The past week in the Forex and cryptocurrency markets was marked by diverse dynamics. The euro weakened against the dollar, continuing its descent within a well-established bearish channel. Gold prices rose steadily but showed signs of overextension, hinting at a possible correction in the coming days. Meanwhile, bitcoin sustained its bullish momentum, testing higher levels while remaining within its ascending trend. As we move into the week of December 16–20, 2024, market participants should pay close attention to critical support and resistance levels, as they are likely to dictate the trajectory of these key assets.

EUR/USD

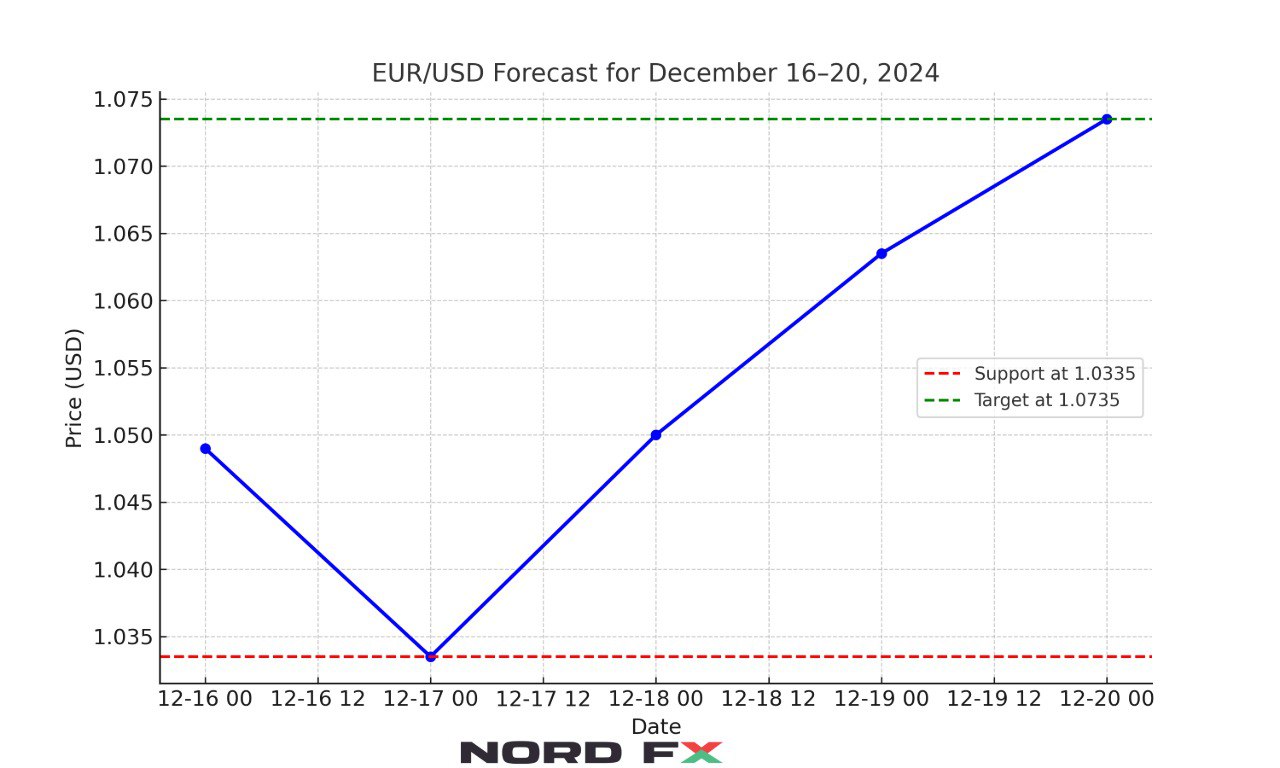

The euro-dollar pair concluded the previous trading week near the 1.0490 level, remaining entrenched in a descending channel that reflects sustained bearish sentiment. The moving averages confirm this trend, and the pair’s breach below key signal lines indicates persistent selling pressure on the euro. However, the upcoming week presents a potential turning point as the pair approaches the critical support level at 1.0335. A rebound from this zone could trigger a corrective upward movement, targeting the 1.0735 area.

Technical indicators reinforce this outlook. The relative strength index (RSI) suggests that the euro is nearing oversold conditions, which may provide a base for recovery. Price action near the 1.0335 level will be crucial in confirming whether the pair is ready for a reversal. A decisive failure to hold above 1.0225, however, would invalidate this scenario and open the door to further declines, potentially driving the pair toward 0.9835.

In the coming week, traders should be prepared for a possible test of the lower boundary of the current trading range, followed by an attempt to recover. While downside risks remain significant, a rebound from support could signal the start of a short-term correction.

XAU/USD

Gold ended the week near the 2667 mark, maintaining its position within a pronounced upward channel. The price action reflects strong bullish momentum, as buyers have consistently pushed prices higher. However, this rally may face resistance in the coming days. The key resistance zone at 2765 is expected to be tested, and a failure to break above this level could result in a downward correction.

A reversal near the 2765 area would likely target the lower support zone around 2285. This potential decline is supported by patterns observed on the relative strength index, which indicates that gold is nearing overbought territory. Additionally, the presence of a Double Top formation on the price chart suggests that a reversal could be imminent.

Despite these bearish signals, the possibility of a breakout above the 2985 level cannot be ruled out. Such a move would confirm a continuation of the bullish trend, paving the way for a rally toward 3265. For the week ahead, the market may initially see an attempt to rise toward resistance before encountering selling pressure, leading to a retracement.

BTC/USD

Bitcoin closed the previous week at 99,875, continuing to exhibit strong upward momentum within a bullish channel. The cryptocurrency’s steady climb has been supported by robust demand from buyers, with prices breaking above key technical levels. However, a short-term correction may be on the horizon. The first significant support zone lies near 92,995, and a retest of this level could provide the foundation for the next leg of the rally.

A rebound from the 92,995 zone would likely propel bitcoin toward a fresh high, with a target above the 125,575 level. This bullish outlook is supported by the RSI, which shows the asset consolidating within an upward trajectory. The lower boundary of the bullish channel also acts as a strong support, reinforcing the likelihood of a rebound.

Conversely, if bitcoin fails to hold above the 92,995 level and breaks below 85,605, it could signal the start of a broader correction. In this scenario, the next significant support level would be 75,605, marking a substantial pullback from current levels.

For the week ahead, bitcoin is expected to trade within a wide range, with a potential dip to support being followed by a resumption of its upward trend. Traders should remain vigilant, as any breakout above the 107,005 level would confirm the continuation of the bullish trajectory.

As we enter the week of December 16–20, 2024, the markets are poised for a mix of corrections and recoveries. The euro-dollar pair is likely to test its lower support level before attempting a rebound, while gold appears set to challenge key resistance before potentially retreating. Bitcoin, on the other hand, remains firmly in an upward trend but may see a temporary pullback before resuming its rally. Traders should closely monitor price action at critical levels, as these will determine whether assets continue their prevailing trends or shift direction. By staying attentive to technical signals, market participants can better navigate the opportunities and risks in the days ahead.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back