General outlook

During the week of 23–27 June, global risk sentiment remained positive on expectations of imminent Fed rate cuts and easing geopolitical tensions. EUR/USD gained, closing around 1.1704 on 27 June. Gold ended lower, slipping about 2.3%, with spot prices around $3,288.55/oz on Friday as haven demand diminished on news of a ceasefire and stronger trade sentiment. Bitcoin hovered steadily near $107,000–107,400, supported by large options expiry and renewed institutional interest. With few major data releases, markets consolidated.

Looking ahead to 30 June – 4 July, focus will shift to the US Core PCE inflation report, major employment data, and any Fed commentary. Expect continued range-bound actions that could sharpen into trend moves after key US indicators.

EUR/USD

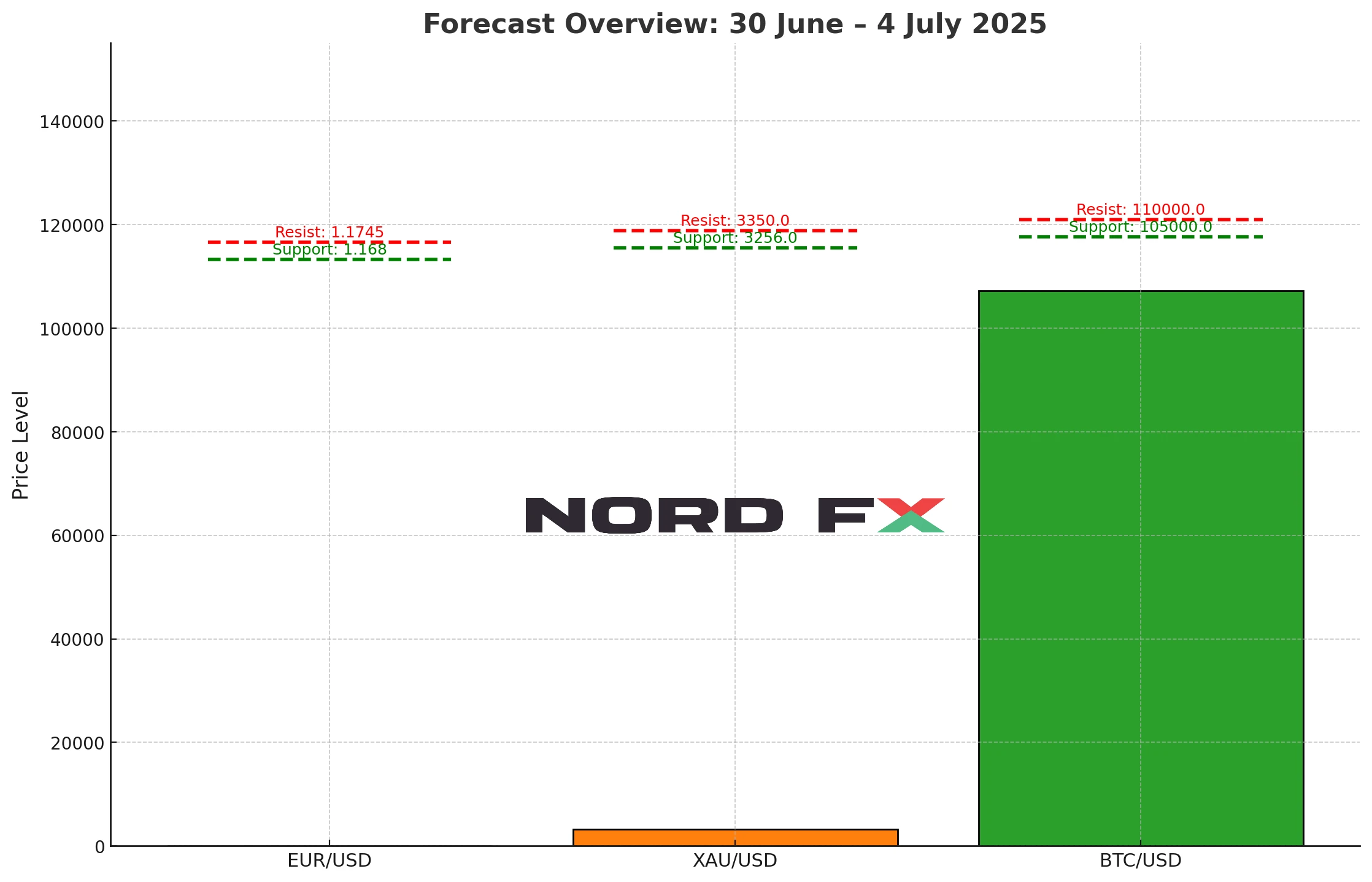

EUR/USD continues to trend higher, ending June trading just above 1.1700, boosted by dollar softness amid Fed rate cut expectations. Technicals suggest a bullish bias, with resistance near 1.1745–1.1800; a break above could open room to 1.1850–1.1900. On the downside, support lies at 1.1680, with a break below shifting focus near 1.1600–1.1585. Key drivers this week: US PCE inflation (expected ~0.1% m/m, ~2.6% y/y) and preliminary jobs data.

XAU/USD (Gold)

Gold closed the week under pressure, falling below its 50‑day moving average and finishing near $3,278/oz on 27 June. Weekly losses of ~2.3% highlight the recent withdrawal of safe-haven flows. Now trading within a corrective structure, key support stands near $3,256–3,295. A rebound from this zone would target $3,330–3,350, while a break below could signal downside risk toward $3,215–3,165. Events to watch are US PCE and any Fed comments.

BTC/USD

Bitcoin is holding firmly in the $107k range, closing the week around $107,000–107,400. Recent stability follows a ~$40 bn options expiry, though implied volatility could spike with broader market moves. Strong demand from institutional and retail investors suggests support around $105,500–106,000. A firm break above $110,000 may ignite another rally, with further resistance at $111,800 (May all‑time high). On the flip side, a breakdown under $105k, particularly on macro weakness, could drag the price toward $100k.

Conclusion

Heading into the final days of June and into early July, all three markets look set to remain range-bound, awaiting key US economic data for direction. EUR/USD’s range is 1.1680–1.1745, gold trades between $3,256–3,350, and bitcoin ranges from $105k–110k, with broader implications based on how US CPI and labour figures shape Fed expectations. Traders should monitor breakouts beyond these levels—they could mark the start of new trends.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.