First, a review of last week’s forecast:

- Recall that the experts' forecasts regarding the behaviour of EUR/USD in the short and medium term were fully opposed. Thus, in the first case, most of them favoured the growth of the pair, whilst in the second they favoured its fall. And, as it often happens, the medium-term forecast turned out to be the most accurate: until Thursday, the pair moved in a downtrend, losing more than 180 points over this period. However, on Friday, data on retail sales in the US was released, which played into the hands of bulls: instead of the expected 0.6%, consumer spending growth was only 0.4%: as a result, the pair drastically launched northwards and froze near the strong medium-term resistance line at 1.0932;

- A similar discrepancy among analysts was observed with respect to the future of GBP/USD. Apart from that, it was projected that the nearest support was at the level of 1.2835, and the resistance was 1.3100. However, just like two weeks ago, the pair ended up behaving more calmly than expected; it stayed within 1.2843-1.2986;

- For almost two months we have been stating in each of our forecasts for USD/JPY that experts are expecting its return first to 113.55, and then to 115.00. The pair has finally conquered the first of these heights and came close to the second one, reaching 114.36 just this week. After this victory, the strength of the bulls dried up, and the pair retreated downwards by 100 points, finishing the week at 113.35;

- An absolute majority (70%) of analysts expected the pair USD/CHF to return to the 1.0000-1.0100 zone. This forecast turned out to be 100% true: the maximum of this week ended up being 1.0098, and the pair met the end of the week’s session at 1.0007.

Forecast for the coming week:

Summarizing the views of a number of analysts from leading banks and brokerage firms, as well as the forecasts made on the basis of a wide variety of technical and graphical analysis methods, we can say the following:

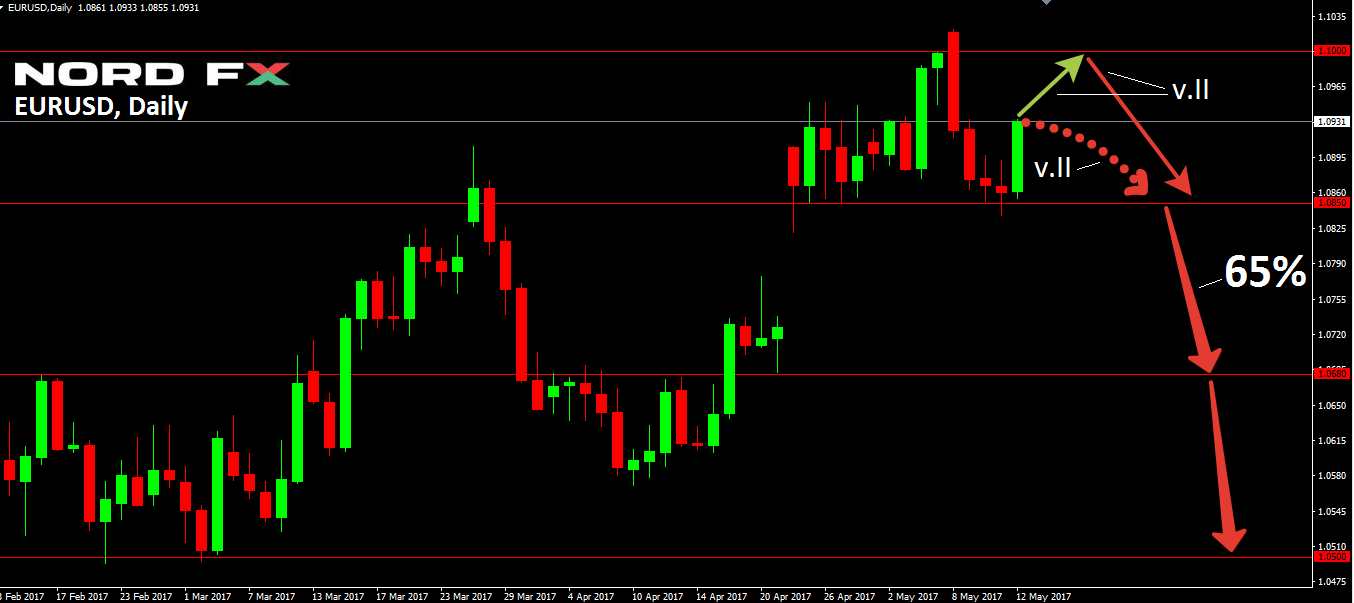

- EUR/USD. The calendar for the upcoming week is not marked by any special economic or political events. This might be the reason why more than 50% of analysts, supported by almost half of the oscillators at D1, predict a lateral movement of this pair. The second fairly large group of experts (about 40%) believes that the pair will again test the height of 1.1000. 10% of experts still believe, though, that the pair will immediately head to the south. Interestingly, their point of view is supported by graphical analysis and almost half of the oscillators on H4, which indicate that this pair is overbought. Moreover, in the medium term, 65% of analysts expect it to fall. The nearest support is 1.0850, the medium-term goal is to return to the 1.0500-1.0680 zone;

- As for the future of GBP/USD, here the trend indicators on D1 insist on the continuation of the sluggish-upward trend, which began in the last decade of April. 30% of experts agree with this point of view, believing that the pair must necessarily break the 1.3000 barrier. An alternative point of view is represented by 70% of analysts, 60% of trend indicators and 90% of oscillators on H4. All of them insist it is best to start selling this pair and suggest the nearest support is 1.2755. If we look at the medium-term forecast, the number of bear supporters among the analysts already exceeds 80%; 1.2100 is declared the main target.

- USD/JPY. After this pair’s impressive spurt upwards in the first half of last week and a sufficiently strong retracement in the second, the indicator readings turned out to be diametrically opposite: on D1, they recommend buying the pair, whilst on H4 they recommend selling. Analysts cannot come to any consensus either: one third of them predict the fall of the pair, another third its growth, and the remaining third foresee a sideways trend. At the same time, about 60% of experts believe that, leaning against the support in the 111.60-111.79 zone, the pair still should try to conquer the height of 115.50 in the next few weeks;

- The last pair of our review, as usual, is USD/CHF. Just like its chart for the past week ended up being similar to the USD/JPY chart, so are the forecasts of the indicators regarding its future: D1 advises to buy and H4 advises selling. As for the experts and graphical analysis, in their opinion, the pair will first have to drop to the 0.9940-0.9960 zone, then claw its way back to 0.9990, before finally returning to the 1.0050-1.0100 area once again.

Roman Butko, NordFX

Go Back Go Back