First, a review of last week’s forecast:

- EUR/USD. Billionaire George Soros is confident that further strengthening of the dollar will lead to a new financial crisis. At the same time, 10 out of 60 analysts interviewed by Reuters believe that the growth of the US currency will be completed within a month, 35 are confident that the strengthening of the dollar will last at least until the fall, and another 15 give the USD growth until the end of the year. Experts from ABN Amro are among the latter, they believe that the euro should fall to the level of 1.1000, and only then, in 2019, it will be able to restore some of the lost ground.

Interestingly, the decision of the US Federal Reserve to raise the interest rate to 2%, which was announced last week, did not surprise anyone. The information that this year should expect two more similar increases, and three in the future did not cause a stir either. The euro quickly recovered and, moreover, demonstrated growth against the background of these events to the level of 1.1850.

But the ECB's decision to extend the quantitative easing (QE) regime instantly dropped the euro against the dollar by more than 300 points. Our experts had named the level 1.1570 as the main support zone, to which the EUR/USD did rush. Due to the unusually powerful bearish impulse, by inertia, it even dropped 30 points lower, however, after coming to its senses, it soon turned around and completed the trading session at 1.1610; - 65% of analysts expected further correction of the GBP/USD to the level of 1.3615, after which it had to resume its movement to the south. However, the pair could not rise even above the level of 1.3445 and rushed down again, trying, as on May 29, to break through support in the zone of 1.3200. And, just like in May, the attempt failed, after which the pair returned to zone 1.3280;

- USD/JPY. 50% of analysts supported the growth of this pair, referring to the horizons as 110.25 and 111.40 as resistance, between which, at 110.60, it completed the five-day period;

- Cryptocurrencies. In recent days, following their leader bitcoin, almost all of them have broken through important support levels and moved further south, testing new horizons. Thus, BTC managed to break through supports of $7,125 and $7,000 and reached a weekly low of $6,110 on June 14, then it managed to win back about 7% and rise to $6,575. Similar dynamics were demonstrated by the remaining virtual currencies included in the TOP-10 market capitalization.

Since the beginning of the year, the crypto market capitalization has decreased by 44.3% (from $611 billion to $340 billion). Just over the night of 10 to 11 June, the market shrank by another $25 billion. Many traders and analysts tried to explain this collapse by the Coinrail exchange in South Korea being hacked, but in reality, it lost only $40 million, so the theft was most likely just an excuse for another lowering the price of crypto-coins.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- In addition to the extension of the QE program mentioned above, the ECB's decision to leave the benchmark interest rate at a record low of 0%, and the deposit rate at -0.4%, also exerts strong pressure on the euro. It was also stated that these rates will not be raised "at least until the summer of 2019". At the same time, Mario Draghi admitted that the economy of the Eurozone in 2018 will not return to the forecasted level of growth.

All this, coupled with the success of President Donald Trump's economic policy, creates significant prerequisites for the further strengthening of the dollar. That's why 65% of experts expect that in the coming week the EUR/USD will test the level of 1.1500 and, if successful, could drop another 100 points lower. 90% of the oscillators on H4 and D1 also agree with this development.

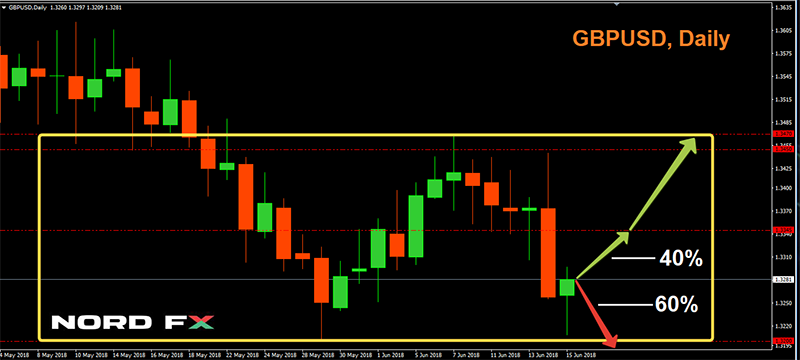

As for the remaining 35% of experts, in their opinion, the pair still has chances to return to zone 1.1825, but the likelihood of such a development will depend on what the ECB Head Mario Draghi and the Fed, J. Powell, will say in their statements earlier this week; - it is clearly visible on the GBP / USD chart that the pair moves in the lateral channel 1.3200-1.3470.for the fourth week in a row. At the same time, 60% of analysts believe that, following the euro, the British pound will also continue its decline. In their view, the pair GBP/USD may as well break through the lower boundary of this channel and move to the level of 1.3050-1.3200. This scenario is supported by graphical analysis on D1 and the absolute majority of indicators.

An alternative point of view, represented by 40% of experts, suggests the movement of the pair in the side corridor 1.3200-1.3345. The next resistance is in the zone is 1.3400.

On Thursday, June 21, the next meeting of the Bank of England should take place. However, with a high probability, it will not present any surprises, so it is not worth it to expect serious exchange rate jumps at this moment;

- a day earlier than their British counterparts, the Committee on Monetary Policy of the Bank of Japan will hold a meeting. As for the experts, two-thirds of them cautiously support the small growth of the pair USD JPY to the area of 111.00-111.50. The next resistance is 112.00.

This time, a third of analysts, graphic analysis on H4 and D1, as well as 20% of oscillators, side with the bears, signalling the pair is overbought. In case their scenario turns out to be correct, the pair is expected to decline first to support 109.40, and then, possibly, further - to levels 109.00 and 108.50; - Most of the forecasts for basic cryptocurrencies can be reduced to just two sentences: 1) in the near future they will continue to fall, and 2) they should grow in the long term. For example, according to the forecast of Fundstrat Global Advisors analysts, the bitcoin can fall to the level of $ 3,250. However, even this, in their opinion, "will not break the long-term ascending trend of the first cryptocurrency".

The closest target for BTCUSD, according to the founder of Onchain Capital Ran Neuner, is the level of $5,900. The optimistic part of his forecast is that "if the price of the bitcoin reaches 20, 40 or 80 thousand dollars within a few years, then no one will be worried about whether it was bought for $6,000 or $6,500. Only traders working on a scale of less than a year should be concerned about the current drop in the market price. "The only thing that the expert didn't specify is when this long-awaited take-off to 80,000 takes place.

Roman Butko, NordFX

Go Back Go Back