The past week was marked by notable growth across several major financial instruments. The euro rebounded strongly, gold surged to fresh highs, and bitcoin displayed a classic correction within its broader upward trend. Investor sentiment remained cautiously optimistic, buoyed by technical signals pointing to the continuation of bullish momentum across markets, despite occasional pullbacks. As we look to the coming week, a phase of short-term corrections appears likely, though the prevailing trends may well remain intact, provided key support levels hold firm.

EUR/USD

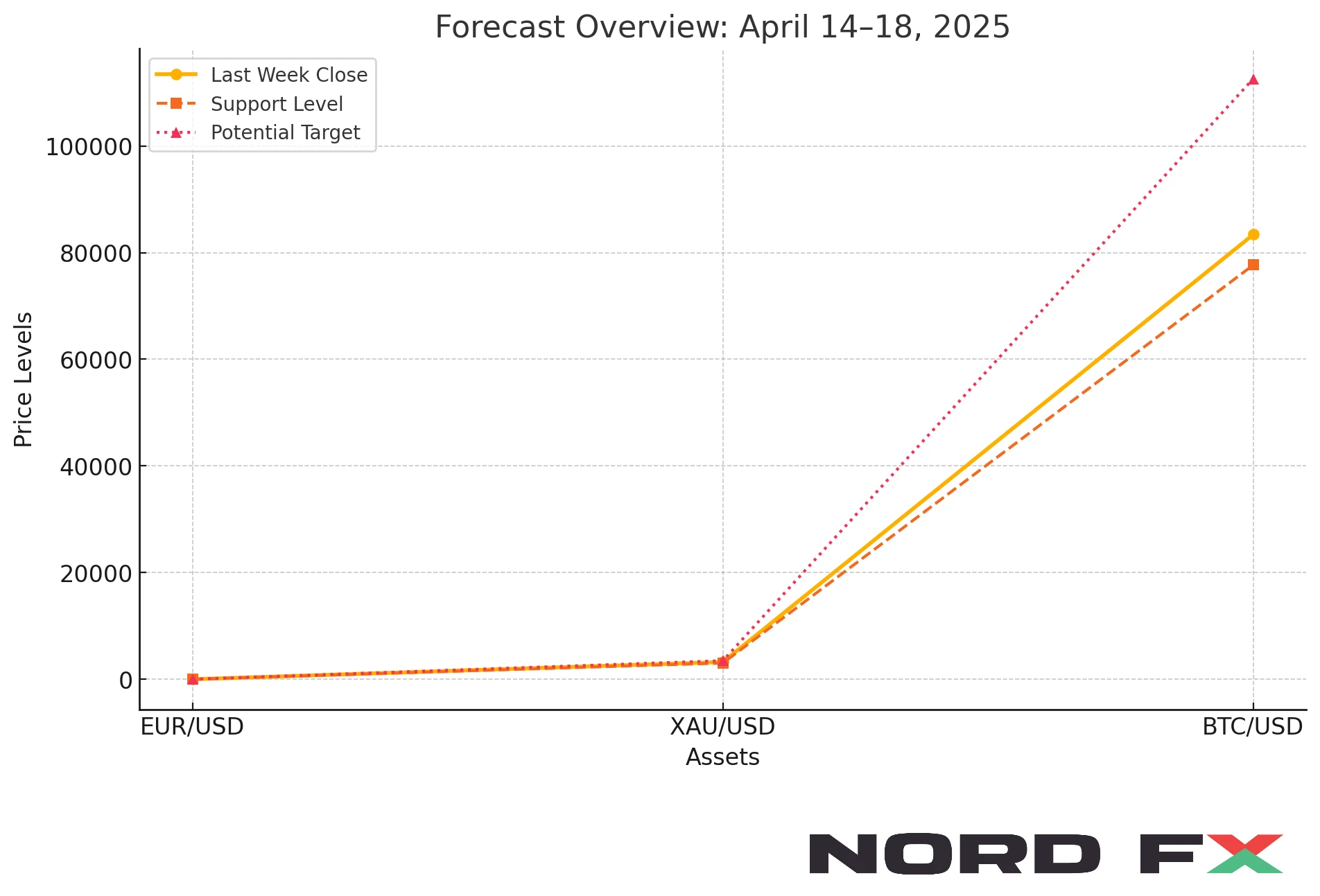

The EUR/USD pair finished last week trading around 1.1361, showing strong upward momentum. Despite this growth, the moving averages still reflect a broader bearish trend. However, the recent breakout above the area between the signal lines suggests that buyers are regaining control and may push the pair higher. In the upcoming week, a short-term correction towards the support zone near 1.1175 is expected. From there, a rebound and continuation of the upward movement towards the 1.1905 level is the most likely scenario.

Support for this view also comes from the relative strength index (RSI), where a test of the support line could act as a signal for further gains. Another signal is the pair’s breakout above the upper boundary of the descending channel. Should EUR/USD break below the 1.0915 level, this would invalidate the bullish outlook and open the way for a deeper decline, potentially targeting the 1.0655 area. A decisive close above 1.1505 would serve as confirmation of renewed bullish momentum.

XAU/USD

Gold (XAU/USD) closed last week with sharp gains, settling near the 3238 level. The precious metal remains within a bullish price channel and continues to trend upwards, supported by the moving averages. At present, a temporary pullback towards support around 3035 is likely. Provided this level holds, the market could rebound, extending the rally toward the 3485 area.

The RSI also supports this outlook, with a test of the trend line acting as a bullish signal, while a bounce from the lower boundary of the ascending channel would reinforce this expectation. However, should gold fall below 2925, it would signal a breakdown of the current bullish structure and open the way for a drop toward the 2835 level. A close above 3265 would strengthen the bullish case and suggest a continuation of the uptrend.

BTC/USD

Bitcoin (BTC/USD) ended the week at 83,380, continuing its correction within an overall bullish structure. While price action remains within an ascending channel, the break below the signal line zone indicates pressure from sellers in the short term. A further decline towards the support level at 77,665 is likely, with the potential for a rebound from that level leading to renewed growth targeting the 112,605 area.

The RSI suggests that a test of the support line could act as an additional bullish signal. Another positive indication would be a bounce off the lower boundary of the channel. However, a fall below 72,005 would invalidate this scenario, pointing instead to a deeper decline with a possible target below 64,505. A confirmed breakout above 89,505 would indicate the successful completion of a "Wedge" reversal pattern and mark the start of a more extended bullish phase.

Conclusion

Markets appear poised for short-term corrections early in the coming week, but the broader bullish momentum in the euro, gold, and bitcoin remains intact. Traders should watch for key support levels to hold, as rebounds from these zones could present opportunities for continued upside moves. However, in all three cases, a breach of support would shift the technical picture and warrant caution. Confirmation through breakouts of resistance levels would be a strong sign that bullish trends are set to resume.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.