The world of Forex trading offers various account types to cater to the diverse needs and investment capacities of traders. Among these, the Mini Forex Account stands out as an accessible option for those looking to enter the Forex market with a relatively small investment. This detailed guide aims to explore the concept of Mini Forex Accounts, providing insights into their workings, benefits, and how they can be a strategic choice for novice and experienced traders alike.

Table of Contents:

Understanding Forex Mini Accounts

Pip for the Forex Mini Account

Characteristics of Mini Accounts

Advantages of Mini Forex Accounts

Popular Currency Pairs for Forex Mini Accounts

How to Open a Mini Forex Account: Step-by-Step Guide

Risks That Come with Mini Forex Accounts

Tips for Successful Trading with a Mini Forex Account

What Is a Forex Mini Account?

A Forex Mini Account is a type of trading account that allows individuals to enter the Forex market with a smaller initial investment compared to a standard account. Typically, a Mini Account holder can start trading with as little as $10 or $50, making it an attractive option for beginners or those with limited capital.

Fx Mini Account is a type of trading account designed specifically for individuals new to the Forex market or those with limited investment capital. Unlike standard accounts, which trade in lots of 100,000 units of the base currency, Mini Accounts allow trading in smaller lots of 10,000 units. This reduced lot size significantly lowers the capital required to enter trades, making Forex trading more accessible to a broader audience. With a Mini FX Account, traders can experience the dynamics of the Forex market, including the opportunity to profit from currency fluctuations, with a much smaller initial investment.

The appeal of a Forex Mini Account lies in its ability to offer traders the chance to explore the complexities of Forex trading without the risk associated with larger financial commitments. It serves as an excellent educational tool, providing a practical learning environment where traders can develop and refine their trading strategies, understand risk management principles, and gain familiarity with the trading platform. The lower risk level associated with Mini Accounts makes them an ideal choice for those looking to gradually step into the world of Forex trading, ensuring they can learn and grow their investment skills at a comfortable pace.

Moreover, Fx Mini Accounts come with the advantage of high leverage, which means traders can control a large position with a relatively small amount of capital. This leverage can amplify both profits and losses, making it crucial for Mini Account holders to adopt sound risk management strategies. Despite the smaller scale of trading, Mini Accounts offer access to the same markets and trading instruments as standard accounts, ensuring a comprehensive trading experience. Whether you're a beginner aiming to dip your toes into Forex trading or an experienced trader looking to manage your risks more effectively, a Forex Mini Account offers a versatile and less capital-intensive way to engage with the global currency markets.

Key Features

- Initial Deposit: Lower than standard accounts, often starting from $10 or $50.

- Lot Size: 10,000 units of the base currency, compared to 100,000 units in a standard lot.

- Leverage: High leverage options, making it possible to control large positions.

Understanding Forex Mini Accounts

Mini Forex Accounts are designed to lower the barrier of entry for Forex trading. They provide a platform for traders to learn the ropes of the market, test strategies, and experience the dynamics of currency trading with reduced risk. This accessibility is crucial for newcomers to the Forex market, who may not have large amounts of capital to invest or are hesitant to risk significant sums without first gaining a solid understanding of how trading works. By offering a way to engage with real market conditions at a lower risk, Mini Accounts play a pivotal role in democratizing Forex trading, making it feasible for a wider audience to participate.

Furthermore, these accounts serve as an invaluable educational tool. They allow traders to apply theoretical knowledge in a practical setting, offering firsthand experience with market fluctuations, leverage, and the execution of trades. This hands-on approach to learning helps traders build confidence and develop a deeper understanding of market movements and trading strategies. The reduced financial commitment also means that traders can afford to experiment with different approaches without the fear of substantial losses, fostering an environment of learning and growth. In essence, Mini Forex Accounts not only make Forex trading more accessible but also provide a supportive platform for traders to refine their skills and strategies in a real-world context.

More Features:

- Accessibility

The lower initial deposit requirement makes Forex trading accessible to a broader audience, allowing more individuals to explore the potential of currency markets.

- Risk Management

With smaller lot sizes, traders have better control over their risk exposure. This feature is particularly beneficial for newcomers to the Forex market, enabling them to manage their investments more effectively.

Pip for the Forex Mini Account

A pip, short for "percentage in point," is the smallest price move that a currency exchange rate can make based on market convention. In a Mini Forex Account, the value of a pip is typically smaller than in a standard account, making it easier for traders to manage their risk. This smaller pip value is a key feature that attracts many to the Mini Account, as it allows for more precise control over the amount of money risked on each trade. For beginners and those with limited capital, this control is crucial, enabling them to engage in Forex trading without exposing themselves to the potentially high volatility and risks associated with larger lot sizes.

Moreover, the reduced pip value in Mini Accounts facilitates a better learning environment for traders to experiment with various strategies and understand the impact of market movements on their positions. It allows traders to experience the nuances of Forex trading, including how to react to market news and technical indicators, without the pressure of large financial consequences. This aspect of Mini FX Accounts is invaluable for building trading confidence and competence, providing a practical and manageable platform for traders at all levels to enhance their trading skills and financial literacy in the Forex market.

Calculation

For a Mini Account, a one-pip movement in a currency pair traded in a mini lot translates to a change in value of approximately $1, as opposed to $10 in a standard lot. This calculation is crucial for traders, as it provides a clear and simplified way to gauge the financial impact of market movements on their trades. By understanding that each pip movement represents a smaller monetary value, traders can better manage their risk and set more precise stop-loss and take-profit levels. This granularity in control is particularly beneficial for those new to Forex trading or those looking to experiment with new strategies without significant financial exposure. It underscores the importance of meticulous risk management and strategic planning in the pursuit of successful Forex trading, especially within the framework of a Mini Forex Account.

Characteristics of Mini Accounts

Mini Forex Accounts offer several distinctive features that cater to the needs of a specific segment of Forex traders.

Leverage

One of the most appealing aspects of Mini Accounts is the availability of high leverage. This feature allows traders to control large positions with a relatively small amount of capital, amplifying both potential returns and risks.

Market Access

Despite the lower initial investment, Mini Account holders gain access to the same markets and trading instruments as standard account holders. This inclusivity ensures that all traders, regardless of account size, can participate in global currency markets.

Advantages of Mini Forex Accounts

Mini Forex Accounts come with a host of benefits that make them an attractive option for many traders.

- Lower Financial Commitment: The reduced initial deposit requirement makes it easier for individuals to start trading without committing a large sum of money.

- Risk Management: Smaller lot sizes allow for better control over risk exposure, making it easier to manage potential losses.

- Educational Value: Mini Accounts serve as an excellent learning platform for novice traders, offering real-market experience with lower risk.

- Flexibility: These accounts provide the flexibility to test various trading strategies and learn about market dynamics without significant financial risk.

Popular Currency Pairs for Forex Mini Accounts

Trading in the Forex market involves the simultaneous buying of one currency and selling of another. The choice of currency pairs can significantly impact the success of your trades, especially in a Mini Forex Account where risk management is crucial. Here are some popular currency pairs that traders often consider:

- EUR/USD (Euro/US Dollar): Known for its liquidity and low spreads, making it a favorite among traders of all levels.

- USD/JPY (US Dollar/Japanese Yen): Offers high liquidity with potentially lower risk, suitable for beginners.

- GBP/USD (British Pound/US Dollar): Known for its volatility, which can offer opportunities for profit but comes with increased risk.

- AUD/USD (Australian Dollar/US Dollar): Offers stable trends, suitable for traders looking to experiment with commodity currencies.

How to Open a Mini Forex Account: Step-by-Step Guide

Opening a Mini Forex Account is a straightforward process that can be completed in a few steps. Here's a general guide to get you started:

- Apply Online: Visit Open an Account page and fill out the application form. You'll need to provide a valid phone number and email.

- Verification: Submit the required documents for identity and residence verification. This may include a passport, driver's license, or utility bills.

- Fund Your Account: Once verified, you can deposit funds into your account.

- Start Trading: With your account funded, you're ready to start trading.

Risks That Come with Mini Forex Accounts

While Mini Forex Accounts offer numerous benefits, they are not without risks. Understanding these risks is crucial for effective risk management:

- Market Volatility: Forex markets can be highly volatile, leading to significant price swings that can affect your trades.

- Leverage: While leverage can amplify profits, it also increases the risk of losses. It's essential to use leverage wisely.

- Emotional Trading: The excitement of trading can lead to impulsive decisions. Developing a disciplined trading strategy is key to success.

Tips for Successful Trading with a Mini Forex Account

Success in Forex trading requires strategy, discipline, and continuous learning. Here are some tips to help you navigate the market successfully:

- Start Small: Begin with small trades to understand market dynamics without risking significant capital.

- Use Leverage Cautiously: Leverage is a double-edged sword. Ensure you understand its implications and use it judiciously.

- Educate Yourself: Continuously learn about the Forex market, analysis techniques, and trading strategies.

- Practice Risk Management: Use stop-loss orders and manage your trades to minimize losses.

- Keep Emotions in Check: Develop a trading plan and stick to it, avoiding impulsive decisions based on emotions.

Is a Mini Forex Account Right for You?

Deciding whether a Mini FX Account is suitable for you depends on several factors, including your investment goals, risk tolerance, and trading experience. If you're new to Forex trading or looking to trade with a smaller capital, a Mini Account can be an excellent way to gain experience without significant risk. However, it's essential to understand the risks involved and have a clear trading strategy.

Frequently Asked Questions (FAQs)

What is the difference between a Mini and a Standard Forex Account?

The primary difference lies in the lot size: a Mini Account trades in mini lots (10,000 units of the base currency), whereas a Standard Account trades in standard lots (100,000 units). This affects the capital requirement and risk exposure.

Can I switch from a Mini to a Standard Account?

Yes, most brokers allow you to upgrade your account type as your trading skills improve and your capital increases.

How much money do I need to start a Mini Forex Account?

The minimum deposit varies by broker but can be as low as $10 to $50, making it accessible for beginners.

Is it possible to make significant profits with a Mini Account?

Yes, with the right strategy and risk management, it's possible to make significant profits. However, it's important to have realistic expectations and understand the risks.

How do I manage risk in a Mini Forex Account?

Effective risk management strategies include setting stop-loss orders, only risking a small percentage of your account on a single trade, and diversifying your trades.

NordFX Fix Trading Account

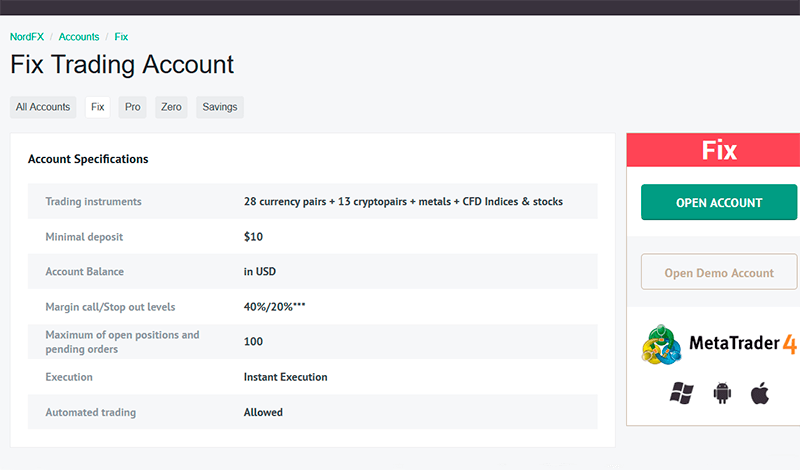

The NordFX Fix Trading Account, often regarded as a Mini Forex Account, stands out for its versatility and accessibility, making it an ideal choice for both novice and experienced traders. This account type offers a comprehensive trading environment with a wide array of instruments, including 28 currency pairs, 13 cryptocurrency pairs, metals, and CFDs on indices and stocks. Here's a closer look at the account specifications and benefits that make the Fix Account a preferred option for traders looking to maximize their trading potential with minimal initial investment.

Account Specifications

- Trading Instruments: The Fix Account provides access to a diverse range of trading instruments, including 28 currency pairs, 13 cryptocurrency pairs, metals, and CFDs on indices and stocks, catering to the varied interests and strategies of traders.

- Minimal Deposit: With a minimal deposit requirement of just $10, the Fix Account is accessible to almost anyone, allowing traders to enter the Forex market without a significant financial burden.

- Account Balance: The account balance is maintained in USD, simplifying the financial management for traders worldwide.

- Margin Call/Stop Out Levels: Set at 40%/20%, these levels ensure traders are alerted in a timely manner to reduce risks and protect their investments.

- Maximum of Open Positions and Pending Orders: Traders can have up to 100 open positions and pending orders, providing ample opportunity for diversification and strategy implementation.

- Execution: The account offers instant execution, ensuring traders can capitalize on market movements swiftly.

- Automated Trading: Allowed on the Fix Account, automated trading is a boon for those utilizing expert advisors and algorithmic strategies.

- Spreads and Leverage: Fixed spreads from 2 pips for currency pairs and floating from 1 pip for crypto pairs, combined with a credit leverage of up to 1:1000, enhance the trading experience by offering the potential for significant profits from small movements in the market.

- Quote Precision: 4 digits for currency pairs, providing clarity and precision in pricing.

- Commission (Fee): No fees for currency pairs, gold, and silver trading, with a minimal commission of 0.06% for cryptocurrency pairs, making trading cost-effective.

- Lot Size: The minimal lot size of 0.01 and a maximum of 50 with a step of 0.01, offers flexibility in trade size and risk management.

Advantages of the Fix Account

The NordFX Fix Account is tailored to facilitate stable trading, including the use of expert advisors. Its structure is conducive to learning the basics of trading in the foreign exchange market for newcomers, as well as for seasoned traders fine-tuning their strategies. Trading on the MetaTrader 4 (MT4) platform, NordFX clients are equipped with extensive tools for market analysis, decision-making, and executing various order types.

A significant advantage of the Fix Account is the minimal deposit of only $10, coupled with a leverage of up to 1:1000. This combination allows traders to engage in transactions up to $10,000, offering the potential for considerable profits while managing trade risks effectively. For beginners, starting with transactions of the minimum volume of 0.01 lots (or $1,000) requires just $1 in margin, providing a safe entry point into Forex trading.

Moreover, the Fix Account's fixed spreads on popular currency pairs and the availability of trading in cryptocurrencies with minimal investment make it an attractive option for traders of all financial backgrounds. The MT4 platform's capability to open up to 100 positions simultaneously and its array of indicators and technical analysis tools further enhance the trading experience, allowing for the implementation of a wide variety of trading strategies.

Key Takeaways

- Mini Forex Accounts allow traders to participate in the Forex market with a smaller initial investment.

- They offer a high level of leverage, enabling traders to control larger positions with a relatively small amount of capital.

- Mini accounts are an excellent way for novice traders to gain experience in the Forex market without taking on significant financial risk.

To further explore the world of Mini Forex Accounts, consider watching this informative video: How to Grow Small Trading Accounts FAST in 2024.

Additionally, for those looking to delve deeper into Forex trading and Mini Accounts, the following resources from NordFX offer valuable insights:

- Forex Micro and Mini Accounts - An introduction to Micro and Mini Accounts in Forex.

- Learning Center - A resource for new traders to get started with Forex trading.

- Market Analysis and News - Stay updated with the latest market trends and analysis to inform your trading decisions.

Incorporating these insights and strategies into your trading can significantly enhance your Forex trading journey, especially when starting with a Mini Forex Account. Remember, success in Forex trading comes with experience, discipline, and continuous learning. As you gain more confidence and expertise, you can explore more complex strategies and potentially increase your trading capital.