General Outlook of the Past and Coming Week

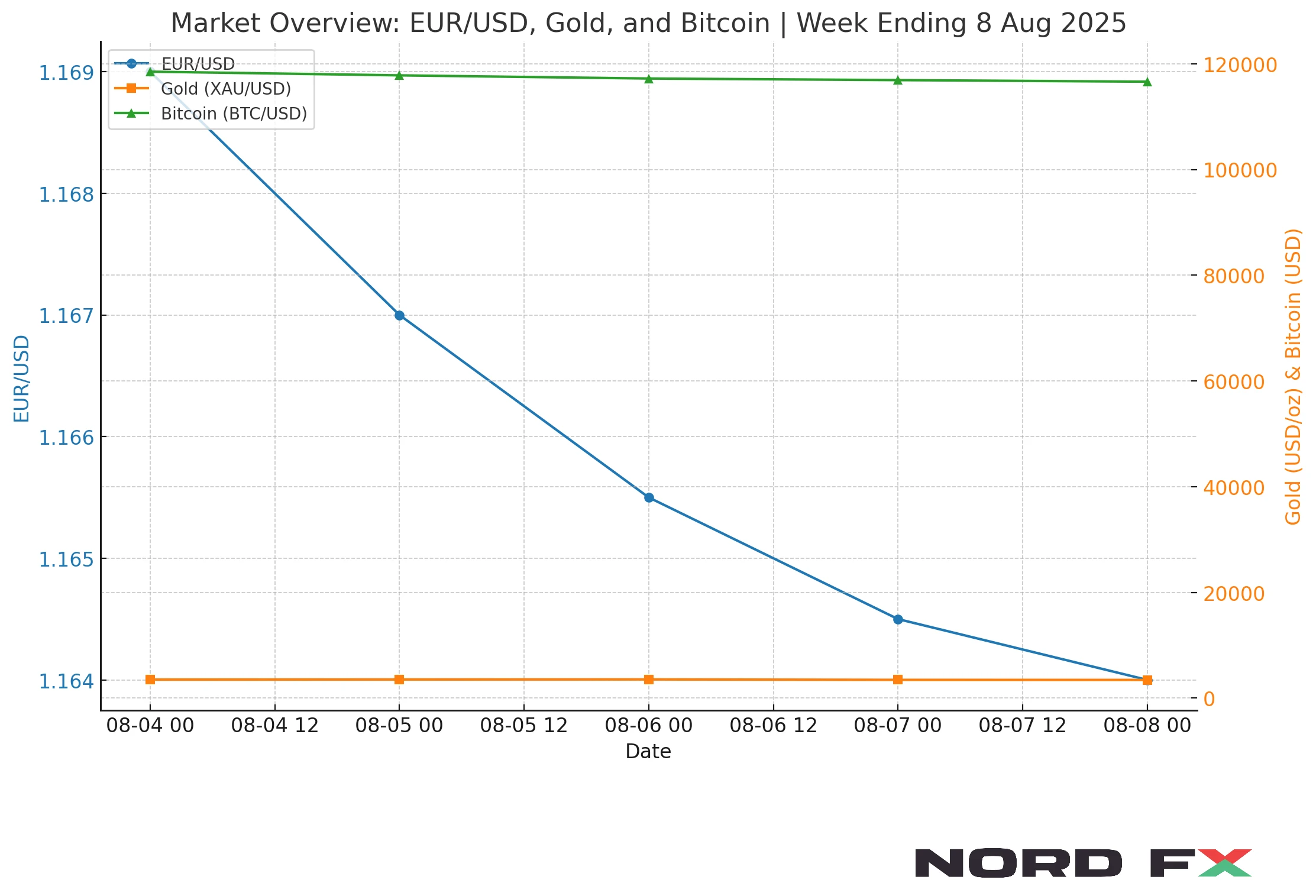

The week ending 8 August 2025 brought a mixed performance across key markets. The euro retreated against the dollar, closing near 1.1640 after failing to hold mid-week gains. Gold remained the standout, hitting a record $3 534 per ounce before easing to around $3 440, as safe-haven demand surged amid persistent trade tensions and inflationary concerns. Bitcoin, meanwhile, lost some of its July momentum, dropping from highs above $123 000 to end the week close to $116 600, pressured by macroeconomic uncertainty and large-holder profit-taking. Looking ahead to the week of 11–15 August, the euro appears confined within a narrow range, gold retains a firm bullish bias, and bitcoin continues to consolidate while awaiting a decisive breakout.

EUR/USD

The EUR/USD pair ended Friday near 1.1640, still holding above short-term moving averages but lacking the momentum to challenge major resistance. The recent pullback reflects a combination of dollar strength and cautious positioning ahead of key US inflation and retail sales data. In the coming week, the euro may attempt another push toward 1.1700–1.1750, but a sustained move above 1.1750 will be needed to revive bullish momentum and target the 1.1800 zone. Should the pair slip below 1.1600, the bias would turn negative, opening the way toward 1.1500. For now, the tone remains neutral-to-positive, with buyers watching for a catalyst to break the current stalemate.

XAU/USD (Gold)

Gold’s explosive rally to $3 534 underscored its dominance as the market’s preferred hedge against uncertainty. Although the metal eased to $3 440 into Friday’s close, the underlying uptrend is well intact. The technical picture shows an ascending triangle, often a continuation signal, suggesting that a clean break above $3 450 could see gold retesting $3 500 and potentially extending toward $3 535–$3 550. A drop back under $3 400 would likely trigger a short-term correction toward $3 350 before buyers step in again. With fundamentals and sentiment aligned, gold remains positioned for further strength if resistance levels are overcome.

BTC/USD

Bitcoin closed the week near $116 600, holding inside its broader bullish channel despite recent pullbacks. The $115 000 level has acted as a solid floor in recent sessions, with rebounds from this area attracting short-term buyers. A move above $117 600–$118 000 could open the door to a push toward $120 000, while a decisive break below $115 000 would likely expose $110 000 as the next downside target. Sentiment remains cautious, and the market is likely to stay in consolidation until a fundamental or technical catalyst sparks the next sustained move.

Conclusion

As the new week begins, EUR/USD looks set to trade within the 1.16–1.17 corridor unless US data injects fresh volatility. Gold maintains its bullish advantage, with any breakout above $3 450 likely to accelerate gains toward fresh highs. Bitcoin is consolidating below resistance, with key levels in play on both sides. Overall, the tone for 11–15 August is one of watchful patience, with selective opportunities emerging for traders ready to act when price breaks occur.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.

Go Back Go Back