If you were even a little interested in cryptocurrencies, you probably heard the name of Satoshi Nakamoto, probably the most mysterious person of the 21st century. Creator of the world's first cryptocurrency. Person who appeared from nowhere and disappeared o who knows where. Or not a person, but a group of people? Could it be him? Or her? Or them? We'll call him “he” In this article, although that's just a guess. So, who, after all, can hide behind this pseudonym? Let's try to dive deep into this mysterious story.

If you were even a little interested in cryptocurrencies, you probably heard the name of Satoshi Nakamoto, probably the most mysterious person of the 21st century. Creator of the world's first cryptocurrency. Person who appeared from nowhere and disappeared o who knows where. Or not a person, but a group of people? Could it be him? Or her? Or them? We'll call him “he” In this article, although that's just a guess. So, who, after all, can hide behind this pseudonym? Let's try to dive deep into this mysterious story.

Everyone who has ever dealt with trading has come across such a thing as volatility. It is easy to guess that this concept is important, since it is talked about, discussed in textbooks and various articles. The choice of a trading strategy, money management and, accordingly, the success of trading depend on volatility. But what is volatility? Let's figure it out.

Everyone who has ever dealt with trading has come across such a thing as volatility. It is easy to guess that this concept is important, since it is talked about, discussed in textbooks and various articles. The choice of a trading strategy, money management and, accordingly, the success of trading depend on volatility. But what is volatility? Let's figure it out.

There is a saying in the world of finance: "America will sneeze, but the whole world will catch a cold." But what is the way to determine how serious the cause of this sneezing is - is it from a slight discomfort, or a serious illness?

There is a saying in the world of finance: "America will sneeze, but the whole world will catch a cold." But what is the way to determine how serious the cause of this sneezing is - is it from a slight discomfort, or a serious illness?

This is what stock/exchange indices were invented for. The main ones that can be used to diagnose the health of the US economy are presented in the NordFX line of trading tools. These are Dow Jones 30 (DJ30.c), S&P 500 (US500.c) and NASDAQ-100 (USTEC.c). Let's consider each of them.

Traders who trade in the financial markets: Forex, stock, commodities and cryptocurrency, will find it useful to have an idea of the relationship between different types of assets. Understanding how the growth or fall of one asset can affect the quotes of another will help you create efficient trading strategies, increase profits from transactions and minimize the risk of losing a deposit.

Traders who trade in the financial markets: Forex, stock, commodities and cryptocurrency, will find it useful to have an idea of the relationship between different types of assets. Understanding how the growth or fall of one asset can affect the quotes of another will help you create efficient trading strategies, increase profits from transactions and minimize the risk of losing a deposit.

A point is a very important concept for calculating possible profit or loss in financial markets. When conducting transactions, you need to clearly understand how much one point costs and how your deposit will change if the price goes in one direction or another, for example, 50 or 100 points. This affects not only the choice of a particular currency pair and trading strategy, but also the determining of the volume of the transaction, the permissible degree of risk, setting Stop Loss and Take Profit orders. It is necessary to know the point value in order to calculate the spread value, to understand how much you can earn or lose due to a swap, at what moment Margin Call and Stop Out can occur.

A point is a very important concept for calculating possible profit or loss in financial markets. When conducting transactions, you need to clearly understand how much one point costs and how your deposit will change if the price goes in one direction or another, for example, 50 or 100 points. This affects not only the choice of a particular currency pair and trading strategy, but also the determining of the volume of the transaction, the permissible degree of risk, setting Stop Loss and Take Profit orders. It is necessary to know the point value in order to calculate the spread value, to understand how much you can earn or lose due to a swap, at what moment Margin Call and Stop Out can occur.

This article is intended primarily for beginners, but it may also be interesting and useful for those who already have some experience in trading in financial markets. We will consider one of the most important factors on which both the choice of strategy and the profitability of trading transactions depend. We will talk about currency pairs.

This article is intended primarily for beginners, but it may also be interesting and useful for those who already have some experience in trading in financial markets. We will consider one of the most important factors on which both the choice of strategy and the profitability of trading transactions depend. We will talk about currency pairs.

It would seem that opening an account with a broker is very simple: you go to its website, click the appropriate button, fill in a few fields and you're done, you can deposit funds and start trading. Many go this way. And then they are surprised that something goes wrong. How do you get things right?

It would seem that opening an account with a broker is very simple: you go to its website, click the appropriate button, fill in a few fields and you're done, you can deposit funds and start trading. Many go this way. And then they are surprised that something goes wrong. How do you get things right?

There are a lot of ways and strategies for trading in the financial markets. They can differ both in the degree of risk and in what kind of analysis a trader uses, fundamental or technical, what factors they take into account, what indicators and advisors are used. Of course, there are differences in which markets (commodity, currency, stock or crypto) and with which assets the trader works with. And finally (or, perhaps, firstly) strategies are divided according to the length of time of each specific transaction. And it can last from a few milliseconds to several years.

There are a lot of ways and strategies for trading in the financial markets. They can differ both in the degree of risk and in what kind of analysis a trader uses, fundamental or technical, what factors they take into account, what indicators and advisors are used. Of course, there are differences in which markets (commodity, currency, stock or crypto) and with which assets the trader works with. And finally (or, perhaps, firstly) strategies are divided according to the length of time of each specific transaction. And it can last from a few milliseconds to several years.

Stocks of the world's largest corporations, such as IBM, JP Morgan Chase, Coca-Cola, Mastercard, McDonalds, Microsoft, Twitter, UBER, eBay, Alibaba, Deutsche Bank and many others take a prominent place in the range of trading instruments offered by NordFX brokerage company. But, like any other financial assets, these securities can not only rise, but also fall in price. Accordingly, both traders and investors can both earn and lose their money on them.

Stocks of the world's largest corporations, such as IBM, JP Morgan Chase, Coca-Cola, Mastercard, McDonalds, Microsoft, Twitter, UBER, eBay, Alibaba, Deutsche Bank and many others take a prominent place in the range of trading instruments offered by NordFX brokerage company. But, like any other financial assets, these securities can not only rise, but also fall in price. Accordingly, both traders and investors can both earn and lose their money on them.

Of course, everyone would like to take the first path. That's why we decided to talk about how Warren Buffett who earned the first $5 on the stock exchange at the age of 11, became one of the richest people in the world with a fortune of $96 billion at the age of 90.

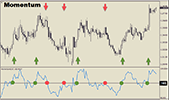

There are currently a huge variety of profitable trading strategies in the financial markets that are based on the latest scientific developments. Everyone dreams of opening the veil of the future, of predicting the behavior of financial instruments accurately. After all, both personal well-being and sometimes the success of an investment organization that operates with impressive resources depend on this. Impulse-based indicators and oscillators are among the most important and reliable technical analysis tools.

There are currently a huge variety of profitable trading strategies in the financial markets that are based on the latest scientific developments. Everyone dreams of opening the veil of the future, of predicting the behavior of financial instruments accurately. After all, both personal well-being and sometimes the success of an investment organization that operates with impressive resources depend on this. Impulse-based indicators and oscillators are among the most important and reliable technical analysis tools.

The set of trading tools that NordFX offers to its clients is a whole arsenal that allows a trader to apply the most effective strategies and win on the fields of "bloody" financial battles, attacking at lightning speed or waging a long positional struggle. 33 currency and 11 cryptocurrency pairs, shares of almost 70 leading companies, 6 major stock indices, precious metals and oil: this volume of "arms" is more than enough for the vast majority of traders to mount an active offensive on all fronts. However, a trader may suddenly feel a lack of "ammunition" at some point, and then synthetic currency and cryptocurrency pairs will come to their aid.

The set of trading tools that NordFX offers to its clients is a whole arsenal that allows a trader to apply the most effective strategies and win on the fields of "bloody" financial battles, attacking at lightning speed or waging a long positional struggle. 33 currency and 11 cryptocurrency pairs, shares of almost 70 leading companies, 6 major stock indices, precious metals and oil: this volume of "arms" is more than enough for the vast majority of traders to mount an active offensive on all fronts. However, a trader may suddenly feel a lack of "ammunition" at some point, and then synthetic currency and cryptocurrency pairs will come to their aid.

CFD trading in the stock market offers excellent opportunities for making money online. Moreover, unlike investors, a trader can make a profit not only on the rise in the value of shares, but also on their fall. However, successful stock trading requires a serious study of the current state and prospects of each specific company: economic reports and technological indicators, competition and sales markets, and many other factors. But there is one more group of CFD-instruments where a trader does not need to plunge in financial statements or conduct a large-scale audit of each individual enterprise. This group is stock indices.

CFD trading in the stock market offers excellent opportunities for making money online. Moreover, unlike investors, a trader can make a profit not only on the rise in the value of shares, but also on their fall. However, successful stock trading requires a serious study of the current state and prospects of each specific company: economic reports and technological indicators, competition and sales markets, and many other factors. But there is one more group of CFD-instruments where a trader does not need to plunge in financial statements or conduct a large-scale audit of each individual enterprise. This group is stock indices.

It comes as a surprise for many newbies to see a negative balance when they open their first trade, although the price has not moved. It comes to the understanding at that time that the broker provides its services for a reason, and you have to pay for access to financial assets and certain trading conditions. This is not surprising, as the broker is not just an intermediary between you and the global financial market, but also a commercial company that should bring profit to its founders.

It comes as a surprise for many newbies to see a negative balance when they open their first trade, although the price has not moved. It comes to the understanding at that time that the broker provides its services for a reason, and you have to pay for access to financial assets and certain trading conditions. This is not surprising, as the broker is not just an intermediary between you and the global financial market, but also a commercial company that should bring profit to its founders.

We are not saying that other ways of investing are stupid and bad. No way. It is just that the methods that will be discussed can help to increase the income from your investments many times over. In addition, they are simple and accessible to everyone.

We are not saying that other ways of investing are stupid and bad. No way. It is just that the methods that will be discussed can help to increase the income from your investments many times over. In addition, they are simple and accessible to everyone.

What is Forex, when, how and why did it appear? Every trader and investor should know the answers to these questions. After all, if you cannot answer them, what kind of professional are you?

What is Forex, when, how and why did it appear? Every trader and investor should know the answers to these questions. After all, if you cannot answer them, what kind of professional are you?

A few simple tips on how to choose profitable signals for a subscription in Copy Trading, and not to lose your money. These recommendations are also suitable for PAMM accounts.

A few simple tips on how to choose profitable signals for a subscription in Copy Trading, and not to lose your money. These recommendations are also suitable for PAMM accounts.

NordFX brokerage company has already paid more than $30,000,000 to its IB partners. And the leading partners of this broker earn between 5,000 and 17,000 USD per month.

NordFX brokerage company has already paid more than $30,000,000 to its IB partners. And the leading partners of this broker earn between 5,000 and 17,000 USD per month.

There are thousands of strategies for trading in financial markets. Some are versatile, others only work well with certain types of financial instruments. For example, Forex currency pairs are more suitable for scalping and intraday trading, as for stocks, many traders prefer to build their strategies focusing on long-term trends.

There are thousands of strategies for trading in financial markets. Some are versatile, others only work well with certain types of financial instruments. For example, Forex currency pairs are more suitable for scalping and intraday trading, as for stocks, many traders prefer to build their strategies focusing on long-term trends.

We think everyone who has watched American westerns knows what a scalp is and why it used to serve as a war trophy. We will not dive into the history of the American Wild West, we will just explain that this word comes from the Latin scalpere, which means "to cut".

We think everyone who has watched American westerns knows what a scalp is and why it used to serve as a war trophy. We will not dive into the history of the American Wild West, we will just explain that this word comes from the Latin scalpere, which means "to cut".

Many traders often wonder how Forex transactions differ from CFDs (Contract for Difference). There are some differences. But in our opinion, there is much more in common between them.

Many traders often wonder how Forex transactions differ from CFDs (Contract for Difference). There are some differences. But in our opinion, there is much more in common between them.

CFDs or Contracts for Difference are financial derivatives (that is, trading stocks or commodities without actually supplying them) that significantly expand the arsenal of any trader. Thanks to them, in addition to currency pairs on Forex, you can work with stocks, stock indices, commodities and even cryptocurrencies. Trading accounts CFD are widely represented by the broker NordFX.

CFDs or Contracts for Difference are financial derivatives (that is, trading stocks or commodities without actually supplying them) that significantly expand the arsenal of any trader. Thanks to them, in addition to currency pairs on Forex, you can work with stocks, stock indices, commodities and even cryptocurrencies. Trading accounts CFD are widely represented by the broker NordFX.

Forex trading is not an easy trip to do. You need to learn a lot before you can earn money here. Luckily, you don’t need to have a university diploma to trade Forex successfully. There are many ways to learn how to trade currencies and other financial assets. Here we are going to provide you with a detailed guide on what aspects you should master to succeed.

Forex trading is not an easy trip to do. You need to learn a lot before you can earn money here. Luckily, you don’t need to have a university diploma to trade Forex successfully. There are many ways to learn how to trade currencies and other financial assets. Here we are going to provide you with a detailed guide on what aspects you should master to succeed.

Trading tools is an asset that a trader can use when making a transaction. It is clear that the more such assets there are, the broader the trader's opportunities for developing various trading strategies and hedging risks. Accordingly, the likelihood of making a serious profit is higher. That is why the brokerage company NordFX offers its clients an impressive range of trading instruments, the complete list and specifications of which can be found both on the broker's official website in the Trading Accounts section and in the trading terminal control panel. Here we will consider their main groups.

Trading tools is an asset that a trader can use when making a transaction. It is clear that the more such assets there are, the broader the trader's opportunities for developing various trading strategies and hedging risks. Accordingly, the likelihood of making a serious profit is higher. That is why the brokerage company NordFX offers its clients an impressive range of trading instruments, the complete list and specifications of which can be found both on the broker's official website in the Trading Accounts section and in the trading terminal control panel. Here we will consider their main groups.

For online transactions on financial markets, the NordFX brokerage company offers its clients the world's most popular trading terminal - MetaTrader 4 (MT4). After downloading it, the trader will see three possible options for the graphical display of quotes for trading instruments in the "Properties" section - these are bars, a line and Japanese candlesticks.

For online transactions on financial markets, the NordFX brokerage company offers its clients the world's most popular trading terminal - MetaTrader 4 (MT4). After downloading it, the trader will see three possible options for the graphical display of quotes for trading instruments in the "Properties" section - these are bars, a line and Japanese candlesticks.

Agree that candlesticks, and even Japanese ones, are difficult to recognize as a tool of technical analysis. But this is only at first glance.

Traders can use not only their knowledge in their work, but also various computer programs: auxiliary scripts, as well as algorithms that can give recommendations and even open and close transactions on their own. These automated trading systems are called Forex robots. This article will discuss them in detail, as well as talk about the types and how to use them.

Traders can use not only their knowledge in their work, but also various computer programs: auxiliary scripts, as well as algorithms that can give recommendations and even open and close transactions on their own. These automated trading systems are called Forex robots. This article will discuss them in detail, as well as talk about the types and how to use them.

It is possible to make money on currency fluctuations not only by trading. Forex PAMM services allow even those who have no previous trading experience to profit from changes in prices of foreign currency assets. On the other hand, for a professional trader, the Forex PAMM service is an opportunity to increase the size of their trading capital.

It is possible to make money on currency fluctuations not only by trading. Forex PAMM services allow even those who have no previous trading experience to profit from changes in prices of foreign currency assets. On the other hand, for a professional trader, the Forex PAMM service is an opportunity to increase the size of their trading capital.

Price is the most unpredictable variable that can surprise many with its bursts, reversals, figures and pirouettes. Despite the fact that there are a huge number of stories of earnings based on intuition, all of them logically end after some time in the same thing: the loss of the deposit.

Price is the most unpredictable variable that can surprise many with its bursts, reversals, figures and pirouettes. Despite the fact that there are a huge number of stories of earnings based on intuition, all of them logically end after some time in the same thing: the loss of the deposit.

Actually, the currency market and adrenaline are two incompatible things. Only curbed emotions and a systemic approach can bring stability to trade. This cannot be achieved without understanding the market, the ability to predict it and use these skills in your trading strategy. A trading plan and a clear algorithm of actions is what every trader should start with. Forex indicators and technical analysis can help you along the way. They will be discussed in this article.

Finding patterns, repeatability and historical cyclicality is one of the main tasks of a trader. Some use graphic patterns to look for the silhouettes of geometric shapes. Some study the characteristic price movements: acceleration, braking, and interaction with graphic objects. However, there is a huge category of traders who are engaged in technical analysis of Forex using indicators. They allow you to predict the market, study its various characteristics and use these patterns in your own trading. Even beginners who have just heard about the existence of technical analysis will be able to analyze the market with their help.

Finding patterns, repeatability and historical cyclicality is one of the main tasks of a trader. Some use graphic patterns to look for the silhouettes of geometric shapes. Some study the characteristic price movements: acceleration, braking, and interaction with graphic objects. However, there is a huge category of traders who are engaged in technical analysis of Forex using indicators. They allow you to predict the market, study its various characteristics and use these patterns in your own trading. Even beginners who have just heard about the existence of technical analysis will be able to analyze the market with their help.

What is Forex? This is a huge over-the-counter marketplace where various currencies are exchanged. Its turnover exceeds 5 trillion dollars a day! (For comparison: the turnover of all world stock markets is "just" about 85 billion dollars, that is, almost 60 times less).

What is Forex? This is a huge over-the-counter marketplace where various currencies are exchanged. Its turnover exceeds 5 trillion dollars a day! (For comparison: the turnover of all world stock markets is "just" about 85 billion dollars, that is, almost 60 times less).

Forex was created for international commercial activity, but today there are not only companies conducting such work, but also private traders who have received access to trade, as well as investors whose main purpose is to profit from fluctuating quotations.

In this article, we will look at the history of the emergence and formation of the international currency exchange market, the main participants in this market, as well as the principles of trading.

The Forex currency market is one of the few places where everyone can try to realize themselves. The absence of superiors, the non-existent ceiling on earnings, the work schedule for which you are responsible — all this is in the trader's profession. But becoming one is not an easy task.

The Forex currency market is one of the few places where everyone can try to realize themselves. The absence of superiors, the non-existent ceiling on earnings, the work schedule for which you are responsible — all this is in the trader's profession. But becoming one is not an easy task.