First, a review of last week’s forecast:

- as we said, the key event last week was the ECB President Mario Draghi press conference on Thursday, April 26. The pair EUR/USD had descended to the lower boundary of the three-month lateral channel around 1.2200 by that date. Recall that this behavior had been predicted by almost 100% of experts. But further on, their opinions diverged: 75% expected the pair to go up and return to the mid-term trading range, and 25% were confident that the euro would lose its positions further.

The dispute between the analysts was resolved by Mr. Draghi, who admitted that the Eurozone economy was unlikely to preserve the last year's growth rates. And although he said that the ECB will gradually reduce the QE quantitative easing program, many experts felt that its terms will likely be extended beyond 2018. As a result, the euro lost another 150 points. True, then a rebound occurred and the pair completed the week at 1.2130; - GBP/USD. Strengthening of the dollar could not but affect the British pound. As a result, the forecast, for which about 40% of analysts voted, was implemented - the breakdown of the horizon is 1.4000 and the decline to support 1.3745, near which, at 1.3780, the pair and met the end of the weekly trading session.

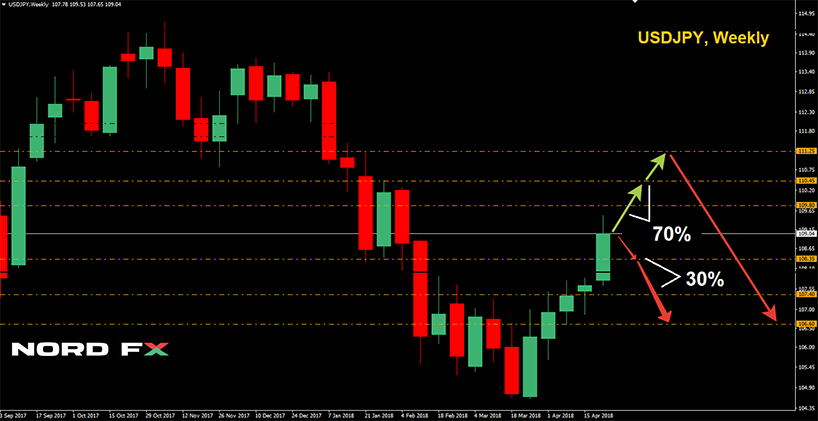

- USD/JPY. 85% of analysts, graphic analysis and the clear majority of indicators had voted for the strengthening of the dollar and further growth of the pair to the heights in the 109.00 zone. This almost unanimous opinion was absolutely true, and the pair completed the five-day period at the height of 109.05;

- Cryptocurrencies. After the BTC/USD rose to 9,000, experts had expected the pair to roll back about 1,000 points down. However, this did not happen, and Bitcoin was in a sideways trend along the horizon of 9,000 for the whole of the week, making fluctuations in the range of about ± 500 points.

Other pairs behaved in a similar way. The level of 150.00 became Pivot Point for LTC/USD, and for XRP/USD, it was 0.845. And only Ethereum showed a noticeable recovery, reaching the mark of 709.83 on April 24. True, then a pullback followed, but despite this, the pair completed the week with an increase of about 10%.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. If only a quarter of experts voted for the transition of the pair to the zone of 1.1915-1.2085 last week, their number has increased to 60% now. About 80% of the indicators are painted red as well. Additional support for the dollar is provided by the expectation of data on the labor market in the US on Friday, May 4. According to forecasts, the number of new jobs created outside the agricultural sector (NFP) may increase from 103K to 198K, which does not exclude the fall of the pair by another 100-115 points lower, to support 1.1800.

This time 40% of experts and graphic analysis on D1 have sided with the bulls. In their opinion, the fall below the level of 1.2200 has been temporary, and the pair will return to the medium-term horizontal channel within a week or two and will reach a height of 1.2415. Oscillators confirm this possibility, 20% of which signal the pair is oversold; - GBP/USD. It is clear that all the trend indicators have turned to the south following the last week's results. As for the experts' opinion, here the supporters of bears have a slight advantage - 55% versus 45% for bulls. Bull sentiment is also supported by a quarter of the oscillators, giving signals that the pair is oversold, as well as graphical analysis on H4 and D1.

If the "growth party" wins, the pair will go up, starting from the support of 1.3750, aiming to rise above the level of 1.4000 and, possibly, to reach the height of 1.4075. The nearest resistance is 1.3840.

If, however, the bears' expectations come true and the pair goes south, the support will be located at the following levels: 1.3585, 1.3455 and 1.3300; - USD/JPY. 70% of analysts, supported by most of the indicators and graphical analysis on D1, expect the continuation of the uptrend. The targets are 109.80, 110.45 and 111.25. The remaining experts together with the graphical analysis on H4 believe that the pair has already reached a local maximum, and now it is expected to decline first to the level of 108.35, and even lower in case of its breakdown. The targets in this case are 107.40 and 106.60.

It should be noted that graphical analysis on D1 also does not exclude a drop to the level of 106.60, but only after the pair reaches heights in the area of 111.00, at least;

- Cryptocurrencies. Experts expect the growth of the BTC/USD first to the level of 10.000, and then 500-700 points higher. The main support is 8.620. In case of its breakdown, it is possible to decline to the level of 7.785.

The main forecast for the pair ETH/USD is an increase to the height of 785, the next target is 865. The nearest support is 594, the next one is 500. LTC/USD: the goal is to return to the April 24 high, 165.00, the support is 140.00. XRP/USD: the goal is to rise to the level of 0.92, and then to the zone 0.942-0.985, the support is 0.7230.

Dear traders, brokerage company NordFX offers you the opportunity to earn both on growth and on the fall of cryptocurrencies, using a leverage ratio from 1:1 up to 1:1000.

Also, you can just invest in cryptocurrencies on favorable terms.

Deposit and withdrawal of funds in USD, bitcoins and ethereums.

Roman Butko, NordFX

Go Back Go Back