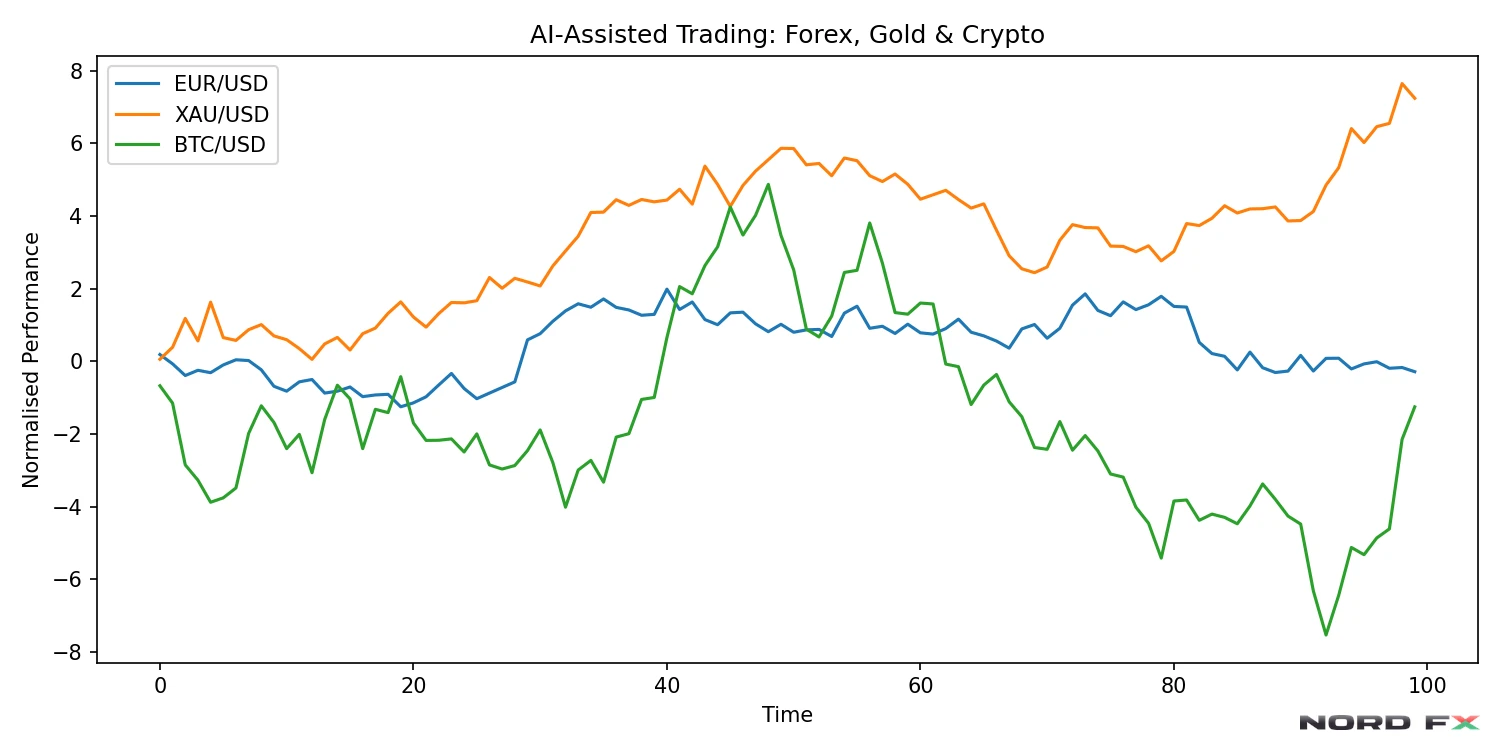

Artificial intelligence (AI) and machine learning are increasingly influencing how traders analyse markets, detect patterns and develop systematic trading strategies. In forex and cryptocurrency markets, where price dynamics are fast-moving and often complex, AI-assisted trading offers a way to process large volumes of data and support more informed decision-making.

This article explains what AI-assisted trading is, how it can be applied in forex and crypto markets, how traders can approach building an AI-assisted strategy, and what risks and limitations should be taken into account before using these tools in live trading.

What Is AI-Assisted Trading?

AI-assisted trading refers to the use of machine learning models and artificial intelligence techniques to support trading analysis and decision-making. Unlike traditional rule-based algorithms or fully automated expert advisors, AI-assisted systems do not rely on fixed instructions alone. Instead, they learn from historical data and adapt their behaviour based on patterns observed in the market.

In practical terms, AI acts as an analytical layer that helps traders evaluate probabilities, identify non-obvious relationships and refine existing strategies. The trader remains in control, combining AI-generated insights with classical market analysis.

To understand how AI builds on traditional analytical methods, it is useful to start with the foundations of technical analysis, which are covered in detail in the NordFX article “Forex Technical Analysis: Basics, Theory, Tools”

How AI Is Applied in Forex and Crypto Markets

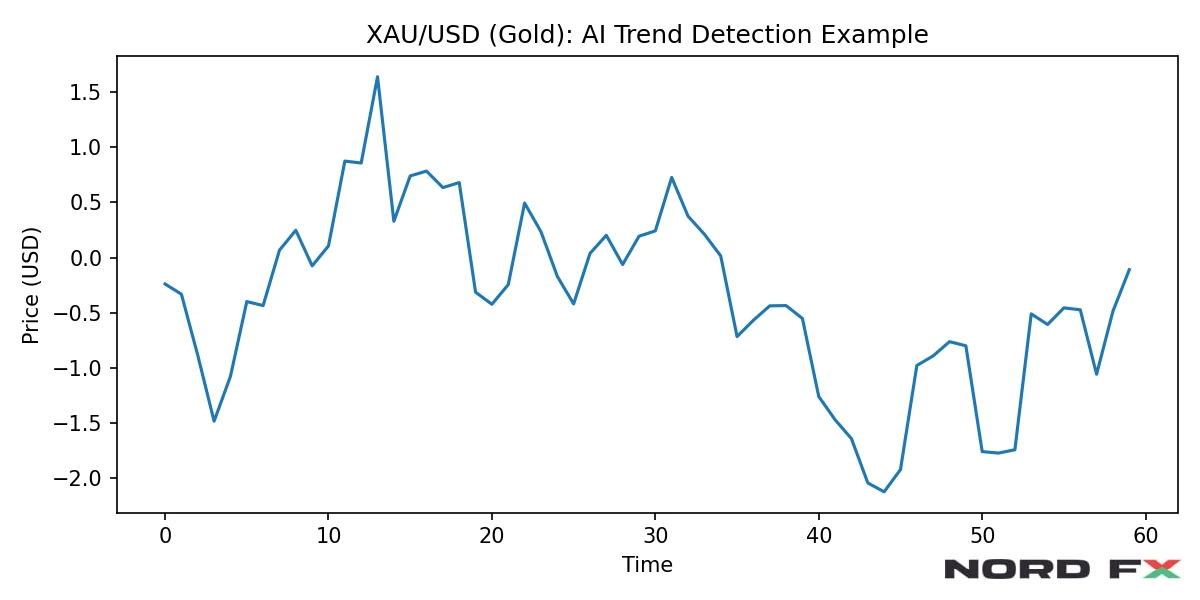

AI-based trading models operate by analysing relationships between input data and future price behaviour. These inputs are not limited to price charts alone. In both forex and crypto markets, AI systems can incorporate multiple data streams simultaneously.

Market Data and Technical Indicators

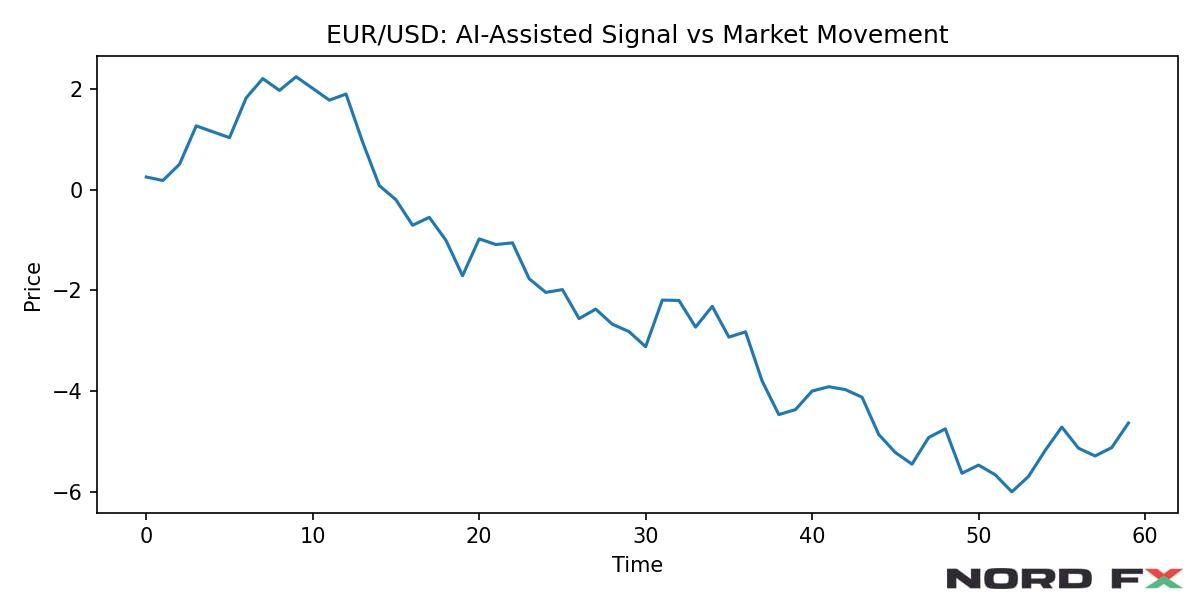

Price history remains a core component of most AI-assisted strategies. Models often use indicators derived from price action, such as moving averages, momentum oscillators and volatility measures. These indicators help structure raw data into meaningful signals.

For example, indicators such as MACD are frequently used as model inputs to identify trend strength and momentum shifts. Traders unfamiliar with these tools can refer to the NordFX article “Advanced Techniques for Trading with MACD” for a deeper explanation of how indicator-based signals work in practice.

Volume, Liquidity and Market Structure

In addition to price, AI systems can analyse volume and liquidity proxies to gain insight into market participation and pressure. In decentralised crypto markets and OTC forex trading, direct order-book data may be limited, but alternative measures can still provide valuable context.

Understanding how liquidity affects price behaviour is also covered in “How to Use Market Depth in Forex, Crypto, and Stock Trading”, which complements AI-driven approaches by explaining how supply and demand dynamics influence price movements.

Data Quality and Feature Engineering

High-quality data is the foundation of any AI-assisted trading strategy. Poor data leads to unreliable models, regardless of algorithm sophistication. Traders must ensure that historical data is accurate, consistent and sufficiently deep to cover different market regimes.

Feature engineering plays a critical role in this process. Rather than feeding raw price data directly into a model, traders often transform it into structured inputs, such as:

• returns over specific time intervals,

• volatility measures,

• trend strength indicators,

• momentum or mean-reversion signals.

These features help AI models focus on economically meaningful relationships rather than random noise.

Building an AI-Assisted Trading Strategy

Developing an AI-assisted strategy does not require institutional-level infrastructure, but it does require a disciplined and structured approach.

Step 1: Define the Trading Objective

Every strategy must start with a clear goal. This may include predicting short-term price direction, identifying trend continuation, or filtering trade entries based on probability. The objective determines the type of model, data and evaluation method to be used.

Step 2: Select Markets and Timeframes

Forex majors, cross pairs and liquid cryptocurrencies are generally more suitable for AI-based analysis due to their data availability and consistent trading activity. Timeframe selection should align with the strategy’s objective and risk tolerance.

Step 3: Model Selection and Training

Traders often begin with relatively simple models, such as regression or classification algorithms, before moving to more complex neural networks. Simpler models are easier to interpret and less prone to overfitting, which is a common issue in AI trading.

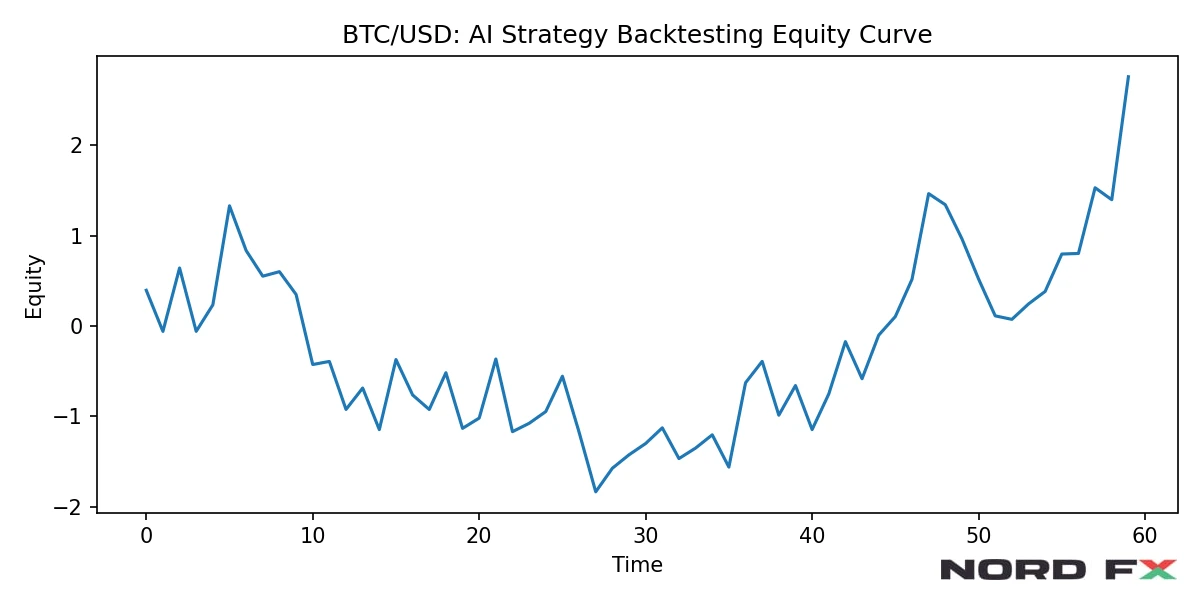

Step 4: Validation and Backtesting

Validation is critical. Models must be tested on data they have not seen before to ensure that results are not purely historical artefacts. Backtesting should include realistic assumptions about spreads, execution delays and trading costs.

Risk considerations at this stage should follow established trading principles. NordFX’s educational materials and glossary provide a solid reference framework for understanding risk terminology and controls.

Risk Management in AI-Assisted Trading

AI does not eliminate risk. In fact, poorly managed AI strategies can increase exposure by encouraging over-trading or excessive leverage. Effective risk management remains essential.

Position Sizing and Drawdown Control

Regardless of signal quality, position sizing rules must limit potential losses. Traders should define maximum drawdowns and stop-loss thresholds before deploying any AI-assisted strategy in live markets.

Avoiding Overfitting

Overfitting occurs when a model performs exceptionally well on historical data but fails in real-time trading. This is particularly common in AI systems trained on limited or overly specific datasets. Keeping models simple and testing across multiple market conditions helps reduce this risk.

Common Mistakes Traders Make with AI Strategies

AI-assisted trading is often misunderstood, leading to unrealistic expectations. Common mistakes include:

• assuming AI guarantees profits,

• ignoring transaction costs and slippage,

• relying exclusively on model output without market context,

• frequently changing models without sufficient testing.

AI should enhance, not replace, sound trading discipline and analytical reasoning.

Can Retail Traders Use AI Effectively?

AI tools are no longer exclusive to large institutions. Retail traders now have access to data platforms, programming libraries and analytical frameworks that make experimentation possible even with modest resources.

However, success depends on combining AI insights with classical analysis methods, including technical indicators, chart patterns and risk management techniques discussed throughout the NordFX Useful Articles section. Continuous learning and realistic expectations are essential.

Conclusion

AI-assisted trading strategies offer traders a powerful way to analyse forex and crypto markets more efficiently. By combining machine learning models with traditional technical analysis and disciplined risk management, traders can gain deeper insight into market behaviour.

AI is not a shortcut to success, but when applied thoughtfully, it can become a valuable analytical tool within a broader trading framework. Traders who build on strong foundations - such as those covered in NordFX’s educational materials on technical analysis, indicators and risk control - are best positioned to use AI responsibly and effectively in evolving financial markets.