General Outlook

In the week leading up to March 21, 2025, financial markets saw mixed dynamics across major instruments. The euro weakened against the dollar amid economic concerns in the eurozone and expectations of tighter US trade policy. Gold surged to new highs as demand for safe-haven assets intensified, while bitcoin experienced sharp intraday swings, reflecting an ongoing tug-of-war between bullish sentiment and technical corrections. As we move into the final week of March, investors will remain focused on key macroeconomic indicators, geopolitical developments, and monetary policy cues that could set the tone for market direction.

EUR/USD

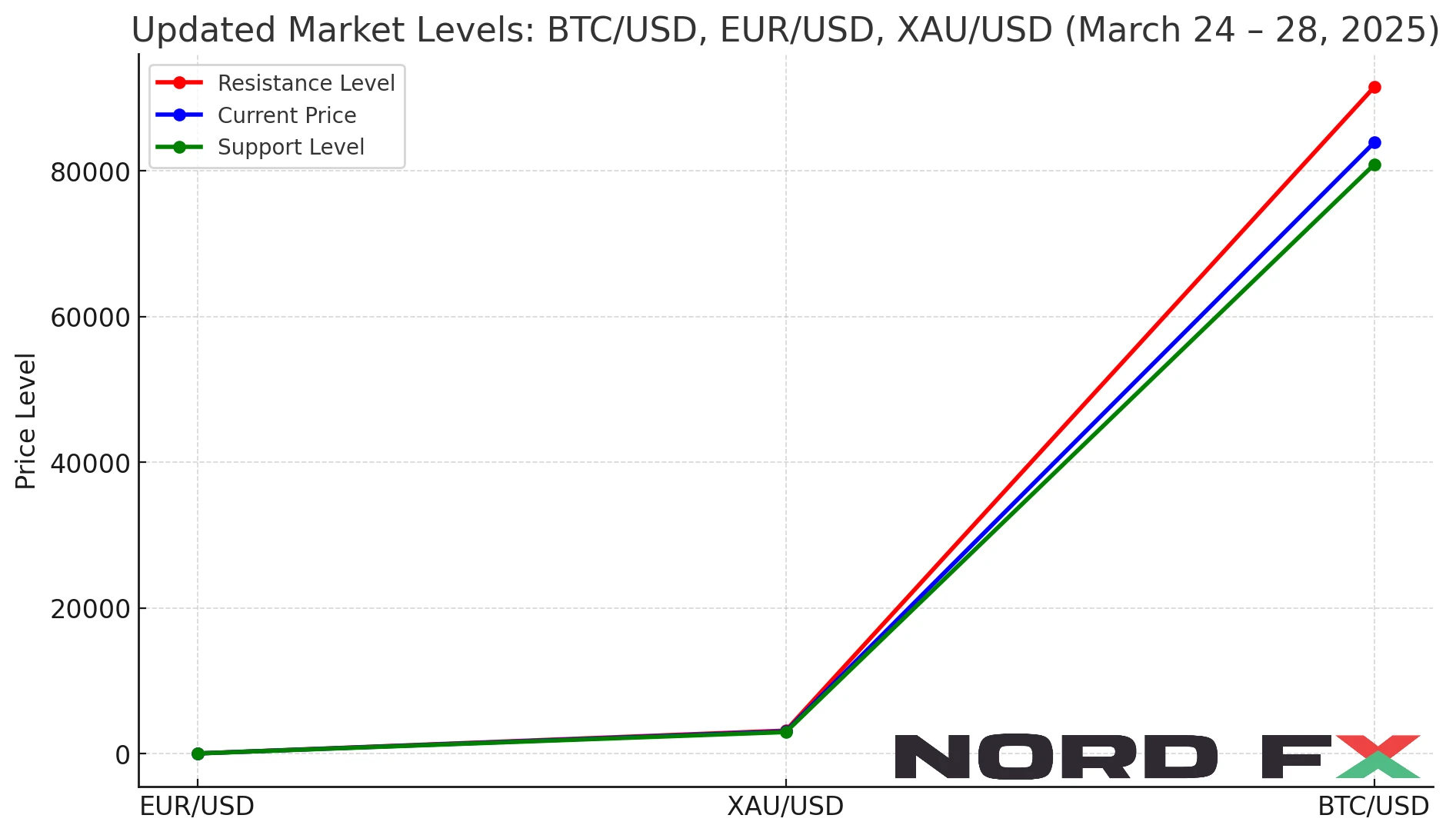

The EUR/USD pair ended the past week with a moderate decline, closing around 1.0815. While the overall trend remains bearish, technical indicators show signs of a potential corrective rebound. The pair is currently trading just above key support near 1.0800. A short-term move towards the 1.0870–1.0905 resistance area remains likely, driven by temporary dollar softness. However, failure to break above this resistance could result in renewed selling pressure, pushing the pair back towards 1.0750 or even lower. A decisive drop below 1.0635 would confirm a bearish breakout, while a breakout above 1.1115 could open the way to 1.1375, marking a shift to a stronger upward trend.

XAU/USD

Gold (XAU/USD) ended the week with aggressive gains, closing near $3,033 after briefly reaching a record high of $3,057. The uptrend remains strong, supported by expectations of lower interest rates and elevated geopolitical risk. However, with such rapid growth, a temporary correction cannot be ruled out. A pullback towards the support level at $2,935 is possible before buyers regain control. If the bullish trend resumes, the next target lies above $3,145. Should prices break below $2,875, this would signal a shift in sentiment and may lead to a decline towards $2,725. For now, momentum remains with the bulls, and dips are likely to be viewed as buying opportunities.

BTC/USD

Bitcoin closed the week at around $83,888, after an eventful few days that saw the cryptocurrency surge near $90,000 before retreating. The broader trend remains bullish, though the market appears to be undergoing a consolidation phase. Current technical conditions suggest a possible test of support near $80,875, from where a fresh upward move could begin, targeting a potential rally above $106,500. A rebound from the lower boundary of the bullish channel and support on the RSI would reinforce the bullish case. However, a fall below $73,605 would indicate a breakdown in structure and increase the risk of decline towards the $65,445 area. A breakout above $91,505 would confirm renewed bullish momentum.

Conclusion

The upcoming week promises to be pivotal across forex and crypto markets. EUR/USD may attempt a corrective rebound but remains vulnerable to renewed dollar strength. Gold continues to benefit from risk-off flows and may extend gains following any pullback. Bitcoin, despite its recent volatility, retains upside potential as long as key support levels hold. With global financial and political developments in flux, traders should remain flexible and alert to both technical signals and fundamental shifts that could redefine market trajectories.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.