First, a review of last week’s forecast:

- EUR/USD. The forecast for this pair turned out to be absolutely correct. Recall that it assumed first a small growth of the pair to the resistance of 1.1800 (in reality, it rose to the height of 1.1790), and then a fall (it fell to the level of 1.1620). After that, a rebound followed, and the pair completed the trading session in a strong support/resistance zone 1.1685;

- GBP/USD. Despite the fact that the volatility was somewhat less than expected, the main trends for this pair were fairly accurately pointed by the graphical analysis on H4 and D1. According to its scenario, the pair was expected to grow to the 1.3400 zone (it rose to 1.3360), and then a sharp drop to the horizon of 1.3000 was expected (it fell to the level of 1.3100).

As expected, another blow to the pound was caused by the government of Great Britain. Last week, key Brexit ministers resigned - Foreign Minister Boris Johnson and Secretary for Brexit David Davis, which put an extra pressure on the pound; - USD/JPY. Despite the trade war between the US and China and the growing demand for the yen as a safe haven, the super soft monetary policy of the Bank of Japan still plays against the currency of this island nation. The main blow to the yen was caused by the rapid growth of Asian stocks and, accordingly, the indices Nikkei and MSCI Asia Pacific. As a result, it fell against all G-10 currencies and lost more than 240 points against the US dollar.

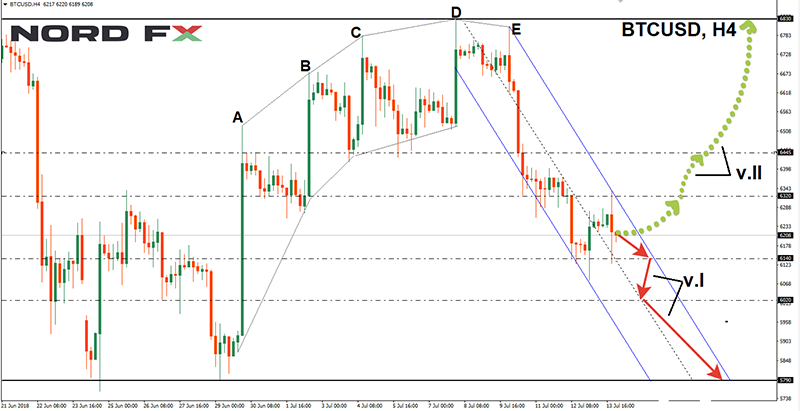

At the end of the five-day period, the traditional correction followed, and the pair froze at 112.35; - Cryptocurrencies. We warned that in the event of any negative news, the ascending trend of bitcoin could very quickly turn from bullish into bearish, leading the pair to June lows. It was said multiple times that in fact all this news is only a virtual excuse, using which large speculators start moving virtual currencies up or down. How, for example, could the theft from the Swiss platform Bancor "some" $23.5 million ($13.5 million according to other sources) affect the sinking of the whole market? No way it could, but as a result, bitcoin collapsed by almost 11%, dragging along all the main altcoins as well.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. Oscillators on both H4 and D1 are in complete disarray as to the future of this pair - about a third of them are green, one third are red and one third are neutral gray. As for analysts, 80% of them, supported by graphical analysis on D1, believe that the pair will continue its movement to the horizon 1.1500. Nearest supports are at the levels of 1.1625, 1.1590 and 1.1550.

The upcoming meeting of the presidents of the United States and Russia on Monday, July 16 may strengthen the dollar. Experts do not expect any significant breakthrough from this meeting, but if both leaders express certain optimism on its results, this can play into the hands of the American currency.

An alternative point of view is represented by only 20% of analysts. In their opinion, the pair can once again test the level of 1.1790 and, if successful, rise to resistance 1.1830; - GBP / USD. The resignation of the two main Brexit negotiators means that British Prime Minister Teresa May chose a soft option for her country to leave the EU. And if she keeps her post, this can strengthen the position of the pound in the future. However, right now the market is negative and most analysts (70%) predict the continuation of the fall of the pair GBP/USD first to the level of 1.3100, and then another 50 points lower.

10% of oscillators agree with this forecast, indicating that the pair is overbought, as well as graphical analysis on D1. At the same time, the latter points out that the pair can move in the side corridor in the range 1.3 190-1.3285 for a while; - Also, 70% of experts expect strengthening of the dollar to the Japanese yen as well. In their opinion, the pair USD/JPY will seek to reach the highs of last December in the zone of 113.50. The next goal for it is the last November high. - 114.75.

The graphical analysis on H4 also agrees with this development of events. But on D1, it draws an opposite picture - the fall into the zone 110.25-111.15, and then even lower - to support 109.35.

It should be noted that even now a number of analysts are calling for being very cautious with the dollar, as this currency, according to their forecasts, has already approached the overbought state; - Cryptocurrencies. We listed the factors that could positively affect the growth of the pair BTC / USD, in the previous forecast. Now, a couple of words about the negative side.

In fact, it was quite simple to predict the drop of bitcoin last week - it is enough to connect the points A, B, C and D on the chart to see the attenuation of the rising trend. Now the capitalization of the market is again near the 2018 lows and is about $240 billion. If such drying continues, according to some experts, the process can acquire the character of a collapse. As a result, the bitcoin will be around $3000, and the total market capitalization will not exceed half of the current market capitalization.

Meanwhile, the pair BTC/USD is trading roughly midway between the June lows ($5,790) and the July highs ($6,830) and, if nothing extraordinary happens, it will likely stay in this corridor for a few more weeks.

Roman Butko, NordFX

Go Back Go Back