As the year transitions into its final week, financial markets have displayed a mixture of corrections and sustained trends across key assets. The past week saw steady movements influenced by macroeconomic developments and year-end portfolio adjustments. Looking ahead, the forthcoming week could bring heightened volatility, with traders positioning for the New Year amidst thinner holiday liquidity.

EUR/USD

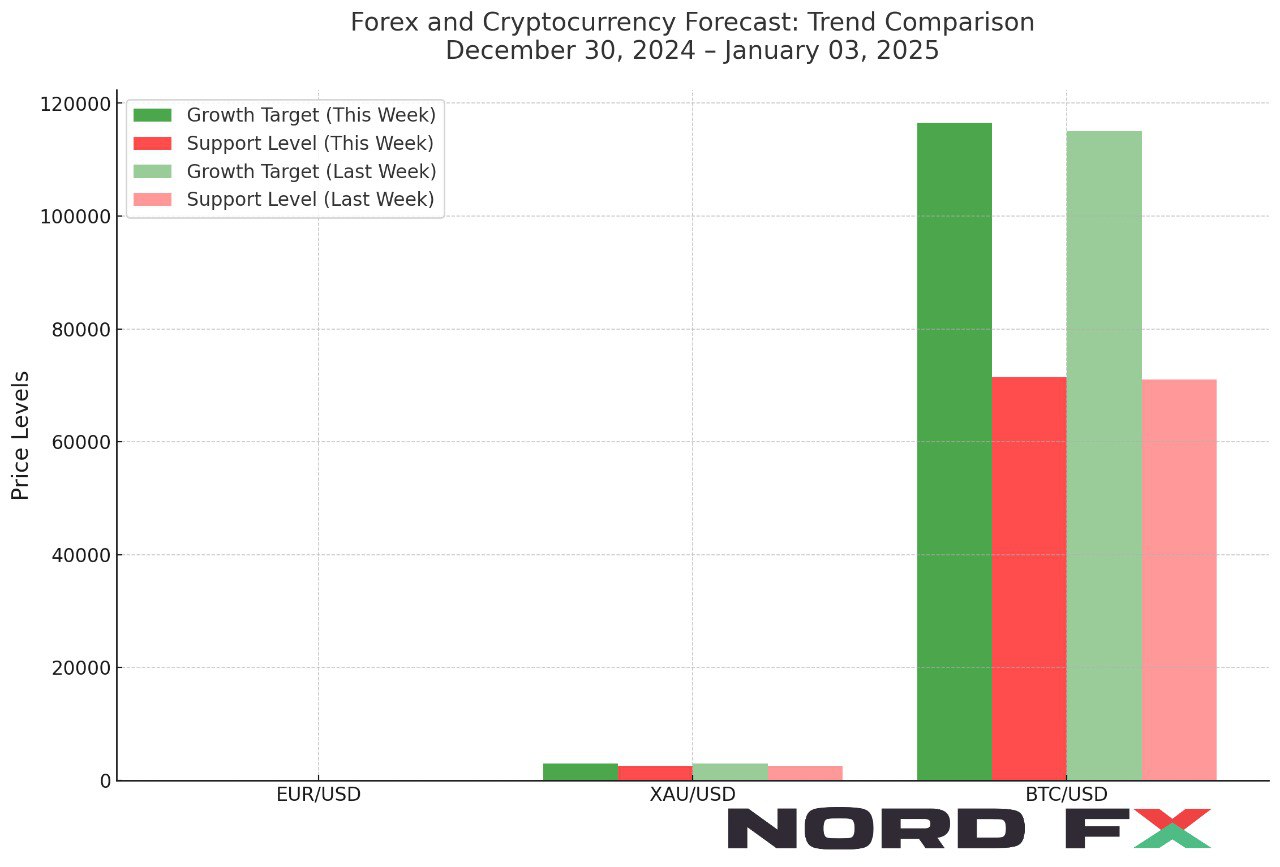

The EUR/USD currency pair ended the past week near 1.0419, continuing its trajectory within a descending channel. Technical indicators highlight a bearish sentiment, with moving averages confirming sustained downward pressure. Sellers maintain control, driving the pair to test support near 1.0375. From this level, a potential rebound is anticipated, with targets suggesting a rise towards the 1.0965 region.

A supportive signal for potential recovery comes from the relative strength indicator (RSI), where a bounce near the support line could reinforce upward momentum. Another key factor to watch will be price reactions near 1.0375. However, a decisive break below 1.0175 would negate this bullish outlook, setting the stage for a deeper decline towards 0.9825. Conversely, a breakout above 1.0585 would validate a reversal, potentially lifting EUR/USD above the descending channel.

XAU/USD

Gold (XAU/USD) closed the previous week with gains near the 2617 level, underpinned by an ascending channel that reflects its bullish trend. Buyers remain in control, supported by moving averages and signals of a potential continuation in price growth. In the coming week, a pullback to test support around 2575 is expected before a likely rebound propels Gold towards the 3035 level.

Additional bullish confirmations may arise from RSI trends and a rebound from the lower boundary of the "Triangle" pattern visible in technical analysis. A break below 2495 would invalidate this growth scenario, indicating a more pronounced drop toward 2405. Conversely, a close above 2745 would signify the breakout of the upper boundary of the "Triangle," reaffirming bullish prospects with extended targets beyond 3035.

BTC/USD

Bitcoin (BTC/USD) finished the week at 94058, moving within a bullish channel while consolidating its recent gains. The cryptocurrency remains in an upward trend, with moving averages signalling robust buyer interest. Resistance near 96265 is a critical level to monitor in the upcoming week. A potential failure to break this level could trigger a decline, with targets below 71405.

Signals supporting bullish continuation include a rebound from the lower boundary of the channel and resistance on the RSI. However, a break below 82405 would confirm a bearish shift, targeting a further decline. On the other hand, if Bitcoin breaks through 110505, it could rally further to reach the 116505 area, underscoring continued investor optimism.

The final week of the year is poised to deliver pivotal movements across Forex and cryptocurrency markets. EUR/USD faces a critical juncture within its descending channel, with room for both rebounds and further declines. Gold continues to shine within its bullish trajectory, eyeing higher levels despite potential short-term pullbacks. Meanwhile, Bitcoin remains volatile but structurally bullish, presenting opportunities for gains if key resistance levels are breached. Market participants should prepare for dynamic trading conditions as the year draws to a close.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.