The current trading week (May 5–9) is drawing to a close, with markets showing cautious optimism and steady demand across key assets. The euro, bitcoin, and gold have all posted moderate gains, supported by expectations of improved trade dialogue between the U.S. and China, alongside generally favourable technical setups. However, each of these instruments is now approaching important resistance levels, and price action in the coming days may determine whether the prevailing bullish trends will continue or give way to corrective moves.

EUR/USD

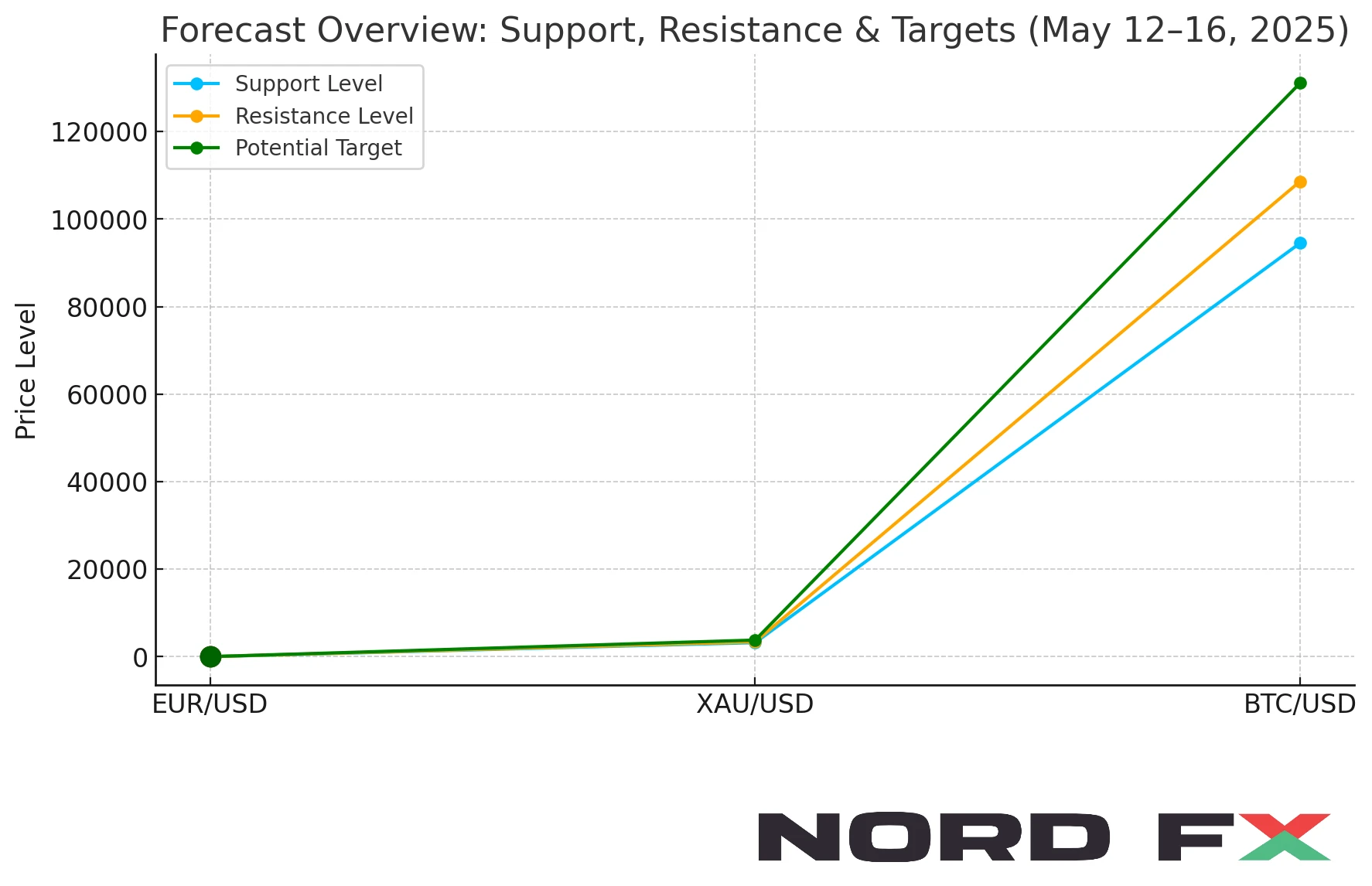

The EUR/USD currency pair is finishing the week with growth near the 1.1227 level. The technical picture remains positive, with moving averages confirming a bullish trend. The price has confidently broken through the area between the signal lines, indicating continued pressure from buyers and the likelihood of further growth from current levels. In the upcoming week, a test of resistance around 1.1375 is expected. From this area, a downward rebound and the beginning of a new correction phase may follow, potentially taking the pair below 1.0705.

An additional signal in favour of a decline will be a test of the resistance line on the RSI, as well as a price rebound from the horizontal resistance zone on the chart. The bullish scenario will be cancelled only in the event of strong growth and a breakout above 1.1705, which would indicate the resumption of the uptrend towards 1.1985. A close below 1.1045, meanwhile, would confirm a break of the bullish channel’s lower boundary and signal the start of a deeper decline.

XAU/USD (Gold)

Gold is ending the current trading week with a slight correction near the 3,329 level. XAU/USD continues to trade within a bullish channel, supported by moving averages pointing upward. Buyers remain active, and the breakout above the signal zone confirms the potential for continued growth. However, in the coming week, a downward test of the support area near 3,195 is likely. If this level holds, a rebound may follow, pushing prices higher towards the 3,785 area.

A test of the RSI trend line and a rebound from the lower boundary of the bullish channel will act as additional confirmation of continued growth. A break below 3,115 would signal a bearish reversal, opening the path towards the 2,845 level. On the other hand, a breakout above 3,385 would confirm further upside momentum.

BTC/USD (Bitcoin)

Bitcoin is closing the trading week at 102,719, maintaining its position inside an upward-sloping channel. The trend remains clearly bullish, with prices above key moving averages and further confirmation coming from the breakout through the signal zone. In the upcoming week, a correction towards the 94,505 support area is likely. From there, a new rebound could follow, with buyers aiming for a target above 131,065.

The bullish outlook is supported by a rebound from the RSI support and the previously broken bearish channel. However, a fall below the 82,205 level would cancel the bullish scenario and trigger a deeper decline, with the next downside target around 74,505. Continued growth will require a breakout above the 108,605 resistance area and a firm close above it.

Conclusion

As the week of May 5–9 draws to an end, the markets are showing resilience, but the technical picture suggests that key resistance areas are approaching for the euro, bitcoin, and gold. The trading week ahead (May 12–16) will be crucial in determining whether these assets will continue their upward momentum or reverse into corrective territory. Traders should remain alert to signals of breakout or rejection at these levels, as they will likely define market direction in the near term.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.