EUR/USD: What Strengthens the Dollar and What Can Weaken It

- The US currency maintained its ascent last week. The minutes from the Federal Open Market Committee (FOMC)'s July meeting of the US Federal Reserve were published on Wednesday, August 16, suggesting the possibility of further monetary policy tightening.

Before the minutes were unveiled, market players debated how long the central interest rate would linger at 5.5%. However, once the document's content was revealed, discussions shifted to how much more this rate could increase. Several FOMC members expressed in the minutes that the current economic landscape might not see as significant a decrease in inflation as hoped. This sentiment paves the way for the Fed to consider another rate hike. As a result, the likelihood that the interest rate could climb to 5.75% or even higher in 2023 has surged from 27% to 37%, reinforcing the dollar's position.

Other factors bolstering the US dollar include the favourable state of the securities market and the robust health of the US economy. Positive retail sales figures prompted the Federal Reserve Bank of Atlanta to revise its Q3 GDP forecast for the country, raising it from 5.0% to 5.8%. The real estate market is also showing promising signs: the monthly issued construction permits rose by 0.1%. Furthermore, the construction of new homes increased by 3.9%, reaching 1.452 million units, surpassing the projected 1.448 million. Retail sales statistics released on August 15th further supported the Dollar Index (DXY), with consumer activity in July expanding by 0.7%: outpacing the anticipated 0.4% and the prior 0.2% figure. Collectively, these data points underscore a diminishing risk of the US economy entering a recession, suggesting a likely continuation of the monetary restriction phase. Additionally, escalating oil prices might nudge the regulator towards subsequent rate hikes, potentially spurring another inflationary wave.

On the other hand, the situation in the US banking sector could pose challenges for the dollar. Neil Kashkari, the President of the Federal Reserve Bank of Minneapolis, believes that the crisis that began in March, leading to the bankruptcy of several major banks, might not yet be over. He opines that if the Federal Reserve continues to raise interest rates, it will significantly complicate the operations of banks and could trigger a new wave of bankruptcies. This perspective is echoed by analysts at Fitch Ratings. Their projections even consider the possibility of downgrading the ratings of several US banks, including giants like JPMorgan Chase & Co.

Strategists at Goldman Sachs believe that the Federal Reserve might only consider reducing the key rate in Q2 2024. A potential trigger for this move could be the inflation rate stabilizing at the target level of 2.0%. However, Goldman Sachs acknowledges that the actions of the regulator remain unpredictable, which means the rate could stay at peak levels for a more extended period. Overall, according to the CME FedWatch Tool, 68% of market participants anticipate that by May 2024, the rate will be reduced by at least 25 basis points (b.p.).

Regarding the Eurozone's economy, data published on August 16th showed that it grew by 0.3% (quarter-on-quarter) for Q2 2023. This figure aligns perfectly with predictions and matches the growth rate of Q1. On an annual basis, the GDP growth stood at 0.6%, which is consistent with both forecasts and the previous quarter's numbers. The inflation figures released on Friday, August 18, were also unsurprising. They matched both market expectations and previous figures. In July, the Core Consumer Price Index (CPI) was recorded at 5.5% (year-on-year) and -0.1% (month-on-month).

Amid such consistently modest economic performance, the euro continues to face downward pressure. Factors contributing to this include the potential energy crisis in Europe this upcoming winter and uncertainties surrounding the monetary policy of the European Central Bank (ECB).

Starting the five-day trading period at 1.0947, EUR/USD closed at 1.0872. As of the evening of August 18, when this review was written, 50% of analysts predict a rise for the pair in the near future, 35% favour the dollar, and the remaining 15% maintain a neutral stance. Regarding oscillators on the D1 timeframe, 100% are leaning towards the US currency, but 25% of them indicate that the pair is oversold. Trend indicators show 85% pointing southward, while the remaining 15% look north. The nearest support levels for the pair lie in the range of 1.0845-1.0865, followed by 1.0780-1.0805, 1.0740, 1.0665-1.0680, 1.0620-1.0635, and 1.0525. Bulls will encounter resistance in the range of 1.0895-1.0925, then at 1.0985, 1.1045, 1.1090-1.1110, 1.1150-1.1170, 1.1230, 1.1275-1.1290, 1.1355, 1.1475, and 1.1715.

Next week, the spotlight will be on the symposium of heads of major central banks in Jackson Hole, taking place from August 24 to 26. If the Federal Reserve Chairman, Jerome Powell, even hints at the imminent conclusion of the current rate-hike cycle in his speech on August 25, the DXY (Dollar Index) might turn downward. However, it's evident that currency pair dynamics will also depend on what leaders of other central banks say, naturally including ECB President Christine Lagarde.

Other notable events for the week include the release of US labour market data on August 22 and 23. On Wednesday, August 23, business activity indicators (PMI) for the United States, Germany, and the Eurozone will be disclosed. Additionally, on Thursday, August 24, statistics on durable goods orders and unemployment in the US will be made available.

GBP/USD: BoE's Indecision - A Disaster for the Pound

- GBP/USD has oscillated within the 1.2620-1.2800 range for the past two and a half weeks, with neither bulls nor bears establishing a clear upper hand. Despite the Bank of England (BoE) recently raising interest rates, bullish momentum for the pound remains elusive.

There's growing concern among market stakeholders that an aggressive monetary policy tightening could further destabilize the UK's already fragile economy, which teeters on the brink of recession. In July, the unemployment rate rose notably by 0.2%, settling at 4.2%. More worryingly, youth unemployment surged by 0.9%, moving from 11.4% to 12.3%. Additionally, there was an increase of 25K in those claiming unemployment benefits compared to the prior month. This rise in unemployment can be largely attributed to the wave of business bankruptcies that initiated in 2021. This trend saw a stark acceleration in early 2022, matching levels witnessed only during the late 1980s crisis and the 2008 financial meltdown.

As per the latest data released by the Office for National Statistics (ONS) on August 18, retail sales in the UK for July declined by 1.2% on a monthly basis, a more significant drop than the 0.6% seen the previous month. On an annual basis, there was a 3.2% contraction, compared to the 1.6% decrease observed in June.

The inflation data (CPI) released on August 16 indicates that despite dropping from 7.9% to 6.8% year-on-year (YoY), inflation remains notably high. Moreover, the core rate remained steady at 6.9%. The rising cost of energy could potentially lead to a further inflationary surge.

The market firmly believes that the Bank of England must take appropriate action in response. The central bank might need to continue increasing rates not only this year but potentially into 2024. However, as economists from Commerzbank suggest, if in the coming weeks the market gets the impression that the BoE is wavering in its commitment to tackle inflationary risks for fear of hampering the economy too much, it could have catastrophic implications for the pound.

GBP/USD closed at 1.2735 n Friday, August 18. Experts' forecast for the near future is as follows: 60% lean bullish on the pound, 20% are bearish, and the remaining 20% prefer a neutral stance. On the D1 oscillators, 50% are coloured red, indicating a bearish trend, while the other 50% are in a neutral gray. For trend indicators, the ratio of red to green is 60% to 40%, favouring the bullish side.

Should the pair move downward, it will encounter support levels and zones at 1.2675-1.2690, 1.2620, 1.2575-1.2600, 1.2435-1.2450, 1.2300-1.2330, 1.2190-1.2210, 1.2085, 1.1960, and 1.1800. If the pair ascends, resistance will be met at 1.2800-1.2815, 1.2880, 1.2940, 1.2980-1.3000, 1.3050-1.3060, 1.3125-1.3140, 1.3185-1.3210, 1.3300-1.3335, 1.3425, and 1.3605.

In terms of macroeconomic data, Wednesday, August 23 will be the "PMI day" not only for Europe and the USA but also for the UK, as business activity indicators in various sectors of the British economy will be released. And, of course, one cannot forget about the annual symposium in Jackson Hole.

USD/JPY: Anticipating Currency Interventions

- The release of the FOMC minutes and the rise in yields of 10-year U.S. Treasuries to levels not seen since 2008 propelled USD/JPY even higher, reaching 146.55. As noted by economists from Japan's MUFG Bank, "The dollar's strengthening has pushed USD/JPY into a danger zone where the risk of intervention to halt its upward movement is increasing." Colleagues from the Dutch banking group ING concur that the pair is now in the territory of currency interventions. "However," ING believes, "it likely lacks the necessary volatility to alarm Japanese officials."

Recall that the Ministry of Finance (MOF) had intervened in USD/JPY at levels above 145.90 last September. But currently, neither the Ministry of Finance nor the Bank of Japan (BoJ) are in a hurry to defend the domestic currency. Contrary to the U.S., Eurozone, and the UK, where inflation is on a decline (albeit at different rates), inflation in Japan is on the rise. On Friday, August 18, the country's Statistical Bureau published the National Consumer Price Index (CPI) for July, which stood at 3.3%, whereas a result of 2.5% (year-on-year) was anticipated.

Commerzbank analysts don't see much chance for the yen to appreciate again, even though the country's GDP is growing. (Preliminary data indicates growth in the second quarter was at 1.5% (year-on-year) compared to a forecast of 0.8% and a previous rate of 0.9%). On the contrary, there are concerns that under current conditions, the yen could weaken further if the Ministry of Finance doesn't take action to halt the decline. "Perhaps the Bank of Japan and the Ministry of Finance are hoping the situation will shift once U.S. interest rates begin to drop again," Commerzbank economists suggest. "We also anticipate a weakening of the dollar at that point. However, that moment is still some time away. The only thing the Ministry of Finance will achieve with its interventions up until then is to buy time. In our view, going against the prevailing winds cannot succeed in strengthening the yen. It might work temporarily, but that's not a certainty.".

However, market participants are growing increasingly concerned that a weak yen might at some point prompt action from Japanese officials. As suggested by ING, the oversold status of the Japanese currency coupled with the threat of interventions will likely exacerbate any bearish corrections in USD/JPY. It was following such a correction, albeit a modest one, that the pair concluded the past week at a level of 145.37.

Regarding the near-term outlook, the median forecast from experts is as follows: An overwhelming majority (60%) anticipates the dollar to strengthen and expects USD/JPY to continue its upward trajectory. The remaining 40% anticipate a bearish correction. On the D1 oscillators, a full 100% are colored green, although 20% indicate overbought conditions. For the trend indicators, 80% are in green while 20% are in red. The nearest support level is situated at the 144.50 zone, followed by 143.75-144.04, 142.90-143.05, 142.20, 141.40-141.75, 140.60-140.75, 139.85, 138.95-139.05, 138.05-138.30, and 137.25-137.50. Immediate resistance lies at 145.75-146.10, then 146.55, 146.90-147.15, 148.45, 150.00, and finally, the October 2022 high of 151.95.

The Consumer Price Index (CPI) for the Tokyo region will be released on Friday, August 25. No other significant data releases pertaining to the state of the Japanese economy are scheduled for the upcoming week.

CRYPTOCURRENCIES: How Elon Musk Crashed the "People's Dollar"

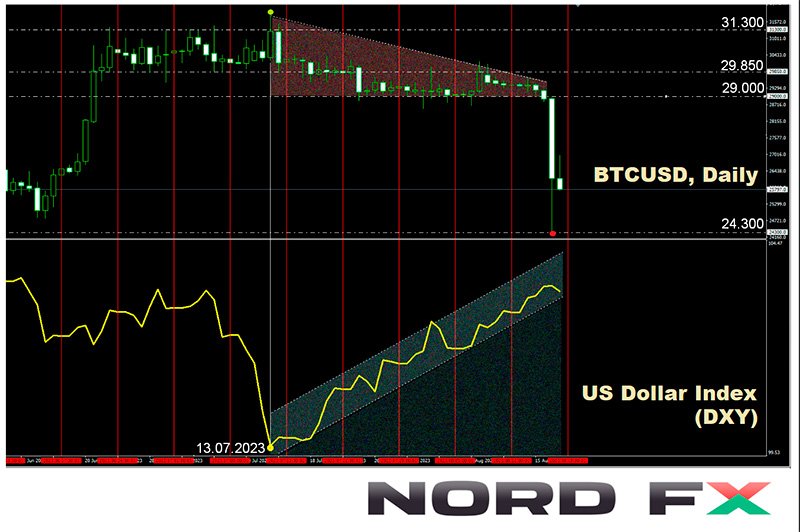

- From July 14, the primary cryptocurrency, and the digital asset market as a whole, have been under the pressure of a strengthening dollar. Clearly, when the weight on the BTC/USD scale tips towards the dollar, bitcoin becomes lighter. In fact, from August 11 to 15, it seemed as if the market had completely forgotten about cryptocurrencies, with the BTC/USD pair's chart thinly stretching from west to east, hugging the Pivot Point of $29,400.

Glassnode analysts noted at the time that the digital gold market had reached a phase of extreme apathy and exhaustion. Volatility metrics at the beginning of the week hit record lows, with the Bollinger Bands spread narrowing to 2.9%. Such low levels were only seen twice in history: in September 2016 and January 2023. "The market needs to take steps to...break the investor apathy," concluded Glassnode specialists.

Such actions were taken, though not necessarily in the direction investors would have preferred. The first move occurred on the evening of August 16 when BTC/USD dropped to $28,533. This decline was likely triggered by the publication of the minutes from the Federal Reserve's July meeting, as mentioned earlier. But that modest setback wasn't the end of it. The next significant drop occurred on the night of August 17 to 18. It can be described as a plunge into the abyss, with bitcoin reaching a low of $24,296. The crash came after The Wall Street Journal, citing undisclosed documents, reported that Elon Musk's SpaceX had liquidated its BTC holdings, accounting for a $373 million markdown in cryptocurrency. However, the report did not specify when exactly SpaceX had sold these coins. Still, such details aren't necessary to ignite panic in the market.

Several other events also added pressure to the quotations. For instance, a U.S. Federal Court granted the Securities and Exchange Commission's (SEC) appeal against Ripple, casting doubt on a partial decision made in favour of Ripple a month prior. The ongoing series of legal claims by U.S. authorities against major cryptocurrency exchanges remains another negative influence.

Bitcoin's nosedive dragged the entire crypto market down with it, leading to a mass liquidation of open margin positions. According to Coinglass, over a 24-hour span, positions of more than 175,000 market participants were liquidated, resulting in traders' losses surpassing $1 billion.

The situation could have been much graver had it not been for a report from Bloomberg stating that the SEC was preparing to authorize the creation of the first futures ETFs for Ethereum. As a result, BTC/USD and ETH/USD corrected upwards, returning to levels seen two months prior. As a reminder, the market soared on June 15 after BlackRock filed an application to establish a spot bitcoin ETF. However, after the recent plunge, those gains were virtually erased.

Should we expect further declines? Notably, a trader and analyst known by the pseudonym Dave_the_Wave, renowned for his accurate forecasts, had warned that by the end of 2023, bitcoin could drop to the lower boundary of its Logarithmic Growth Curve (LGC), implying a roughly 38% drop from this year's peak. In such a scenario, the bottom would be around $19,700.

Another well-known trader, Tone Vays, did not rule out a drop in BTC to $25,000 (which has already occurred). In this case, Vays believes there's a high likelihood of a further long-term decline. From his perspective, the premier cryptocurrency is "teetering on the edge, and things look bleak." "The price needs to reverse immediately, I mean – this month. We cannot afford another month of decline; otherwise, panic will set in the market. I wouldn't be surprised if BTC trades below $20,000. Miners might even begin offloading their holdings, which is highly precarious," Vays cautions.

We have previously mentioned another expert, Michael Van De Poppe, founder of the venture company Eight, who has refuted claims of BTC's price dropping to the $12,000 mark. However, in his view, for bitcoin to return to active growth, it needs to surpass the $29,700 level. The next significant target for the coin would be $40,000.

In contrast to Michael Van De Poppe, Kevin Kelly, co-founder, and head of research at Delphi Digital, has already spotted early signs of a bull rally. However, this observation was made before the slump on August 18. According to Kelly, a standard crypto cycle starts when bitcoin reaches an all-time high (ATH), followed by an 80% decline. Roughly two years later, it rebounds to its previous ATH and continues climbing to a new peak. This sequence typically spans around four years.

Kelly believes this pattern isn't random but aligns with a "broader business cycle." He noted that bitcoin's price peak often coincides with the ISM manufacturing index, which currently appears to be in the final phase of its downturn. The current situation reminds Kelly of the market dynamics between 2015 and 2017.

He highlighted that the last two bitcoin halvings occurred roughly 18 months after the asset bottomed out and about seven months before it broke its historical peak. The next halving is anticipated in April 2024. After which, about six months later by the expert's estimates, the digital gold might reach its ATH. However, Kelly warned that there are no guarantees of this scenario unfolding. He also speculated about the possibility of a "false bottom."

A similar cyclical analysis was conducted by an analyst known as Ignas, predicting a bitcoin bull market in 2024. His calculation is based on the pattern that the primary cryptocurrency has showcased for many years: 1. An 80% dip from ATH, lowest point a year later (Q4 2022). 2. Two years for recovery and reaching the previous peak (Q4 2024). 3. Another year of price growth leading to a new ATH (Q4 2025).

According to Ignas, the crypto industry faced macroeconomic challenges in 2022, but the situation is now improving. The bitcoin halving in April 2024 might align with a global liquidity surge, fuelling the anticipated bull rally. Additionally, new use cases for bitcoin and the launch of spot bitcoin ETFs, once approved by the SEC, will influence its price.

From a survey conducted by the popular blogger and analyst known as PlanB, 60% of respondents believe in a bull market's onset post-halving. PlanB himself theorizes that by the time of this event, BTC will be priced around $55,000. Signals from his bitcoin price prediction model, S2F, hint at the coin's potential movement towards this figure.

Robert Kiyosaki, investor, and author of the financial bestseller “Rich Dad Poor Dad” made another prediction. "Bitcoin is heading to $100,000," Kiyosaki believes. "The bad news: if the stock and bond market crashes, gold and silver prices will skyrocket. Worse, if the global economy collapses. Then bitcoin will be worth a million, gold can be bought for $75,000, and silver for $60,000. The national debt is too great. Everyone is in trouble," wrote Kiyosaki. But he added, just in case, "I hope I'm wrong."

Fittingly for a writer, Kiyosaki metaphorically called gold and silver "God's money" and bitcoin the "people's dollar". "I like bitcoin because we have a common enemy - the US federal government, the treasury, the Federal Reserve, and Wall Street. I don't trust them. If you trust, then collect dollars, and you'll get an IOU," he said.

It's worth noting that, in contrast to Robert Kiyosaki's stance, many investors have recently been gravitating towards the US dollar instead of the "people's currency." They view the dollar as a more reliable safe-haven asset. This shift is evident when comparing the DXY and BTC charts. At the time of this review, on the evening of August 18, the market has shown some signs of stabilization, with the BTC/USD trading close to $26,100. The total market capitalization of cryptocurrencies took a significant hit, narrowly maintaining above the psychological threshold of $1 trillion, registering at $1.054 trillion, down from $1.171 trillion just a week prior. Not surprisingly, the Crypto Fear & Greed Index also saw a decline, moving from the Neutral category into the Fear territory, marking a score of 37, a drop from last week's 51 points.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back