General Outlook

Markets enter the final week of October digesting the delayed US CPI release and the ongoing federal shutdown that has limited macro data visibility. September inflation came in slightly softer than expected, easing pressure on the dollar and allowing EUR/USD to stabilise around 1.16. Gold is consolidating after setting a new record near 4,380 earlier in the month, while Brent has rebounded from five-month lows. Bitcoin is attempting to rebuild momentum after a sharp correction in mid-October. Volatility is likely to remain elevated as traders position ahead of the FOMC and ECB meetings, with few fresh data releases to provide direction.

EUR/USD

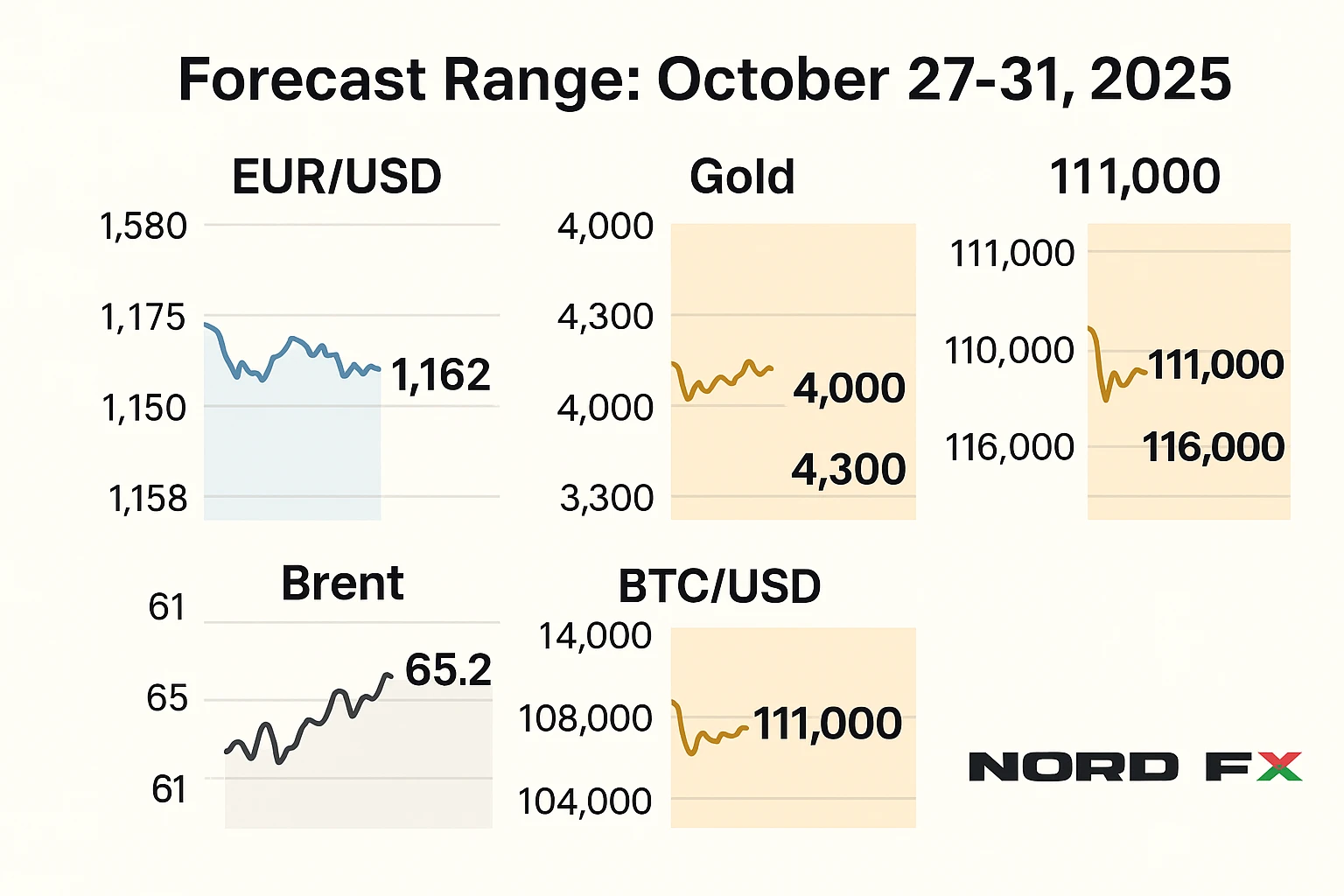

EUR/USD finished the previous week around 1.162 after testing both 1.158 and 1.165 during the range-bound session. The softer CPI data helped the pair recover slightly from its earlier lows. The near-term outlook remains constructive while above 1.1580. A breakout above 1.1660–1.1710 could open the way towards 1.1755 and 1.1810. On the downside, support lies at 1.1600/1.1580, followed by 1.1550 and 1.1500. With the US data calendar constrained, direction will depend mainly on risk sentiment and policy comments from the FOMC and ECB.

Levels: Support 1.1600/1.1580, 1.1550, 1.1500. Resistance 1.1660, 1.1710/1.1755, 1.1810.

XAU/USD (Gold)

Gold is trading within a broad 4,000–4,300 range after a record high near 4,380 earlier this month. The metal remains supported by ongoing geopolitical tensions and uncertainty over US fiscal policy. The uptrend stays intact while prices hold above 4,000–4,080. A close above 4,240–4,300 would refocus attention on the record zone near 4,380. Conversely, a drop below 4,000 could trigger a correction towards 3,900–3,890. For now, gold traders continue to buy dips while monitoring dollar and bond yield movements.

Levels: Support 4,080, 4,000, 3,900. Resistance 4,240, 4,300, 4,380.

Brent

Brent crude rebounded from five-month lows near 61 and is now stabilising around the mid-60s. Supply concerns remain limited as the forward curve stays in contango, reflecting near-term surplus expectations. Bulls need a close above 66.5–67.0 to target 69.8–71.0. A failure to hold above 64.5 would increase the risk of another move towards 61.0 and possibly 58.0. Traders continue to focus on OPEC+ communication and signs of recovery in global demand.

Levels: Support 64.5, 61.0, 58.0. Resistance 66.5/67.0, 69.8, 71.0.

BTC/USD

Bitcoin is consolidating after a volatile start to the month, trading near 111,000 at the end of last week. The earlier decline towards 104,000 appears to have found temporary support. Key resistance sits at 112,000–116,000; a break above this zone would open 120,000 and 124,000. Support levels are seen at 110,000, 107,000 and 104,000, with 100,000 remaining a crucial threshold for the medium-term trend. ETF inflows remain steady, but investor sentiment is cautious following the sharp swings seen in early October.

Levels: Support 110,000, 107,000, 104,000, 100,000. Resistance 112,000/116,000, 120,000, 124,000.

Conclusion

For the week of 27–31 October, EUR/USD remains range-bound but supported while above 1.1580. Gold is consolidating between 4,000 and 4,300 after record highs. Brent is stabilising yet vulnerable below 67, while Bitcoin is attempting to rebuild its uptrend above 104,000. With the FOMC and ECB meetings ahead and limited new data, markets are likely to trade reactively to headlines and risk sentiment.

NordFX Analytical Group

Disclaimer: These materials are not investment recommendations and are for informational purposes only. Trading on financial markets is risky and may lead to a complete loss of deposited funds.

Go Back Go Back