a prolonged cycle of raising the key interest rate. Unlike several US banks, major UK banks maintain high capitalization, and their profits are growing. This suggests that they can withstand several more rate hikes this year. It is expected that at its next meeting on August 3, the Bank of England (BoE) will raise the rate by another 50 basis points (bps) to 5.50%. And it will do so regardless of potential economic problems, as the fight against rising prices is more important. Consumer inflation (CPI) in the country in May was 8.7% (for comparison, over the same period in Germany it was 6.1%, in France 4.5%, in Japan 3.2%, and in the USA 4.0% in May and 3.0% in June).

The UK's labour market is also pushing inflation upwards. Even despite the increase in the interest rate, the latest report noted an acceleration in wage growth to 6.9% YoY. Excluding the turbulence during the Covid-19 pandemic, this is the fastest pace since 2001. And although unemployment is rising alongside wages, its current level of 4.0% is still historically low. Yes, in August of last year it was lower - 3.5%, but what is a growth of only 0.5% almost over a year? It's nothing! (Or almost nothing).

In general, in the foreseeable future, there are no major obstacles that would prevent the Bank of England from continuing to tighten monetary policy. Thus, the prospect of further rate hikes will continue to fill the sails of the British currency with a tailwind. And, according to a number of analysts, GBP/USD, having broken through the 1.3000 resistance, may now aim for an assault on the 1.3500 level.

However, this does not mean that such growth will happen right now. "In a sense, the pound has already experienced overvaluation against the backdrop of a hawkish Bank of England and is unlikely to show strong results against the current bearish phase of the dollar. However, traders will now be targeting 1.3300 on GBP/USD assuming we can close the week above 1.3000," believe strategists from the largest banking group in the Netherlands, ING.

The possibility of the pound's consolidation in the coming week is also suggested by Canada's Scotiabank, not ruling out pullbacks to 1.2900-1.3000 and further growth to the area of 1.3300. The bullish sentiment is also supported by Singapore's United Overseas Bank. Its economists believe that "the strong growth momentum suggests that GBP/USD is unlikely to pull back. On the contrary, it is more likely to continue moving towards the upper boundary of the weekly exponential moving average. This key resistance level is currently at 1.3335."

When it comes to the median forecast for the near future, at the moment only 25% of experts have spoken out for further growth of the pair. The opposite position was taken by 50%, the remaining 25% maintained neutrality. As for technical analysis, all 100% of trend indicators and oscillators are pointing upwards, although a quarter of the latter are in the overbought zone. If the pair moves south, it will encounter support levels and zones – 1.3050-1.3060, then 1.2980-1.3000, 1.2940, 1.2850-1.2875, 1.2740-1.2755, 1.2675-1.2695, 1.2570, 1.2435-1.2450, 1.2300-1.2330. In the case of the pair's rise, it will meet resistance at levels 1.3125-1.3140, 1.3185-1.3210, 1.3300-1.3335, 1.3425, 1.3605.

The events of the upcoming week worth noting in the calendar are Wednesday, July 19, when the value of such an important inflation indicator as the United Kingdom's Consumer Price Index (CPI) will become known. Towards the end of the working week, on Friday, July 21, data on retail sales in the country will also be published. These figures can have a significant impact on the exchange rate, as they provide insights into consumer spending and overall economic activity, which are key factors in the Bank of England's decisions on interest rates.

USD/JPY: The Yen Pleased Investors Once Again

- For the second week in a row, yen investors have been rewarded for their patience. USD/JPY continued its descent from the Moon to Earth, marking a local minimum at 137.23. Thus, since June 30th, in just two weeks, the Japanese currency has gained more than 780 points against the US dollar.

Compared to other currencies included in the DXY basket, the yen appears to be the primary beneficiary. The main ace up this safe-haven currency's sleeve is investor fears about a recession in the US and narrowing yield differentials on US government bonds. The correlation between Treasuries and USD/JPY is no secret to anyone. If the yield on US Treasury bills falls, the yen shows growth against the dollar. Last week, following the publication of CPI data, the yield on 10-year US papers slipped from 3.95% to 3.85%, and on 2-year papers – from 4.85% to 4.70%.

Speculation that the Bank of Japan (BoJ) may finally adjust its ultra-loose monetary policy towards tightening in the coming months also continues to favor the yen. We are talking about speculation here, as no clear signals have been given by the country's Government or the BoJ leadership on this matter.

Let's recall that at the French Societe Generale, it's expected that the yield on 5-year US bonds will fall to 2.66% in a year's time, which will allow USD/JPY to break below 130.00. If, at the same time, the yield on Japanese government bonds (JGBs) remains at its current level, the pair could even drop to 125.00. Economists at Danske Bank are forecasting a USD/JPY rate below 130.00 within a 6–12-month horizon. Similar forecasts are made by strategists at BNP Paribas: they are aiming for a level of 130.00 by the end of this year and 123.00 by the end of 2024. Against this backdrop, many hedge funds have begun active selling of dollars and buying of yen.

Last week, USD/JPY ended at 138.75 after a correction to the north. As of this review, 45% of analysts believe the pair will resume growth in the coming days. Only 15% support further fall, and 40% maintain a wait-and-see stance. The D1 indicators are as follows: 100% of oscillators are coloured red, but 10% signal oversold. The balance between green and red among trend indicators is 35% to 60%. The nearest support level is in the 138.05-138.30 zone, followed by 137.25-137.50, 135.95, 133.75-134.15, 132.80-133.00, 131.25, 130.60, 129.70, 128.10, and 127.20. The closest resistance is 1.3895-1.3905, then 139.85, 140.45-140.60, 141.40-141.60, 142.20, 143.75-144.00, 145.15-145.30, 146.85-147.15, 148.85, and finally the October 2022 high of 151.95.

No significant economic information related to the Japanese economy is expected in the upcoming week. However, traders may want to note that Monday, July 17th is a holiday in Japan: the country is observing Marine Day.

CRYPTOCURRENCIES: Karl Marx and $120,000 for BTC

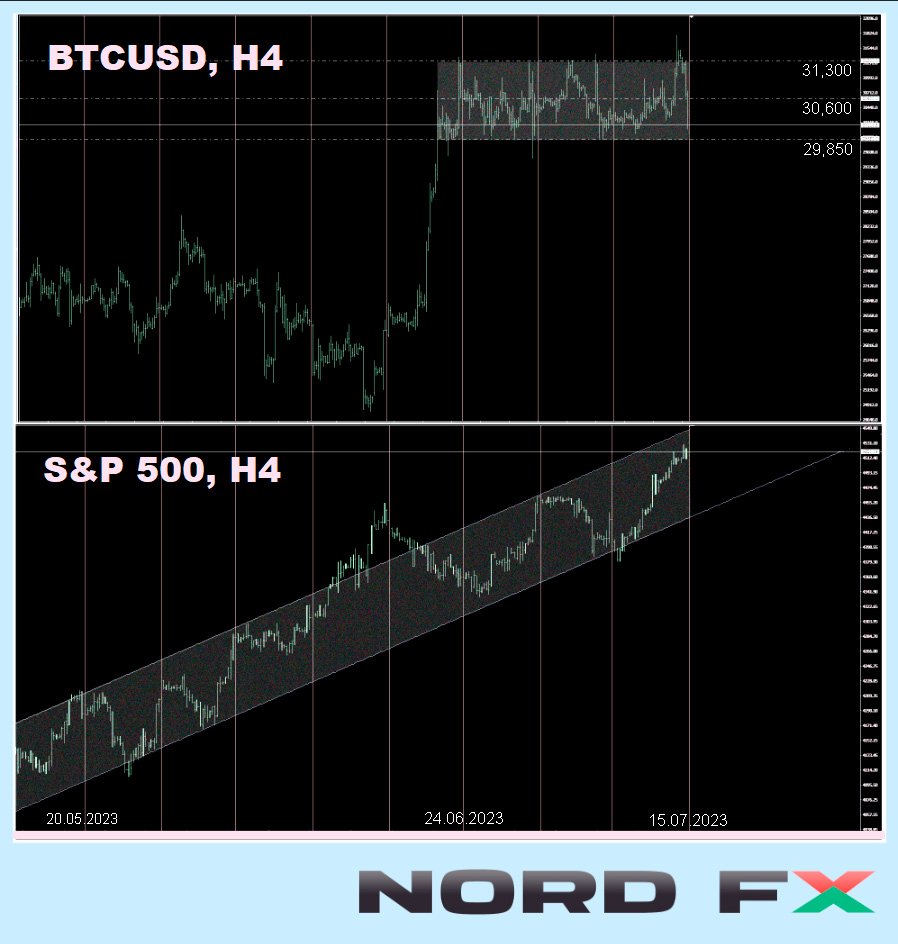

- After the release of impressive consumer inflation data in the US last week, the markets became confident in the Fed's imminent abandonment of monetary restriction and a turn towards lowering the key rate. The dollar responded to this with a sharp fall, and risky financial instruments - with growth. The S&P500, Dow Jones, and Nasdaq Composite stock indices went up, but not bitcoin. The BTC/USD pair continued to move sideways along the Pivot Point $30,600, trapped in a narrow range. It seems as if it has completely forgotten about its direct correlation with stocks and its inverse correlation with the dollar. On Thursday, July 13, after the release of the American PPI, bitcoin still tried to break through to the north, but unsuccessfully: the very next day it returned within the limits of the sideways channel.

Why did this happen? What prevented digital gold from soaring along with the stock market? There don't seem to be any super serious reasons for this. Although analysts do point to three factors that are weighing on the crypto market.

The first of these is the low profitability of mining. Due to the increasing computational complexity, it remains close to a historical minimum. Moreover, it is accompanied by the fear of a possible new price drop. This is pushing miners to sell not only freshly mined coins (about 900 BTC per day), but also accumulated reserves. According to Bitcoinmagazine data, miners have transferred a record volume of coins to exchanges in the last six years.

In addition to miners, the US Government is contributing to the increase in supply. On just one day, July 12, it transferred $300 million worth of coins to crypto exchanges. And this is the second negative factor. Finally, the third is the bankrupt Mt.Gox exchange, which must pay customers everything that remains in its accounts by the end of October. This equates to approximately 135,900 BTC, totalling roughly $4.8 billion. Payments will be made in cryptocurrency, which will then be available on the market for sale and exchange for fiat.

Of course, all of this does not add positivity, increasing the supply but not the demand. However, considering that the average trading volume of bitcoin exceeds $12 billion daily, the figures mentioned do not seem that apocalyptic. In our view, the main reason for the current sideways trend is a balance between positives and negatives. The positives are the applications to launch spot btc-ETFs from such giants as BlackRock, Invesco, Fidelity, and others. The negatives are the increasing regulatory pressure on the crypto market by the US Securities and Exchange Commission (SEC).

It should be noted that the SEC has previously rejected all applications for spot BTC-ETFs and is not currently eager to give them the green light. Therefore, the struggle for these funds could be drawn out over many months. For instance, a final decision on BlackRock's application is not expected until mid-Q3 2023 at the earliest, and no later than mid-March 2024, just a month before the next BTC halving. The halving could be the trigger for not only the subsequent, but also the preceding growth of BTC.

According to economists at Standard Chartered Bank, the price of bitcoin may exceed $50,000 this year, and it could reach $120,000 by the end of the next year. In the view of bank analyst Geoff Kendrick, as the price rises, miners will return to a strategy of accumulation. As already mentioned, they are currently selling everything they mine. However, when bitcoin is trading at $50,000, their sales will decrease from the current 900 coins to 180-270 per day. Such a decrease in supply should lead to further growth in the value of the asset. In general, everything is in line with Karl Marx's economic theory of supply and demand.

In addition to miners, institutional investors are also expected to show interest in accumulating bitcoins, in anticipation not only of the launch of spot BTC-ETFs and the halving, but also of a shift in the Federal Reserve's monetary policy and a weakening of the dollar. As Grayscale Investments CEO Michael Sonnenshein recently stated, it has become clear that the first cryptocurrency is no longer a "passing fad". "Recent news [...] underscores the resilience of this asset class in a broader sense, and many investors view [digital gold] as a unique investment opportunity."

Analyst and trader Michael Pizzino also believes that the dollar is ready to significantly depreciate. However, he does not consider an apocalyptic scenario of a collapse of the world's main currency, as the dynamics of its exchange rate are slower than those of other classes of financial assets. However, Pizzino predicts a steady downward trend in USD in the foreseeable period and a redistribution of funds in favor of digital assets. The macrographic chart suggests their upward trend, and given the correlation between USD and BTC, a fall in the former could contribute to an increase in the value of the latter, followed by growth in other significant crypto assets.

Robert Kiyosaki, author of the famous book "Rich Dad, Poor Dad", claims that by 2024, bitcoin will reach the $120,000 mark. The economist bases his forecast on the fact that BRICS countries (Brazil, Russia, India, China, and South Africa) will soon move to the gold standard and issue their own cryptocurrency backed by gold. This could undermine the dominance of the U.S. dollar in the world economy and cause its devaluation. He also warns that many traditional financial institutions may go bankrupt in the near future due to their imprudent decisions and corruption. In this regard, Kiyosaki recommends protecting your money from inflation by buying physical gold and bitcoin.

A similar figure, only not at the beginning, but by the end of 2024, was named by the head of research at the crypto-financial service Matrixport, Markus Thielen. He stated in an interview with CoinDesk that the quotes of the first cryptocurrency could overcome the $125,000 mark by the end of next year. "On June 22, bitcoin reached a new annual high. This signal historically indicated the end of bearish and the beginning of bullish markets," he explained.

According to Thielen, the price of bitcoin can soar by 123% over 12 months and by 310% over a year and a half. With such growth, the asset will rise to $65,539 and $125,731, respectively. The expert's forecast is based on the average profitability of similar signals in the past: in August 2012, December 2015, May 2019, and August 2020. (Thielen intentionally ignores the first case with growth of 5,285% over 18 months, calling it "epic" and "disproportionate".).

As for a more short-term forecast, Michael Van De Poppe, founder of venture company Eight, believes that bitcoin is preparing for a leap to $41,000. The popular analyst bases his opinion on the recent growth of the first cryptocurrency rate and Fibonacci levels. According to him, "the previous annual high for BTC was overcome in April. And now we are seeing increasingly higher highs as traders build up bullish momentum and positions." "To continue the uptrend, which we call a bull cycle, bitcoin needs to reach a new and clearer high," explains Michael Van De Poppe. "There are several points that allow determining the possibilities of further growth using Fibonacci levels. And now I would say that there is a rally to $41,000 ahead."

"There are two scenarios: a rise above the current maximum, followed by some consolidation and a rollback before a new growth. Or consolidation at current levels, and then accelerated growth in the coming months. For bitcoin, this is pretty standard behaviour. And then we will go to $41,000 or even $42,500," the analyst predicts.

As of writing this review on the evening of Friday, July 14, BTC/USD is trading around $30,180. The total market capitalization of the crypto market has slightly increased and stands at $1.198 trillion ($1.176 trillion a week ago). The Crypto Fear & Greed Index is in the Greed zone and stands at 60 points (55 points a week ago).

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back