First, a review of last week’s events:

- EUR/USD. President Trump is plannng to be re-elected for a second term thanks to the strong growth of American GDP. Major US indices continue to storm historical highs. Futures on the S&P500 rose above 3100. The wave of purchases in the markets was spurred by the optimistic statement of the White House economic adviser Larry Kudlow about the imminent conclusion of a trade deal with China. At the same time, the Financial Times reports that, in fact, the White House is not happy that China is stalling and not offering significant concessions in response to the abolition of tariffs. And Trump himself does not want to cancel them completely.

Speaking in Congress, the Fed Chairman Jerome Powellpraises the US economy, calling it a "star", but at the same time, citing many factors, including inflation and trade wars, does not rule out another interest rate cut. As a result, his words, together with the encouraging GDP of Germany, stopped the downward trend of the EUR/USD pair at the support of 1.0990 and pushed the European currency up, allowing it to finish the week with a small plus of 35 points; - GBP/USD. The UK is preparing for early parliamentary elections. Therefore, there is no special news directly related to Brexit. And in this situation, the market begins to react actively to macroeconomic indicators. Thus, data on UK GDP in the 3rd quarter became known on Monday, November 11. As we predicted, the GDP growth was +0.3% against -0.2% in the previous quarter, which pushed the pair up more than 110 points to 1.2900. Then, until Thursday, the dollar tried to play back losses. But at the end of the week, thanks to the head of the Federal reserve Jerome Powell, the bulls took the initiative in their hands once again, and the pair ended the week near the landmark level of 1.2900;

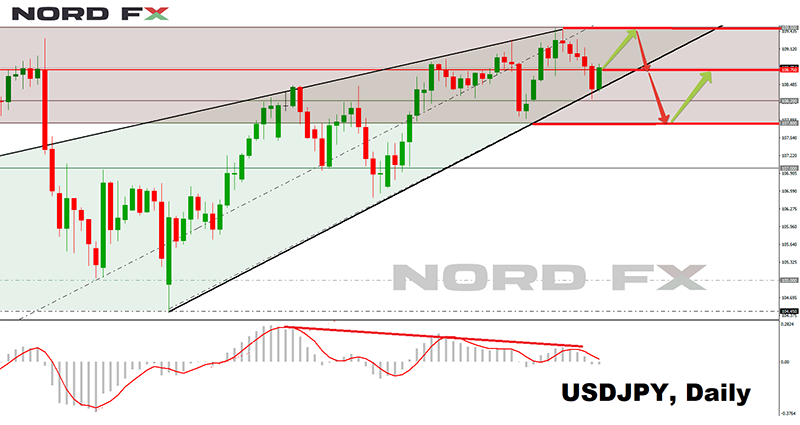

- USD/JPY. The more or less stable demand for the yen remained almost until the end of Thursday 14 November. The market hardly reacted even to the really weak GDP figures of Japan in the 3rd quarter (+0.1% compared to +0.4% in the previous quarter). All this allowed the Japanese currency to gain 100 points since the beginning of the week, reaching the critical point of contact with the MA-200 on the four-hour chart, which investors often use as a trend indicator. But the breakdown of the support and the reversal of the trend did not happen: thanks to the optimistic statements of Larry Kudlow about the course of the US-Chinese negotiations, the demand for protective assets fell, and the pair went north again, ending the trading session at 108.80 yen per 1 dollar;

- cryptocurrencies. The forecast, which was supported last week by the majority of experts (60%), can be reduced to just two words: "caution" and "pessimism". It is in line with these two concepts that the benchmark currency follows, gradually declining since the end of October. As a result, the pair reached the local bottom at $8,420 on the evening of November 15, returning to the boundaries of the side channel of $7,800-8,600, in which it moved from September 26 to October 22.

The pair was below the 200-day moving average for the whole last week, and it broke through the support in the form of a 50-day average as well by the end of the week, which also did not contribute to the growth of bullish optimism.

Top altcoins generally followed the bitcoin, repeating its poor performance. Ripple (XRP/USD) was not assisted by the large-scale support company deployed by bloggers and media, nor by its inclusion in The Coinbase debit card payment list. Ripple shrank another 8% during the week, reaching a low of $0.2528

Ethereum (ETH/USD) is struggling to keep from breaking the lower border of the three-week side channel of $175-195. Holders of this coin are constantly warmed by the idea that, thanks to POS-mining (proof of ownership), it may be recognized as a security in the future, which will cause an explosive growth in quotations.

Litecoin (LTC/USD) also found support near the bottom of the three-week corridor of $57-64. This level can be considered as a medium-term Pivot Point, around which the pair rotates starting from September 25.

As for the forecast for the coming week, summarizing the opinions of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. As mentioned above, thanks to the statement of the head of the Federal Reserve Jerome Powell and encouraging data on German GDP, the bears failed to break through the support at the level of 1.1000. After the GDP growth from -0.2% to +0.1%, representatives of the German government believe that the introduction of additional incentives to support the economy in the near future will not be required. Consumer demand together with government spending will be able to neutralize the problems of industry and exports.

It should be noted here that many macroeconomic indicators of the EU countries have recently turned out to be higher than forecast. However, uncertainty in the markets persists, and the preponderance of supporters of bulls over bears is now only 10%. 55% of experts voted for the growth of the Euro against 45%, who are convinced of the dollar strength. At the same time, both set modest goals for the pair. The goal of the bulls is its return in the corridor 1.1075-1.1175. The goal for the bears is a breakout of the 1.1000 support and transition to the 1.0940-1.1000 zone. Reaching the low of October 01, 1.0884, seems unlikely this week.

90% of oscillators and 80% of trend indicators on H4 side with the bulls. On D1, the picture is the opposite: 85% of oscillators and 75% of trend indicators are colored red. Graphical analysis on both H4 and D1 is also on the side of the bears and indicates a fall of the pair at least to the horizon of 1.0965.

As for significant events that can affect the formation of trends and cause increased volatility next week, we are looking at the meeting of the US Federal Reserve and the ECB on Wednesday and Thursday, respectively, as well as the speech of the new head of the ECB Christine Lagarde and data on business activity in the EU and Germany on Friday 22 November; - GBP/USD. Against the backdrop of the Brexit respite, it is difficult to say what markets reaction will be caused by the hearing of the inflation report in the UK on Wednesday 20 November. But as the conservatives build their election program with an emphasis, among other, on the weakening of the country's economy, one can expect a number of loud statements from them.

In the meantime, 60% of experts, supported by graphical analysis on D1, expect a reversal of the uptrend and the return of the pair to the November 08 low, 1.2765, and then its fall by another 100 points. The opposite position is taken by 40% of analysts in agreement with 100% of trend indicators and 90% of oscillators on H4 and D1. (The remaining 10% of the oscillators signal the pound is overbought). The nearest resistance levels are 1.2975 and 1.3015. The target is the height of 1.3100; - USD/JPY. The yen has been falling for almost all autumn, and the pair moves up, relying on the MA200, which is clearly visible on the H4 chart. At least four attempts to break through this support ended in failure. And how the fifth attempt will end depends directly on the macroeconomic indicators of the United States and China, and the prospects of signing a "Peace Treaty" between them.

The White House economic adviser Larry Kudlow's optimism about an imminent trade deal with China in the coming week could be quickly negated by both his boss, President Trump, and representatives of the Chinese government. So, it is quite possible that the pair will be able to reverse the uptrend and, at least, move to a sideways movement.

Experts' opinions are currently divided 50-50. The situation is similar with the indicators. Therefore, we can assume that the pair is expected to move sideways along the Pivot Point 108.75 in the corridor with the boundaries of 107.80-109.50 for some time. The next support is in the area of 107.00, resistance –110.30;

- cryptocurrencies. If you look at what has happened to bitcoin in 10 years, everything seems to be fine: it has risen in price 100 times during this time. But it does not want to continue to grow. Those who were going to purchase this cryptocurrency as a long-term investment have already done so. And now the market belongs to short-term speculators, who play not only on the rise, but also on the fall. The mantra of such apologists as co-founder of the oldest Chinese crypto exchange BTCC Bobby Lee, that the price of bitcoin will rise to $500 thousand by 2028, does not affect them. The speculators are focused on quick profits, which can only be obtained thanks to the increased volatility of cryptocurrencies and the news that creates this volatility.

Halving of Bitcoin in 2020 will become such a piece of news. In the near future, it will be the hard fork Istanbul, which the creators of Ethereum are going to hold on December 4, 2019. Another piece of news is the launch of regulated bitcoin options on Bakkt, which is also scheduled for early December. These and similar events can cause sharp one-time jumps in quotations.

In our previous review we wrote that, according to Bloomberg analysts, the first cryptocurrency has a chance to fall to the level of $8,000 before the end of the year. The height of $12,000 is called as a possible high. As for the high of the year 2020, it is at $16,000. A similar opinion with his colleagues from Bloomberg was previously expressed by the head of the Binance crypto exchange, Changpeng Zhao. According to him, traders and investors in China can ensure the growth of the reference coin at least to such a height.

But this can be prevented by one event. A sensational statement was made by Jack Lee, founder and managing partner of HCM Capital. He believes that the People's Bank of China will issue its own digital currency in two to three months. And it is this currency that investors from China can switch their attention and capitals to.

As for the forecast for the very near future, since the BTC/USD pair has fallen to the boundaries of the side channel of $7,800-8,600, three scenarios are possible here. The first is bearish, according to which the pair will continue to move to the lower border of the channel. 25% of experts vote for it. The same number support the second, bullish, scenario. When it is implemented, the upper limit of the channel $8,600 will act as a support, starting from which the pair will go up. The nearest resistance is $8,815, the next ones are $9,130 and $9,470. And finally, the third scenario. According to it, the $8,600 level will act as a Pivot Point along which the pair will move to the east. This development is supported by the majority of analysts, 50%.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back