To begin with, a few words about the forecast for the previous week, which ended up being almost 100% correct for EUR/USD, GBP/USD and USD/JPY.

- Recall that the overwhelming majority (70%) of experts and almost 100% of indicators voted for the growth of the EUR/USD. 1.1500 was named the main target. As for the remaining analysts, they thought lateral movement would dominate last week.

The pair worked on both scenarios. First, as predicted, leaning on the support of 1.1380, it rushed up and reached the height of 1.1490 on Wednesday. Then it rolled back to the support zone, turned around and rushed up again, finishing the five-day period in the zone of 1.1470; - As for GBP/USD, the odds here, as in the case of the EUR/USD, were on the bulls' side. 65% of analysts, graphical analysis, as well as most indicators on D1, had voted for the movement of the pair to the north. In their opinion, the pair was supposed first to rise to the resistance at 1.3050, and then to the height of 1.3100, which was recorded at the very end of the weekly trading session;

- USD/JPY. The pair has been striving north for more than a month, trying to reach the May high at 1.1435. Most experts believed that last week it would manage to do it. At the same time, a third of the indicators signaled that the bulls' strength had already dried up, and this gave grounds to talk about an imminent fall of the pair.

That's exactly what happened: having hardly reached 1.1450, the pair immediately turned and sharply collapsed, groping the local bottom at 112.25 on Friday; - The most accurate forecast for USD/CHF was given by graphical analysis, which was drawing a back-and-forth movement in the side channel for the second week in a row. However, the range of oscillations of the pair turned out to be narrower than expected (0.9520-0.9735), and it stayed within 0.9600-0.9700.

As for the forecast for the coming week, summarizing the opinions of analysts from a number of banks and brokerages, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

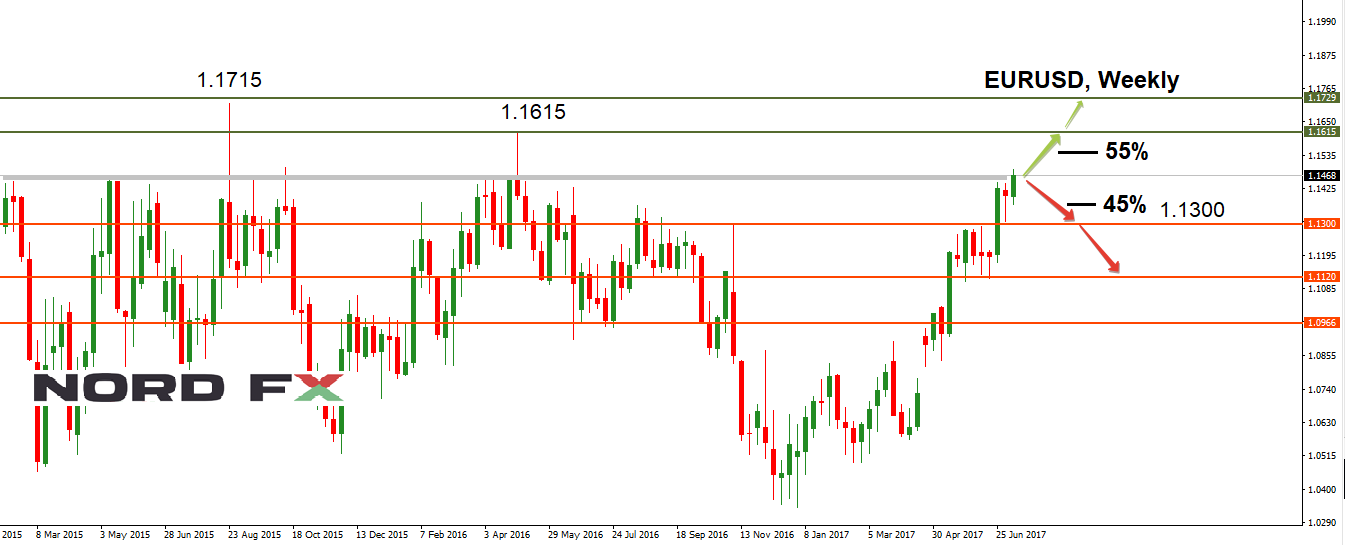

- EUR/USD. Almost 100% of indicators believe that the upward trend of the pair will continue. And as for the experts, only 55% of them are bullish. This is because the pair has reached the upper boundary of its long-term lateral channel, where it has been moving since January 2015. The W1 chart clearly shows that if the pair breaks through the 1.1500 level, its next target will be the 2016 high: 1.1615.

An alternative scenario involves the pair being pulled downwards. In this case, 1.1380 and 1.1300 will be support levels. 45% of analysts and graphical analysis on D1 agree with this version.

In the coming week, we expect the publication of data on euro area consumer market on Monday, July 17 and the ECB's decision on the interest rate on Thursday, July 20. However, these events will likely not have a strong impact on the EUR/USD exchange rate.

As for the medium-term outlook, it remains negative, and 75% of analysts expect the pair to fall to 1.1100-1.1200 during the summer;

- GBP/USD. Graphical analysis on H4, 100% of trend indicators, 2/3 oscillators and only 1/3 of analysts believe that the pair still has enough strength to rise to 1.3150 or even 1.3200. On the other hand, an overwhelming majority of experts, supported by one third of oscillators, are confident that the upward impulse of the pair has dried up: judging by this view, the pair can now be expected to decline first to 1.3000, and then 175-200 points lower. After that, according to the readings of graphical analysis on D1, the pair will move in the lateral channel 1.2800-1.3025 for a month;

- If, speaking of the future of USD/JPY, most of the indicators on H4 look to the south, their eyes turn westwards on D1. In other words, they have taken a neutral position. But almost 70% of experts are sure that the pair will try to re-test the level of 114.50 and, in case of its breakthrough, will rush to this February high at the height of 115.50.

As for the small number of supporters of the pair's decline, they think it can drop to the zone of 110.50-111.00.

The decision of the Bank of Japan on interest rates, which will be published on July 20, is unlikely to surprise the financial markets, and they are likely to react to it quite calmly; - and the last pair of our review is USD/CHF. In this case, indicators do not provide any clear forecast. However, most analysts (85%) still expect the pair to fall at least to the zone of 0.9500-0.9550.

A slightly different scenario is offered by graphical analysis on D1: an initial growth of the pair to the resistance of 0.9700-0.9725, and only then its fall into the designated zone.

Roman Butko, NordFX

Go Back Go Back