EUR/USD: Dollar Bulls Disappointed by NFP

- Throughout the past week, leading up to Thursday, August 3, the dollar continued to strengthen its position and build on the offensive that began on July 18. It appears that markets, wary of the global economic condition, have once again turned to the American currency as a safe haven.

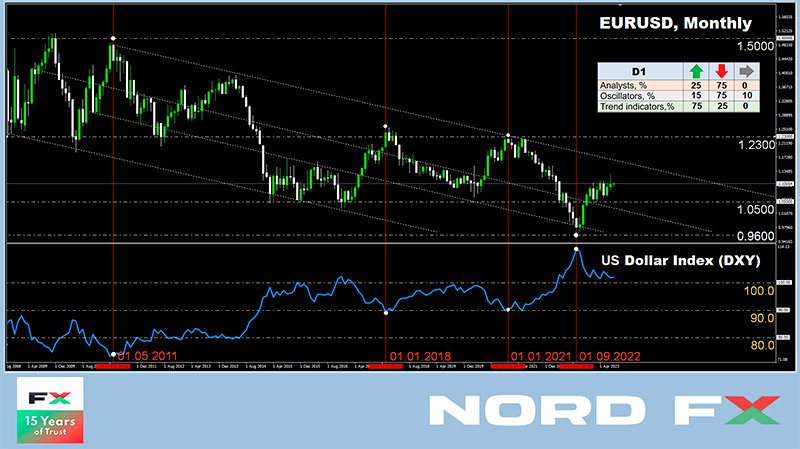

Interestingly, the dollar seemed to benefit from Fitch's first downgrade of the long-term US credit rating in 12 years. The agency reduced the rating by one notch from the highest AAA to AA+, a move that seems more of a reputational hit than a trigger for market collapse. However, in such situations, investors tend to shed the weakest and most risky assets in their portfolio, opting for more liquid US treasury bonds and the dollar instead. It's worth recalling 2011 when the US rating downgrade by Standard & Poor's triggered a stock market fall and multi-year dollar growth as it turned out that other countries were in even worse conditions. The shaky state of high-risk corporate bonds doesn't need to be mentioned, as it is self-evident.

A number of analysts do not rule out the possibility that a similar situation could repeat this time around. The key level of the DXY Dollar Index at 100.0 points could serve as a launching pad for further growth. (Round levels like 80.0 during the periods from 1990 to 1995 and in 2014, and 90.0 from 2017 to 2021 played a similar role.).

The macroeconomic data released last week for the United States proved to be rather mixed. On one hand, the Purchasing Managers' Index (PMI) in the country's manufacturing sector grew month-over-month from 46.0 to 46.4 points, but on the other hand, it fell short of the forecast of 46.8. Conversely, the PMI in the services sector declined from 53.9 to 52.7, against a forecast of 53.0. Despite the index remaining in the recovery zone (above 50), the figures suggest that this sector of the economy is also grappling with the consequences of the Federal Reserve's hawkish policy and decreasing consumer demand. The increase in initial jobless claims from 221K to 227K also put pressure on the dollar.

As for the Eurozone, preliminary data shows that inflation, albeit slowly, is beginning to recede. The Consumer Price Index (CPI) fell from 5.5% to 5.3%, which fully met market expectations. The rate of decline in retail sales volumes also slowed, moving from -2.4% to -1.4%, beating the forecast of -1.7%.

Following such statistics, everything was set to be decided on Friday, August 4. The market was awaiting fresh data from the US labour market, including indicators such as wage levels, unemployment rates, and Non-Farm Payrolls (NFP): the number of new jobs created outside the agricultural sector. These figures play a special role as the state of the labour market, alongside inflation, influences the Federal Reserve's decisions regarding future monetary policy.

In the end, the figures didn't change significantly. However, market participants decided that they were more indicative of a bearish than bullish sentiment for the dollar. The increase in average hourly earnings (month over month) remained at the previous level of 0.4%, the unemployment rate dropped slightly from 3.6% to 3.5% (forecast was 3.6%). The NFP figure also remained relatively unchanged, registering at 187K compared to 185K a month earlier. However, this number fell short of expectations of 200K.

The NFP is a key barometer of potential cooling in the US economy. A decline in NFP suggests that the 'screws' have been tightened too much, the economy is stagnating, and perhaps further tightening of monetary policy needs to be paused. At the very least. Or maybe it's time to end the cycle of monetary restriction altogether. This logic drove the DXY down and pushed EUR/USD up. As a result, the pair ended the five-day period at a mark of 1.1008.

As for the near-term prospects, at the time of writing this review on the evening of August 4, only 25% of analysts voted for the pair's growth and further dollar weakening, with 75% taking the opposite stance. The picture is similar among the oscillators on D1: 75% point south (15% are in the oversold zone), 15% point north, and 10% are in the neutral zone. The trend indicators present the opposite situation: 75% recommend buying, and the remaining 25% recommend selling.

The pair's nearest support is located around 1.0985, then 1.0945, 1.0895-1.0925, 1.0845-1.0865, 1.0780-1.0805, 1.0740, 1.0665-1.0680, and 1.0620-1.0635. The bulls will meet resistance around 1.1045, then 1.1090-1.1110, 1.1150-1.1170, 1.1230, 1.1275-1.1290, 1.1355, 1.1475, and 1.1715.

We've already mentioned that the state of the labour market and inflation are the defining factors for Central Banks' monetary policy formation. While we received plenty of statistics on the former last week, the coming week will bring data on the latter. On Monday, August 8, we'll find out what's happening with inflation in Germany, and on Thursday, August 10th, the US Consumer Price Index (CPI) values will be made public. Also, on this day, unemployment statistics in the US will be released. To round off the work week, on Friday, August 11, another important inflation indicator, the US Producer Price Index (PPI), will be revealed.

GBP/USD: Was the BoE Right or Wrong?

- The intrigue regarding how much the Bank of England (BoE) would raise the key interest rate on August 3, by 50 or 25 basis points (bps), ended in favour of a more cautious step. The rate increased from 5.00% to 5.25%, returning the GBP/USD pair to the zone of five-week lows, with the local bottom found at the level of 1.2620.

Economists at Commerzbank commented on the decision by the British regulator as follows: "The Bank of England is trying to restore its authority," they write. "However, it is still unclear how successful it will be." Commerzbank believes that the BoE's decision to slow the pace of rate hikes, based only on the fact that June's inflation surprised with a smaller figure, does not necessarily indicate that the Central Bank has changed its overall approach. "If inflationary conditions in the UK continue to improve," the bank's economists believe, "the current rate decision may turn out to be adequate. But if the June inflation report turns out to be an isolated case, then the Bank of England will most likely seem too hesitant again, which will put pressure on the pound.".

In June, the Consumer Price Index (CPI) in the United Kingdom decreased from 8.7% to 7.9% (with a forecast of 8.2%). However, inflation in the country remains the highest among developed nations. Considering that it significantly exceeds the target benchmark of 2%, the British regulator, according to some experts, will still have to maintain a more active stance and continue raising the rate, despite the growing risks of recession.

After the fall of DXY due to disappointing labour market data in the US, GBP/USD ended the week at 1.2748. The median forecast of experts for the near future looks quite neutral. Bears were backed by 45%, bulls by 30%, and the remaining 25% preferred to abstain. Among the oscillators on D1, 10% are coloured green, 15% are neutral grey, and 75% are red (a quarter of them signal oversold). The ratio of green and red for trend indicators remains 50% to 50%, as a week ago. If the pair moves south, it will encounter support levels and zones at 1.2675-1.2695, 1.2575-1.2600, 1.2435-1.2450, 1.2300-1.2330. 1.2190-1.2210, 1.2085, 1.1960, and 1.1800. In case of the pair's growth, it will meet resistance at the levels of 1.2800-1.2815, then 1.2880, 1.2940, 1.2980-1.3000, 1.3050-1.3060, 1.3125-1.3140, 1.3185-1.3210, 1.3300-1.3335, 1.3425, 1.3605.

It's noteworthy that the UK's GDP data is set to be released on Friday, August 11, offering some insight into the country's economic health. However, you can expect more significant volatility in the exchange rate on Thursday, August 10, when the U.S. inflation (CPI) data will be published. These economic indicators wield a significant influence on the exchange rate, and will be closely scrutinized by traders and investors. The outcome could potentially influence the Bank of England's future monetary policy decisions and, in turn, impact the value of GBP/USD.

USD/JPY: Inflation Decides Everything

- During the first half of the week, the yen, like other currencies in the DXY basket, retreated under the pressure of the dollar, and the USD/JPY pair reached a high of 143.88. However, then the Bank of Japan (BoJ) came to the aid of the national currency.

We reported in our last review that for the first time in many years, the new head of the Bank, Kazuo Ueda, decided to turn the rigid targeting of the yield curve into a flexible one. The target level of yield on Japanese 10-year government bonds (JGB) remained the same, 0%. The allowable yield fluctuation range of +/-0.5% was also maintained. But from now on, this limit was no longer to be seen as a rigid boundary but became more flexible. Of course, within certain limits – the Bank of Japan drew a "red line" at the 1.0% level and announced that it would conduct purchase operations to keep the yield from rising above this mark.

And now, less than a week after this revolutionary step for the BoJ, the yield on JGB reached nine-year highs near the 0.65% mark. As a result, the central bank hurried to intervene, and to avoid further growth, it conducted an intervention by buying these securities, thereby supporting the yen.

The Japanese currency received further support on Friday, August 4th, due to weak data on the NFP in the USA. As a result, the week's finish for USD/JPY was at the level of 141.73.

There is no doubt that inflation data will be crucial for central banks and, in turn, for currency markets. At the moment, there is much evidence that inflation in Japan will continue to rise. A few days ago, the country's government recommended a 4% increase in the minimum wage, and spring wage negotiations secured the highest wage growth in the last three decades. Against this backdrop, there is increasing evidence that businesses are ready to pass this growth on to consumers, leading to a rise in the Consumer Price Index (CPI). This trend reflects a willingness among Japanese companies to respond to growing labour costs by increasing prices, potentially fuelling inflation. In turn, this may have an impact on the Bank of Japan's policy decisions and influence the value of the yen in currency markets. The situation clearly highlights the interconnectedness of labour markets, monetary policy, and currency value, and underscores the importance of closely monitoring economic indicators and central bank actions.

To combat rising prices, the Bank of Japan's (BoJ) counterparts in the U.S. and Europe are tightening monetary policy and raising interest rates. Analysts at the Dutch Rabobank are hoping that the BoJ will finally follow suit and gradually move away from its ultra-soft policy. As a result, they anticipate that the USD/JPY exchange rate could return to the 138.00 mark within a three-to-six-month period.

The view of strategists at Japan's MUFG Bank is less optimistic. They write, "Currently, we forecast the first rate hike by the Bank of Japan in the first half of next year. The shift towards tightening BoJ policy supports our forecast of yen strengthening in the coming year." As for the recent change in the yield curve control policy, MUFG believes that it alone is insufficient to cause a recovery of the Japanese currency.

Economists at Germany's Commerzbank and Finland's Nordea Bank agree that if the Japanese regulator manages to tame inflation, the yen's exchange rate should rise. However, changes in the Bank of Japan's policy will not happen quickly. Therefore, according to many specialists, significant shifts can only be expected around 2024.

The various views and forecasts presented highlight the complexity of the economic environment and the challenges of predicting monetary policy changes and currency movements. The situation in Japan is particularly nuanced, given the BoJ's long-standing struggle with deflation and its commitment to an extremely accommodative monetary stance. Market participants and policymakers will need to pay close attention to a range of economic indicators, central bank signals, and global economic trends to navigate the evolving landscape.

As for the analysts' short-term forecast, it offers no clear direction. A third of them believe the USD/JPY pair will move north in the coming days, a third expect it to move south, and the final third anticipate a sideways or "east" movement. The indicators on the D1 timeframe look as follows:

Oscillators: 75% are coloured green, and 25% are neutral grey. Trend indicators: The greens have a clear advantage, with 85%, and the reds account for only 15%.

The nearest support level is positioned at 141.40, followed by 140.60-140.75, 139.85, 138.95-139.05, 138.05-138.30, 137.25-137.50, 135.95, 133.75-134.15, 132.80-133.00, 131.25, 130.60, 129.70, 128.10, and 127.20. The nearest resistance stands at 141.20, then 142.90-143.05, 143.75-144.04, 145.05-145.30, 146.85-147.15, 148.85, and finally, the October 2022 high of 151.95.

Given the divergent opinions of analysts and the varying readings of the technical indicators, market participants should approach this currency pair with caution. A careful examination of upcoming economic data releases, central bank statements, and other fundamental factors could provide additional insights into the likely direction of USD/JPY.

No significant information concerning the Japanese economy is expected in the upcoming week. Traders should be aware that Friday, August 11, is a holiday in Japan, as the country observes Mountain Day.

CRYPTOCURRENCIES: ETH/BTC - Who Will Win?

- Last week's crypto review was titled "In Search of a Lost Trigger." Over the past week, the trigger has still not been found. After the decline on July 23-24, BTC/USD moved to another phase of sideways movement, vigorously resisting the strengthening dollar. The surge on August 1-2 to $30,000 looked very much like a bull trap and ended with the pair hesitating and returning to the Pivot Point around $29,200. Digital gold, unlike physical gold, hardly reacted to the publication of labour market data in the US on August 4.

Some analysts believe that the crisis in DeFi is putting additional pressure on Bitcoin, and even predict a significant decline for the leading cryptocurrency in the near future. However, in our view, what they call a "crisis" is not actually one. Everything comes down to the vulnerabilities in early versions of the Vyper programming language, which is used to write smart contracts on which decentralized exchanges (DEX) operate. On July 30, liquidity pools in four pairs (CRV/ETH, alETH/ETH, msETH/ETH, pETH/ETH) using early Vyper versions 0.2.15-0.3.0 were hacked on the Curve Finance exchange. Other pools, the total number of which exceeds two hundred, were unaffected. The total loss amounted to about $52 million.

According to CertiK experts, traders lost digital assets worth $303 million as a result of hacking attacks in July. According to PeckShield data, from January to June 2023, the crypto industry faced at least 395 hacks, resulting in the theft of about $480 million. So, the hacking of Curve Finance is certainly unpleasant, but nothing extraordinary. It's far from the scale of last year's crashes in Terra (LUNA) and FTX.

Perhaps in order to feel more or less at ease, one should not put all their eggs in one basket. This was the message from the CEO of Galaxy Investment Partners, Michael Novogratz, in an interview with Bloomberg. "If an investor was young and took risks calmly, I would advise him to buy Alibaba shares," the billionaire said. "I would also advise investing in silver, gold, bitcoin, and Ethereum. That would be my portfolio."

Novogratz's confidence in bitcoin's future was bolstered after the largest investment company, BlackRock, filed an application for a spot bitcoin ETF. The businessman noted that BlackRock's CEO, Larry Fink, never believed in bitcoin, but has now changed his mind. "Now he says that BTC will be a global currency, and people around the world will trust it. He took the orange pill. He believes in bitcoin," Michael Novogratz stated.

Peter Brandt, a legendary trader and veteran of the financial industry, has also "taken the orange pill." He believes that over time, the first cryptocurrency will "come out of the shadow" of more traditional investment assets, such as stocks and gold, and in the future, it will be bitcoin that sets the tone in the financial market.

Peter Brandt emphasized that U.S. regulators will surely approve the launch of spot bitcoin ETFs. However, in his opinion, this approval will not be news, just as the halving will not be an event. After them, the price of BTC may even go down instead of up. "In 48 years of speculation," Brandt writes, "I have always found that markets take into account events before they happen." Always follow the saying "Buy on the rumour, sell on the fact," advises the Wall Street legend.

Moderate pessimism regarding the consequences of the halving was also expressed by analysts at CME Group. They noted that the demand for crypto assets, which was very strong during the first eight years of bitcoin's existence, has noticeably slowed down over the past five years. Therefore, in their opinion, there is no guarantee that the halving will lead to an appreciation of either BTC or altcoins.

Despite the warnings, many influencers and crypto enthusiasts continue to compete in forecasting how much bitcoin will grow in the coming years. Here are some opinions, sorted in ascending order. An analyst going by the nickname TechDev forecasts the price of BTC by relying on the behaviour of traditional financial markets, including the price of 10-year Chinese bonds, the dynamics of the Dollar Index, as well as the balances of the central banks of major countries, etc. According to him, the coin's rate closely follows the indicators of global liquidity, and the current economic cycle should once again conclude with massive growth in the money supply. Therefore, bitcoin is preparing for growth. In the analyst's view, the logarithmic growth curve indicator, which ignores short-term asset fluctuations, indicates that the leading cryptocurrency will reach a level of $140,000 by 2025.

"I will note that this is a very rough approximation, based on specific parameters of the indicator and the steepness of the momentum," warned TechDev. The analyst also noted that such an indicator as Bollinger Bands is in a very narrow range. The last time bitcoin exited such a range, a full-scale bull trend began.

Next in our top 3 is venture capitalist and billionaire Tim Draper, who stated in an interview with FOX Business that sooner or later, the entire world will embrace the first cryptocurrency. "It's only a matter of time before retailers realize they can save 2% by accepting bitcoin. They don't have to pay banks and credit card manufacturers," he explained. Draper repeated his forecast for the first cryptocurrency's growth to $250,000, predicting this would happen by 2025. (It's worth noting that the investor had already mentioned this price back in 2018, though at that time he referred to 2022 as the "Hour X." As we can see, the billionaire was mistaken.)

And finally, the gold step of the podium of honor this time goes to BitMEX co-founder Arthur Hayes. He published an article in which he forecasted the flagship cryptocurrency's surge to $760,000. In his opinion, the integration of Artificial Intelligence (AI) projects into the BTC blockchain will sharply increase the coin's appeal as a foundational asset of the ecosystem.

Hayes believes that ethereum should demonstrate a similar development model. If AI-based projects are integrated into this altcoin, the investment attractiveness of ETH, the main transaction instrument in the network, will sharply intensify. In this case, the altcoin may appreciate by 1,556%. In other words, the BitMEX co-founder does not rule out that ETH may soar to $31,063.

Another factor stimulating the growth of ETH over the next five years, according to Hayes, will be the expansion of the decentralized finance (DeFi) market. Most protocols of this ecosystem are based on ethereum, and their popularity continues to grow. An increase in the number of users of decentralized exchanges (DEX) will lead to a growth in transaction volumes with ETH and, consequently, to a rise in the price of the altcoin.

A survey was conducted among industry experts on the financial platform Finder to assess the future prospects of ethereum. The experts forecasted that ETH would be valued at an average of $2,400 by the end of 2023. They also predict that the price of ethereum will reach $5,845 by the end of 2025, and $16,414 by the end of 2030. It's worth noting that 56% of the experts believe that now is the most opportune time to buy ETH, while 41% advise holding the cryptocurrency, and a mere 4% recommend selling it.

PwC, the world's second-largest consulting firm, conducted a survey involving representatives from both cryptocurrency and traditional hedge funds. 93% of those surveyed believe that the market has already hit bottom, and they expect the cryptocurrency market to grow by the end of 2023. Among cryptocurrencies, they continue to favour bitcoin and ethereum. However, 72% think that ethereum has no chance of ever surpassing bitcoin in market capitalization. Of the remaining 28% who believe in the altcoin's victory, the majority expect that it will occur within the next 2 to 5 years.

A recent report from CME Group showed that ETH/BTC exhibits almost zero correlation with changes in interest rates, gold futures, and crude oil. However, it is significantly influenced by factors such as the strength of the dollar, changes in the market supply of bitcoin, and the dynamics of technology company stocks. The research indicates that ETH is more vulnerable to the strength of the USD, and changes in BTC supply have more influence on ETH/BTC than changes in ETH supply. At the same time, ETH often grows relative to BTC on days when technology company stocks (S&P 500 and Nasdaq-100 Tech indices) are on the rise.

As of the time of writing this overview, on the evening of Friday, August 4, BTC/USD is trading around $28,950, ETH/USD is around $1,820, and ETH/BTC is at 0.0629. The total market capitalization of the crypto market continues to decline and stands at $1.157 trillion ($1.183 trillion a week ago). The Crypto Fear & Greed Index remains in the Neutral zone at a mark of 54 points (52 points a week ago).

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back