The past trading week ended on a bullish note across several key markets. The euro strengthened against the US dollar, gold held firm above support despite a corrective move, and bitcoin remained within a bullish channel, closing the week above the $97,000 mark. For the upcoming week, the general tone across the forex and cryptocurrency markets is cautiously optimistic, though signs of technical correction in all three assets may lead to short-term pullbacks before potential rebounds.

EUR/USD

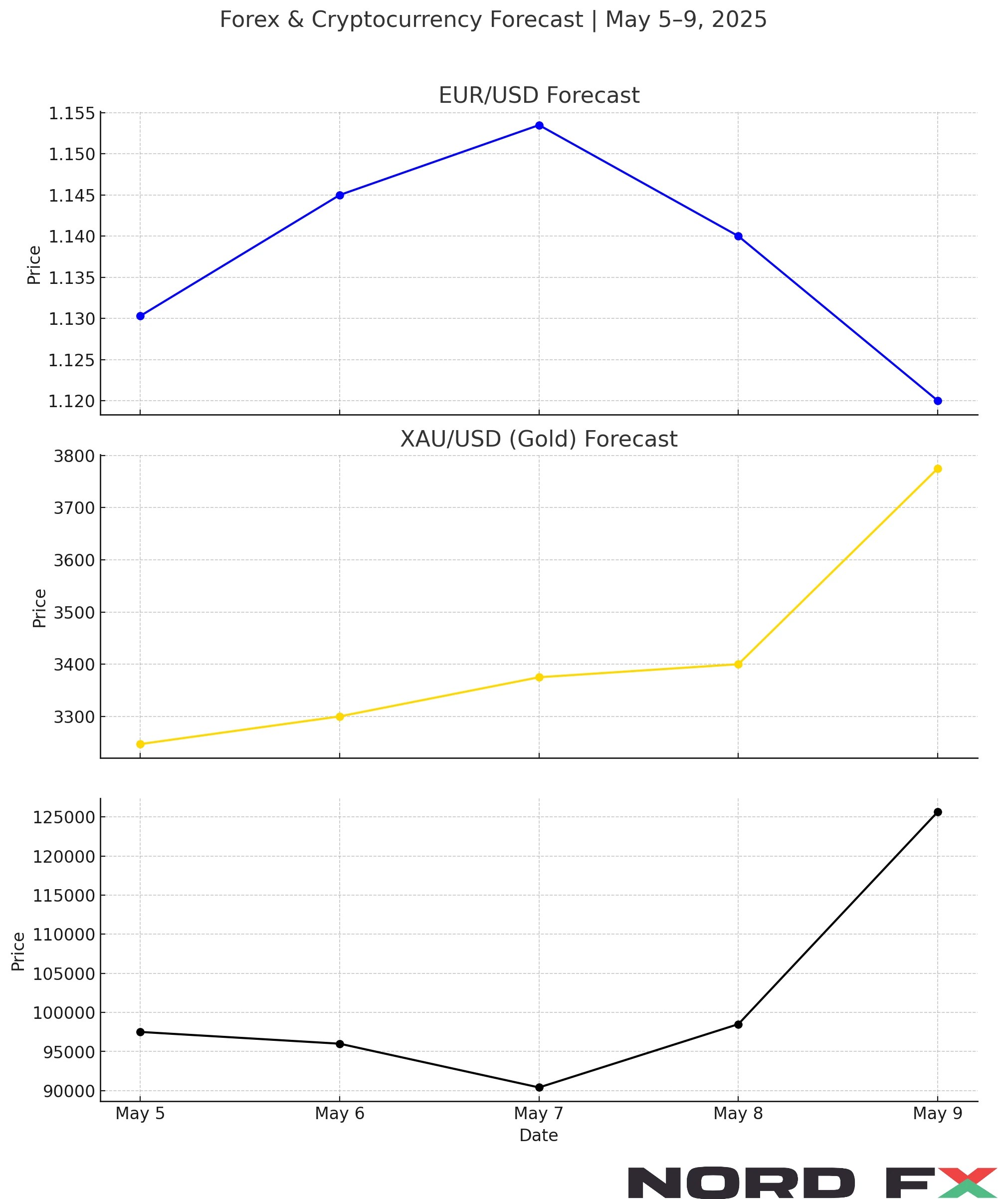

The EUR/USD pair closed last week near 1.1303, maintaining its position within a bullish trend. The upward breakout between the moving average signal lines reflects continued buyer interest and suggests a potential extension of the rally. A test of the resistance zone around 1.1535 is expected early in the week, from which a downward rebound and subsequent decline could follow. Should this scenario play out, the pair may drop towards the 1.0745 area. A test of the RSI resistance line and a pullback from the upper boundary of the ascending channel would support this bearish scenario. However, a break above the 1.1765 level would invalidate expectations of a fall, opening the way for a further rise towards 1.1985. A break below 1.1135, on the other hand, would confirm a bearish reversal and a potential exit from the bullish correction channel.

XAU/USD (Gold)

Gold ended the week near 3247, still moving within an overall bullish channel despite signs of correction. The moving averages support a continued upward trend, though a temporary pullback to test the support near 3155 appears likely in the coming days. If this level holds, gold prices may resume their rise, targeting a move above 3775. A rebound from the RSI trend line and the lower boundary of the bullish channel would further confirm bullish momentum. Should the price drop below 3105, the bullish scenario would be invalidated, and we would expect continued decline towards 2745. Confirmation of further growth would require a break above 3375, indicating renewed buying interest and strength in the precious metal.

BTC/USD (Bitcoin)

Bitcoin concluded the trading week at 97,505, sustaining its position within a bullish channel supported by strong upward momentum. The break above the signal line zone indicates that buyer pressure remains dominant. However, a short-term correction to the support area near 90,405 is possible before the resumption of the uptrend. If the price rebounds from this support, bitcoin could rise towards 125,645. Technical signals such as a bounce from the RSI support line and the upper boundary of the bearish channel lend support to the bullish outlook. If, however, the price falls below the 72,005 level, this would signal a bearish reversal and could push bitcoin further down towards the 64,505 mark. A break above 99,665 would confirm the continuation of the upward movement.

Conclusion

The markets are entering the new trading week with a mix of bullish trends and looming corrections. EUR/USD and gold both show potential for short-term pullbacks before possibly resuming their respective uptrends. Bitcoin remains the strongest among the three, though it too may see a brief dip before targeting higher levels. Traders should watch key resistance and support levels closely, as breakouts or rebounds from these zones are likely to set the tone for market direction in the days ahead.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.

Go Back Go Back