EUR/USD: Correction is Not a Trend Reversal Yet

- The dynamics of the EUR/USD pair in the past week were atypical. In a standard scenario, combating inflation against the backdrop of a strong economy and a healthy labour market leads to an increase in the central bank's interest rate. This, in turn, attracts investors and strengthens the national currency. However, this time the situation unfolded quite differently.

U.S. macroeconomic data released on Thursday, September 28, indicated strong GDP growth in Q2 at 2.1%. The number of initial unemployment claims was 204K, slightly higher than the previous figure of 202K, but less than the expected 215K. Meanwhile, the total number of citizens receiving such benefits amounted to 1.67 million, falling short of the 1.675 million forecast.

This data suggests that the U.S. economy and labour market remain relatively stable, which should prompt the U.S. Federal Reserve to increase interest rates by 25 basis points (bps). It's worth noting that Neil Kashkari, President of the Federal Reserve Bank of Minneapolis, recently confirmed his full support for such a move, as combating high inflation remains the central bank's primary objective. Jamie Dimon, CEO of JPMorgan, went even further, stating that he does not rule out the possibility of rate hikes from the current 5.50% to as high as 7.00%.

However, these figures and forecasts failed to make an impression on market participants. Especially since the rhetoric from Fed officials proved to be quite contradictory. For instance, Thomas Barkin, President of the Federal Reserve Bank of Richmond, does not believe that U.S. GDP will continue to grow in Q4. He also pointed out that there's a wide range of opinions regarding future rates and that it's unclear if additional changes in monetary policy are required. Austin Goolsbee, President of the Federal Reserve Bank of Chicago, noted that overconfidence in the trade-off between inflation and unemployment carries the risk of policy mistakes.

Such statements have tempered bullish sentiment on the dollar. Amid this murky and contradictory backdrop, yields on U.S. Treasury bonds, which had been supporting the dollar, fell from multi-year highs. Uncertainty surrounding the U.S. federal budget and the threat of a government shutdown also weighed on the dollar. Furthermore, September 28 and 29 marked the last trading days of Q3, and after 11 weeks of gains, dollar bulls began closing long positions on the DXY index, locking in profits.

As for the Eurozone, inflation has clearly started to wane. Preliminary data indicates that the annual Consumer Price Index (CPI) growth in Germany has slowed from 6.4% to 4.3%, reaching its lowest point since the onset of Russia's military invasion of Ukraine. The overall Eurozone CPI also fell—despite a previous rate of 5.3% and a forecast of 4.8%, it declined to 4.5%.

This reduction in CPI led to a rescheduling of the European Central Bank's (ECB) anticipated dovish policy shift from Q3 2024 to Q2 2024. Moreover, the likelihood of a new interest rate hike has significantly diminished. In theory, this should have weakened the euro. However, concerns over the fate of the dollar proved to be more impactful, and after bouncing off 1.0487, EUR/USD moved upward, reaching a high of 1.0609.

According to analysts at Germany's Commerzbank, some traders were simply very dissatisfied with levels below 1.0500, so neither macro data nor statements from Fed officials could exert any significant influence on this. However, the rebound does not indicate either a trend reversal or the complete end of the dollar rally. Commerzbank analysts believe that since the market has clearly bet on a soft landing for the U.S. economy, the dollar is likely to react particularly harshly to data that does not confirm this viewpoint.

Analysts at MUFG Bank also believe that the 1.0500 zone has finally become a strong level that served as a catalyst for the reversal. However, in the opinion of the bank's economists, the correction is primarily technical in nature and could soon fizzle out.

On Friday, September 29, traders awaited the release of the Personal Consumption Expenditures Index (PCE) in the U.S., which is a key indicator. Year-on-year, it registered at 3.9%, precisely matching forecasts (the previous figure was 4.3%). The market reacted with a minor increase in volatility, after which EUR/USD closed the trading week, month, and quarter at 1.0573. Strategists at Wells Fargo, part of the "big four" U.S. banks, believe that Europe's low metrics compared to the U.S. should exert further downward pressure on the euro. They also believe that the European Central Bank (ECB) has already concluded its current cycle of monetary tightening, as a result of which the pair may drop to the 1.0200 level by early 2024.

Shifting from the medium-term outlook to the near-term, as of the evening of September 29, expert opinions are evenly split into three categories: one-third foresee further dollar strengthening and a decline in EUR/USD; another third expect an upward correction; and the last third take a neutral stance. As for technical analysis, both among trend indicators and oscillators on the D1 chart, the majority, 90%, still favor the U.S. dollar and are coloured red. Only 10% side with the euro. The pair's nearest support levels are around 1.0560, followed by 1.0490-1.0525, 1.0375, 1.0255, 1.0130, and 1.0000. Bulls will encounter resistance in the area of 1.0620-1.0630, then 1.0670-1.0700, followed by 1.0745-1.0770, 1.0800, 1.0865, 1.0895-1.0925, 1.0985, and 1.1045.

Data releases pertaining to the U.S. labour market are anticipated throughout the week spanning from October 3 to October 6. The week will culminate on Friday, October 6, when key indicators, including the unemployment rate and the Non-Farm Payroll (NFP) figures, are set to be disclosed. Earlier in the week, specifically on Monday, October 2, insights into the U.S. manufacturing sector's business activity (PMI) will be unveiled. Federal Reserve Chair Jerome Powell is also scheduled to speak on this day. On Wednesday, October 4, information regarding the business activity in the U.S. services sector as well as Eurozone retail sales will be made public.

GBP/USD: No Drivers for Pound Growth

- According to the latest data published by the UK's National Statistics Office, the country's Gross Domestic Product (GDP) increased by 0.6% year-over-year in Q2, exceeding expectations of 0.4% and up from 0.5% in the previous quarter. While this positive trend is certainly encouraging, the UK's 0.6% growth rate is 3.5 times lower than the comparable figure in the United States, which stands at 2.1%. Therefore, any commentary on which economy is stronger is unnecessary.

Strategists from ING, the largest banking group in the Netherlands, believe that GBP/USD rose in the second half of the past week solely due to a correction in the U.S. dollar. According to them, there are no tangible catalysts related to the United Kingdom that would justify a sustained increase in the British currency at this stage.

Analysts at UOB Group anticipate that GBP/USD could fluctuate within a fairly broad range of 1.2100-1.2380 over the next 1-3 weeks. However, Wells Fargo strategists expect the pair to continue its decline, reaching the 1.1600 zone in early 2024, where it last traded in November 2022. The likelihood of such a move is corroborated by signals from the Bank of England suggesting that the interest rate on the pound may have peaked.

GBP/USD closed the past week at the 1.2202 mark. Analyst opinions on the pair's near-term future are split, offering no clear direction: 40% are bullish on the pair, another 40% are bearish, and the remaining 20% have adopted a neutral stance. Among trend indicators and oscillators on the daily chart (D1), 90% are painted in red, while 10% are in green. Should the pair move downward, it will encounter support levels and zones at 1.2120-1.2145, 1.2085, 1.1960, and 1.1800. Conversely, if the pair rises, it will face resistance at 1.2270, 1.2330, 1.2440-1.2450, 1.2510, 1.2550-1.2575, 1.2600-1.2615, 1.2690-1.2710, 1.2760, and 1.2800-1.2815.

No significant events related to the United Kingdom's economy are anticipated for the upcoming week.

USD/JPY: Awaiting the Breach of 150.00

- "Appropriate measures will be taken against excessive currency movements, not ruling out any options," "We are closely monitoring currency exchange rates." Do these phrases sound familiar? Indeed, they should: these are words from yet another verbal intervention conducted by Japan's Finance Minister Shunichi Suzuki on Friday, September 29. He added that "the government has no specific target level for the Japanese yen that could serve as a trigger for currency intervention."

One can agree with the last statement, especially considering that USD/JPY reached the 149.70 level last week, a height it last achieved in October 2022. Moreover, amid large-scale global bond selloffs, the Bank of Japan (BoJ) took measures to curb the rising yields of 10-year JGBs and announced an unscheduled operation to purchase these bonds on September 29. In such a scenario, if not for the global dollar correction, it's highly likely that this operation could have propelled USD/JPY to break through the 150.00 mark.

As we've already noted above, according to many experts, the dollar's sell-off is most likely related to profit-taking in the final days of the week, month, and quarter. Therefore, this trend may soon dissipate, making the breach of the 150.00 level inevitable.

Could 150.00 be the "magic number" that triggers Japan's financial authorities to commence currency interventions? At the very least, market participants view this level as a potential catalyst for such intervention. This is all the more plausible given the current economic indicators. Industrial production remained unchanged in August compared to July, and core inflation in Japan's capital slowed for the third consecutive month in September. Under these conditions, economists at Mizuho Securities believe that although currency interventions may have limited impact, "the government would lose nothing politically by demonstrating to the Japanese public that it is taking the sharp rise in import prices seriously, caused by the weakening yen.".

The week concluded with USD/JPY trading at the 149.32 mark. A majority of surveyed experts (60%) anticipate a southern correction for the USD/JPY pair, possibly even a sharp yen strengthening due to currency intervention. Meanwhile, 20% predict the pair will confidently continue its northward trajectory, and another 20% have a neutral outlook. On the D1 timeframe, all trend indicators and oscillators are painted in green; however, 10% of the latter are signalling overbought conditions. The nearest support levels are situated at 149.15, followed by 148.45, 147.95-148.05, 146.85-147.25, 145.90-146.10, 145.30, 144.45, 143.75-144.05, 142.20, 140.60-140.75, 138.95-139.05, and 137.25-137.50. The closest resistance stands at 149.70-150.00, followed by 150.40, 151.90 (October 2022 high), and 153.15.

Apart from the release of the Tankan Large Manufacturers Index for Q3 on October 2, no other significant economic data concerning the state of the Japanese economy is scheduled for the upcoming week.

CRYPTOCURRENCIES: Hopes on Halving and Halloween

- In the first half of the week, BTC/USD trended downward, succumbing to the strengthening U.S. dollar. However, it managed to hold within the $26,000 zone, after which the dynamics shifted: The Dollar Index (DXY) began to weaken, giving the bulls an opportunity to push the pair back to the support/resistance area around $27,000.

It's clear that the stringent monetary policy of the Federal Reserve will continue to exert pressure on bitcoin, as well as the broader cryptocurrency market. While the U.S. regulator opted not to raise the refinancing rate at the end of September, it did not rule out such a move in the future. Adding to the market's uncertainty is the SEC's pending decisions on spot bitcoin ETF applications.

Mark Yusko, CEO of Morgan Creek Capital, believes that a favourable decision by the SEC on these applications could trigger an inflow of $300 billion in investments. In such a scenario, both the market capitalization and the coin's value would significantly increase.

However, the key word here is "if." Anthony Scaramucci, the founder of SkyBridge Capital, acknowledged at the Messari Mainnet Conference in New York the existence of "headwinds" for bitcoin in the form of high interest rates set by the Federal Reserve and the hostility of SEC Chairman Gary Gensler. Nevertheless, this investor and former White House official is confident that bitcoin offers greater prospects than gold. If the bitcoin ETF applications are eventually approved, it would lead to widespread adoption of digital assets. Scaramucci believes that the worst is already behind us in the current bear market. "If you have bitcoin, I wouldn't sell it. You've weathered the winter. [...] The next 10-20 years will be incredibly bullish," he stated. According to the financier, the younger generation will mainstream the first cryptocurrency, just as they did with the internet.

Amid uncertainties surrounding the actions of the Federal Reserve and the SEC, the primary hope for the growth of the crypto market lies in the forthcoming halving event scheduled for April 2024. This event is almost certain to occur. However, even here, opinions vary. A number of experts predict a decline in bitcoin's price before the halving.

An analyst known as Rekt Capital compared the current market situation to the BTC price dynamics in 2020 and speculated that the coin's price could fall within a descending triangle, potentially reaching as low as $19,082.

Well-known trader Bluntz, who accurately predicted the extent of bitcoin's fall during the 2018 bear trend, also foresees a continuing downward trajectory. He doubts that the asset has hit its bottom because the descending triangle pattern forming on the chart appears incomplete. Consequently, Bluntz anticipates that bitcoin could depreciate to around $23,800, thereby completing the third corrective wave.

Benjamin Cowen, another renowned analyst, is also bearish in his outlook. He believes that the BTC price could plummet to the $23,000 level. Cowen bases his prediction on historical patterns, which suggest that the price of the flagship cryptocurrency usually experiences a significant slump before a halving event. According to Cowen, past cycles indicate that BTC and other cryptocurrencies do not exhibit strong performance in the period leading up to this crucial event.

In the event of a downturn in digital asset prices, the upcoming halving could spell financial ruin for many miners, some of whom have already succumbed to the competitive pressures of 2021-2022. Currently, miners are operating on thin margins. At present, block rewards constitute 96% of their income, while transaction fees make up just 4%. The halving will cut the block mining rewards in half, and if this occurs without a corresponding increase in the coin's price, it could lead to financial catastrophe for many operators.

Some companies have started to connect their mining farms directly to nuclear power plants, bypassing distribution networks, while others are looking to renewable energy sources. However, not everyone has such options. According to Glassnode, the industry-average cost to mine one bitcoin currently stands at $24,000, although this varies significantly from country to country. CoinGecko data shows the lowest cost of mining in countries like Lebanon ($266), Iran ($532), and Syria ($1,330). In contrast, due to higher electricity costs, the U.S. sees costs soar to $46,280. If bitcoin's price or network fees do not significantly increase by the time of the halving, a wave of bankruptcies is likely.

Is this a bad or good development? Such bankruptcies would lead to a reduction in the mining of new coins, creating a supply deficit, and ultimately driving up their price. As it is, the crypto exchange reserves have already decreased to 2 million BTC, nearing a six-year low. Market participants are opting to hold their reserves in cold storage, anticipating a future surge in prices.

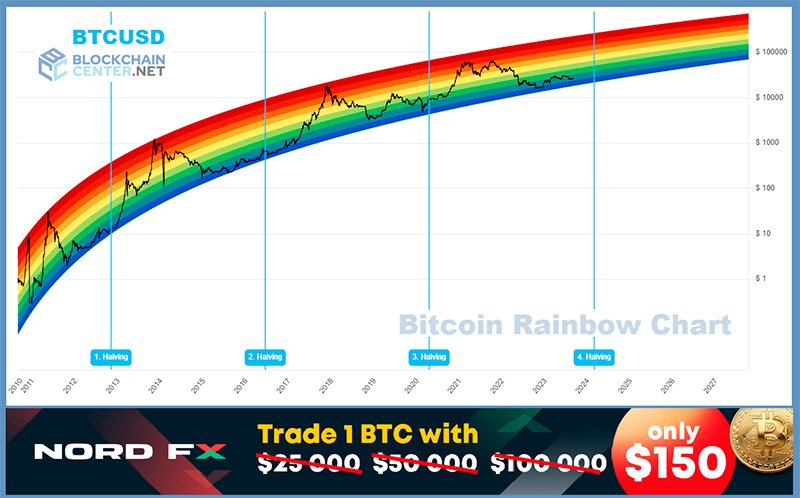

Research firm Fundstrat has speculated that against the backdrop of the halving, BTC prices could surge by more than 500% from current levels, reaching the $180,000 mark. Financial corporation Standard Chartered projects that the price of the flagship cryptocurrency could rise to $50,000 this year and to $120,000 by the end of 2024. The Bitcoin Rainbow Chart by the Blockchain Center also recommends buying; BTC/USD quotes on their chart are currently in the lower zone, suggesting a rebound is due.

According to Michael Saylor, the CEO of MicroStrategy, the inherent supply limitation of bitcoin capped at 21 million coins makes it the best asset for preserving and growing capital. The billionaire compared the depreciation rate of fiat currencies with the dynamics of inflation. He argued that individuals could see their savings erode if held in traditional currencies, citing that over the past 100 years, funds held in U.S. dollars would have lost about 99% of their value.

As of the time of writing this review, on the evening of Friday, September 29, BTC/USD has neither fallen to $19,000 nor risen to $180,000. It is currently trading at $26,850. The overall market capitalization of the cryptocurrency market stands at $1.075 trillion, up from $1.053 trillion a week ago. The Crypto Fear & Greed Index has increased by 5 points, moving from 43 to 48, transitioning from the 'Fear' zone to the 'Neutral' zone.

In conclusion, a forecast for the upcoming month. Experts have once again turned to artificial intelligence, this time to predict the price of the flagship cryptocurrency by Halloween (October 31). AI from CoinCodex posits that by the specified date, bitcoin will increase in price and reach a mark of $29,703.

Interestingly, there is even a term in the crypto market known as "Uptober." The idea is that every October, bitcoin sees significant price gains. Looking at the 2021 figures, bitcoin was trading near $61,300 on October 31, marking an increase of over 344% compared to 2020. This phenomenon remained relevant even in the past year, 2022, following the high-profile crash of the FTX exchange. On October 1, 2022, the asset was trading at $19,300, but by October 31, the coin had reached a mark of $21,000. Let's see what awaits us this time.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back