First, a review of last week’s forecast:

- Medium-term forecasts often come true much faster than expected. 65% analysts had expected that EUR/USD would test the midpoint of the 1.1575-1.2090 side channel - along which it has been moving for several months - in the medium term. However, it was just last week that the pair once again returned to the August values, completely defying the bulls' short-term expectations;

- A similar situation developed for GBP/USD. 70% of experts had expected its growth in the short term, and 70% of experts expected its fall in the medium term. It was also noted that the bears’ desire to return the pair to the boundaries of the 1.3050-1.3325 side corridor was strong enough and they would act on it at the first opportunity. This is what happened: on Thursday, 7 December, the pair fell to 1.3318, and finished the week’s session at 1.3380;

- USD/JPY. It was unfeasible to give any forecast for this pair with the help of indicators, using either H4 or D1: some of them were painted green, some red, and some neutral gray. As for the experts, the bulls had a slight advantage (60% versus 40%): according to them the pair was supposed to once again rise to the level of 113.30-114.00. This was confirmed by graphical analysis on H4. However, on D1, the pair seemed posed to once again test the Pivot Point of the medium-term side channel 108.00-114.50 in the 111.70 vicinity.

If you look at the graph, it becomes obvious that both these forecasts turned out to be correct. The pair dropped to 111.98 by the middle of the week and then made a u-turn, rushing to where the bulls were expecting it; by the end of the five-day period it reached the height of 113.58; - USD/CHF. 45% experts had claimed that once it reached a strong support/resistance level of 0.9760, the pair would rebound first to the resistance at 0.9845, followed by another 100 points up. This scenario had been confirmed by the oscillators as well, which had indicated it was oversold. The forecast turned out to be 100% true, with the pair having steadily moved north during the entire week, fixing a maximum at 0.9975. Then it experienced a rebound of 50 points, and it froze at 0.9925.

As for the forecast for the coming week, summarizing the opinions of analysts from a number of banks and brokerages, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- As the Christmas holidays and the year’s end approach, we should expect the usual decline in financial activity. However, as trading becomes "thinner", it becomes possible for even minor speculators to influence rates.

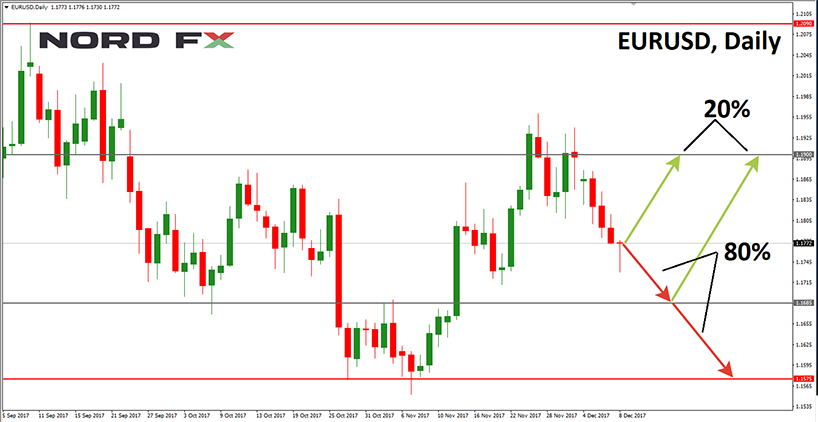

Regarding EUR/USD, the bears have a serious advantage (80% vs. 20%): they expect the pair to continue falling to the lower boundary of the medium-term side channel 1.1575-1.2090. At the same time. it is possible that in the coming days the pair will move in a much narrower range - 1.1685-1.1900.

Graphical analysis and about 70% indicators also agree with this forecast. As for the bulls' supporters, they are corroborated by the roughly third of oscillators which indicate the pair is oversold. However, in this scenario the pair should not rise above the zone 1.1850-1.1900;

- The readings of the indicators regarding the future of GBP/USD on H4 and D1 are diametrically opposed. On H4, most of them point to the south, and on D1, they look to the north. A similar situation occurs with graphical analysis. Experts, however, are dominated by bearish sentiments: 65% of them have voted for the fall of the pair. The nearest support is in the 1.3300 zone, with the next one being in the 1.3125-1.3200 area. The main resistance is located at 1.3550;

- USD/JPY. Here, just as last week, most experts (75%) are voting for the continued growth of the pair. The targets are 114.00, 114.45 and 114.75. This forecast is supported by almost all indicators and graphical analysis. On the other hand, 25% of oscillators on H4 signal the pair is overbought, which may cause it to fall to 112.00-113.00;

- USD/CHF. 90% experts, graphical analysis on D1 and 90% indicators on H4 and D1 believe that the pair will continue its growth to 1.0100. The nearest resistance is at the parity level of 1.0000.

A mere 10% of analysts and 10% of oscillators adhere to the opposite viewpoint, thinking that the pair is overbought: they expect a decline to support 0.9880. The next support is at the level of 0.9845.

Roman Butko, NordFX

Attention: grab an unprecedented opportunity!

NordFX offers you a unique opportunity to trade cryptocurrencies (Bitcoin, Litecoin and Ethereum) with a leverage 1: 1000!