EUR/USD: Europe Turns Red, US Turns Green

● The most active day of the past week was Thursday, 24 October, when market participants faced a barrage of data on business activity (PMI) across various sectors of the European Union, the Eurozone as a whole, and the United States.

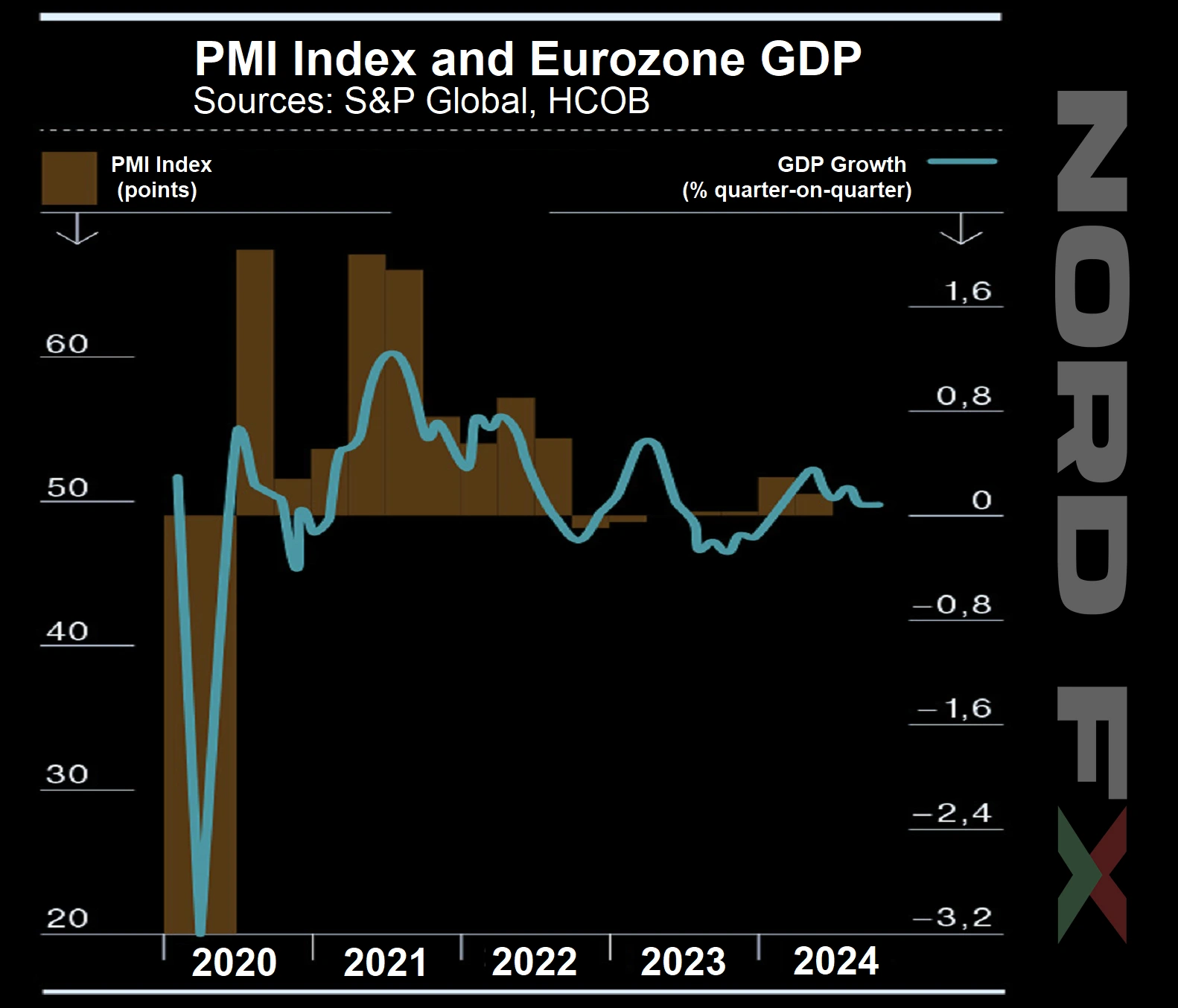

According to S&P Global, business activity in the Eurozone has shown a decline for the second consecutive month. In October, the composite PMI stood at 49.7 points, a slight increase from September's figure of 49.6. While this aligned with market expectations, it remains below the key 50-point threshold, which separates economic growth from contraction.

The services sector remained in positive territory but has also seen a slowdown in growth. Despite forecasts predicting an increase to 51.6, the index actually dropped from 51.4 in September to 51.2 points in October, marking an eight-month low. In the Eurozone’s manufacturing sector, the PMI rose slightly to 45.9 from 45.0 in September but continues to reside within contraction territory. The most significant decline since the start of the year was observed in the export segment, largely due to trade tensions between the EU and China as they compete for dominance in the automotive industry.

● It has emerged that Beijing is pressuring its car manufacturers to pause their expansion plans in Europe. This move is in response to potential restrictive tariffs on Chinese electric vehicle imports, which could reach as high as 45%. The Chinese government is urging manufacturers, who are outpacing European firms in the race to produce affordable electric vehicles, to hold off on actively seeking production sites in the region and to delay potential new deals amid ongoing tariff negotiations with the EU.

● The two main engines of the European economy, Germany and France, have shown diverging trends, though both countries lead in business contraction within the EU. In Germany, the composite PMI rose to 48.4 points from September’s 47.5, largely thanks to stable growth in the services sector, where PMI increased from 50.6 to 51.4 points in October, driven by rising wages. Meanwhile, the manufacturing sector also saw an uptick, from 40.6 to 42.6 points, though it remains well below the crucial 50.0 mark. This indicates that the German economy still risks slipping into stagnation, as its automotive and manufacturing industries grapple with declining demand.

● Meanwhile, France experienced a "sharp and accelerated" drop in demand, particularly in the manufacturing sector, where the PMI fell to 44.5 points from the previous 44.6. A decline was also observed in the services sector, with the index dropping from a hopeful 49.6 to 48.3 points. Consequently, the composite PMI showed a downturn, reaching a nine-month low of 47.3 points, contrary to analysts' forecasts, which had expected an increase to 49.0.

● As mentioned above, these two countries are seen as primary contributors to the broader slowdown in the region, which has already prompted the European Central Bank (ECB) to accelerate the easing of its monetary policy. Should current trends persist, further pressure could mount on the ECB, likely pushing it towards more decisive action by year-end. The decision expected on 12 December could significantly impact the region's economic stability and recovery trajectory. ECB President Christine Lagarde has already confirmed plans for policy easing, yet the exact approach remains uncertain: a rate cut of 25 basis points (bps) or perhaps a more substantial 50 bps reduction. Officials appear divided on the matter, with dovish members openly advocating a sharper rate cut, while their hawkish colleagues urge caution.

● In the United States, preliminary data released on Thursday, 24 October, showed that, according to S&P Global, "in October, business activity continued to grow at encouragingly high rates, supporting the economic expansion recorded from the start of the year through Q4." Growth in the services sector accelerated, with the PMI index here rising from 55.2 in September to a preliminary 55.3 in October. In manufacturing, the PMI remains below 50.0, yet the increase in the index was even more impressive: against a forecast of 47.5, it jumped from 47.3 to 47.8. The US labour market also held strong, with initial jobless claims falling from 242K to 227K over the week, exceeding forecasts of 243K.

● Revised US business activity data is set for release next Friday, 1 November. As for the previous Friday, 25 October, at the time of writing this review (15:00 CET), the EUR/USD pair is trading around the 1.0830 mark.

● The coming week promises to be eventful. On Tuesday, 29 October, we’ll see the US JOLTS job market data. Wednesday, 30 October, will bring Q3 GDP figures for both Germany and the US, along with Germany’s Consumer Price Index (CPI) and the ADP report on US non-farm employment.

Thursday could either please or disappoint, with preliminary consumer inflation (CPI) data from the Eurozone and the US Personal Consumption Expenditures Index. Additionally, as usual, initial jobless claims in the United States will be published on Thursday. Finally, Friday, 1 November, will see the release of final US business activity data and a fresh set of US labour market data, including key indicators such as the unemployment rate and the Non-Farm Payrolls (NFP).

CRYPTOCURRENCIES: Awaiting Bitcoin’s "Divine Candle"

● On Monday, 21 October, bitcoin reached a peak of $69,502, marking a three-month high. However, this bullish momentum has since waned, though Bitfinex analysts attribute it to a delayed effect. The current bull rally has been largely driven by increased speculation regarding Donald Trump's potential victory in the upcoming US presidential election on 5 November. According to the cryptocurrency forecasting service Polymarket, Trump’s odds stand at 60.7%, while Harris's are at just 39.1%. Nevertheless, it is essential to remember that the crypto community’s perspective does not necessarily reflect the views of the broader US electorate.

● Many analysts are confident that a Trump victory would propel bitcoin to new heights, creating what’s referred to as a “Divine Candle.” This belief is fuelled by Trump’s promises to make the leading cryptocurrency a new symbol of the United States. Last month, Standard Chartered analysts forecasted that his win could lift bitcoin to $125,000, whereas a Harris victory might also boost it, but only to around $75,000. Leading brokerage and research firm Bernstein has reached a similar conclusion.

If Trump wins, an enormous green "Divine Candle" could appear simply due to powerful market sentiment. Analysts note that, over the years, bitcoin has created several of these epic daily candles. The largest "Divine Candle" was recorded on 10 April 2013, when bitcoin's price soared from just under $20 to $290, a 115% surge in a single day. Another impressive spike occurred when Elon Musk’s Tesla invested in bitcoin; on 8 February 2021, the digital gold instantly surged by 22.4%. Experts believe that, should Trump win, the candle could fall within this projected range. However, this doesn’t mean it will remain there. BTC/USD quotes are likely to undergo rapid corrections in either direction soon after.

● There is a possibility that, fuelled by pre-election hype, bitcoin could break its historical high of $73,743 even before election day. According to Bloomberg, options market traders are ramping up bets on the leading cryptocurrency reaching a record $80,000 by the end of November. Interestingly, market sentiment suggests this could happen regardless of who wins the US presidential race. Implied volatility for BTC options expiring near election day, 5 November, has risen, with a bias toward call options, granting the right to purchase bitcoin at new peak prices.

● Despite the prevailing enthusiasm, renowned analyst and MN Trading head Michael Van De Poppe cautions that bitcoin might dip to the $64,000-65,000 range before taking off. He views this potential drop as a "prime buying-the-dip opportunity," suggesting it could offer an ideal entry point for investors looking to capitalise on bitcoin’s next surge.

Van De Poppe remains optimistic about BTC’s long-term prospects. He believes this anticipated dip might be the last significant correction before bitcoin makes its way to a new all-time high. The analyst also posits that this ATH could align with the upcoming US election or the next Federal Reserve meeting on 7 November. Both events are key milestones for financial markets, including digital assets.

● The long-term outlook appears even more impressive. Analysts from the research and brokerage firm Bernstein have stated that their forecast of $200,000 per BTC by the end of 2025 is "conservative." Bernstein views bitcoin's limited supply as making it a "store of value" asset, which they argue is "not a bad thing in a world where US debt hits new records (currently at $35 trillion), and inflation risks are mounting." "If you like gold, you should love bitcoin even more," the firm's analysts add.

● Experts also point to several signs of an impending parabolic growth phase for bitcoin, during which the leading cryptocurrency could soar to $240,000. Analysts at CryptoQuant highlight that crypto whales are behaving in much the same way as they did in 2020, following BTC’s crash at the onset of the COVID-19 pandemic. Just as they did four years ago, they are actively accumulating coins in anticipation of a bull rally.

Moreover, stablecoin reserves are reportedly dwindling. An analyst known as Doctor Magic has observed a decline in the capitalisation of leading pegged coins: Tether (USDT), USD Coin (USDC), and Dai (DAI), starting in September 2024. This trend suggests that traders are exchanging stablecoins for fiat currency and using the funds to purchase bitcoin and other top digital assets. If the parabolic growth scenario plays out, bitcoin’s price could reach $240,000 by late spring or early summer 2025, more than tripling its current value.

● At the time of writing this review (25 October, 17:00 CET), the BTC/USD pair is trading around $68,500. The total cryptocurrency market capitalisation has grown to $2.33 trillion, up from $2.20 trillion a week ago. The Bitcoin Crypto Fear & Greed Index has risen from 32 to 56 points, moving from the Fear zone into Neutral territory.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.