EUR/USD: Storms and Tempests on September 18, 19, and 20

● The past week can be divided into two parts – from September 9 to 11, and from the 12th to the 13th. Initially, the dollar strengthened, then it lost ground. The trend shift occurred after data released on Wednesday, September 11, indicated a slowdown in US inflation and the labour market.

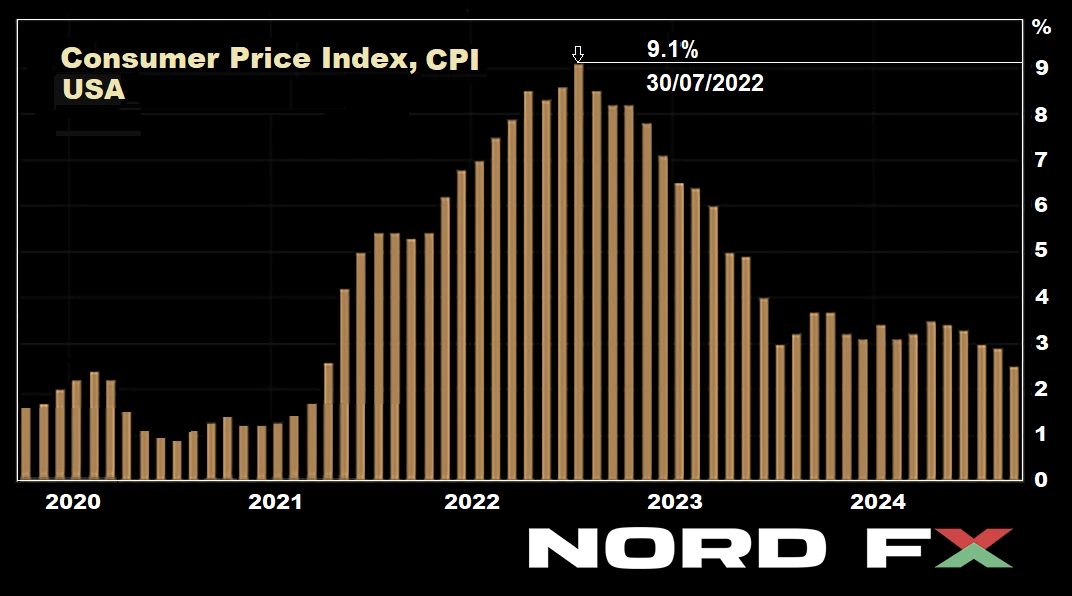

According to the US Department of Labor's report, consumer prices (CPI) in August rose by an average of 2.5% year-on-year, the lowest figure since February 2021. By comparison, the annual inflation rate in July was 2.9%. Thus, in just a month, the rate of consumer price growth slowed by 0.4%. It’s worth noting that the country's annual inflation rate has been declining for several months. For instance, by the end of July, CPI growth had already fallen to its lowest since March 2021. And although 2.9% is not yet the target 2.0%, it’s a far cry from the 9.1% seen two years ago. The light at the end of the tunnel is becoming visible. The same cannot be said for the labour market. Let’s recall that the Bureau of Labor Statistics report on September 6 showed that the number of new jobs created outside the US agricultural sector (Non-Farm Payrolls) was only 142K, compared to the expected 164K. The number of initial unemployment claims, published on September 12, was also somewhat disappointing. With a previous figure of 228K and a forecast of 227K, the number actually rose to 230K. The difference is small, of course, but the trend is still negative.

The market reacted to all this data in a very logical way. Before its release, the probability of a 25 basis point (bps) cut in the federal funds rate at the FOMC (Federal Open Market Committee) meeting of the US Federal Reserve on September 17-18 was 87%. Afterward, it dropped to 55%. Meanwhile, the chances of a 50 bps cut jumped from 13% to 45%. The thinking goes: the economy needs saving, and the fight against inflation can wait. However, we still believe that the Fed will exercise caution and start with a quarter-point cut rather than half a percent.

● On the news mentioned above, the EUR/USD pair was unable to break through the 1.1000 support level. After wavering near it, the pair reversed and moved upwards. While the market's reaction to the US Department of Labor's statistics was logical, the euro's strengthening following the European Central Bank (ECB) meeting is harder to explain.

On Thursday, the ECB resumed its monetary easing cycle (QE), which had been paused in July. The key interest rate was lowered from 4.25% to 3.65%, a cut of 0.6%. Why 0.6% and not a round 0.5% remains a mystery. But this is not the main point. What matters is that such a move should have weakened the euro. Yet, the opposite happened. The reason for this is likely ECB President Christine Lagarde, who, at the post-meeting press conference, did not give the slightest hint that the QE cycle could continue in October.

Despite the possible inflation slowdown in September, a rise is forecast towards the end of the year. The ECB expects inflation to be at 2.5% by the end of 2024, 2.2% in 2025, and only below the target 2.0% at 1.9% by the end of 2026. So why continue cutting rates so drastically when they are already quite low? Christine Lagarde even admitted that while the June cut had been planned in advance, the decision to ease monetary policy at the July meeting was, in fact, deemed hasty.

After Madame Lagarde's speech, the futures market reduced the likelihood of further ECB monetary easing in October from 40% to 20%, which led to the rise in EUR/USD. Derivatives now expect the US Federal Reserve to lower rates by 25 basis points 10 times over the next 12 months, while only 7 similar moves are expected from the ECB. This could lend strength to the bulls on this pair.

● As a result, the EUR/USD closed the past week at 1.1075, almost exactly where it began. Experts’ opinions on its short-term performance are divided as follows: 25% of analysts support a stronger dollar and a decline in the pair, 50% favour its rise, while the remaining 25% maintain a neutral position. However, the medium-term outlook paints a different picture. Here, 70% are in favour of the US dollar, while only 30% are against it.

In technical analysis on D1, the trend indicators show an overwhelming majority supporting the bulls, with 80% in the green camp and 20% siding with the bears. Among oscillators, the picture is more mixed: 25% are green, 40% are red, and the remaining 35% are neutral (grey).

The nearest support for the pair is in the 1.1000-1.1025 zone, followed by 1.0880-1.0910, 1.0780-1.0805, 1.0725, 1.0665-1.0680, and 1.0600-1.0620. Resistance zones are located around 1.1100, then 1.1135-1.1150, 1.1190-1.1200, 1.1240-1.1275, 1.1385, 1.1485-1.1505, 1.1670-1.1690, and 1.1875-1.1905.

● As for the upcoming week, the calendar will be packed with important economic events that will undoubtedly lead to increased volatility. On Tuesday, September 17, US retail sales data will be released. On Wednesday, September 18, key inflation indicators such as the Consumer Price Index (CPI) for the UK and the Eurozone will be made public. On the same day, the US Federal Reserve's FOMC will announce its decision on interest rates. Following the Fed meeting, similar meetings will be held by the Bank of England (BoE) on September 19 and the Bank of Japan (BoJ) on September 20. Naturally, besides the specific decisions, traders and investors will pay close attention to the statements and comments from the heads of these three central banks regarding future monetary policy.

CRYPTOCURRENCIES: Will the New US President Decide BTC's Fate?

● In our mid-week crypto market review, we were pleased to report some positive news from the analytics service Coinglass. According to their data, September 9 marked the end of the longest phase of capital outflows from US spot BTC-ETFs. The capitalisation of these funds had been declining since August 26, resulting in a loss of $1.2 billion. However, on Monday, September 9, bitcoin ETFs managed to attract $28.6 million in capital, breaking the streak of losses. But... the celebration was premature. By Wednesday, US-traded spot bitcoin funds recorded another outflow, ending the brief two-day inflow period, with losses totalling $43.97 million.

And here’s a bit more data: according to CryptoQuant, there has been a notable shift in bitcoin ownership dynamics over recent months. Short-term holders (those owning BTC for 155 days or less) have significantly reduced their positions, especially in July and August. Meanwhile, long-term holders have been increasing their holdings. Due to this redistribution, whales now control nearly 67% of the circulating supply of bitcoin and over 43% of ethereum reserves.

● Is this good or bad? Overall, the statistics seem rather contradictory. "The fact that short-term holders are not accumulating positions may indicate weak demand for bitcoin," notes CryptoQuant. However, they also suggest that the capital flow from weak hands (short-term holders) to strong hands (long-term holders) could set the stage for a potential market recovery, as increased accumulation by HODLers may stabilise prices. Nevertheless, as analysts at Santiment point out, unless whales (the primary target of BTC-ETFs) start buying bitcoin again, a bullish rally is unlikely in the near term.

● Evaluating the current situation, Greg Cipolaro, head of research at Bitcoin New York Digital Investment Group, urged bitcoin holders to be patient. In his view, September is unlikely to bring any surprises in terms of price growth for the leading cryptocurrency. The key factor influencing BTC, according to Cipolaro, will be the upcoming US presidential election on November 4. He believes the outcome of the election will be a pivotal event for the entire crypto market, regardless of who wins. However, Cipolaro declined to predict whether Donald Trump or Kamala Harris would emerge victorious. The analyst is also convinced that factors such as employment data, inflation levels, and even changes in the Fed's interest rate at its September 17-18 meeting will not have a lasting impact on bitcoin’s price.

● Greg Cipolaro's colleagues at 10x Research disagree with him. They believe that a potential 50 basis point rate cut by the Federal Reserve could negatively impact bitcoin and other cryptocurrencies.

"A sharp rate cut is a sign of economic concern, not confidence," say analysts at 10x Research. In their view, a 50 bps reduction in borrowing costs may signal that the regulator is struggling to address an impending downturn in the labour market. They argue that the community's expectations for bitcoin's price increase may go unfulfilled, as there are no clear growth catalysts, and the Fed is focused on balancing its efforts between combating unemployment and inflation.

● With only a few days left until the Federal Reserve meeting, there’s still over a month until the US presidential election. On September 10, the first debate between presidential candidates Donald Trump and Kamala Harris took place. Although cryptocurrencies were not mentioned, the debate outcome negatively impacted the prices of major digital assets. Before the debate, Trump held a slight lead in prediction markets. For example, on Polymarket, his chances of victory were at 53%, compared to Harris's 46%. However, after the debate, both candidates' odds levelled out at 49%. On another prediction platform, PredictIt, the difference was more pronounced: Harris's chances rose to 56%, while Trump's fell to 47%.

Since Trump portrays himself as a supporter of cryptocurrencies, while Harris has not yet taken a clear stance, the shift in balance had a negative effect on bitcoin and other digital assets. After the debate, the price of BTC dropped by about 3%. However, it soon recovered, as verbal sparring is far from the final vote outcome.

● It’s worth noting that the rhetoric of the US presidential candidates is quite different. Trump promises that the US will become the "world capital of bitcoin and cryptocurrencies." In contrast, Harris's programme avoids any mention of virtual assets. Based on this, experts at Bernstein have outlined their forecast for the crypto market. According to their predictions, bitcoin could test the $80,000 to $90,000 range if Donald Trump wins, and the $30,000 to $40,000 range if Kamala Harris becomes the next president. "While some crypto industry leaders harbour hopes for a more constructive policy from Harris, we expect a significant difference between the two outcomes. A Harris victory would maintain the challenging regulatory environment that has stifled market growth in recent years," Bernstein stated.

Analysts at Matrixport have also released a forecast on bitcoin's price following the election results. In their view, bitcoin will continue to rise regardless of the voting outcome. Matrixport noted that during Donald Trump's presidency from 2016 to 2020, bitcoin grew by 1,421%. Under Joe Biden, from 2020 to 2024, BTC’s price increased by 313%. "Bitcoin can continue to thrive regardless of who wins the presidential election in November and takes the White House," Matrixport analysts wrote. They believe the next president is likely to have a greater impact on cryptocurrency market regulation than on bitcoin’s price itself.

● Amidst this uncertain backdrop, a statement from MicroStrategy founder Michael Saylor sounded like a balm for bitcoin enthusiasts. Saylor predicted that bitcoin will soon increase in value by 70 times—reaching a staggering $3.85 million. The billionaire explained his forecast by highlighting the technological superiority of the leading cryptocurrency over other assets and its annual returns. Since MicroStrategy began purchasing BTC in August 2020, the cryptocurrency has delivered an average annual return of 44% to investors. In comparison, the S&P 500 index has grown by around 12% per year over the past four years.

Saylor is also confident that the future belongs to HODLers (long-term investors), who will ultimately outperform traders focused on short-term price fluctuations. In the long term, the billionaire forecasts that bitcoin could reach $13 million, though this would only happen by 2045. By 2050, he predicts that bitcoin’s market capitalisation will account for 13% of the world’s total capital (for reference, it currently stands at just 0.1%).

● As of the evening of Friday, September 13, at the time of writing, the BTC/USD pair surged sharply after a weakening of the US dollar, reaching the $59,900-60,000 zone. The total crypto market capitalisation rose slightly above the psychologically significant $2.0 trillion level, now standing at $2.10 trillion (compared to $1.87 trillion a week ago). Bitcoin's Crypto Fear & Greed Index increased from 22 to 32 points, shifting from the Extreme Fear zone into the Fear zone.

● And in conclusion, since we began our review with statistics, we'll end it with them as well. Specialists from Gemini conducted a survey among 6,000 respondents from the USA, the UK, France, and Singapore and found that among digital asset owners, 69% are men and 31% are women. But that's not all. According to Date Psychology, it turned out that the majority of women (77%) consider cryptocurrency enthusiasts unattractive. They perceive only those who collect Funko figures (toys dedicated to characters from movies, comics, cartoons, etc.) as worse. Perhaps this is because women view digital assets as unserious and project this attitude onto the men who are involved with them.

The most attractive to the female respondents were men who prefer hobbies such as reading, learning foreign languages, and playing musical instruments. However, as other surveys show, women working in the crypto industry achieve great success and often hold higher positions than their male colleagues. Draw your own conclusions, gentlemen!

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.