First, a review of last week’s forecast:

- When giving the forecast for EUR/USD, 35% of experts and indicators on D1 insisted that it should return to the highs of February and March 2017. This is what happened in response to the first round of the French presidential elections. Having established an impressive gap at the opening of the weekly session, the pair rose to 1.0900, where it spent the whole week, turning this level into a Power Point;

- after an inspiring leap upwards on 18 March, GBP/USD reacted calmly to the elections in France: there were no gaps and, instead, there was a smooth increase by 180 points during the week. The roots of this growth are at the support at 1.2775, which used to be the upper limit of six-month long side channel;

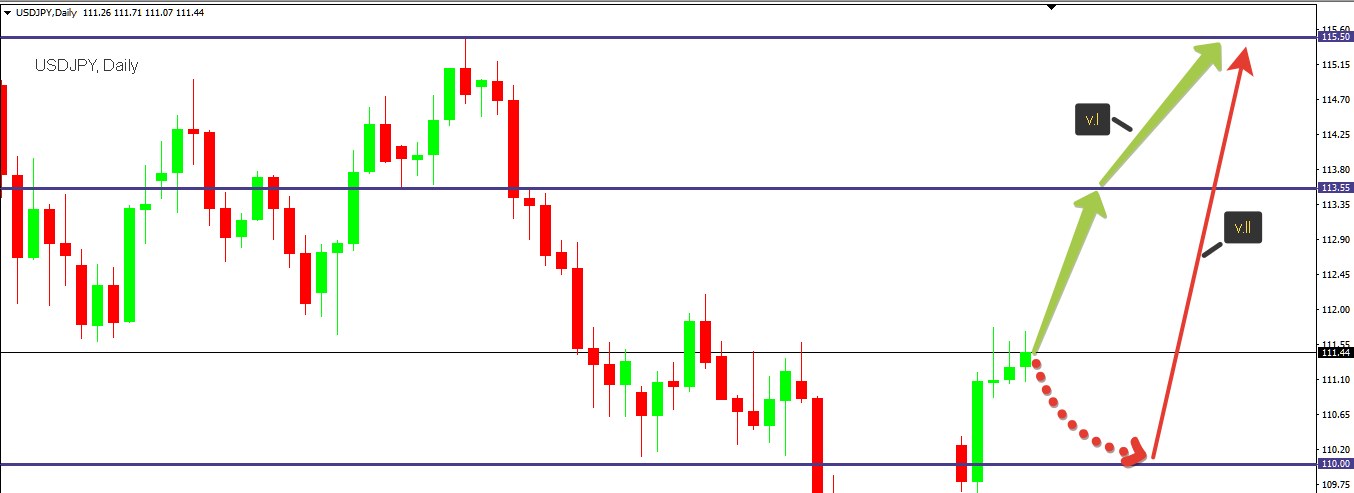

- The French elections tsunami has reached the Japanese islands and has swept USD/JPY towards a strong medium-term support / resistance level around 111.60. It should be noted that analysts have long expected the growth of the pair to 112.00, to which it came very close: it checked out on Wednesday at the height of 111.77;

- The gap at the beginning of the week gave additional strength to the bears. Hence, the pair USD/CHF continued its downward trend, which began on April 10. The pair fell by almost 100 points, reaching the local bottom at 0.9893, and then it turned and finished the week at the level of 0.9950.

Forecast for the coming week:

Summarizing the views of a number of analysts from leading banks and brokerage firms, as well as the forecasts made based on a wide variety of technical and graphical analysis methods, we can say the following:

- Regarding the indicators, in predicting the future of the EUR/USD, more than 80% of them are oriented northwards, pointing to 1.1120 as the target height. However, one third of oscillators on D1 have already indicated that the pair is overbought. Expert opinions regarding its nearest future are almost equally divided: 35% foresee the growth of the pair, 30% anticipate its fall and 35% predict a sideways trend. But in the medium term, the picture is quite different: here, 80% of experts vote for the fall of the pair to an initial support 1.0680 and a subsequent one of 1.0570;

- GBP/USD. It is for the second week running that the pair moves in the corridor that separates the two side channels: the upper one of July-October 2016, and lower one of October 2016 - April 2017. 65% of the experts believe that the pair will be unable to overcome the resistance of 1.3055 and will return to the channel’s lower boundary as early as in the first half of May. Support levels are 1.2570, 1.2375 and 1.2130. An alternative point of view is supported by 35% of analysts who predict that the immediate goals for the pair are 1.3370 and 1.3445. As for the graphical analysis, on H4 it points to a sideways trend in the range of 1.2775-1.3055;

- USD/JPY. Finally, analysts' opinions are aligned with the indicator readings, and more than 80% of them predict a continuation of the upward trend for this pair. The main goals are 113.55 and 115.50. This does not exclude a short-term slide of the pair to the 110.00 horizon;

- as often happens, the future of USD/CHF represents a mirror image of the EUR/USD. And if, in the short term, 75% of experts speak about the continuation of the downward trend, when giving a medium-term forecast 70% of them see growth. There are support levels at 0.9920, 0.9890 and 0.9820. The target heights are 1.0000 and 1.0100. As for graphical analysis, on H4 it points to the growth of the pair to 1.0040 in the coming days.

Roman Butko, NordFX

Go Back Go Back