EUR/USD: Fed's Apples and ECB's Oranges

- The dollar continues to strengthen, while the EUR/USD pair moves down. A week's low was recorded at 1.0757 after the ECB meeting on Thursday, April 14. After correction, the final chord, sounded at around 1.0808.

We named three reasons for the growth of the US currency in the previous forecast. The first is the difference between the monetary policies of the Fed and the ECB. Now, the probability of further tightening the position of the US Central bank has increased even more against the background of the latest data on inflation in the United States: the consumer price index has exceeded the forty-year high and reached 8.5%. Such an acceleration of inflation may force the regulator to act more vigorously and to revise its plans to raise the key rate and reduce the balance sheet in May.

New York Fed President John Williams, who is also vice chairman of the FOMC (Federal Open Market Committee), said in an interview with Bloomberg that it makes sense for the Fed to bring interest rates to a neutral level as soon as possible, which, not stimulating, it does not hinder economic growth, and is in the range from 2% to 2.5%. Therefore, a 0.5% increase in federal borrowing costs at the May FOMC meeting looks quite realistic.

In contrast to the Fed's hawks, their European counterparts remain extremely dovish. The ECB left the interest rate unchanged at 0% at its meeting on April 14, which, in fact, was expected. Moreover, the Bank's representatives have already said earlier that the growth in the cost of lending in the context of continuing economic uncertainty could do more harm than good.

The head of the regulator, Christine Lagarde, confirmed at a press conference that followed the meeting that the ECB is moving more slowly than the Fed, and that the Eurozone will be hit harder by the military actions in Ukraine. The American and European economies, according to Ms. Lagarde, are as incomparable as apples and oranges. Such a fruity allegory made a strong impression on the market, as a result of which the EUR/USD pair collapsed to the zone of two-year lows.

Indeed, the current economic situation in the euro area does not inspire optimism and, according to many experts, will continue to worsen in the future. The German economic sentiment index published last week fell to a new multi-month low: minus 41.0 (minus 39.3 a month earlier). The index of current economic conditions of this locomotive of the European economy also fell to minus 30.8 in April (minus 21.4 in March). Against this background, the German GDP growth forecast for 2022 was lowered from 4.5% to 2.7%.

The situation may become even more complicated, as the President of the European Commission Ursula von der Leyen and the head of EU diplomacy Josep Borrell announced their intention to include restrictions on the export of hydrocarbons from Russia in the next package of anti-Russian sanctions. Thus, the risk of stagflation in Europe remains at a fairly high level.

We mentioned another reason for the pressure on the euro - the presidential elections in France in the previous review. Their first round took place on Sunday April 10. So far, the incumbent President Emmanuel Macron is leading with 27.84% of the vote. Marine Le Pen, head of the far-right National Rally Party, gained 23.15%. The gap is not very large and there is still a possibility that the opposition may win in the second round on April 24. Its leader Marine Le Pen is a Eurosceptic. Please note that she called for almost the exit of the country from the Eurozone back in 2017. And if this lady comes to power, the EUR/USD pair, according to a number of analysts, may fall to the level of 1.0500, or even lower.

There is another factor pushing the pair south, which is the deterioration of global risk appetite. The S&P500 stock index has been falling for the third week in a row, while demand for safe-haven assets such as the dollar and US Treasuries, on the contrary, is growing.

At the moment, 50% of analysts vote for further strengthening of the dollar. The opposite opinion is shared by 40% and the remaining 10% of experts have taken a neutral position. All trend indicators and oscillators on D1 are colored red, although 15% of the latter give signals that the pair is oversold.

The nearest support is located at the level of 1.0800. The nearest target for EUR/USD bears will be April 14 low at 1.0757. And if they manage to break through this support, they will then aim for the 2020 low of 1.0635 and the 2016 low of 1.0325. The bulls will try to lift the pair above the 1.1000 level and, if possible, reach the 1.1050 zone. But to do this, they first need to overcome the 1.0840 and 1.0900-1.0930 resistances.

The upcoming week's calendar includes speeches by Fed and ECB heads Jerome Powell and Christine Lagarde on Thursday April 21. Data on unemployment and manufacturing activity in the US will also be published on this day. As for the indicators of business activity in Germany and the Eurozone as a whole, they will become known on Friday, April 22.

GBP/USD: Battle for 1.3000

- In the previous forecast, most experts (65%) supported the correction of the GBP/USD pair to the north and were absolutely right. It seemed at the beginning of the week that the victory was on the side of the bears: they managed to overcome the support in the 1.3000 zone and lower the pair to 1.2972.

Recall that 1.3000 is a key support/resistance level as it is not only the March 15 low, but also the 2021-2022 low. The bulls managed to seize the initiative on Wednesday, April 13, break through this resistance, reach the height of 1.3147 and complete the week also above it, at around 1.3060.

The pound was supported by a possible tactical victory of the Bank of England over the FRS in the fight for raising interest rates. Inflation in the UK increased from 6.2% to 7.0%. The Bank of England predicted that it would peak in April, accelerating to 7.2%. However, a number of banks did not agree with the regulator's opinion, believing that inflation will not stop at this point, reaching 9.0% in April, and then its growth will continue. Therefore, the Bank of England will have to do something about it. And this “something” is, of course, another increase in interest rates. It was this prospect that pushed the British currency to growth.

We can expect the battle for 1.3000 to continue next week. If the victory is on the side of the bears, they will try to update the April 13 low of 1.2972 and open the way to the November 2020 lows around 1.2850, and then to the September 2020 lows in the zone 1.2700. The nearest support is 1.3050. 30% of analysts vote for the victory of the bears, while the majority (70%) side with the bulls. The resistance levels are 1.3100, 1.3150 and the zone 1.3190-1.3215, then 1.3270-1.3325 and 1.3400. Among the indicators on D1, the advantage of the reds is evident. Among the oscillators, 75% are colored in this color, another 15% are green and 10% are neutral gray. Trend indicators have 100% on the red side.

Among the events concerning the economy of the United Kingdom, we can highlight the speeches of the Governor of the Bank of England Andrew Bailey on April 21 and 22. Data on business activity in the manufacturing and services sectors of the UK will also be published on Friday, April 22.

USD/JPY: Do We Expect New Anti-records from the Yen?

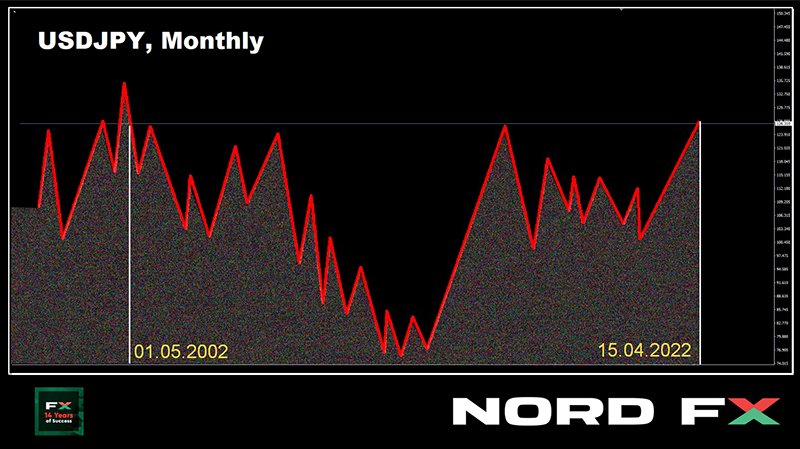

- It seems that nothing can stop the fall of the yen and the growth of the USD/JPY pair. The Japanese currency sets an anti-record after an anti-record, and the pair recorded another high at 126.67. The last time it climbed so high was on May 01, 2002, that is, 20 years ago.

We noted in the last review that the majority of Japanese people are against the weak yen. However, despite this, the Bank of Japan still refuses to raise the key rate and reduce monetary easing. The regulator believes that maintaining economic activity is much more important than fighting inflation. And this divergence with the US Federal Reserve's monetary policy is pushing the USD/JPY further north.

The pair closed the week's trading session at 126.37. 45% of analysts vote for maintaining the uptrend next week. A little more, 55%, remembering a powerful correction to the south after a similar rally in the last week of March, expect something similar now. It should be noted here that when switching to the forecast for may-June, the number of supporters of the dollar strengthening increases to 80%. We have already cited Rabobank strategists who believe that a quick USD/JPY jump above 125.00 will seriously increase the likelihood that the Japanese regulator will revise its quantitative easing (QE) program. And this jump took place last week.

There is complete unanimity among the indicators on D1: 100% of trend indicators and 100% of oscillators look up, although 35% of the latter are in the overbought zone. Without a doubt, the main support in the coming days will be the levels of 126.00 and 125.00. Then, taking into account the high volatility of the pair, we can single out the zones 123.65-124.05, 122.35-123.00 and 120.60-121.30. As for the plans of the bulls, they will try to update the high of April 15, and rise above 127.00. An attempt to designate their subsequent goals, focusing on the levels of 20 years ago, will rather look like fortune telling.

There are no expected releases of any important statistics on the state of the Japanese economy this week.

CRYPTOCURRENCIES: April 12: Space Flight Day. But not for bitcoin.

- It is impossible to call the first half of April successful for the crypto market. And if bitcoin was still trying to jump over the 200-day SMA two weeks ago, on April 04, then the bulls completely capitulated and a local low was recorded at $39.210 on April 12. It is noteworthy that Cosmonautics Day is celebrated on this day: Yuri Gagarin went into space and circled the planet Earth on April 12, 1961, for the first time in the world. The BTC/USD pair did not make a breakthrough to the stars. Rather, we observed a fall from orbit.

As of this writing, on the evening of Friday, April 15, the pair is trading around $40,440. The total market capitalization has slightly decreased and is still below the important psychological level of $2 trillion, at the level of $1.880 trillion. The Crypto Fear & Greed Index did not stay in the previous orbit either: it fell from 37 to 22 points and returned to the Extreme Fear zone.

We wrote earlier that bitcoin has become a part of the global economy and now demonstrates a strong correlation with stock indices. Therefore, its quotes chart is largely congruent, first of all, with the S&P500 chart. So, as of March 2022, according to Arcana Research, the correlation coefficient between BTC and S&P500 was 0.497. The main cryptocurrency falls and rises after the stock market. And that, in turn, falls or rises depending on the actions of the US Federal Reserve. There is no longer any question of bitcoin's independence.

As we have already mentioned, there has recently been a clear trend towards the accumulation of digital gold. The volumes of accumulation began to exceed emission many times over. According to Glassnode, the rate of outflow of coins from centralized platforms has increased to 96,200 BTC per month, which is extremely rare in historical retrospect. In addition to the “whales”, the so-called “shrimps” (addresses with a balance of less than 1 BTC) also contributed to the accumulation. So why doesn't hodle sentiment lead to higher prices?

The answer is simple: no new investors. The old ones either go into the state of long-term holders of coins, or get rid of them. Approximately $439 million worth of crypto positions were liquidated on April 12 alone, according to Coinglass. At the same time, more than 88% of closed orders accounted for long positions. Bitcoin futures contracts for $160 million were also closed. But there is no strong inflow of new investments into the crypto sector.

Investors have lost their appetite for risk since the end of March, the DXY dollar index and US 10-year bond yields reach new highs on a regular basis. Due to rising inflation, which reached 8.5% in the US in March, the markets are waiting for the US Central Bank to raise interest rates again at the May meeting, and not by 0.25%, but immediately by 0.5%. This is the reason why interest from high-risk assets flows to more conservative instruments.

According to Bloomberg analysts, the value of the flagship cryptocurrency may soon fall to $26,000. The experts emphasized that if the technical analysis pattern called “bear flag” works, then such a scenario will be inevitable. In their opinion, the BTC rate is now on its way to testing a key support level around $37,500. If it does not hold above this mark, the market is in for a disaster.

Analyst Jeffrey Halley's forecast sounds slightly more optimistic. He believes that the flagship cryptocurrency continues to trade within the established range, the lower limit of which is at $36,500. If BTC falls even more, it can lead to serious losses for traders and investors. However, if the price of bitcoin soars in the near future above the upper limit of the range of $47,500, this will be a prerequisite for reaching a new record high.

There are also influencers who are not worried or upset by the current market situation at all. These include Michael Saylor, CEO of Microstrategy, a company known for its investments in bitcoin, and Cathie Wood, head of investment company Arch Invest, who still believe in bitcoin and look forward to its growth.

Saylor and Wood spoke at the Bitcoin 2022 conference in Miami and concluded that the Fed's monetary policy will continue to be inflationary, pushing prices up. In such a situation, according to Cathie Wood, bitcoin, as a means of hedging, has great potential for growth and its price could reach a record $1 million per coin. “It takes quite a bit of effort to do this,” the head of Arch Invest said. "We don't need much. All we need is for 2.5% of all assets to be converted to bitcoin.”

Well-known writer and investor Robert Kiyosaki has a similar opinion, he believes that the US dollar and other markets are on the verge of collapse due to rising food, oil and energy prices, as well as widespread inflation. The author of the bestselling book Rich Dad Poor Dad assured that what is happening in the world of finance is a sign of a coming crisis, and this process will simply destroy half the US population. He noted that cryptocurrencies in this situation are a good tool to reduce risks, but not all people resort to using this asset class. Kiyosaki emphasized that now 40% of Americans do not even have $1,000 in their savings. The inflation rate is rising, and this figure will soon exceed 50%. Then, according to the investor, a revolution will begin.

Morningstar analysts posted a report claiming that cryptocurrencies are no match for the stock and bond markets in terms of returns. At the same time, they note that bitcoin “is still too risky to be compared to gold.” The authors of the report argue that, despite the prospect of significant profits that the cryptocurrency market can offer its participants, one must be very careful with it. “Every breathtaking rally has led to an equally brutal crash at the end,” Morningstar notes.

It is difficult to argue that speculation or investment in digital assets is quite risky. But there are certain things in this business, as in any other, that allow you to get additional benefits. It is about them that we regularly talk about in our crypto life hacks section. This time it's about heat energy and a man named Jonathan Yuan who has kids who love to swim in the pool. However, they almost did not do this because the water was too cold.

Yuan himself is actively involved in mining and drew attention to the fact that his equipment generates too much heat. He purchased a heat exchanger and used it to install a system for heating water. According to him, thanks to this invention, the temperature in the pool can be maintained at about 32° C, and the crypto farm receives a water cooling system. Jonathan Yuan notes that almost everything can be heated according to this principle: living premises, garages and so on. It is assumed that the heating temperature can reach a maximum threshold of 60°C.

There are nuances here, however. When the inventor pushed his ASIC miners to the limit, the temperature in the pool rose above 43°C. His children did not like it either and they stopped swimming again. So, the ancient Greek “father” of medicine, Hippocrates, was right, saying “good things in small doses”

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back