EUR/USD: Verbal Interventions by the Federal Reserve Support the Dollar

- In previous reviews, we extensively discussed the verbal interventions made by Japanese officials who aim to bolster the yen through their public statements. This time, similar actions have been taken by FOMC (Federal Open Market Committee) officials, led by the Chairman of the Federal Reserve, Jerome Powell. At their meeting on September 20th, the FOMC decided to maintain the interest rate at 5.50%. This was largely expected, as futures markets had indicated a 99% probability of such an outcome. However, in the subsequent press conference, Mr. Powell indicated that the battle against inflation is far from over, and that the 2.0% target may not be achieved until 2026. Therefore, another rate hike of 25 basis points is very much in the cards. According to the Fed Chairman, there is no recession on the horizon, and the U.S. economy is sufficiently robust to sustain such high borrowing costs for an extended period. Furthermore, it was revealed that 12 out of 19 FOMC members anticipate a rate hike to 5.75% within this year. According to the Committee's economic forecast, this rate level is expected to persist for quite some time. Specifically, the updated forecast suggests that the rate could only be lowered to 5.1% a year from now (as opposed to the previously stated 4.6%), and a decrease to 3.9% is expected in a two-year outlook (revised from 3.4%).

Market participants have mixed beliefs about these prospects, but the fact remains that the hawkish assertions from officials have bolstered the dollar, despite the absence of tangible actions. It's possible that the Federal Reserve has learned from the mistakes of their European Central Bank (ECB) counterparts, who have led market players to believe that the monetary tightening cycle in the Eurozone has concluded. As a reminder, ECB President Christine Lagarde made it clear that she considers the current interest rate level to be acceptable, while the Governor of the Bank of Greece, Yannis Stournaras, stated that, in his opinion, interest rates have peaked, and the next move will likely be a reduction. A similar sentiment: that the September act of monetary tightening was the last, was also expressed by Stournaras's colleague, Boris Vujčić, the Governor of the National Bank of Croatia.

As a result of the Federal Reserve's verbal intervention, the Dollar Index (DXY) soared from 104.35 to 105.37 within just a few hours, while EUR/USD declined to a level of 1.0616. Economists at Oversea-Chinese Banking Corporation (OCBC) believe that, given the Fed's decision to retain flexibility concerning another rate hike, it is not advisable to anticipate a dovish turn in the foreseeable future.

Danske Bank strategists opine that "the Fed was as hawkish as it could be without actually raising rates." However, they contend that "despite the ongoing strengthening of the dollar, there may be some upside potential for EUR/USD in the near term." Danske Bank further states, "We believe that peak rates, improvements in the manufacturing sector compared to the service sector, and/or a reduction in pessimism towards China could support EUR/USD over the next month. However, in the longer term, we maintain our strategic position favouring a decline in EUR/USD, expecting a breakthrough below 1.0300 within the next 12 months."

Data on U.S. business activity released on Friday, September 22, presented a mixed picture. The Manufacturing PMI index rose to 48.9, while the Services PMI declined to 50.2. Consequently, the Composite PMI remained above the 50.0 threshold but showed a slight dip, moving from 50.2 to 50.1.

Following the PMI release, EUR/USD concluded the week at 1.0645. Seventy percent of experts favoured further strengthening of the dollar, while 30% voted for an uptrend in the currency pair. In terms of technical analysis, not much has changed over the nearly completed week. All trend indicators and oscillators on the D1 timeframe are still unanimously supporting the American currency and are coloured red. However, 15% of them are signalling the pair's oversold condition. The nearest support levels for the pair lie in the 1.0620-1.0630 range, followed by 1.0490-1.0525, 1.0370, and 1.0255. Resistance levels will be encountered in the 1.0670-1.0700 zone, then at 1.0745-1.0770, 1.0800, 1.0865, 1.0895-1.0925, 1.0985, and 1.1045.

As for the upcoming week's events, Tuesday, September 26 will see the release of U.S. real estate market data, followed by durable goods orders in the U.S. on Wednesday. Thursday, September 28 promises to be a busy day. Preliminary inflation (CPI) data from Germany as well as U.S. GDP figures for Q2 will be disclosed. Additionally, the customary U.S. labour market statistics will be released, and the day will conclude with remarks from Federal Reserve Chairman Jerome Powell. On Friday, we can also expect a slew of significant macroeconomic data, including the Eurozone's preliminary Consumer Price Index (CPI) and information regarding personal consumption in the United States.

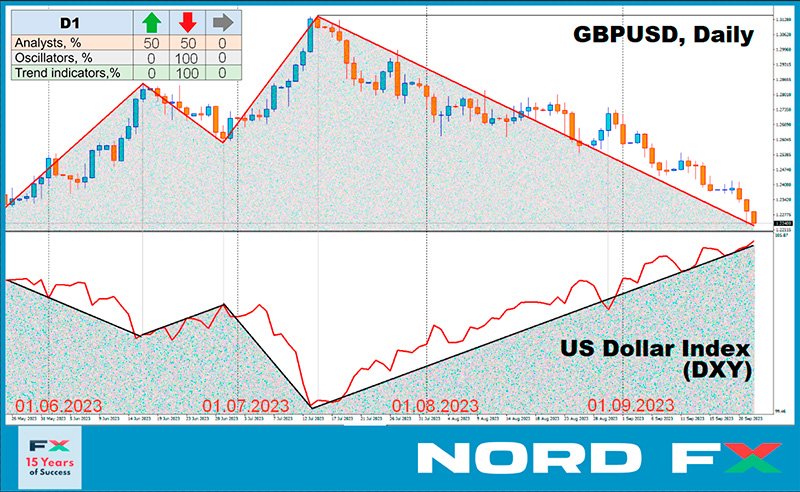

GBP/USD: BoE Withdraws Support for the Pound

- The financial world doesn't revolve around the Federal Reserve's decisions alone. Last week, the Bank of England (BoE) also made its voice heard. On Thursday, September 21, the BoE's Monetary Policy Committee left the interest rate for the pound unchanged at 5.25%. While a similar decision by the Federal Reserve was expected, the BoE's move came as a surprise to market participants. They had anticipated a 25 basis point increase, which did not materialize. As a result, the strengthening dollar and weakening pound drove GBP/USD down to 1.2230.

The BoE's decision was likely influenced by encouraging inflation data for the United Kingdom published the day before. The annual Consumer Price Index (CPI) actually declined to 6.7%, compared to the previous 6.8% and a forecast of 7.1%. The core CPI also fell from 6.9% to 6.2%, against a forecast of 6.8%. Given such data, the decision to pause and not burden an already struggling economy appears reasonable. This rationale is further supported by the United Kingdom's preliminary Services Purchasing Managers' Index (PMI) for September, which hit a 32-month low at 47.2, compared to 49.5 in August and a forecast of 49.2. The Manufacturing PMI was also reported at 44.2, significantly below the critical level of 50.0.

According to economists at S&P Global Market Intelligence, these "disheartening PMI results suggest that a recession in the United Kingdom is becoming increasingly likely. [...] The sharp decline in production volumes indicated by the PMI data corresponds to a GDP contraction of more than 0.4% on a quarterly basis, and the broad-based downturn is gaining momentum with no immediate prospects for improvement.".

Analysts at one of the largest banks in the United States, Wells Fargo, believe that the BoE's decision signals a loss of rate-based support for the British pound. According to their forecast, the current rate of 5.25% will mark the peak of the cycle, followed by a gradual decline to 3.25% by the end of 2024. Consequently, they argue that "in this context, a movement of the pound to 1.2000 or lower is not out of the question."

Their counterparts at Scotiabank share a similar sentiment. New lows and strong bearish signals on the oscillator for short-term, medium-term, and long-term trends indicate an elevated risk of the pound dropping to 1.2100-1.2200.

Economists at Germany's Commerzbank do not rule out the possibility of a slight recovery for the pound if inflation outlooks significantly improve. They believe that the Bank of England has left the door open for another rate hike. The vote for maintaining the current rate was surprisingly close at 5:4, meaning four members of the Monetary Policy Committee voted in favour of a 25 basis point increase. This underscores the high level of uncertainty. Nevertheless, due to the weakness in the UK economy, the outlook for the pound remains bearish.

GBP/USD closed the past week at 1.2237. Analyst opinions on the pair's immediate future are evenly split: 50% expect further downward movement, while the other 50% anticipate a correction to the upside. All trend indicators and oscillators on the D1 chart are coloured in red; moreover, 40% of these oscillators are in the oversold zone, which is a strong signal for a potential trend reversal.

If the pair continues its downward trajectory, it will encounter support levels and zones at 1.2190-1.2210, 1.2085, 1.1960, and 1.1800. On the other hand, if the pair rises, it will face resistance at 1.2325, 1.2440-1.2450, 1.2510, 1.2550-1.2575, 1.2600-1.2615, 1.2690-1.2710, 1.2760, and 1.2800-1.2815.

In terms of economic events impacting the United Kingdom for the upcoming week, the highlight will be the release of the country's GDP data for Q2, scheduled for Friday, September 29.

USD/JPY: Lacklustre Meeting at the Bank of Japan

- Following their counterparts at the Federal Reserve and the Bank of England, the Bank of Japan (BoJ) held its meeting on Friday, September 22. "It was a lacklustre meeting," commented economists at TD Securities. "All members unanimously voted to keep policy unchanged. The statement was largely similar to the one issued in July, and no changes were made to the forward guidance." The key interest rate remained at the negative level of -0.1%.

The subsequent press conference led by BoJ Governor Kazuo Ueda also disappointed yen bulls. Ueda did not speak against the weakening of the national currency; instead, he reiterated that the exchange rate should reflect fundamental indicators and remain stable. The central bank's head also noted that the regulator "could consider the possibility of ending yield curve control and altering the negative interest rate policy when we are confident that achieving the 2% inflation target is near."

Japan's Finance Minister Shunichi Suzuki's speech was also a typical form of verbal intervention for him. "We are closely monitoring currency exchange rates with a high sense of urgency and immediacy," the minister declared, "and we do not rule out any options for responding to excessive volatility." He added that last year's currency intervention had its intended effect but did not indicate whether similar steps could be expected in the near future.

Ten-year U.S. Treasury bonds and the USD/JPY currency pair are traditionally directly correlated. When the yield on the bonds rises, so does the dollar against the yen. This week, following hawkish statements from the Federal Reserve, rates on 10-year Treasuries soared to their highest peak since 2007. This propelled USD/JPY to a new high of 148.45. According to economists at TD Securities, considering the rise in U.S. yields, the pair could break above 150.00. Meanwhile, at the French bank Societe Generale, target levels of 149.20 and 150.30 are being cited.

The last note of the five-day trading session sounded at the 148.36 mark. A majority of surveyed experts (70%) agreed with the views of their colleagues at TD Securities and Societe Generale regarding the further rise of USD/JPY. A correction to the downside, and possibly a sharp drop due to currency interventions, is expected by 20% of analysts. The remaining 10% took a neutral stance. All 100% of trend indicators and oscillators on the D1 timeframe are coloured green, although 10% of the latter are signalling overbought conditions. The nearest support level is in the 146.85-147.00 zone, followed by 145.90-146.10, 145.30, 144.50, 143.75-144.05, 142.20, 140.60-140.75, 138.95-139.05, and 137.25-137.50. The nearest resistance is at 148.45, followed by 148.45, 148.85-149.20, 150.00, and finally, the October 2022 high of 151.90.

No significant economic data related to the state of the Japanese economy is scheduled for release in the upcoming week. However, traders may want to mark Friday, September 29 on their calendars, as consumer inflation data for the Tokyo region will be published on that day.

CRYPTOCURRENCIES: Battle for $27,000

- On Monday, September 18, the price of the leading cryptocurrency began to soar, pulling the entire digital asset market upward. Interestingly, the reason behind this surge was not directly related to bitcoin, but rather to the U.S. dollar. Specifically, it was tied to the Federal Reserve's decisions regarding interest rates. High dollar rates limit the flow of investments into riskier assets, including cryptocurrencies, as large investors prefer stable returns. In this case, ahead of the upcoming Federal Reserve meeting, market participants were confident that the regulator would not only refrain from raising rates but would also keep them unchanged until year-end. Riding on these expectations, BTC/USD surged, reaching a peak of $27,467 on August 19, adding more than 10% since September 11.

However, although the rate did indeed remain unchanged, it became clear following the meeting that the fight against inflation would continue. Therefore, any hopes of a shift away from the Fed's hawkish stance should be set aside for now. As a result, the price of bitcoin reversed course. After breaking through the support zone at $27,000, it returned to its starting positions.

Despite the recent pullback, many in the crypto community remain confident that the digital gold will continue to rise. For instance, an analyst going by the alias Yoddha believes that bitcoin has a chance to refresh its local high in the short term and reach $50,000 by year-end. After which, he suggests, a correction to $30,000 may occur in early 2024, ahead of the halving event. Blogger Crypto Rover also anticipates that troubles in the U.S. economy will fuel BTC's growth. If the pair manages to firmly establish itself above $27,000, he expects the price to move towards $32,000.

Analyst DonAlt is of the opinion that bitcoin stands a chance to stage a new impressive rally and update its 2023 high. "If we rise and overcome the resistance we are currently battling," he writes, "the target, I believe, could be $36,000. [...] I won't rule out missing a good entry at $30,000 because if the price takes off, it may rise too quickly. [But] we have enough compelling reasons to also move downward. In the worst case, I'll take a minor hit if it plunges into the $19,000 to $20,000 range.".

Trader and analyst Jason Pizzino believes that bitcoin's bullish market cycle began forming around January, and this process is still not complete despite the recent price consolidation. According to the expert, bitcoin will confirm its bullish sentiment if it crosses a key level at $28,500. "This market has seldom seen sub-$25,000 levels. I'm not saying it can't go down, but for six months now, the weekly closings have been above these levels. So far, so good, but we're not in bull territory yet. Bulls need to see closings above $26,550 at least occasionally," states Pizzino. "Bulls still have much to do. I'll start talking about them once we cross the white line at the $28,500 level again. This is one of the key levels for bitcoin to start moving upwards and then try to break $32,000.".

John Bollinger, the creator of the Bollinger Bands volatility indicator, does not rule out the possibility that the leading crypto asset is preparing for a breakout. The indicator uses the standard deviation from the simple moving average to determine volatility and potential price ranges for an asset. Currently, BTC/USD is forming daily candles that touch the upper band. This could indicate a reversal back to the central band or, conversely, an increase in volatility and upward movement. Narrow Bollinger Bands on the charts suggest that the latter scenario is more likely. However, Bollinger himself comments cautiously, believing that it is still too early to draw definitive conclusions.

PlanB, the well-known creator of the S2FX model, has reaffirmed his forecast made earlier this year. He noted that the November 2022 low was the bottom for bitcoin, and its ascent will begin closer to the halving event. PlanB believes that the 2024 halving will drive the leading cryptocurrency up to $66,000, and the subsequent bull market in 2025 could push its price above the $100,000 mark.

Investor and best-selling author of "Rich Dad Poor Dad," Robert Kiyosaki, has high hopes for the halving event as well. According to the expert, the U.S. economy is on the verge of a serious crisis, and cryptocurrencies, particularly bitcoin, offer investors a safe haven during these turbulent times. Kiyosaki predicts that the price of bitcoin could soar to $120,000 next year, and the 2024 halving will serve as a key catalyst for the rally.

In conclusion, to balance out the optimistic forecasts mentioned earlier, let's introduce some pessimism. According to popular analyst and host of the DataDash channel, Nicholas Merten, the crypto market could experience another downturn. He cites the declining liquidity of stablecoins as an indicator. "It's a good metric for identifying trends in the cryptocurrency market. For instance, from April 2019 to July 2019, bitcoin rose from $3,500 to $12,000. During the same period, the liquidity of stablecoins increased by 119%. Then we see a period of consolidation where liquidity also remained at a constant level. When bitcoin rose from $3,900 to $65,000 in 2021, the liquidity of stablecoins surged by 2,183%," the expert shares his observations.

"Liquidity and price growth are interconnected. If liquidity is declining or consolidating, the market is likely not going to grow. This is true for both cryptocurrencies and financial markets. For market capitalization to grow, you need liquidity, but what we are seeing is a constant decline in liquidity, which makes a price drop for cryptocurrencies more probable," Nicholas Merten states.

As of the time of writing this review, Friday evening, September 22, BTC/USD is trading around $26,525. The overall market capitalization of the crypto market has remained virtually unchanged, standing at $1.053 trillion (compared to $1.052 trillion a week ago). The Bitcoin Crypto Fear & Greed Index has dropped by 2 points, moving from 45 to 43, and remains in the 'Fear' zone.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back