A few simple tips on how to choose profitable signals for a subscription in Copy Trading, and not to lose your money. These recommendations are also suitable for PAMM accounts.

The Main Difficulty in Copy Trading

Copy Trading is a very convenient and useful service since it allows anyone to get passive income in the financial markets. Moreover, this income can be tens, hundreds and even thousands of times higher than the interest on bank deposits. At the same time, you do not need to be an experienced trader, you do not need to study all the wisdom of fundamental and technical analysis, you do not need to sit days and nights in front of the monitor, testing the strength of your nervous system. You just need to select a trader - a provider of trading signals, subscribe, and all their transactions will be automatically copied to your account. All you have to do is watch your wealth grow.

Easy? Yes, in words. But everything is much more complicated in practice. And the main difficulty is to choose a provider that will really bring you a stable profit, and will not bring you to a heart attack by zeroing your deposit. The signals must be reliable.

In order to help the investor avoid a mistake, online monitoring is carried out for each signal by more than 50 parameters on the website of the brokerage company NordFX, which is reflected in the corresponding charts and tables.

Some of these parameters are fundamentally important, while others only complement the picture. An experienced investor can easily deal with them all. But what should beginners do? This service is intended for them in the first place.

This article is intended to give you a few quite simple recommendations. They may not help you choose the best signal. But they will definitely help to discard those signals to which it is risky to subscribe.

Insidious Martingale, or the Most Common Mistake of a Novice Subscriber

A familiar feeling most of us know, greed, lies at the heart of this mistake. Who does not want to earn as much as possible and as quickly as possible! Therefore, looking at the rating of signals, the first thing we pay attention to is profit (Return per period).

Plus 200%, 300%, 400%, 500% per month - these numbers delight our hearts. But in no case should we forget that the greater the profit, the higher the risk of losing your money. Statistics show that such signals do not last long and often end up with zeroing the deposit.

Usually, providers of such signals trade without Stop Loss and use an aggressive strategy based on building up a losing position. A similar strategy is used in the algorithms of many robots/advisors for automatic trading.

This trading method is often referred to as the Martingale method, and it came to financial markets from gambling. A "clean" martingale assumes a doubling of a losing position in order to get out of the drawdown and, as a result, close a series of orders with a profit. That is, you open, for example, a sell order with a volume of 1 lot. But the price goes up and you start to suffer losses. Then you open another order for sell, but the volume is already 2 lots, then another of 4 lots, and more, and more. And you wait until the price turns in the direction you want, and you can close the entire series of orders (with a volume of 1+2+4+8+16+... lots) with a profit.

In addition to the "clean" Martingale with a doubling of the losing position, other increase factors are often used. For example, at a coefficient of 1.5, the order series will look like 1.0+1.5+2.25+3.38+5.06, etc.

This technique works great in a flat, but with a strong trend it leads to significant drawdowns of the deposit, sometimes reaching 85-95%. And in case of a very strong trend without serious corrections, this is a guaranteed way to completely zero the deposit. And such trends are not so rare. Even for the EUR/USD pair, one-way movement can reach 500-800 points. And there is no need to mention how cryptocurrencies are "storming": the jumps reach 25-30% of the token price.

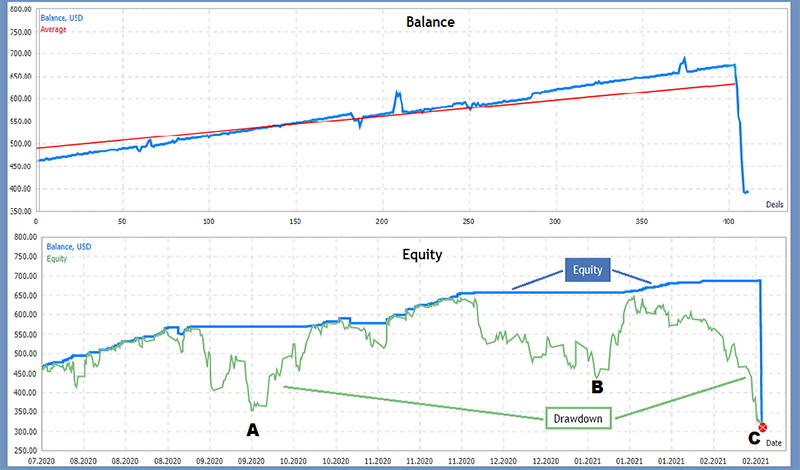

With such a strategy, the charts of balance (Balance) and growth of funds (Equity) can look very attractive for a certain time and represent a smoothly growing upward line. But at the same time, as already mentioned, there are periodical alarming drawdowns in the account (green line on the chart), from which it is sometimes possible to get out (cases A and B), and sometimes they lead to a complete disaster - zeroing the deposit and closing the account (point C).

Three Main Parameters for Signal Selection

We warn you right away that what has been said below is just our recommendations based on many years of experience. The last, decisive word will be yours in any case.

So, what parameters do we consider to be the main ones? This is a combination of: 1) the signal's lifetime, 2) its profitability, and 3) the maximum drawdown.

1) The longer a given signal lives, the better. In our opinion, it is worth considering signals that have been stable for at least six months, preferably a year or more.

2) It is clear that the higher the yield, the better. But choosing from two signals with the same profit of 200%, which was received 1) in a month and 2) in a year, we would choose the second option, because in this case, the profit is still quite high, and the risks are significantly lower.

3) A parameter such as maximum drawdown will also be very useful for risk assessment. However, it may not be as indicative in a short period of time as in a long one. For example, if a signal has existed for only a month, and the market was calm (flat) all this time, then the drawdown on it may turn out to be insignificant. But in the event of a subsequent strong price spike, it can rise repeatedly and deal a serious blow to your deposit. Therefore, if you are going to subscribe to such a signal, it will be very useful to look at the quotes and assess the volatility of trading instruments in a given period of time.

Even the ancient Romans used to say "Festina lente" - "Hurry slowly." It is this catch phrase, proven over millennia, that forms the basis of modern money management - asset management in financial markets. There is no need to strive to earn all the money at once. The higher the profit, the higher the risk. And greed is the main enemy of the investor. That is, your enemy!

Go Back Go Back