First, a review of last week’s forecast:

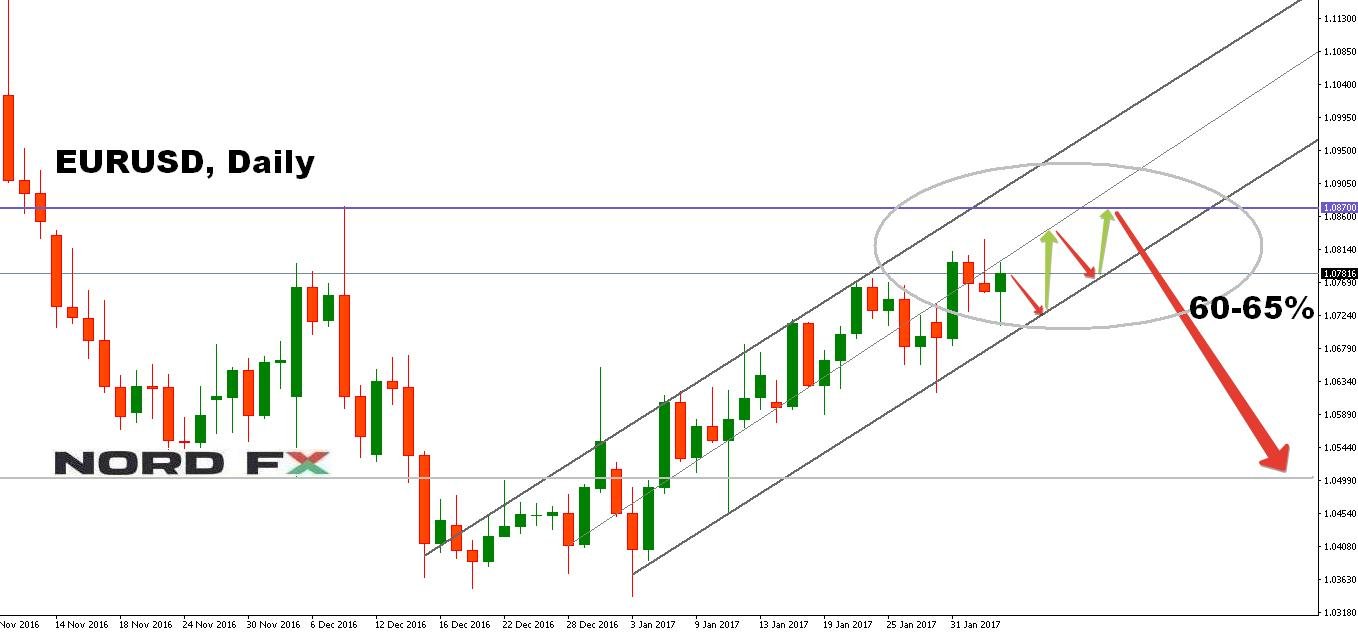

- Despite the fact that the past week was filled with important economic events, it failed to deliver any big surprises. The uptrend of the pair EUR/USD, the start of which was precisely on New Year's night 2017 (clearly visible on D1) was continued. Most experts expected the pair to decline to the rising channel's lower border in the area of 1.0600 and possibly to break through it. However, having descended to 1.0620, the pair could not penetrate the support and went up, ending the week where analysis on H4 predicted: precisely at the intersection of the centre line of the ascending channel and the strong resistance level of 1.0780;

- With regard to the forecast for GBP/USD, most analysts and indicators on H4 expected it to fall to the support 1.2415. It was already Tuesday when the pair recorded a local minimum at 1.2412. Afterwards, it turned northwards. However, by Thursday the trend had changed again and, following the Bank of England announcements, the pair fell down, losing 250 points in one and a half days;

- Recall that experts' opinions on the future of USD/JPY were almost evenly divided: 30% of them expected its growth, 40% expected it to fall and 30% took a neutral position. However, the relatively larger collective weight of the bears (by just 10%), apparently tipped the pair over, and the pair rushed downwards right from the beginning of the weekly session, easily breaking through the 113.95 Pivot Point of the side channel which was launched in mid-January, and ended the week at its lower border in the area of 112.50;

- The forecast for the USD/CHF pair came true with an accuracy close to 100%. The vast majority of experts, supported by indicators, expected it to fall to the 0.9900 zone. At the same time graphical analysis warned that a correction might follow before the down trend continued, and the pair would rise to the 1.0085 area. That is what happened: on Monday, the pair reached the upper border of the descending channel (1.0045), and then went to the south, ending the week at the level of 0.9920.

Forecast for the coming week:

Summarizing the views of a number of analysts from leading banks and brokerage firms, as well as the forecasts made on the basis of a wide variety of technical and graphical analysis methods, we can say the following:

- Speaking about the future of EUR/USD, the vast majority (65%) of experts believe that the target of the medium-term uptrend has not been reached yet, and the pair should rise to at least 1.0850-1.0870. Trend indicators and oscillators on D1 agree with this. As for the indicators on H4, they have taken a neutral stance, and the graphical analysis on H4 specifies the boundaries of the side corridor: 1.0700-1.0820. It should be noted that, giving the forecast for the next month, 60% of experts and graphical analysis on D1 believe that the pair will not be able to avoid falling to the level of 1.0500;

- Speaking about the future of GBP/USD, 55% of analysts, with the support of indicators and graphical analysis on H4, expect the sideways trend of the last two weeks to continue. According to this forecast, the bears will possess a certain degree of superiority, the main support will be at 1.2415, and the Pivot Point will be at 1.2542. It is within these limits that the pair should move inside in the coming days. As for the medium-term forecast, 60% of analysts and graphical analysis on D1 side with the bears, waiting for the fall of the pair to the 1.2100-1.2200 zone;

- The opinion of indicators both on H4 and on D1 unequivocally sides with the growth of the USD/JPY pair. But there is no such unity among analysts - only half of them agree with the indicators regarding the coming week. However, in the medium term, the number of growth supporters increases to 75%. The graphical analysis sides with the latter, according to its readings the local minimum for the pair is in the zone 112.07-112.50 and after reaching it, the pair should set out to conquer the peaks of the North. The resistance levels are at 116.70 and at 118.70;

- As for the last pair of our review, USD/CHF, 65% of the experts and graphical analysis on H4 are confident that having rebounded from the support in the 0.9870-0.9900 area, the pair should rise and return to the symbolic mark around 1.0000. An alternative point of view is represented by the remaining 35% of experts and graphical analysis on D1. In their view, the pair may fall even further downwards and enter a period of lateral movement in the 0.9750-0.9870 corridor. The next support is 0.9670.

Roman Butko, NordFX

Go Back Go Back